- Decreasing demand for U.S. Treasury Securities may signal a capital shift toward riskier assets, including Bitcoin.

- Currently, Bitcoin’s Social Volume is trending upward, though it remains below levels seen during the 2021 bull market.

As an analyst with over a decade of experience navigating global financial markets, I find myself increasingly intrigued by the dynamic interplay between Bitcoin and the broader macroeconomic landscape. The recent trends in U.S. Treasury Securities demand, global liquidity, market sentiment, and network activity all point to a potentially bullish outlook for Bitcoin in 2024-25.

The decreasing demand for USTs may signal a capital shift toward riskier assets like Bitcoin, as investors seek higher returns amidst the Federal Reserve’s quantitative tightening policy. This potential shift, coupled with the slight uptick in global liquidity, could support Bitcoin’s bull market even in the absence of direct Quantitative Easing (QE).

However, it is essential to keep a watchful eye on unexpected tightening measures from the Feds or geopolitical uncertainties that could trigger fear among traders. As the saying goes, “the only constant is change,” and the cryptocurrency market is no exception.

Monitoring metrics like Social Volume, Greed & Fear Index, active addresses, and liquidity trends can offer valuable insights into market sentiment and potential long positions. For instance, if Bitcoin sustains above key psychological levels, the Greed & Fear Index is likely to strengthen, driving further price growth. On the other hand, subdued activity might indicate hesitation among traders, potentially leading to slower price growth.

In my experience, timing the market is akin to trying to catch a greased pig at a county fair – you may get lucky once in a while, but it’s not a reliable strategy! Instead, focus on understanding the underlying trends and making informed decisions based on the data.

And remember, as the old adage goes, “Don’t put all your eggs in one basket… unless that basket is Bitcoin!” So, keep diversifying and happy investing!

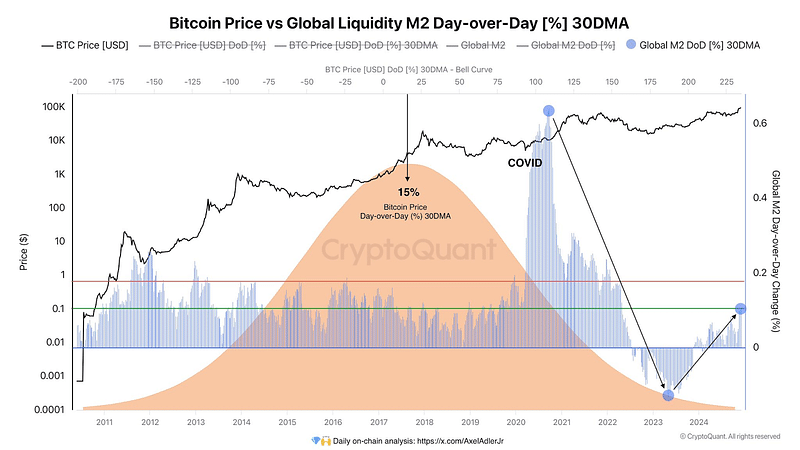

The flow of global money has regularly affected the costs of various assets, such as Bitcoin, too. By examining money supply increases, symbolized by M2, it’s observed that they tend to coincide with Bitcoin’s rise, albeit with a small lag.

Contrarily, as the U.S. Federal Reserve persists with its Quantitative Tightening (QT) strategy, a potential decrease in the appetite for U.S. Treasury bonds might indicate a movement of funds towards riskier investments, such as Bitcoin.

CryptoQuant

Under these circumstances, along with the influence of worldwide money flow patterns, Bitcoin’s rising market might persist without needing immediate Quantitative Easing (QE) directly.

Bitcoin’s price movement and Global M2 Liquidity

In simpler terms, changes in Bitcoin’s price tend to mirror fluctuations in the Global M2 Money Supply’s daily rate of change (30-day moving average). A clear example of this correlation was observed after the COVID-19 crisis, when an injection of liquidity led to a swift increase in M2, which was followed by Bitcoin reaching its record high price.

As someone who closely follows financial markets and has witnessed numerous market cycles over the past two decades, I find it intriguing to see global liquidity trends reversing course despite the Federal Reserve’s Quantitative Tightening (QT) stance. This unexpected shift in market dynamics has caught my attention, as it could potentially impact various asset classes, including Bitcoin. In my experience, such changes often precede significant price movements in the financial markets, and I believe this could be the case for Bitcoin’s current recovery. It’s essential to keep a close eye on global liquidity trends, as they can offer valuable insights into the market’s direction.

