-

Bitcoin holder buys hit $10 billion for the first time.

Bitcoin large holders supply hit 262,000 BTC over the past 30 days.

As a seasoned crypto investor with a decade-long journey in this volatile yet exhilarating market, I find myself both alarmed and intrigued by the recent Bitcoin dynamics. The $10 billion worth of Bitcoin purchases by long-term holders during this downturn is nothing short of impressive. It’s like watching whales dance in the crypto sea, each dip being an opportunity for them to fill their tanks.

Currently, the dominant digital currency, Bitcoin (BTC), is facing a significant drop in value. As of this writing, its price stands at approximately $58,679. Over the last day, this has represented a decrease of about 6.69%.

Previously, Bitcoin had been on an upswing and reached a peak of $64,404 just recently. But, a significant downturn on the daily graphs has overshadowed the weekly progress, resulting in a 1.71% decrease when viewed over the week.

As a seasoned investor with over two decades of experience in the stock market, I have seen my fair share of sudden declines and the chaos that follows. The recent drop in Bitcoin’s price has once again raised some concerns for me, particularly regarding the potential impact of panic selling and the role of long-term holders in maintaining its stability.

Long-term Bitcoin holder buys hit $10 billion

As per the analysis by Amr Taha from CryptoQuant, long-term investors tend to keep their investments and not sell them even during periods of market decline, instead choosing to hold on to them.

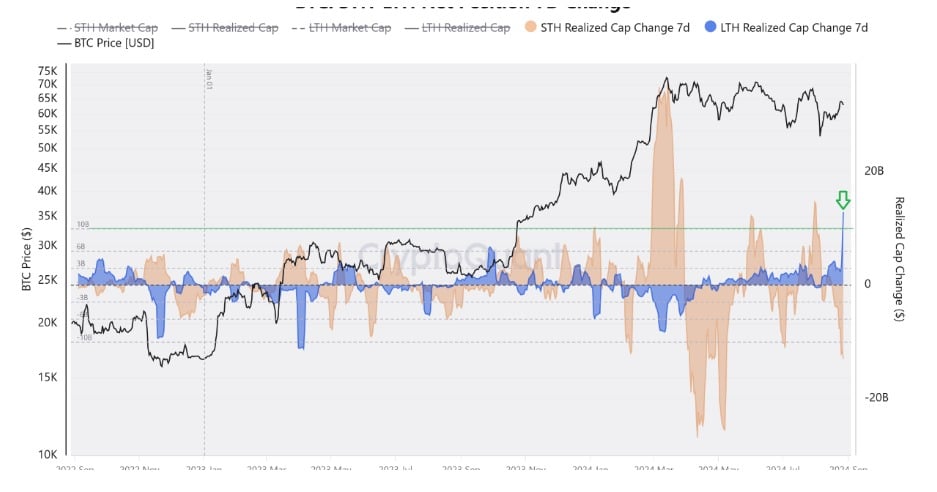

According to Amr Taha’s interpretation, it is suggested that long-term investors have invested approximately $10 billion in purchasing cryptocurrency. Moreover, these investors chose not to sell during the recent market dip.

In a post, the analyst shared,

“For the first time ever, the realized capitalization of long-term holders has exceeded $10 billion.”

From our findings, it appears that those who held onto their cryptocurrency for more than 155 days remained steadfast in their possession. Moreover, during the last month, there has been a noticeable rise in institutional buying of digital assets.

Over the past month, notable Bitcoin investors like Marathon, BlackRock, Galaxy Digital, Metaplanet, and others have boosted their BTC holdings.

These institutions are large holders and tend to accumulate their assets for a prolonged period.

