- STHs are crying over $7 billion in losses – grab the tissues! 🧻

- Bitcoin’s price is stuck under moving averages, and STHs are sweating like it’s a sauna 🥵

Short-term Bitcoin [BTC] holders are feeling the burn 🔥 as their unrealized losses pile up faster than a toddler’s LEGO tower. But hey, history says this is just a little “chill pill” in the middle of a bull market. So, relax, folks – it’s not the apocalypse… yet. 🚀

Bitcoin Losses: Not the End of the World (Yet) 🌍

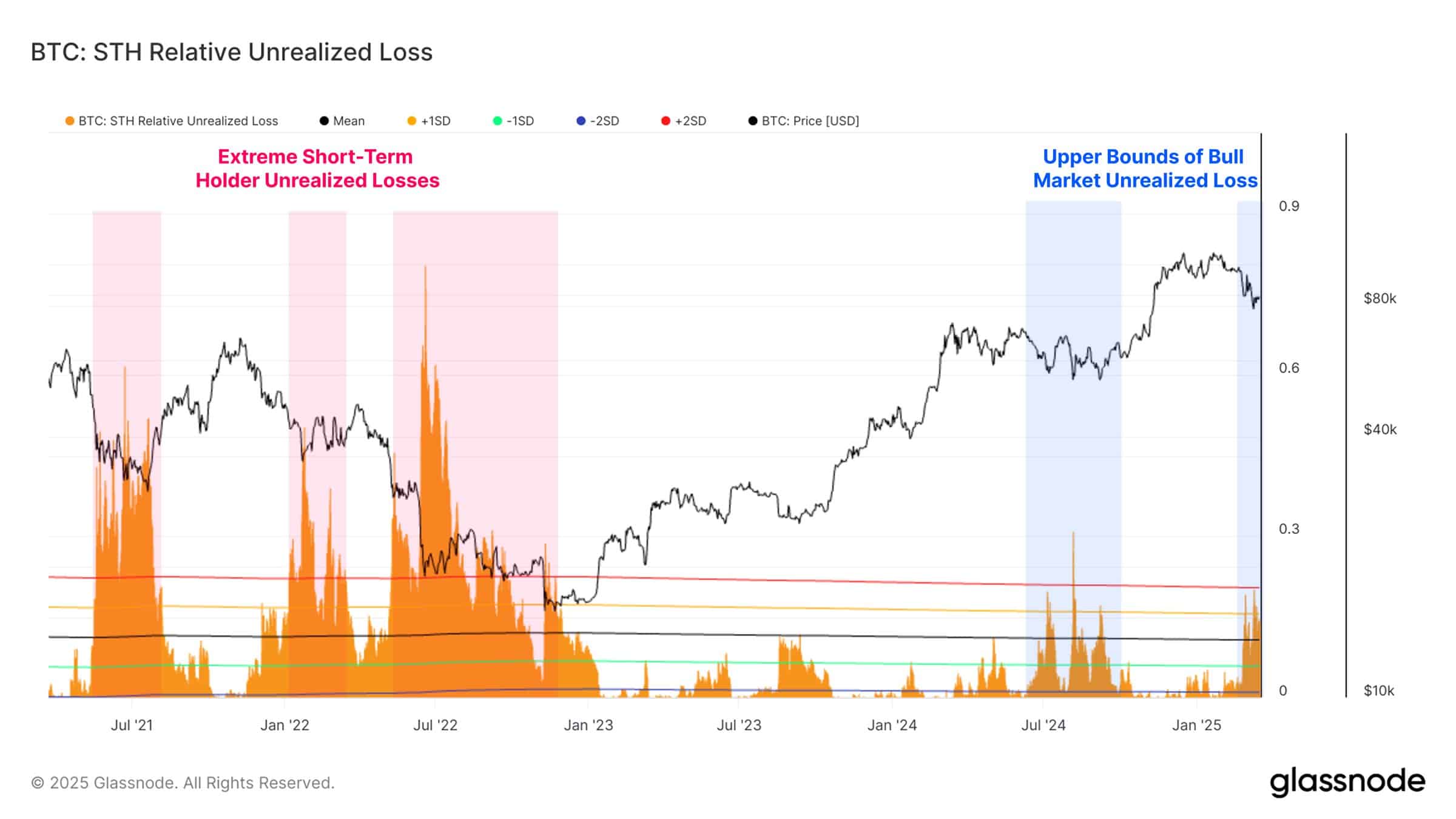

According to Glassnode, the unrealized losses for short-term holders [STHs] are nearing the +2 standard deviation level – which is basically the “I’m freaking out” zone. But guess what? They’re still within the “bull market” range. So, no need to call the funeral home just yet. 🏥

And let’s not forget the $7 billion in realized losses over the last 30 days. Sure, it’s the highest in this cycle, but it’s peanuts compared to the $19.8 billion and $20.7 billion losses in May 2021 and June 2022. So, chin up, buttercup! 🧈

What does this mean? Well, it seems like short-term holders are cutting their losses before things get really ugly. It’s like leaving a party before the cops show up – smart move! 🚔