The recuperation follows a typical pattern of slower reactions to M2 influxes in the past. Similarly shaped like a bell curve, the development of M2 mirrors Bitcoin’s prolonged bullish trends, illustrating how liquidity boosts Bitcoin’s pricing.

If the Federal Reserve steps in during a possible T-bills crisis, it might lead to a significant increase in M2. This intervention could potentially boost Bitcoin prices once more.

As someone who has closely followed the cryptocurrency market for over a decade, I believe that with the recent surge in M2 (money supply), there is a strong possibility that Bitcoin could revisit its previous highs. My personal experience has taught me that liquidity plays a significant role in determining the direction of the market, and if this trend continues, we might witness a bullish breakout for Bitcoin as early as 2024. I have seen similar patterns before, and when it comes to the cryptocurrency world, past performance can provide valuable insights into future trends. However, it’s essential to remember that investing in Bitcoin always involves risk, and one should never invest more than they are willing to lose.

Market sentiment and Bitcoin’s potential growth

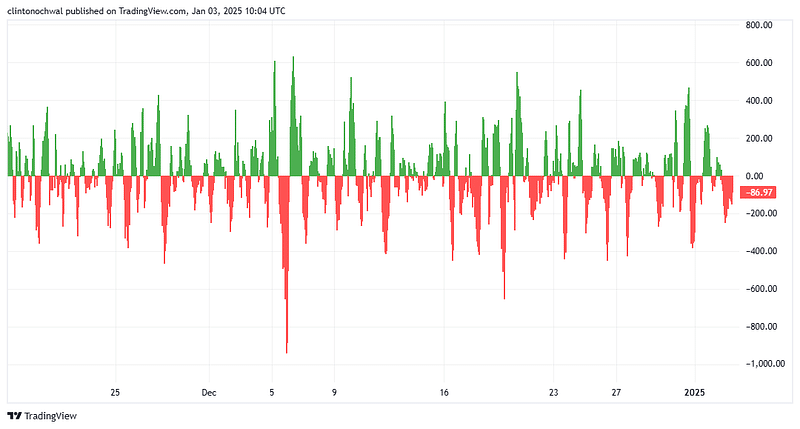

The Greed and Fear Index serves as a gauge for market emotions, exerting a substantial impact on the direction of Bitcoin’s price fluctuations. Over time, it has been observed that the value of Bitcoin often increases when the index transitions from intense fear to more balanced or optimistic sentiments.

As a crypto investor, I’m feeling a mix of cautious optimism right now. We’ve moved on from the intense fear that characterized the market earlier in the year, and we seem to be settling into a more balanced, neutral stance.

TradingView

The trend in M2 follows a similar pattern as the global liquidity chart, as it has shown a minor rise which correlates with Bitcoin’s recent surge in value.

If the positive trend in sentiment persists due to rising liquidity and a decrease in demand for US Treasuries, traders might opt to invest their funds in riskier options such as Bitcoin, potentially leading to additional price increases in that market.

Moving forward, should Bitcoin maintain its position above significant psychological thresholds, I expect the Greed & Fear Index to solidify further. Nevertheless, unanticipated monetary tightening actions from the Federal Reserve or geopolitical turbulence may spark fear, potentially curbing the market’s upward momentum.

Keep a close eye on market sentiment since it tends to match up with liquidity patterns, which can help you decide the right time to take long positions.

A metric of market engagement

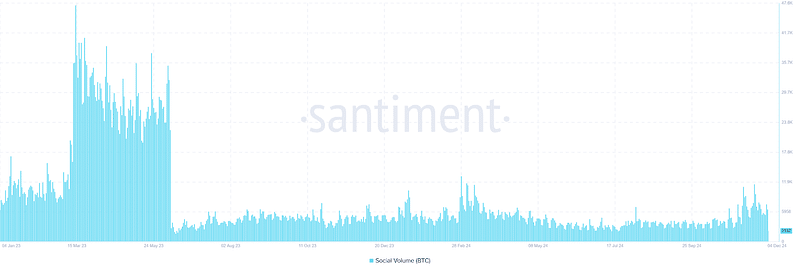

The measure known as Social Volume, which monitors how often Bitcoin is mentioned on various social media outlets, serves as a key signal for the level of user involvement in the crypto market.

