-

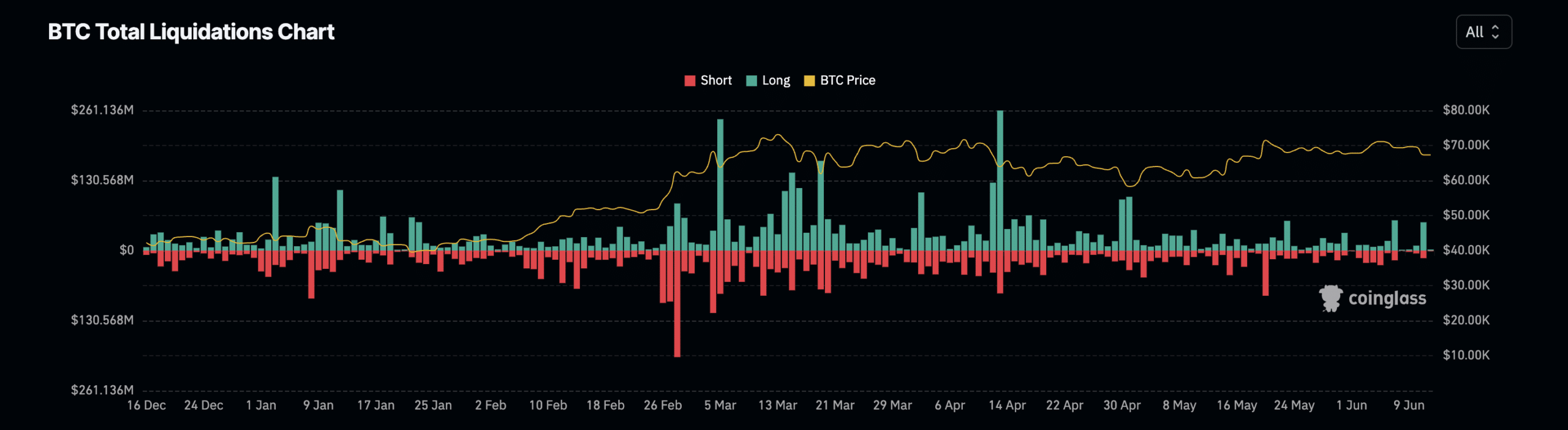

BTC saw a surge in long liquidations in the past 24 hours.

This comes as the market awaits the release of the CPI report and the outcome of the Federal Reserve meeting.

As a researcher with experience in the cryptocurrency market, I’ve observed that Bitcoin (BTC) experienced a significant correction on June 11, 2024, ahead of the U.S. inflation report and Federal Reserve meeting on June 12. The price dropped to near $66,000 but has since rebounded slightly to around $67,243.

As a researcher studying the cryptocurrency market, I observed Bitcoin‘s [BTC] price dipping to around $66,000 during intraday trading on the 11th of June. This correction occurred prior to the highly anticipated U.S. inflation report and Federal Open Market Committee (FOMC) meeting scheduled for the 12th of June.

Since that time, the price of the coin has bounced back a bit and is currently being traded at around $67,243 based on the most recent information from CoinMarketCap.

Based on information from CNBC, as a researcher I’d interpret that the experts predict a slight uptick of 0.1% for the Consumer Price Index (CPI) in May compared to April. Yet, this would imply a more substantial yearly price hike of 3.4%.

The Federal Reserve is expected to do nothing regarding interest rates.

Instead, the officials may choose to issue regular quarterly revisions to their Economic Projection Summaries, potentially affected by the Consumer Price Index (CPI) report’s data.

Long traders bear the brunt

The significant drop in Bitcoin’s price on the 11th of June triggered a large number of long position liquidations in its futures market, amounting to approximately $67 million, as reported by Coinglass. Nearly three-quarters of these liquidations were for long contracts.

In the derivatives market, a liquidation occurs when a trader’s position is forcibly terminated due to lack of sufficient funds to keep the position open.

When the worth of an asset unexpectedly plummets, long-position holders compelled by market conditions are forced to sell, leading to prolonged liquidation processes.

On that particular day, the long positions liquidation for Bitcoin amounted to $52 million on AMBCrypto, whereas the short positions liquidation was $14 million.

Bitcoin to surge?

Despite the fact that numerous long-term investors sustained losses over the last 24 hours, market analysts pointed out that the coin’s historical trends suggest a swift recovery in the near future.

In a recent post on X, an anonymous cryptocurrency analyst referred to as Gumshoe, pointed out that there have been four Federal Open Market Committee (FOMC) meetings in this year, and all of them exhibited the same sequence of events.

The price of Bitcoin dropped by 10% within a 48-hour timeframe preceding those meetings. However, it bounced back on the very day these events took place. As Gumshoe puts it, “The market often reacts to overly pessimistic comments with a subsequent price reversal.”

Read Bitcoin’s [BTC] Price Prediction 2024-2025

As a researcher, I’ve come across the views of fellow crypto analyst Jelle. He expressed that the Federal Reserve meetings have positively impacted the market in recent times.

Based on Jelle’s analysis, the last four Federal Open Market Committee (FOMC) meetings have corresponded with market lows for the foremost cryptocurrency, leading to significant rallies exceeding 20%.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

2024-06-12 16:07