Bitcoin’s Price: Stuck in Traffic 🚦

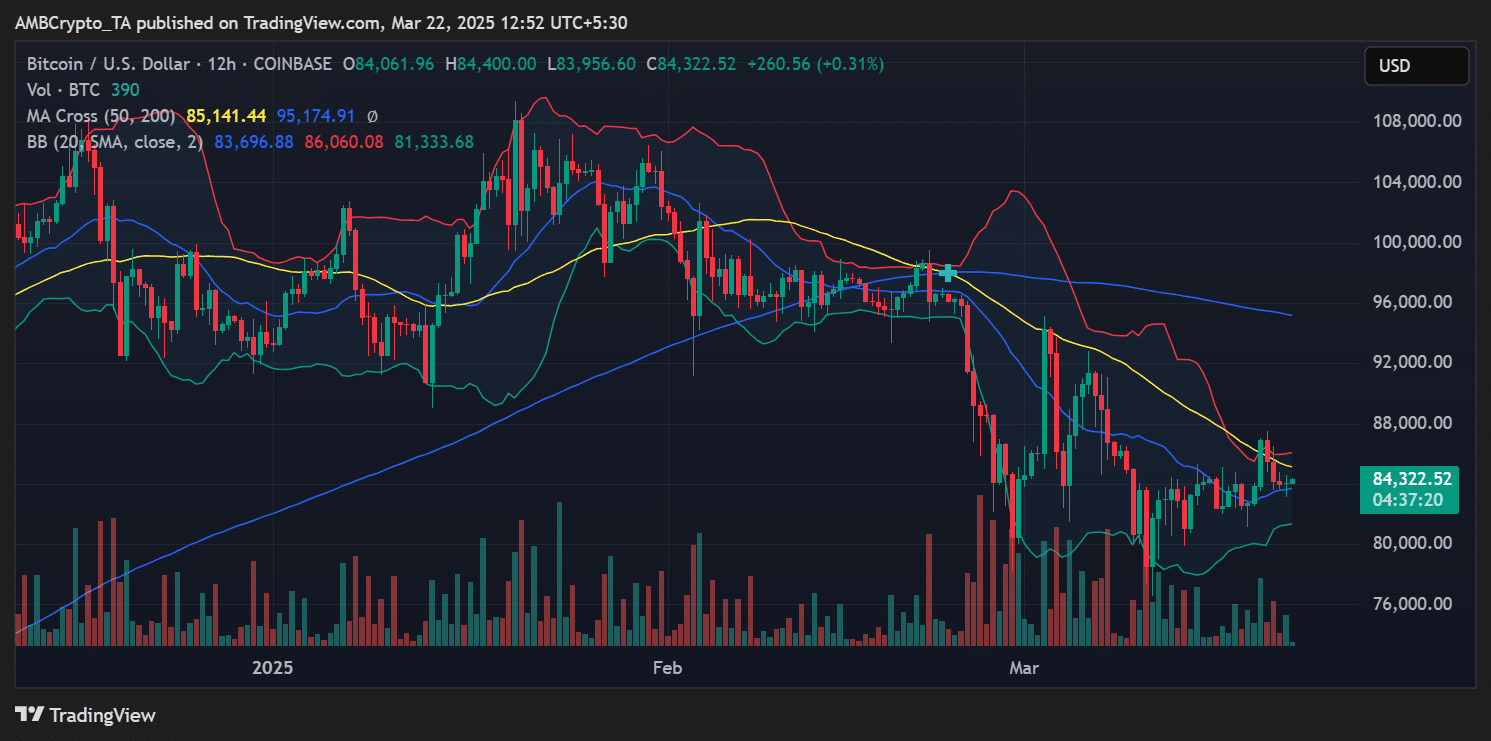

Bitcoin was trading at $84,322 at press time, which is like being stuck in traffic just before the exit ramp. It’s below the 50-day moving average of $85,141 and way below the 200-day moving average at $95,174. So, unless Bitcoin finds a turbo boost, it’s going to be a slow ride. 🐢

The Bollinger Bands are tightening, which is like a rubber band being stretched – something’s gotta give! But with short-term holders feeling the heat, the bias could be bearish unless some new buyers show up with their wallets open. 💰

What’s Next for Bitcoin? 🤔

Rising unrealized and realized losses mean higher risk, especially for those who bought Bitcoin at recent highs. But since these losses are still within historical bull market patterns, it’s not time to panic… yet. 🚨

If Bitcoin can reclaim the $85,000 level, it could give STHs a reason to smile again. But if it falls below $83,000, it could trigger more selling and test lower supports near $80,000. So, buckle up, folks – it’s going to be a bumpy ride! 🎢

In conclusion, short-term pain is real, but it’s not the end of the world. As long as Bitcoin holds above key psychological levels and macro flows stay intact, this correction might just be a reset button. So, keep calm and HODL on! 🚀

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Rick and Morty Season 8: Release Date SHOCK!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

2025-03-23 07:07