- Bitcoin was trading below $66k at press time, with analysts pointing to $71k as a key level for a bullish reversal.

- Short-term holder supply declines, indicating growing confidence in the market, while open interest sees mixed signals.

As a seasoned crypto investor with a decade of experience navigating the wild West of digital assets, I find myself cautiously optimistic about the recent developments in Bitcoin. The current dip to $61,639 represents a minor setback, but it’s important to remember that we’ve been here before – and every dip is another opportunity for accumulation.

As a researcher studying the cryptocurrency market, I’ve observed that Bitcoin [BTC] has experienced a slight dip today, trading at approximately $61,639. This represents a drop of around 3.5% in the past 24 hours. It’s worth noting that this decline follows a significant recovery last week, where Bitcoin soared to reach an impressive high of $66,000.

Despite the recent dip, Bitcoin was still up by 9.4% over the last two weeks.

Although there aren’t definitive reasons for the recent decline in value, analysts are tracking various tendencies and significant thresholds that Bitcoin investors might want to consider while predicting the asset’s future price direction.

Key levels and shifts among Bitcoin holders

Recently, experienced trader Peter Brandt discussed his insights about the Bitcoin market, highlighting an important threshold that bulls should aim to regain control over.

As per Brandt’s advice, Bitcoin owners and investors ought to keep an eye on whether the value of BTC ends the day above $71,000, following a fresh record high (peak), as this would suggest that the bullish trend initiated since November 2022 is still ongoing.

Brandt mentioned in his post,

“The recent rally in Bitcoin did NOT disturb the 7-month sequence of lower highs and lower lows.”

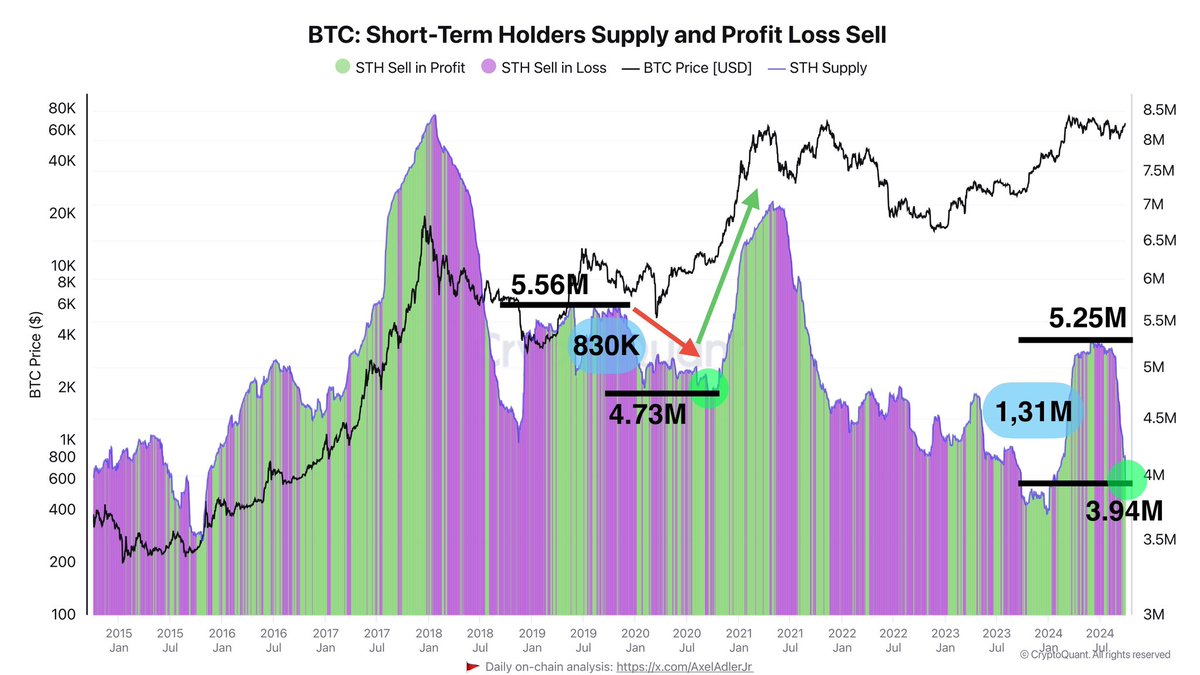

Currently, findings from CryptoQuant reveal a change in the Bitcoin holding habits, notably among short-term holders (those who own Bitcoin for a relatively short period). Notably, there’s been a reduction of about 1.31 million Bitcoins (approximately $83 billion worth) in the total amount of Bitcoin held by these short-term holders.

