- Bitcoin has dropped 5.6% from its $99,645 all-time high, with retail traders yet to join the rally.

- Exchange inflows and Open Interest revealed insights into market sentiment.

As a seasoned crypto investor with battle scars from multiple bull and bear markets, I find myself intrigued by the recent developments in Bitcoin’s price action. The drop from its all-time high of $99,645 was inevitable, but it doesn’t deter my enthusiasm for this revolutionary digital asset.

Following a remarkable surge that took Bitcoin’s [BTC] value to its peak of $99,645 just recently, we are currently in a period where the asset is experiencing a downturn or adjustment.

At the moment of reporting, Bitcoin is trading at $93,602, representing a 4.3% decrease over the last day. This dip is a 5.6% fall from its highest point.

The correction comes as Bitcoin inches closer to the psychologically significant six-digit price level of $100,000. Despite the pullback, market analysts continue to analyze key metrics for signs of what lies ahead.

Retail trader current trend

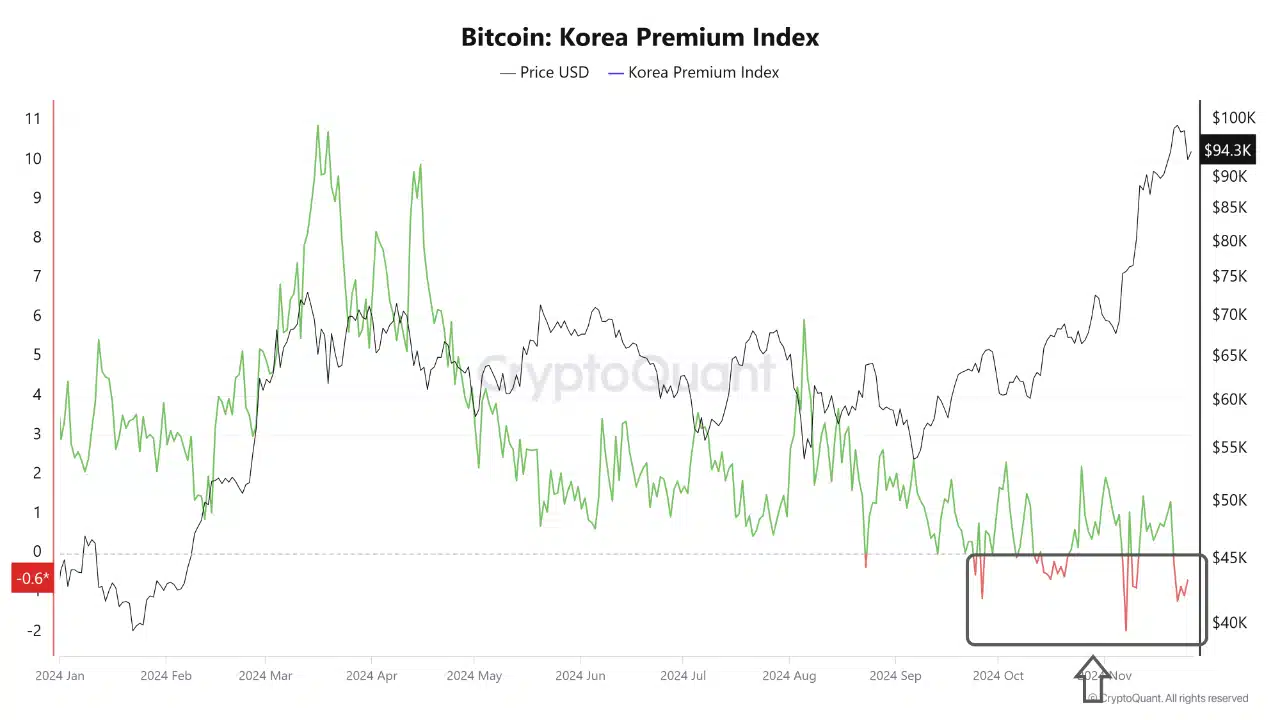

According to an analyst from CryptoQuant named Woominkyu, it’s been noticed that retail investors haven’t significantly impacted the fluctuations in Bitcoin’s value so far.