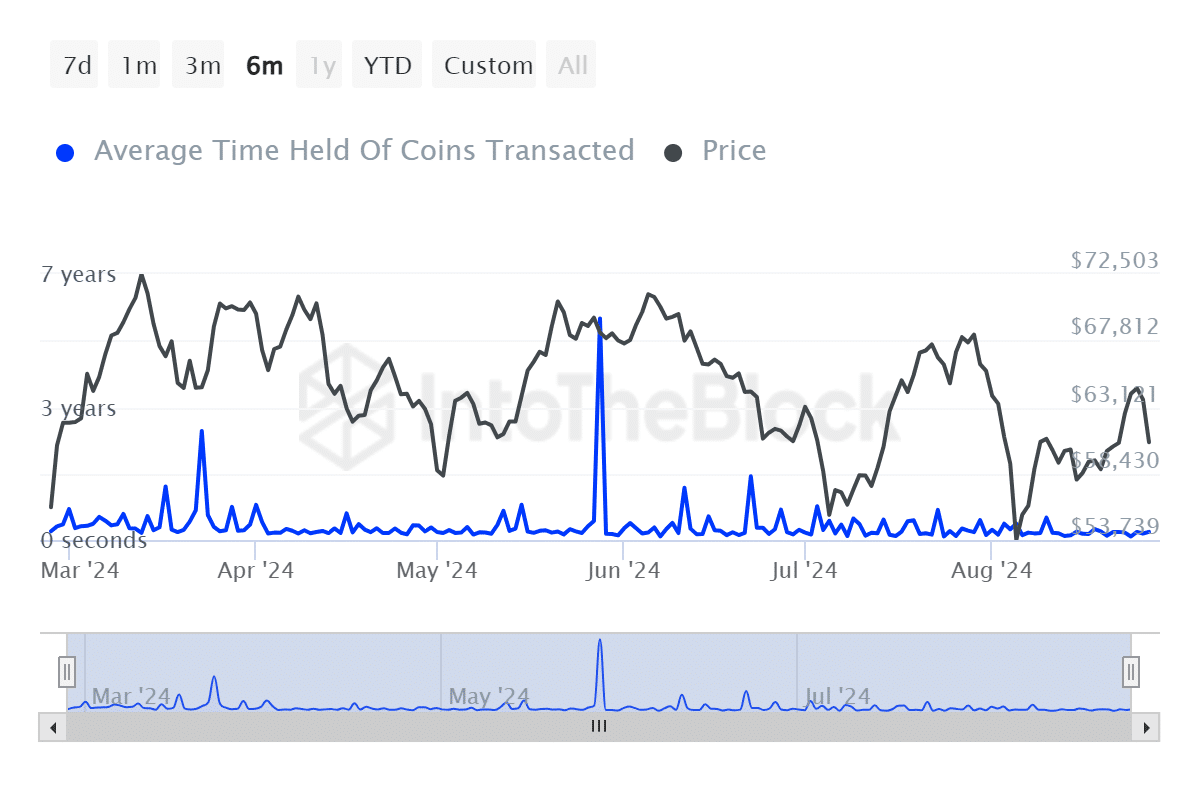

In my research findings, it appears that for significant stakeholders, the period of asset accumulation stretches over a considerable timespan, ranging from half a year to as long as three years. Data sourced from IntoTheblock corroborates this trend, suggesting that large holders are generally more patient in disposing of their assets compared to smaller investors who tend to offload their holdings more frequently.

Long-term holders supply increased by 262,00 BTC

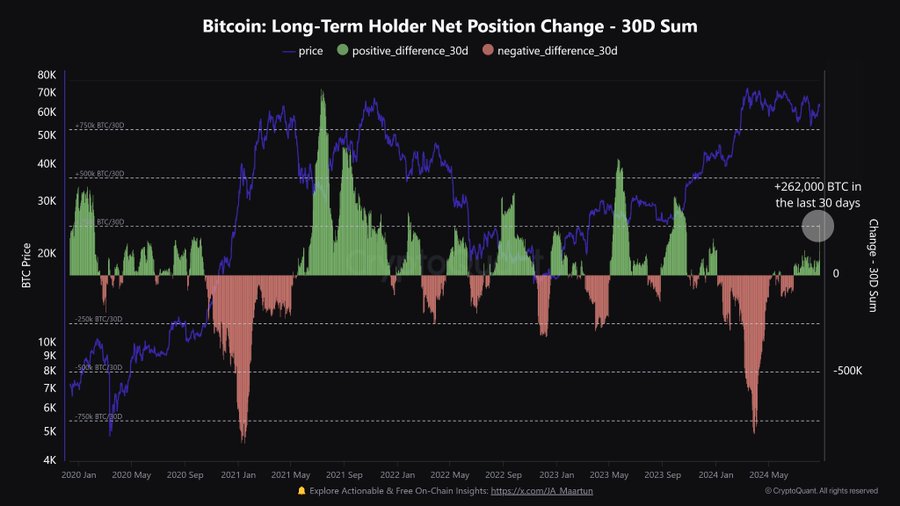

Despite the fact that long-term holders usually don’t sell, there has been a significant increase in the amount of Bitcoin they own. According to Cryptoquant, long-term holders currently account for more than 75% of the total Bitcoin supply.

