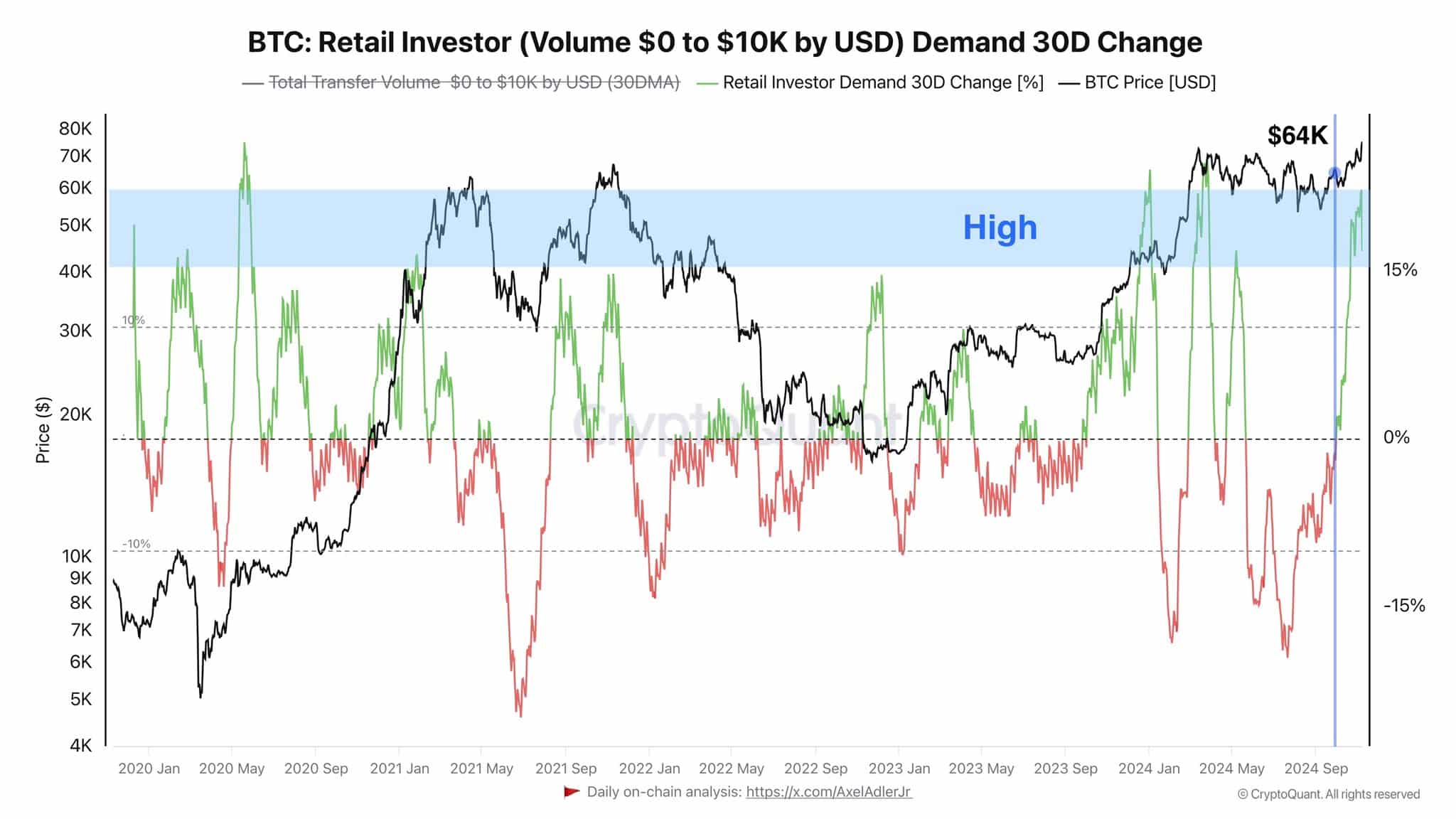

- Bitcoin retail investor volume alongside its price rising.

