-

Bitcoin has been heavily exposed to leverage this month.

A look at how heavy shorts liquidations this week have influenced BTC’s performance.

As a seasoned researcher who has witnessed the rollercoaster ride of cryptocurrencies for years now, I find myself both awestruck and cautious when observing Bitcoin’s recent performance. The swift surge past $65,000 was indeed impressive, but the heavy losses incurred by shorts, especially those who expected a pivot at that price range, serve as a stark reminder of the inherent volatility in this market.

During today’s trading, I saw Bitcoin (BTC) confidently surpassing the $65,000 mark. Yet, this milestone came with significant drawbacks, particularly for those traders who anticipated a price reversal around the $64,000 level, resulting in substantial losses for them.

Some traders expected Bitcoin to go through another retracement at or near the $65,000 level.

Since the middle of September, Bitcoin (BTC) has been experiencing a steady increase. It’s reasonable to expect that some investors might decide to cash in their profits soon.

These anticipations sparked a surge in taking short positions, but as prices persisted in rising, it left those investors with insufficient resources to maintain their short positions. (Or) As the expectations were met and prices kept rallying, those holding short positions found themselves running out of stock to sell short. (Or) The increasing anticipations resulted in a boom of short selling, but as the market continued to rise, those betting on a decline struggled to keep up their short trades.