As per the analysis, the Korea Premium Index – a measure indicative of retail involvement – was found to be below -0.5 when last recorded. This indicates that retail activity has not played a significant role in fueling the recent price increase.

Historically, the Korea Premium Index tends to have substantial increases prior to Bitcoin reaching its highest prices. Woominkyu underscores the need for close attention to this index as it could help pinpoint possible price peaks.

A low level of retail interest indicates that Bitcoin’s recent surge might be mainly fueled by institutional investment or other elements. This could mean further growth when individual traders start investing again in the market.

Exchange Outflows, Open Interest offer insights

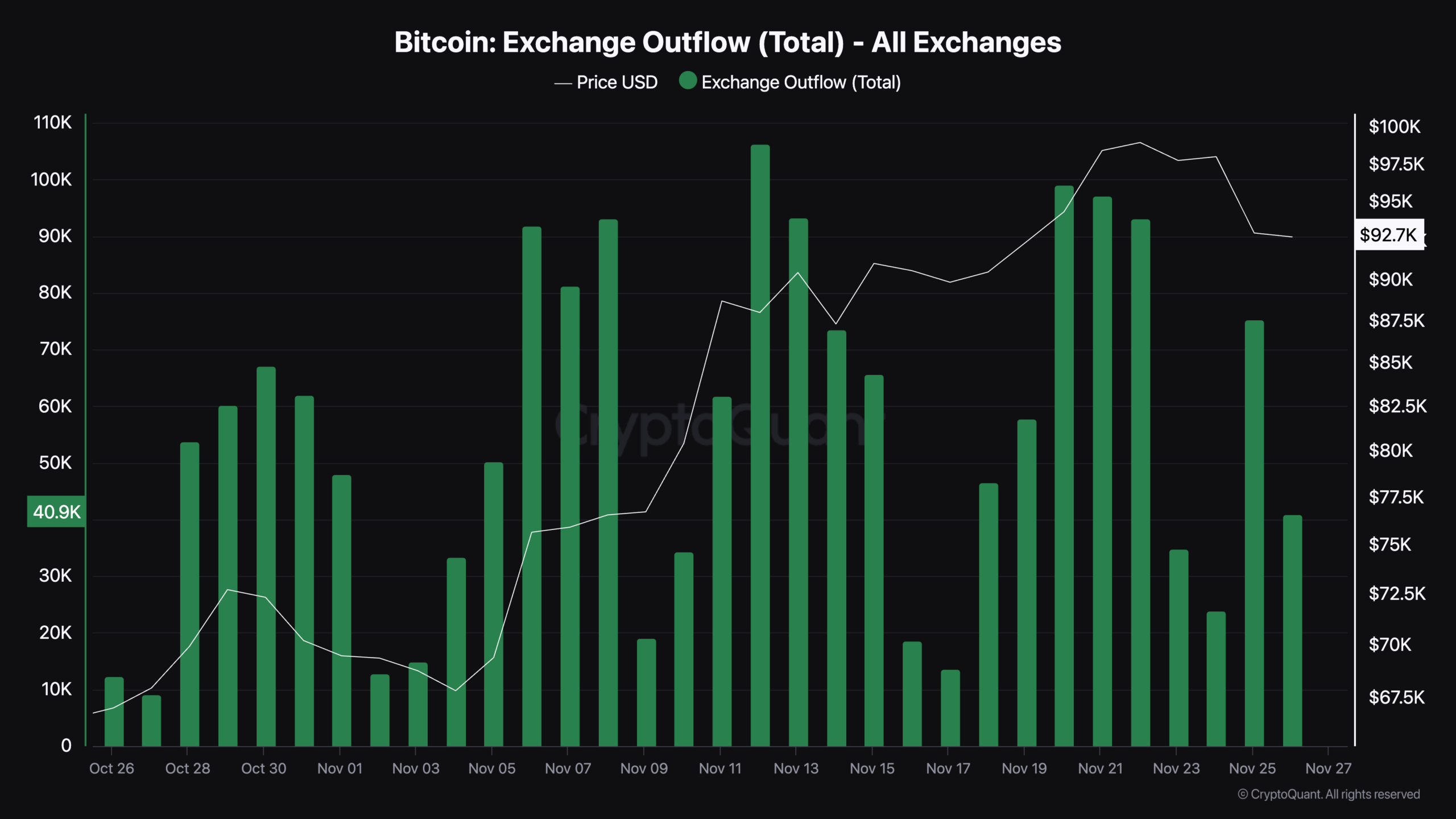

Analyzing Bitcoin’s exchange withdrawals and the concept known as Open Interest can offer a more insightful perspective on market movements. As per data from CryptoQuant, there seems to be a significant pattern emerging in the exchange withdrawal activity.