According to crypto analyst Axel Adler Jr from CryptoQuant, the decrease in BTC circulation among long-term investors (STHs) indicates a rise in market confidence. This is because these investors are choosing to keep their assets instead of selling them (often referred to as HODLing).

Furthermore, although some individuals have cashed in on their investments by offloading their coins, it appears that a more long-lasting approach to holding these assets is becoming popular among many investors.

Adding to the discussion on market sentiment, prominent crypto analyst Willy Woo shared his thoughts on the current and future structure of Bitcoin’s price.

He suggested that the mid-term outlook is moving from bearish to neutral, and could be on its way to becoming bullish. Woo also predicted that a new all-time high for Bitcoin may take time, with the next bullish attempt potentially coming after a “cool-off” period of 1-3 weeks.

According to him, there may not be much movement in October, but he expects a rise in bullish trends during November and December.

Open interest and active addresses indicate mixed trends

Apart from the opinions of single experts, market statistics offer an extra viewpoint regarding Bitcoin’s current condition.

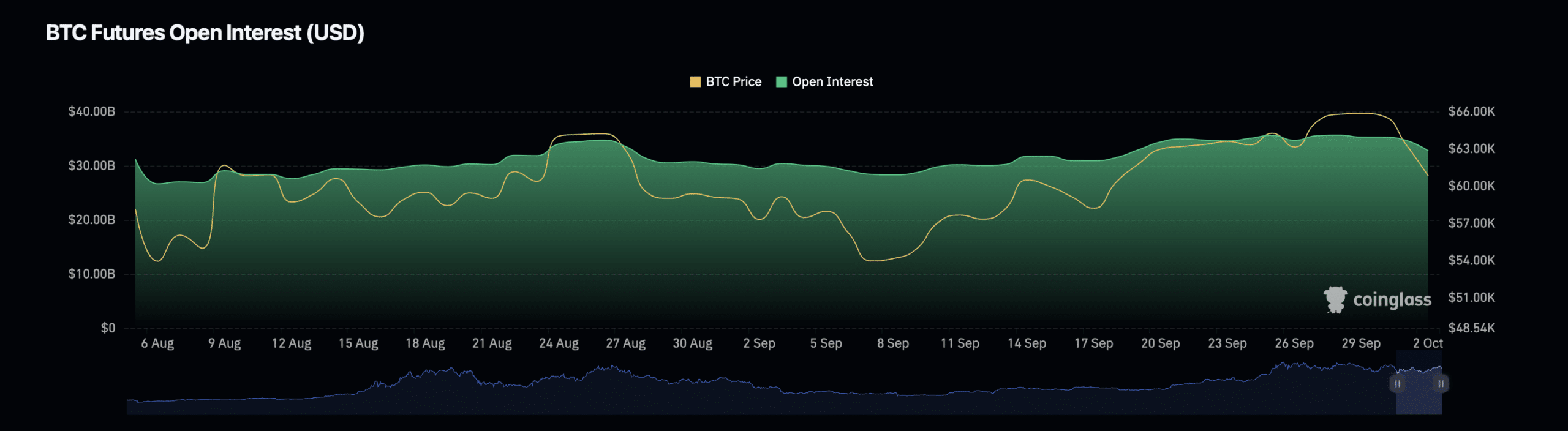

The number of open derivative contracts for Bitcoin, which serves as a vital sign, is an aspect that Bitcoin owners tend to keep a close eye on.

Based on statistics from Coinglass, the open interest for Bitcoin has seen a drop of approximately 4.52%. At present, this figure stands at around $32.92 billion.

As an analyst, I’ve noticed a significant jump in open interest volume, which has soared by 61.23% to hit $101.57 billion. This rise in trading activity, even amid a decline in overall open interest, points towards a growing fascination with Bitcoin derivatives. However, it remains uncertain whether this escalating interest will lead to a prolonged price surge.

