-

Bitcoin has reached a fork in the road- recovery, or an extended accumulation phase.

The long-term holders were slow in buying BTC despite the recent drops, a reticence that could spell trouble.

As a seasoned crypto investor, I’ve seen my fair share of market fluctuations. The recent behavior of Bitcoin (BTC) has left me with mixed feelings. On one hand, BTC has reached a crucial juncture – recovery or an extended accumulation phase. On the other hand, the lackluster buying from long-term holders is causing concern.

Bitcoin (BTC) held steadfast near the $61,000 mark despite news that some Bitcoin miners were considering shifting to Kaspa (KAS). This potential shift could add to market unease as mentioned in a recent analysis by AMBCrypto.

As a researcher studying the Bitcoin mining industry, I’ve come across an intriguing perspective. Some analysts propose that miners offloading their assets following a halving event or for financial reasons may not significantly influence the market as initially assumed.

As a market analyst, I ponder over the current state of Bitcoin (BTC) price action and consider the following perspective. Am I prepared to witness a surge in BTC prices? Or is the selling momentum still in play from external sources?

Lack of demand combined with long-term holder behavior caused worries

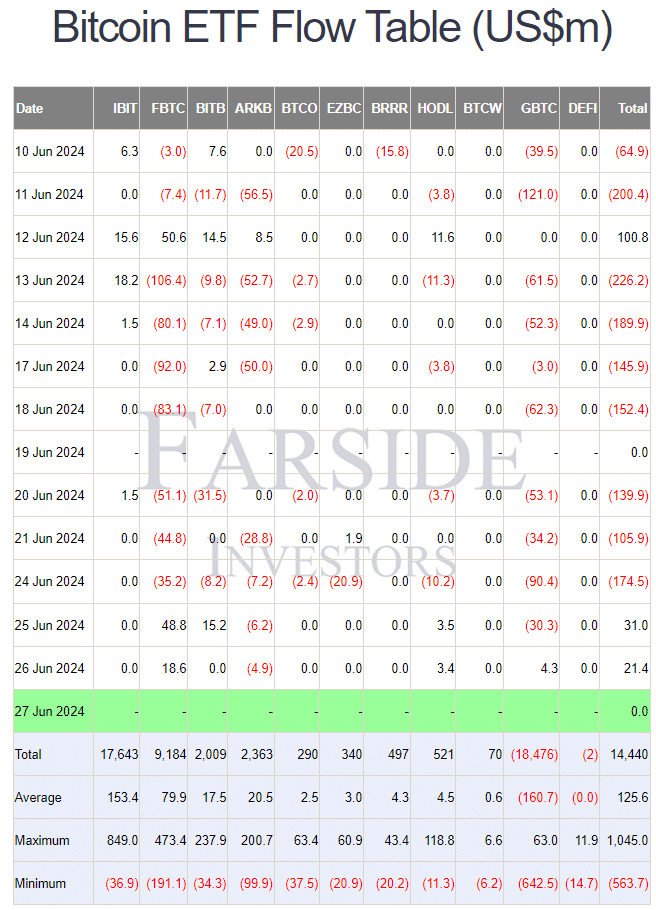

As a crypto investor, I’ve noticed that the ETF inflows have predominantly taken a downturn over the past two weeks. However, there has been a slight respite in the form of positive flows on the last two trading days, providing some momentary relief from the intense selling pressure.

Investor attitudes towards Bitcoin suggested bearishness, but it remains uncertain if this trend has reversed or if it’s just a brief pause before more selling ensues.

