- Bitcoin’s LTHs are distributing slower, signaling a potential shift in market sentiment

- Historical trends suggest reduced LTH selling pressure often leads to upward price momentum

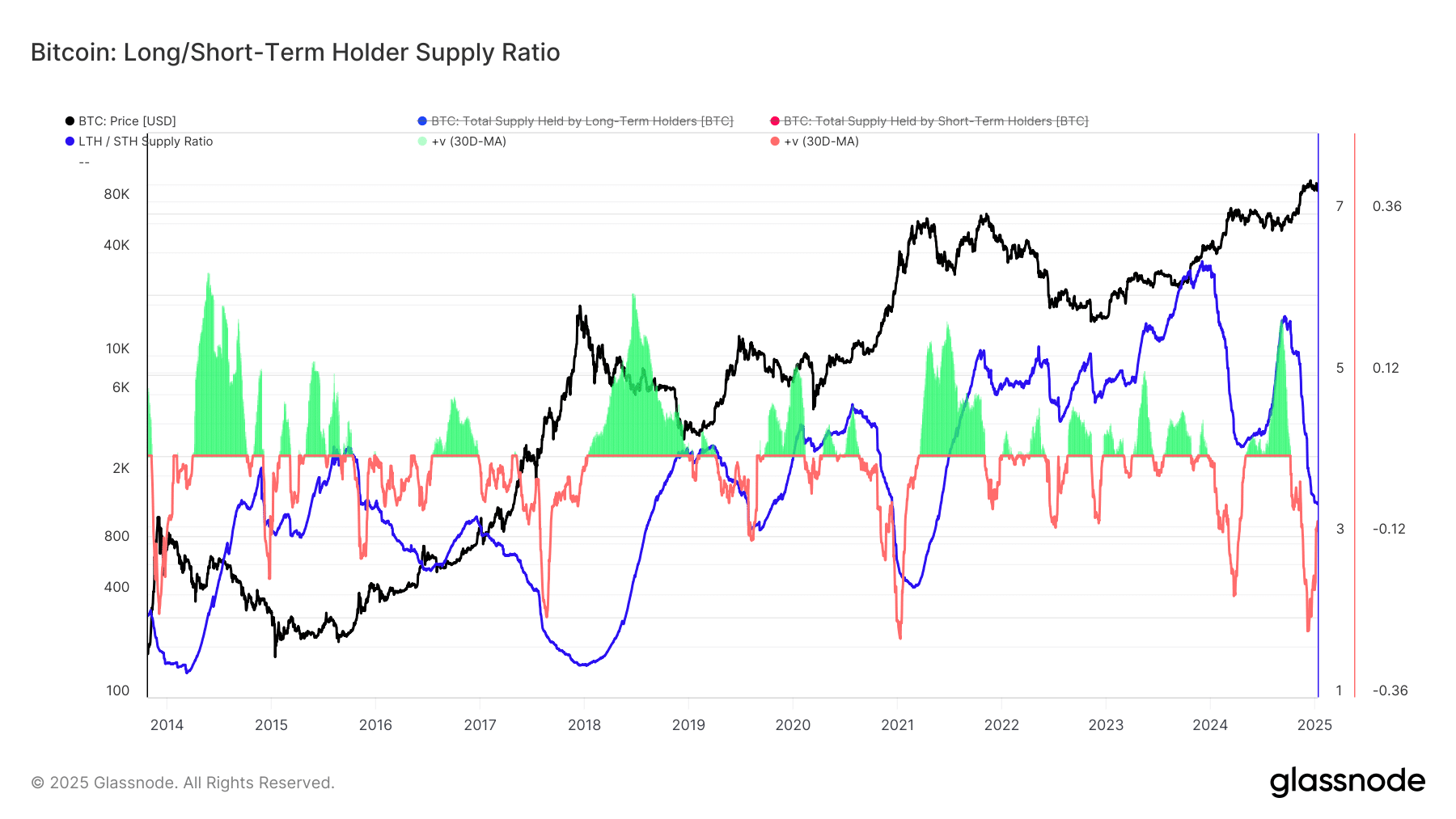

At the current moment, Bitcoin’s [BTC] value appeared to be slightly under its record peak by approximately 12%. This has sparked curiosity among many about the potential trajectory of the market. Interestingly, even with this decline, Long-Term Holder (LTH) investors are still gradually dispersing their Bitcoin holdings, although at a reduced rate compared to before.

It’s worth noting that on-chain data indicates a significant change – Large Holder Transactions (LHTs) are still offloading assets, but the pace of distribution is starting to decelerate. What’s more intriguing is that the 30-day change in LTH supply suggests this distribution cycle might have reached its highest point, implying that the selling pressure could diminish soon.

LTH distribution trends

It appears that long-term Bitcoin holders have been offloading their coins, even though the price is only 12% shy of its record high. This persistent selling pattern suggests they are being cautious, perhaps influenced by wider economic conditions or a desire to cash in on profits amid volatile market scenarios. However, it’s worth noting that the rate of this distribution has noticeably decreased recently.

Over the past 30 days, there has been a decrease in the amount of Long-Term Holder (LTH) supply, hinting that the peak point for LTH sell-offs might be behind us. This change could be due to an improvement in market confidence and the alleviation of some external pressures, which may have lessened the worries that led to previous selling.

30-Day percent change in LTH supply

Over a month, the percentage change in Long-Term Holder (LTH) supply shows us if these investors are primarily amassing or dispensing Bitcoin. An increase usually suggests they’re accumulating, whereas a decrease generally means they’re distributing.

As a crypto investor, I’ve noticed that the data indicates a leveling off in the distribution of Large Holder Tokens (LHT). This could be a sign that the selling phase might be nearing its end. Historically, such slows have been followed by periods with less selling pressure. With fewer LHTs being distributed, the downward pressure on Bitcoin might lessen, paving the way for consolidation or even a possible bullish reversal.

Comparison to previous cycles and potential implications

As a researcher, I’ve observed that when examining past market cycles, it appears that slowdowns in the distribution of Long-Term Holders (LTH) often signify the conclusion of bear markets or the beginning of bull markets. In 2015, 2019, and 2020, such LTH distribution slowdowns were preceded by decreased market volatility, paving the way for upward trends. During these periods, Bitcoin exhibited increased stability, higher investor confidence, and fresh investments from newcomers – all factors that contributed to price escalations.

If historical patterns are any indication, Bitcoin’s current price might hold steady for a while and then potentially increase. A change in the behavior of Long-Term Holders and less selling pressure suggests the onset of a price surge. This could trigger either a strong bullish trend or prolonged consolidation, based on market circumstances.

Historically speaking, periods with less selling activity tend to pave the way for Bitcoin to reach unprecedented peaks. Yet, it’s uncertain if the market will repeat this trend in the future.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

2025-01-11 22:15