Since the frost touched December’s brow, Bitcoin, like a stubborn mule, has meandered between $85,000 and $90,000. Desperation hangs in the air as man tries to anticipate its next move. Like the calmening sea that still hides the lurking leviathan below, this market sits caught between thirds of heaven and earth, seeming stable yet teetering on the whimsy of trader whims. In the quietude of these daily numbers, positioning and the capricious nature of demand play their deceitful tunes.

With volatility as placid as a placemat, traders’ antics and dearly held convictions gain traction, shaping the flight or fall of this digital gold once the shackles break. Long positions rise like the anticipation in a crowded barn, suggesting maybe, just maybe, the sodbusters of crypto’s frontier have foreseen a hopeful sunrise.

Hope Marches on – Are Traders Dancing to the Same Euphoric Tune?

Longs, where traders play at sunnier skies, speak of confidence once barren like the Dust Bowl. The start of 2022 saw hope climb from lows near $15,000, heralded by an agrarian applause. Now, with 22-week highs, the optimists stake their claim, betting their shining future on the rise. These dreams are wilder than the winds of destiny, setting root not amidst thunderous confirmation but in the quiet before the storm.

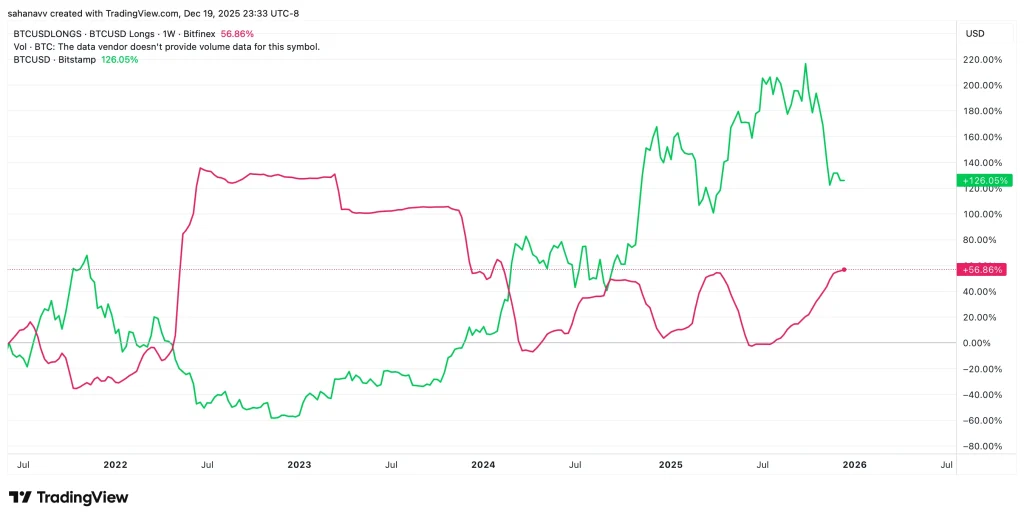

The chart lays out its tale like a dusty roadmap, mapping long positions’ march against prices’ lullabies. History whispers of inverse trysts-tops in long positions meeting the humility of a promised bear, and the fading of longs accompanying the restorative revival of values. Since the year 2024, this dance has spun its pirouettes many times, with longs amassing at fresh highs while Bitcoin lingers near the depths of the range, a fateful divergence that threatens to rend the sails with mighty gales should momentum fail.

When the winds of price no longer sing of uplift, these battlements of longs may fortify a torrent of correction, driving Bitcoin into trenches of support rather than the prairies of consolidation.

A Stepping Stone, Not a Answer

The range may hold, but beneath lies a tilting scale of risk. When longs strain against their own optimism, when volatility sits as still as dust in an old beam of sunlight, and the expansion of demand gasps like a lark, the price trembles, vulnerable as a babe before its fall. Should it breach the lands of $83,000-$82,000, a deeper sorrow beckons, towards levels of $78,000-$75,000-a ghostly embrace where demand once shuddered in relief.

These zones are not mere glimpses at a forecast but whispers of change. The clasp of Bitcoin in the heights of glory remains elusive, leaving traders teetering on the edge, treating the seeming stability as a borrowed tiller on choppy waters. The rhythm continues, but beware the longer the calm, the greater the storm.

Read More

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Resident Evil Requiem cast: Full list of voice actors

- Survivor’s Colby Donaldson Admits He Almost Backed Out of Season 50

- Gold Rate Forecast

- Best Thanos Comics (September 2025)

- Best Controller Settings for ARC Raiders

- How to Build a Waterfall in Enshrouded

- The 10 Best Episodes Of Star Trek: Enterprise

- Best Shazam Comics (Updated: September 2025)

- Goat 2 Release Date Estimate, News & Updates

2025-12-20 13:52