-

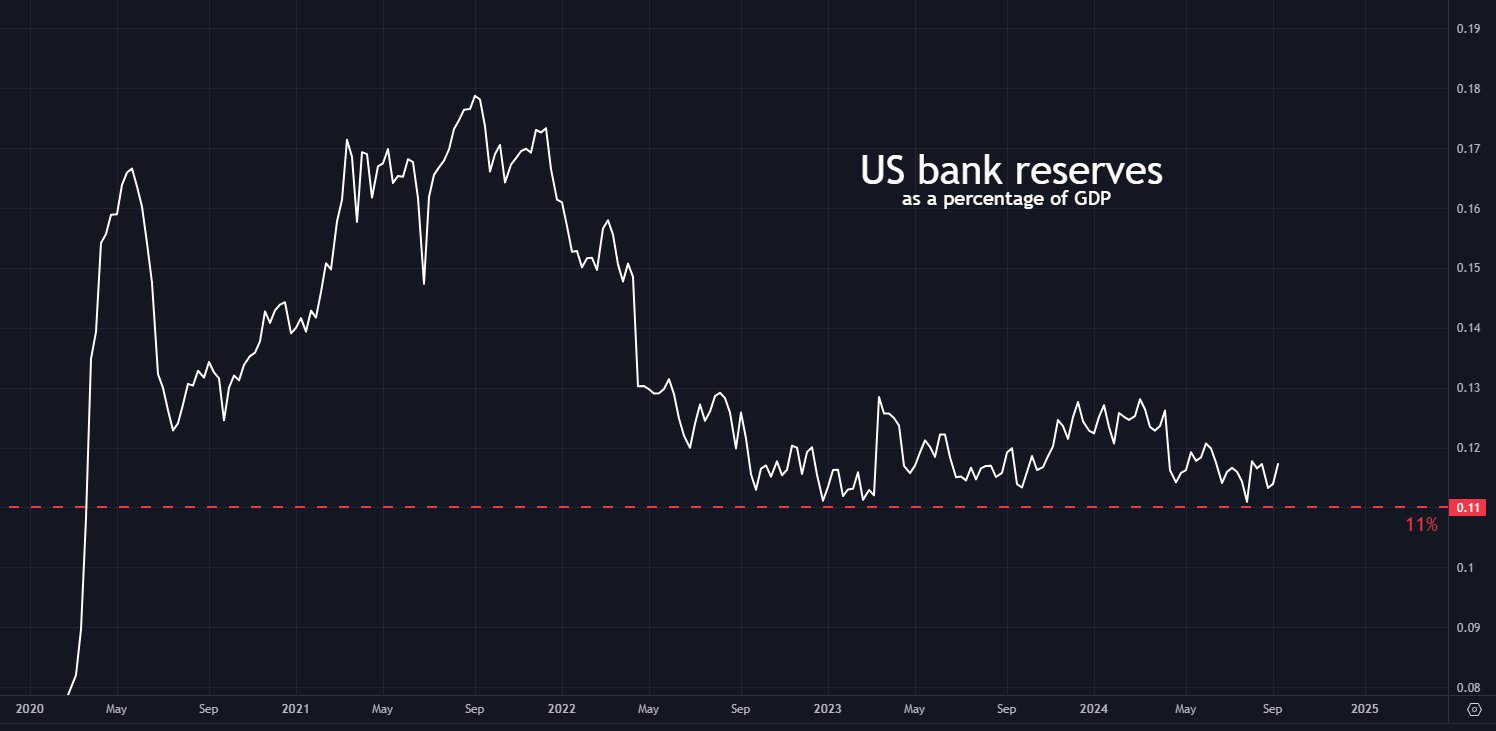

A temporal fall in US bank reserves expected could boost BTC.

Price action looking good as BTC dominance continues.

As a seasoned analyst with over two decades of experience in financial markets, I’ve seen more than my fair share of market cycles and trends. Based on the current analysis, I believe that Bitcoin [BTC] is primed for higher prices, given the potential boost to liquidity due to the anticipated fall in U.S. bank reserves. The temporary halt of Quantitative Tightening (QT) could lead to a significant increase in liquidity and benefit risk assets like BTC.

The current market situation seems to suggest that Bitcoin (BTC) might experience an increase in its price due to signs pointing towards improved liquidity.

According to analyst Tomas, he forecasted a short-term decrease in American bank reserves to their lowest point in more than four years, potentially leading the Federal Reserve to cease Quantitative Tightening (QT) procedures.

When Quantitative Tightening (QT) comes to a halt, it’s anticipated that there will be a substantial surge in market liquidity. This increase in liquidity could potentially boost the performance of riskier assets such as Bitcoin.

The prospect of this change has ignited a sense of hope, leading many to anticipate that Bitcoin might increase further, given that the Federal Reserve is likely to modify its strategies to accommodate economic transitions.