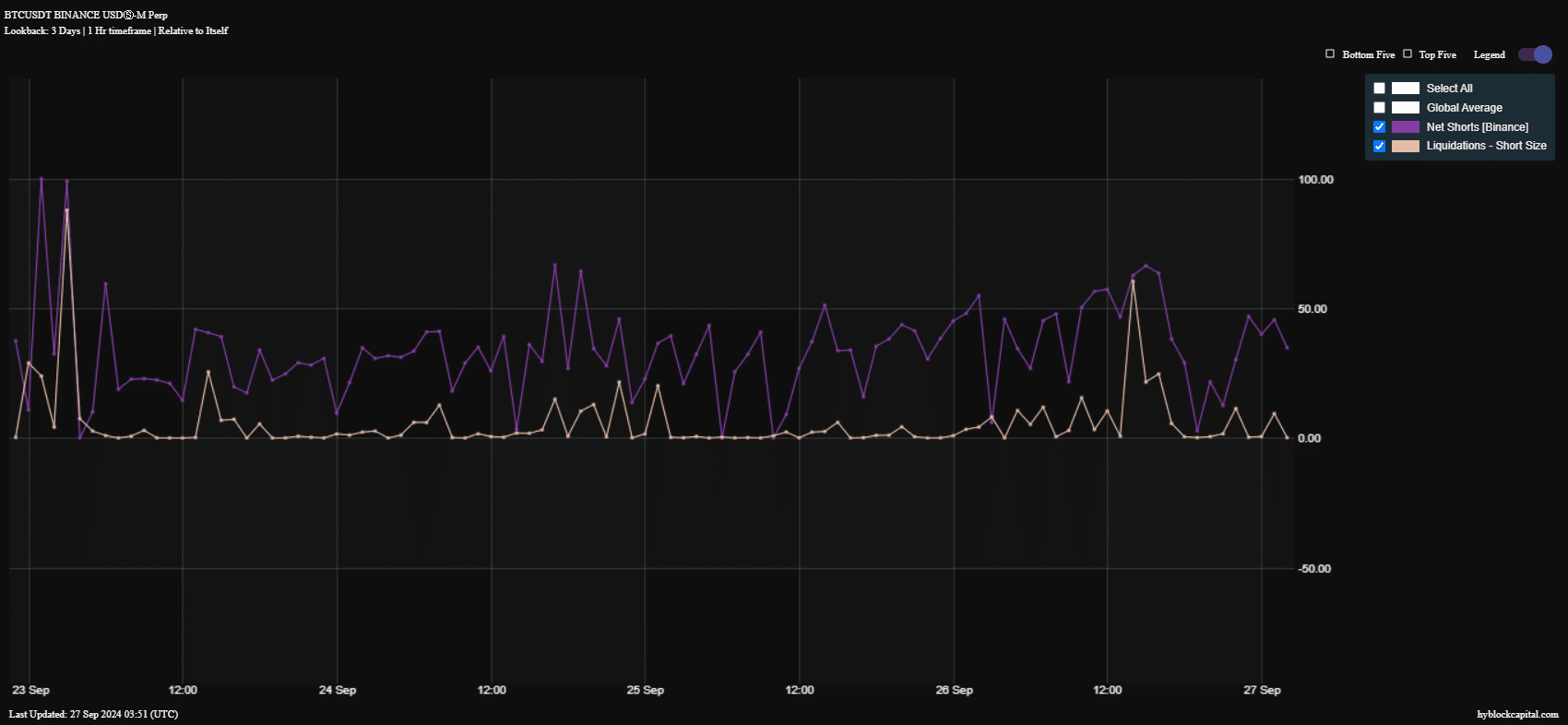

As a crypto investor, I’ve noticed an interesting pattern over the past few days: there have been significant increases in short positions. I believe this isn’t just a coincidence, given that the bullish sentiment around Bitcoin seemed to be waning between September 20th and 23rd. This could potentially indicate a shift in market dynamics.

Some may have seen this as a sign that the bears would likely take over.

On the 23rd of September, there was a significant increase in short positions (net shorts) on Binance. This was followed by a surge in the closure of these short positions (shorts liquidations).

Another spike occurred the following day, but there were fewer liquidations.

Ultimately, AMBCrypto noticed another brief surge on September 26th, which was then followed by a significant increase in liquidations.

Yesterday’s Bitcoin trading session saw liquidations take place unexpectedly due to a shift in the market direction contrary to my expectations as a short position holder. This sudden change exposed my short positions, leading to the liquidation event.

This aligns with an earlier finding where it was noticed that long-term investors weren’t cashing out, and instead, the reserve of miners was increasing over time.

Assessing Bitcoin exposure to leverage

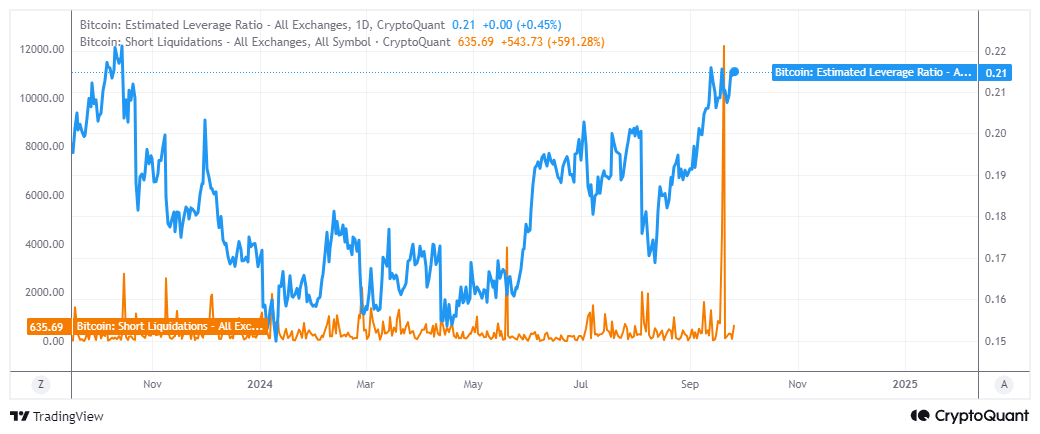

The shorts may have been heavily leveraged, thus liquidations triggered a short-squeeze situation.

According to CryptoQuant’s findings, the calculated leverage ratio rebounded significantly following its drop in August.

The last time that Bitcoin’s estimated leverage ratio was that high was in October 2023.

According to data from CryptoQuant, there was a significant increase – a staggering 591% – in the number of short positions that were liquidated over the past 24 hours.

During this timeframe, approximately 635 short positions were closed (liquidated). However, this figure is minuscule when compared to the massive 12,118 short positions that were liquidated on the 20th of September.

The recent compression and resulting sell-offs highlight just how exposed and reactive Bitcoin can be when it comes to high levels of debt. In terms of its value, there’s a possibility that Bitcoin may continue to face further decreases.

However, it will likely be limited if most long-term holders continue to HODL.

Read Bitcoin’s [BTC] Price Prediction 2024-25

At the moment, there’s a generally optimistic outlook, however, it’s crucial for traders to tread carefully as market conditions can shift unexpectedly.

As the election nears, Bitcoin’s value continues to experience significant fluctuations. This upcoming event is likely to have a substantial impact on the cryptocurrency market.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-09-28 05:12