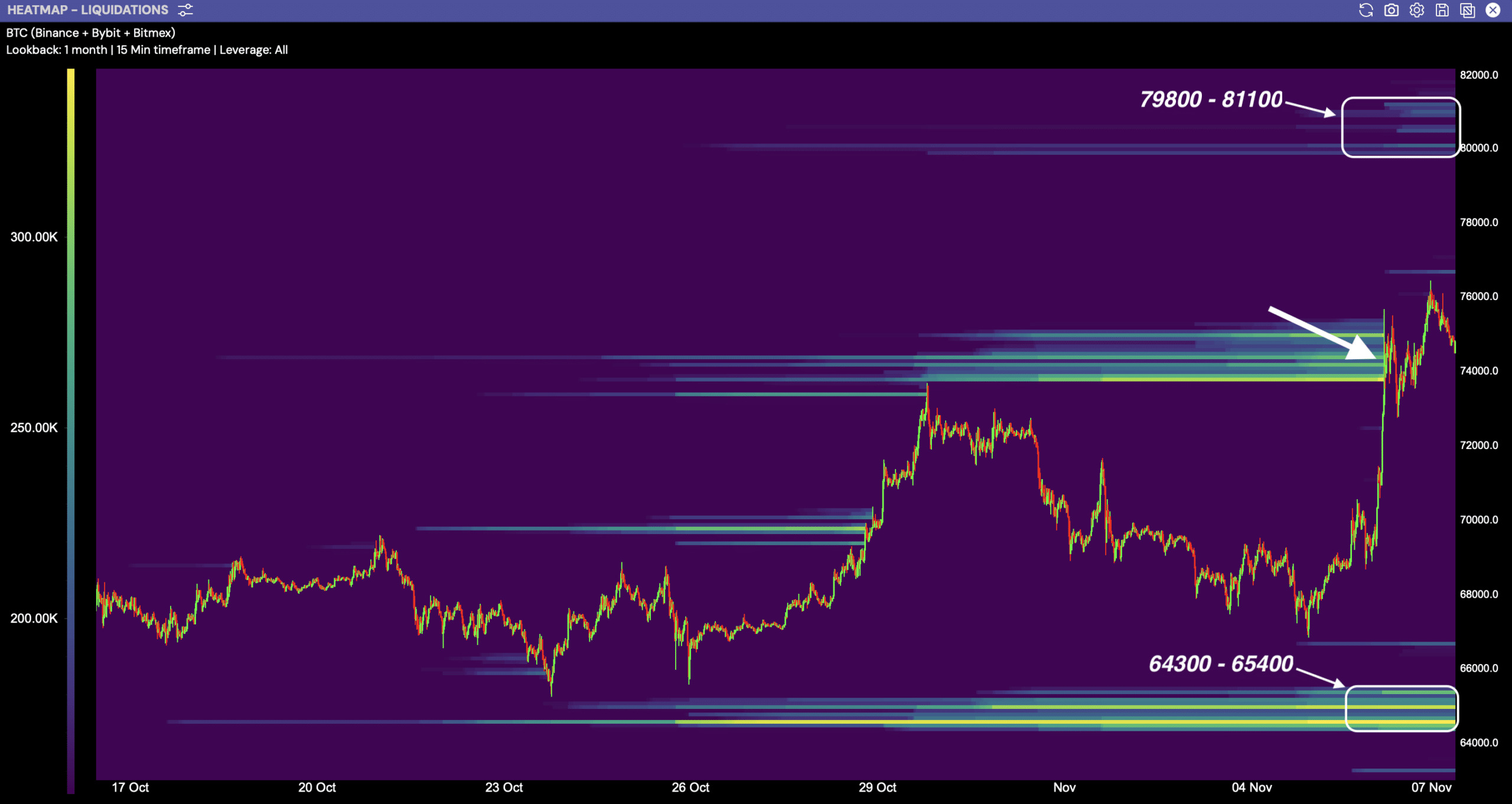

- BTC perfectly swept liquidity triggering high slippage.

As a seasoned analyst with over two decades of experience in the financial markets, I’ve seen my fair share of market trends and cycles. The recent surge in Bitcoin [BTC] retail investor volume alongside its price rise is reminiscent of the dot-com boom of the late 90s – a time when retail investors were driving prices up with sheer enthusiasm.

As the price of Bitcoin [BTC] increases, so does the volume of retail investors, indicating a strong correlation between heightened retail activity and changes in the market price.

As a crypto investor, I’ve certainly noticed a striking revival in retail enthusiasm for Bitcoin ever since it hit the $64K mark. This renewed interest is especially evident when we consider that retail demand has been consistently rising, with a notable spike above 15% recently.

This suggests that retail investors are taking advantage of price drops, which frequently leads to increased demand that comes before price increases.

During times when the price of Bitcoin remained steady or rose, there were corresponding surges in retail demand. This implies that an increase in retail involvement could be a positive indicator for the future trend of Bitcoin’s price.

With retail investors increasingly active at these high levels, there’s a possibility that this trend might exert prolonged upward force on the market value of Bitcoin.

Peak in slippage

Due to the recent increase in Bitcoin’s price, there was a significant rise in slippage during trading on the perpetual futures market. This means that trades were executed quickly at different prices because of sudden fluctuations in liquidity, which resulted in a steep spike.

In simpler terms, the amount of goods sold in retail stores (retail volume) seems to have a growing impact on Bitcoin’s value, causing it to rise. This sudden jump in price might be due to Bitcoin quickly absorbing available resources (liquidity) at lower costs, before making a sudden increase.

Historically, when there’s a surge in retail interest, it often leads to price fluctuations, demonstrated by sudden increases followed by corrections.

Next liquidity clusters to influence BTC next move

The liquidity heatmap for Bitcoin revealed crucial clusters around $64K and $79K, highlighting areas where substantial transaction volumes are likely to occur.

Lately, individual investors have been driving up Bitcoin’s price, and with its close proximity and recent formation, it seems primed to aim for the $79K price range.

Approaching a crucial threshold with Bitcoin, the chances of another price surge become more promising. The continued upward momentum could be contingent upon the conviction and overall market mood among retail investors.

If Bitcoin continues its upward trend, there’s a possibility that it might break through the $79,000 mark. If this happens, it may later retest the $64,000 price point once more.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

If fear and apprehension start to surface in the market, the recent excitement could decrease, potentially leading Bitcoin (BTC) to either maintain its current level or even drop down.

In the near future, we’ll see if retail investors possess sufficient strength and determination to propel Bitcoin towards these lofty price goals, overcoming any market anxieties that might dampen their optimistic momentum.

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

2024-11-08 04:07