Looking at the short-term charts, like the 15-minute one, Bitcoin’s trends appear to be inconsistent or ambiguous.

Based on current market conditions, the TD Sequential indicator is signaling a potential sell opportunity for Bitcoin against the Tether currency (BTC/USDT). Meanwhile, both the Relative Strength Index (RSI) and Stochastic RSI are showing signs of an overbought market, suggesting that the price may have risen too quickly and could potentially correct.

It implies that even though there might be an upcoming adjustment, Bitcoin could potentially hold its ground and recover if it manages to end and maintain itself above the $60K mark.

Over the last six weeks, I’ve noticed the fluctuation in Bitcoin’s price, with it moving between $53K and $62K, showcasing its inherent volatility as an asset. I’m keeping a close eye on the market, hoping to witness a consistent breakout that might propel the value of Bitcoin even higher.

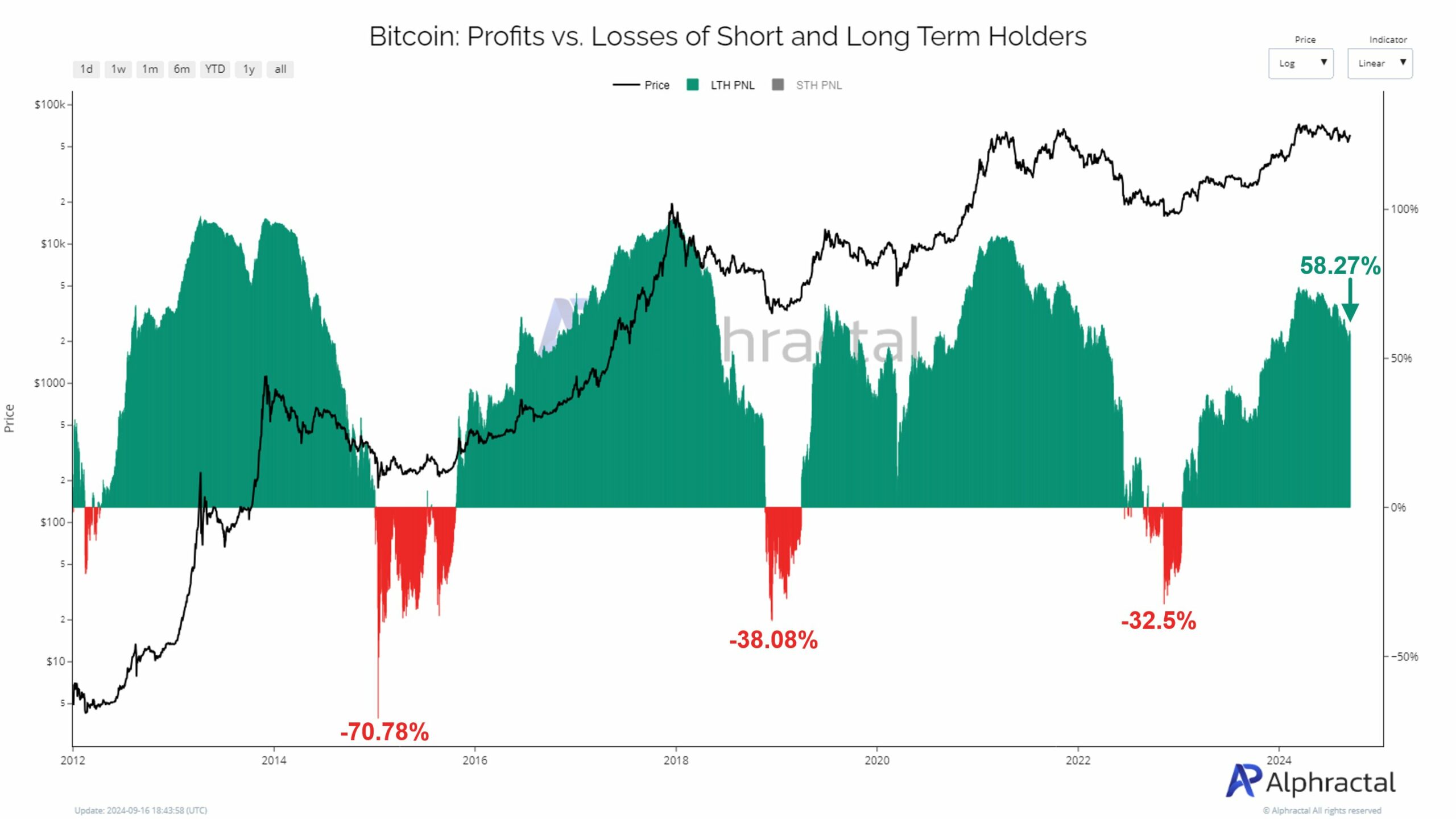

Profits vs losses of short and long term holders

Furthermore, it appears that Short-Term Holders are proving their strength, as they’ve only experienced a 4.46% loss at present, implying there’s little indication of an imminent sell-off in the market.