In periods of large changes in market prices due to liquidity factors, social media activity tends to increase significantly, mirroring the growing curiosity and participation from both individual and professional investors.

At present, Bitcoin’s Social Activity is on an uptick, however, it hasn’t reached the heights witnessed during the 2021 price surge. This indicates increasing curiosity about Bitcoin as it rebounds, but we’re not seeing the frenzy or extreme enthusiasm that characterizes a full-blown market mania yet.

Based on my years of studying and analyzing financial markets, I have observed that there is often a delay in the response of Social Volume to significant events, such as inflows of liquidity into Bitcoin. This was clearly evident when I examined the chart depicting this relationship. The lag in Social Volume’s reaction to M2 liquidity inflows mirrored the slight delay in Bitcoin’s price movement. It’s important for traders and investors like myself to keep a close eye on these subtle indicators, as they can provide valuable insights into market trends and help us make more informed decisions about our investments.

If the Social Volume continues to increase, it may be an indication of heightened interest in the market and a potential upward momentum for the bull trend. Conversely, if the activity remains low, it could suggest that traders are uncertain or hesitant, which might slow down the pace of price escalation.

Keeping an eye on this indicator together with liquidity fluctuations and resistance points might provide us with early indications of prolonged positive trajectory.

Network activity as a bullish indicator

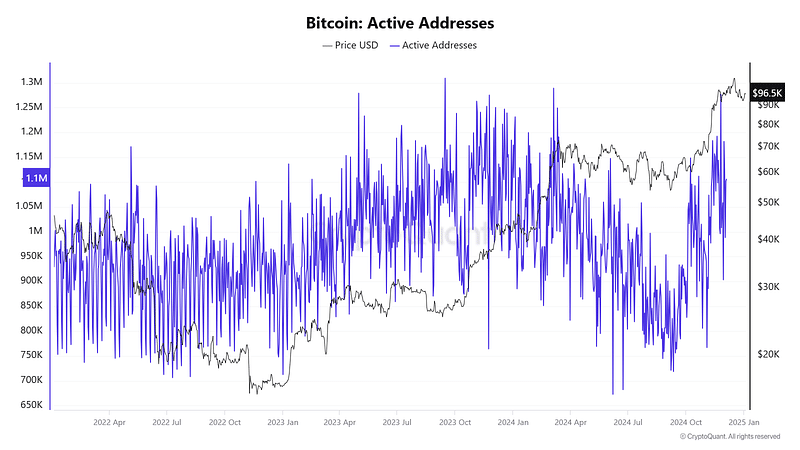

High energy levels tend to coincide with times of heightened price movement, since a larger number of individuals suggest higher network activity and demand.

New information indicates a consistent increase in active wallets, suggesting that traders and investors are re-engaging with growing enthusiasm.

As someone who has been closely observing and participating in the cryptocurrency market for several years now, I believe that liquidity inflows play a crucial role in driving market activity. Recently, I noticed a correlation between the slight increase in global M2 liquidity and Bitcoin’s recent price recovery. This observation aligns with my personal experience of witnessing how liquidity can influence market trends, even if there may be delays in its impact. It’s an interesting phenomenon to see how the flow of money can shape the movement of cryptocurrencies like BTC, and I am intrigued by the potential implications this could have for future market predictions and investment strategies.

If the number of actively used addresses keeps rising, it indicates growing trust in the network and potentially sets the stage for a bullish market trend. Conversely, if activity levels remain unchanged or decrease, it might hint at uncertainty or selling among users.

The latest increase in Bitcoin’s price underscores its responsiveness to worldwide liquidity fluctuations, a relationship that can be observed through its association with the 30-day moving average shown on the graph.

Although the Federal Reserve continues with its quantitative tightening, an incremental increase in global liquidity and decreasing demand for U.S. Treasuries have laid a solid base for Bitcoin’s expansion.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Moving from apprehension to a hopeful outlook suggests a positive change in market opinion, whereas expanding social participation shows growing curiosity. Furthermore, an uptick in active users indicates heightened network interaction.

Moving forward, the interaction between global funds availability, investor attitudes, and network actions will continue to play a significant role. Should systemic risks necessitate action from the Federal Reserve, Bitcoin might experience a rapid increase in value due to additional investments pouring in.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- PI PREDICTION. PI cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- SOL PREDICTION. SOL cryptocurrency

- Bitcoin’s Golden Cross: A Recipe for Disaster or Just Another Day in Crypto Paradise?

2025-01-04 09:13