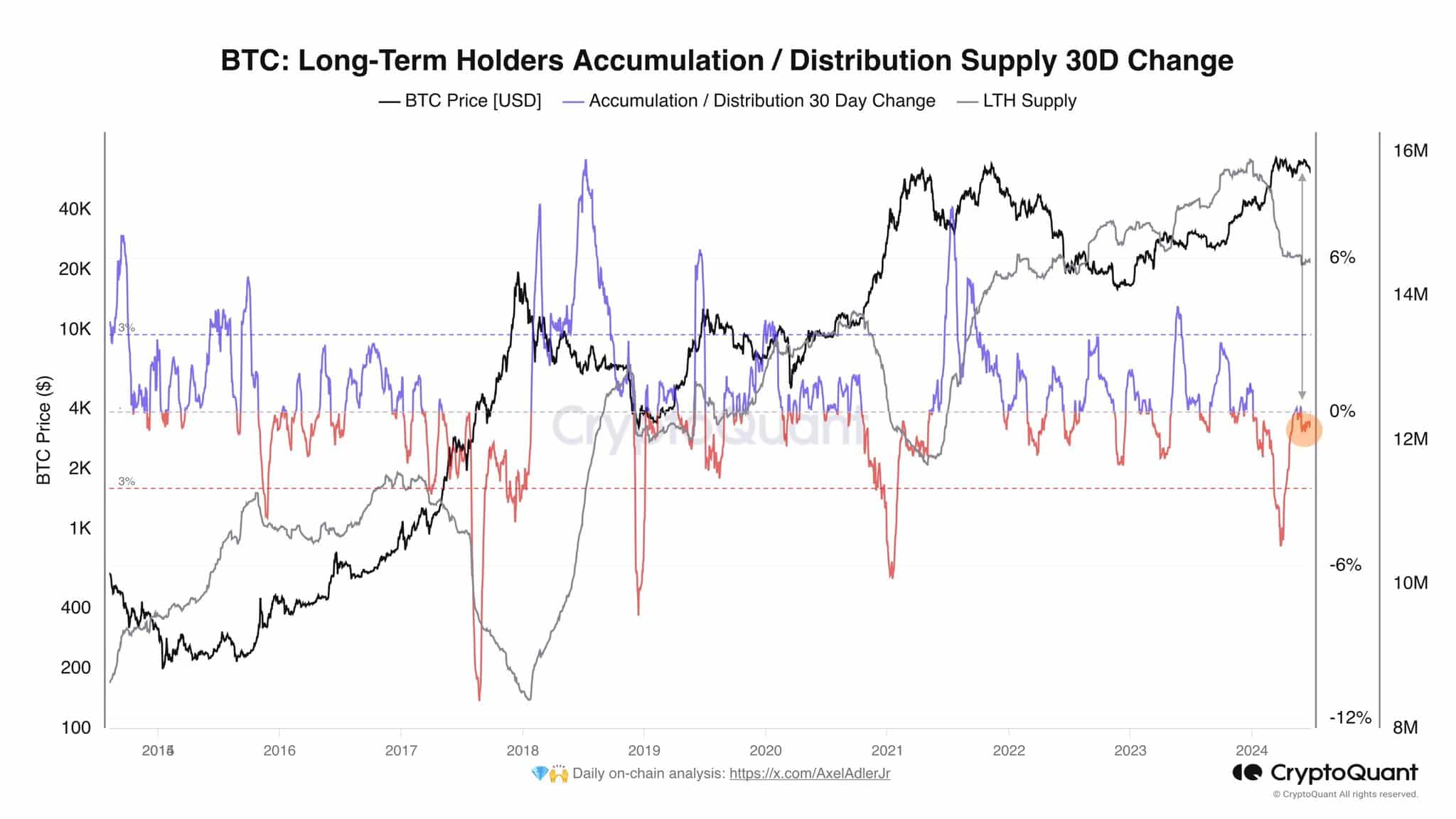

Crypto expert Axel Adler noted on X, previously known as Twitter, that the quantity of cryptocurrency held by long-term investors had scarcely changed over the past few weeks. This stagnation in the number of long-term holders was indicative of a prevailing sense of pessimism within the market.