Historically, significant dips in the price of Bitcoin often happen when it reaches approximately a 60% decrease from its peak.

A small proportion of losses among Short-Term Holders suggests that the market is steady, with minimal signs of panic or compulsory selling.

Conversely, long-term investors have experienced a reduction in their average profitability, currently standing at 58.27%, which is a decline from its highest point of 74% back in March.

Based on my personal experience and observations of the Bitcoin market, this recent dip might signal a potential shift towards a bearish trend. Over the years, I have noticed that when profit margins start to dwindle consistently, it often precedes a downturn in the market. While Bitcoin has been profitable for many investors so far, if the current weakening of profitability continues, it could be an indication of tougher times ahead. It’s always essential to stay vigilant and adaptable as an investor, especially when navigating the volatile world of cryptocurrencies.

Bitcoin base cost analysis

As a researcher studying the Bitcoin market, I’ve observed an interesting dynamic among its participants. New ‘whale’ investors and Binance traders are aggressively purchasing Bitcoin, indicating a surge in accumulation. Conversely, the older ‘whale’ investors seem to be maintaining their holdings, suggesting a strategy of holding onto their assets rather than selling them off.

New buyers, both seasoned and novice, along with existing large-scale investors, are showing increased interest. This could indicate that the market is poised for possible price increases in the future.

If there’s a possibility of an error causing less money in banks, this could lead to a monetary injection (liquidity pump), which might positively impact assets like Bitcoin and other high-risk investments. This situation suggests a promising context for Bitcoin’s continued development.

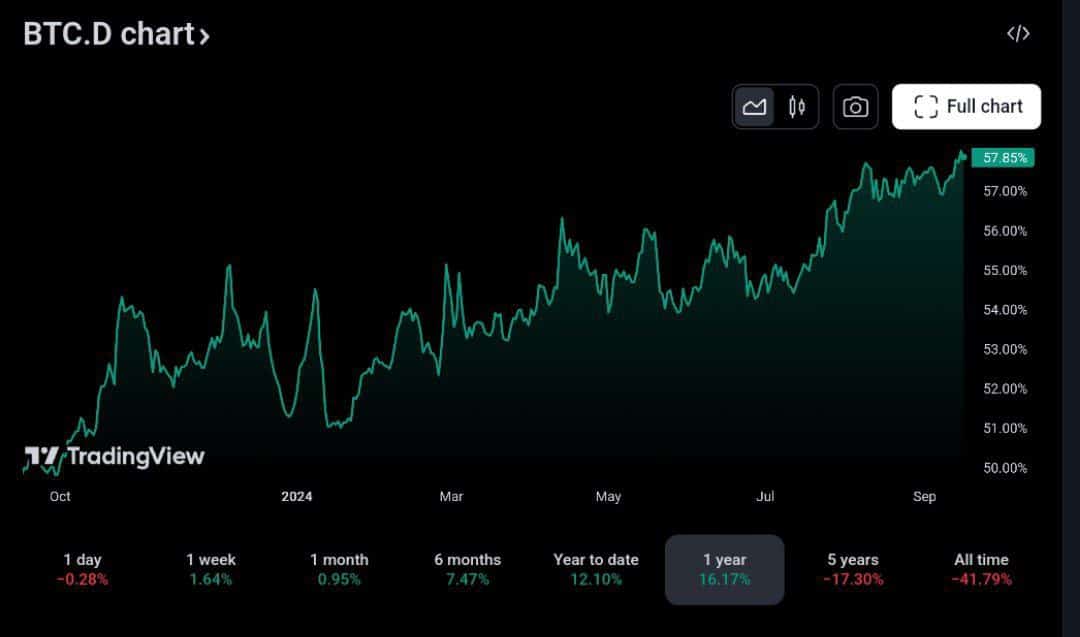

Bitcoin dominance continues to rise

The influence of Bitcoin within the cryptocurrency market has spiked, exceeding 57.86%, which is its peak level since last April.

This growing control suggests that Bitcoin is taking charge in the market, potentially gearing up for a substantial surge ahead.

Read Bitcoin’s [BTC] Price Prediction 2024-25

As Bitcoin consistently surpasses other digital currencies, such a trend might also have a substantial, long-term influence on the entire cryptocurrency sector overall.

Investors are keeping a close eye on this critical juncture, looking for indications that Bitcoin’s value may increase. As Bitcoin’s market influence expands, it could pave the way for increased profits in the near future and potentially push prices upward swiftly.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-09-18 11:04