On November 25th, there was a substantial increase in Bitcoin outflows from exchanges, amounting to over 75,000 BTC.

Even though it dropped to roughly 31,000 Bitcoins as of the latest report, it’s worth noting that this figure is significant given that the day has only just begun.

It seems that more people are choosing to withdraw their Bitcoins from exchanges, suggesting they prefer to hold onto their investments themselves instead of quickly selling them. This trend could indicate a focus on long-term investment as opposed to putting pressure on the market for immediate sales.

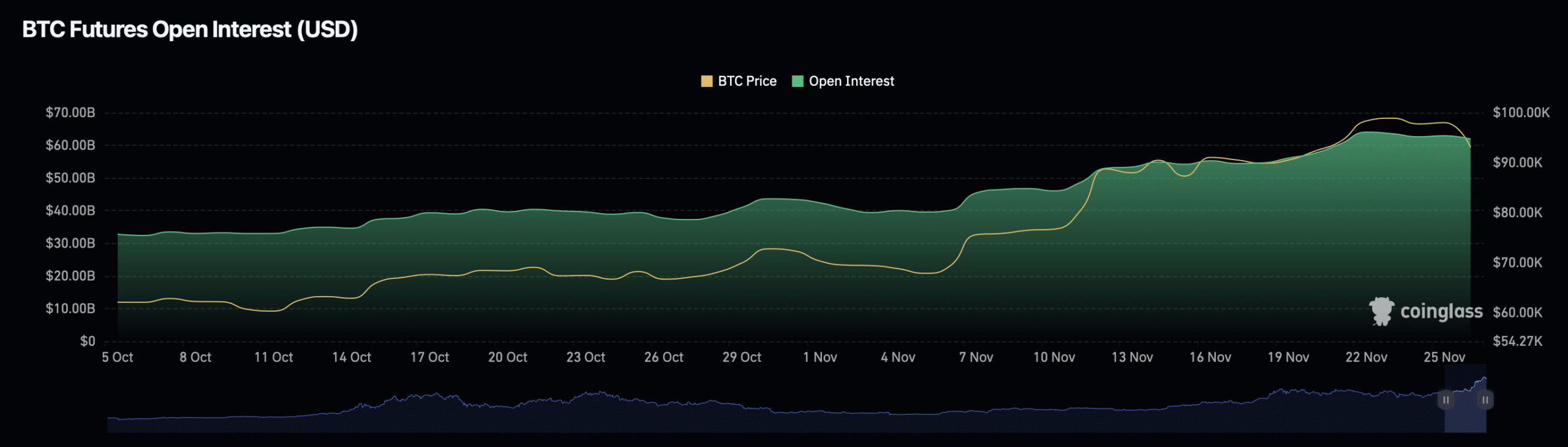

On the other hand, Bitcoin’s open interest metrics paint a mixed picture.

Based on data from Coinglass, the Open Interest value for Bitcoin has dropped by approximately 4.55%, now standing at around $60.37 billion. This decline could suggest that there might be less demand for leveraged trading positions.

However, the Open Interest surged by an impressive 62.58%, reaching $132.86 billion.

As a crypto investor, I’ve noticed a fascinating trend: although the overall contract value seems to be decreasing, the number of active positions in the market appears to be on the rise. This suggests that while people may be holding less value collectively, more individuals are actively participating and potentially betting on different cryptocurrencies.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

The increase in trading could indicate a surge in market action, as investors might be entering transactions in preparation for future price fluctuations.

On the other hand, the decrease in the total worth of these roles could suggest that bigger investors are exercising caution.

Read More

2024-11-27 05:44