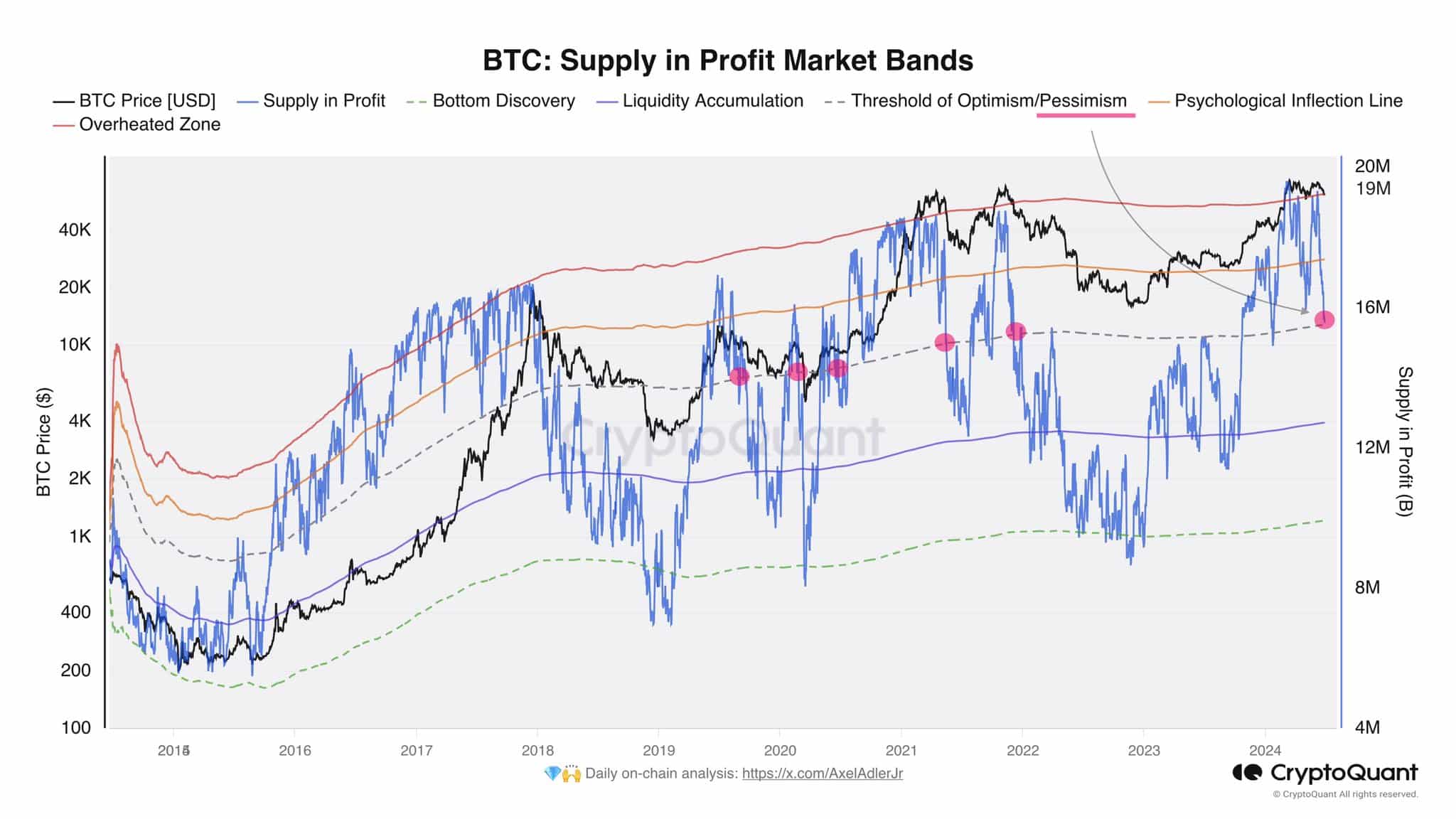

Supply in profit turns back from overheated zone

As a researcher analyzing the data, I noted that we had reached a turning point in terms of supply and profit. The tipping point of optimistic or pessimistic outlooks had been surpassed.

For the previous four years, when the profit line’s supply dipped beneath a certain threshold, it was typically a sign that the market was heading into an extended period of buying (accumulation).

As a researcher studying the Bitcoin market, I would explain it this way: A potential price decrease might follow the upcoming event, which could temper the market’s optimistic outlook on Bitcoin post-halving in May.