Through their X (formerly Twitter) page, they shared the analysis, noting that,

Over the last month, there has been a rise of approximately 262,000 Bitcoin in the possession of long-term holders. Currently, they own around 14.82 million Bitcoins, which represents 75% of the entire Bitcoin supply.

Over the past month, Bitcoin’s (BTC) price has seen significant fluctuations, reaching a minimum of $49,577. This rollercoaster ride in prices is why long-term investors have been buying more.

These investors often acquire additional resources when the market is experiencing a dip, and then resell these resources during an extended period of market growth. This approach allows them to buy assets at lower prices initially and subsequently sell them for higher profits later on.

Thus, for long-term holders, low BTC prices are a buying opportunity to accumulate.

Consequently, even though Bitcoin is currently on a downward trend, it offers a chance for long-term investors to buy at lower prices. This increased purchasing activity creates buying demand, which ultimately pushes the price upward.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

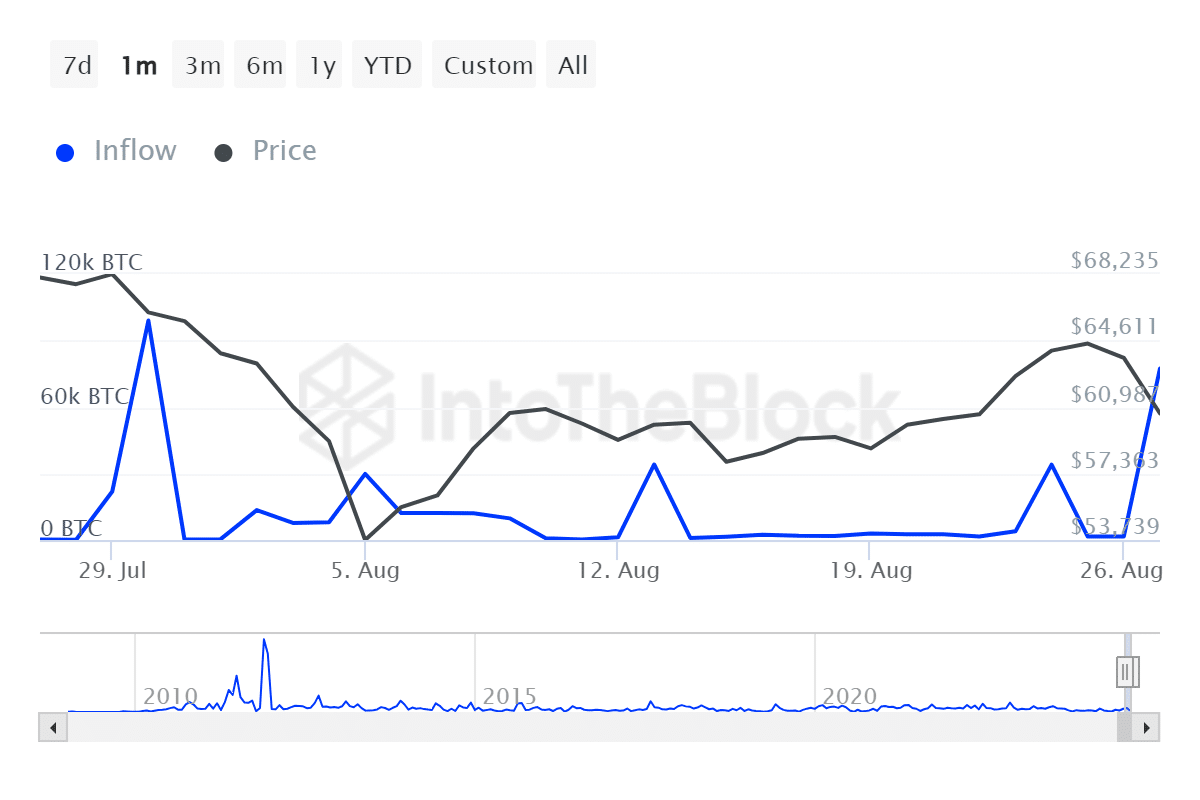

Consequently, during the market’s crash earlier in August, there was a surge in the influx of large holdings from the 5th through the 9th, which helped push prices up towards the $60,662 resistance point.

Thus, such a cycle will likely repeat itself to drive prices above $60k.

Read More

2024-08-28 20:40