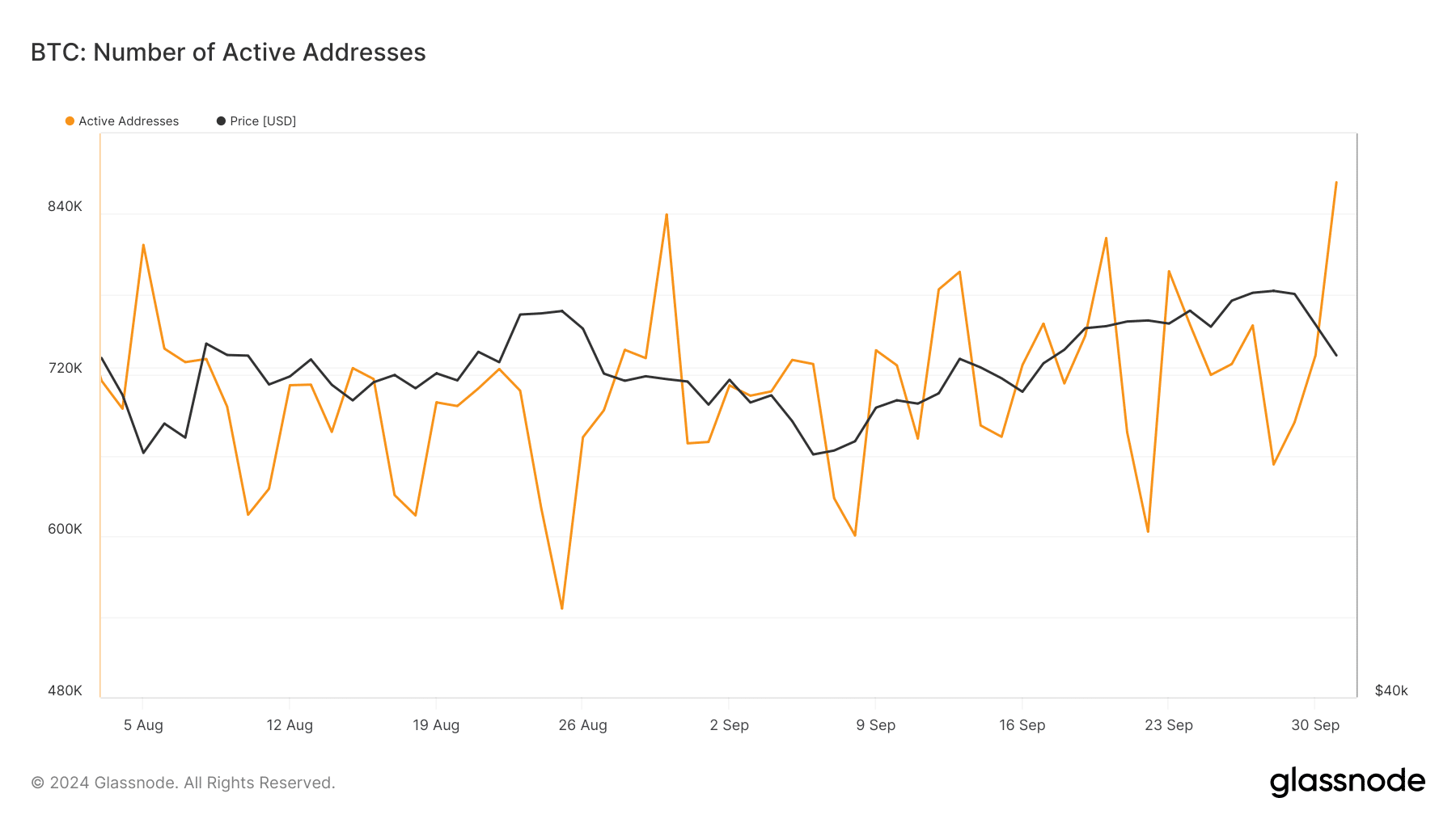

As a researcher, I’ve found that another significant indicator I’m closely monitoring is the count of active Bitcoin wallets. Interestingly, this statistic appears to be on an upward trend, suggesting potential recovery.

Read Bitcoin’s [BTC] Price Prediction 2024-25

The number of active addresses has grown dramatically, reaching more than 863,576 at the current moment, which represents a considerable jump compared to the approximately 603,000 active addresses observed just a few days ago in the previous month.

This rise in activity may be an indicator of renewed market engagement and potentially signals a shift towards increased usage and trading among Bitcoin holders.

Read More

2024-10-02 15:04