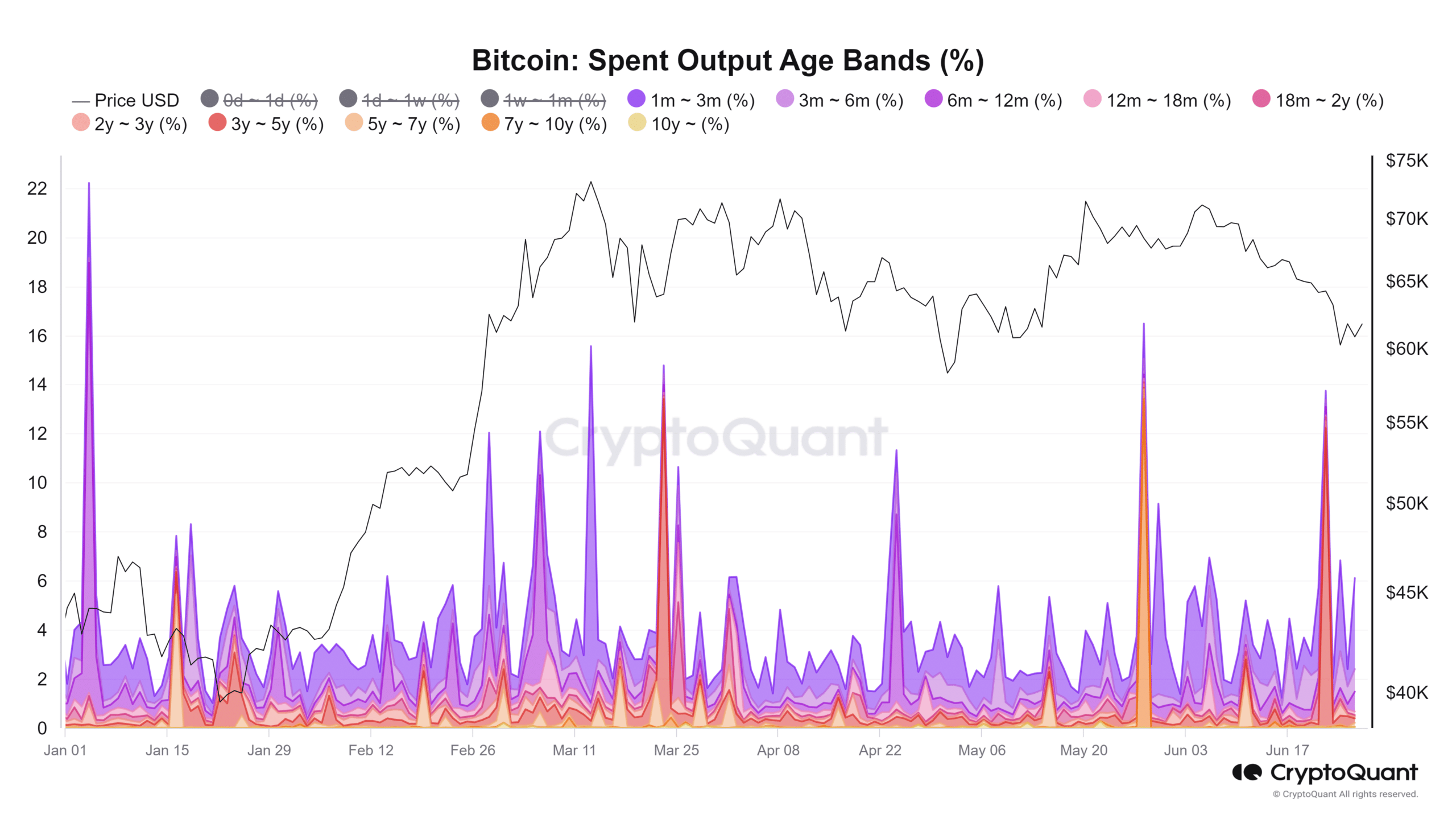

The analysis of historical data revealed that a significant number of coins were transferred from the groups of investors who had held their assets for 7 to 10 years and those who had owned them for 3 to 5 years during late May and mid-June, respectively.

Read Bitcoin’s [BTC] Price Prediction 2024-25

This suggested that long-term holders were likely selling and was a sign of a lack of conviction.

The current trend doesn’t assure more price decreases, but it indicates that selling force hasn’t weakened yet.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- PI PREDICTION. PI cryptocurrency

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

2024-06-28 10:15