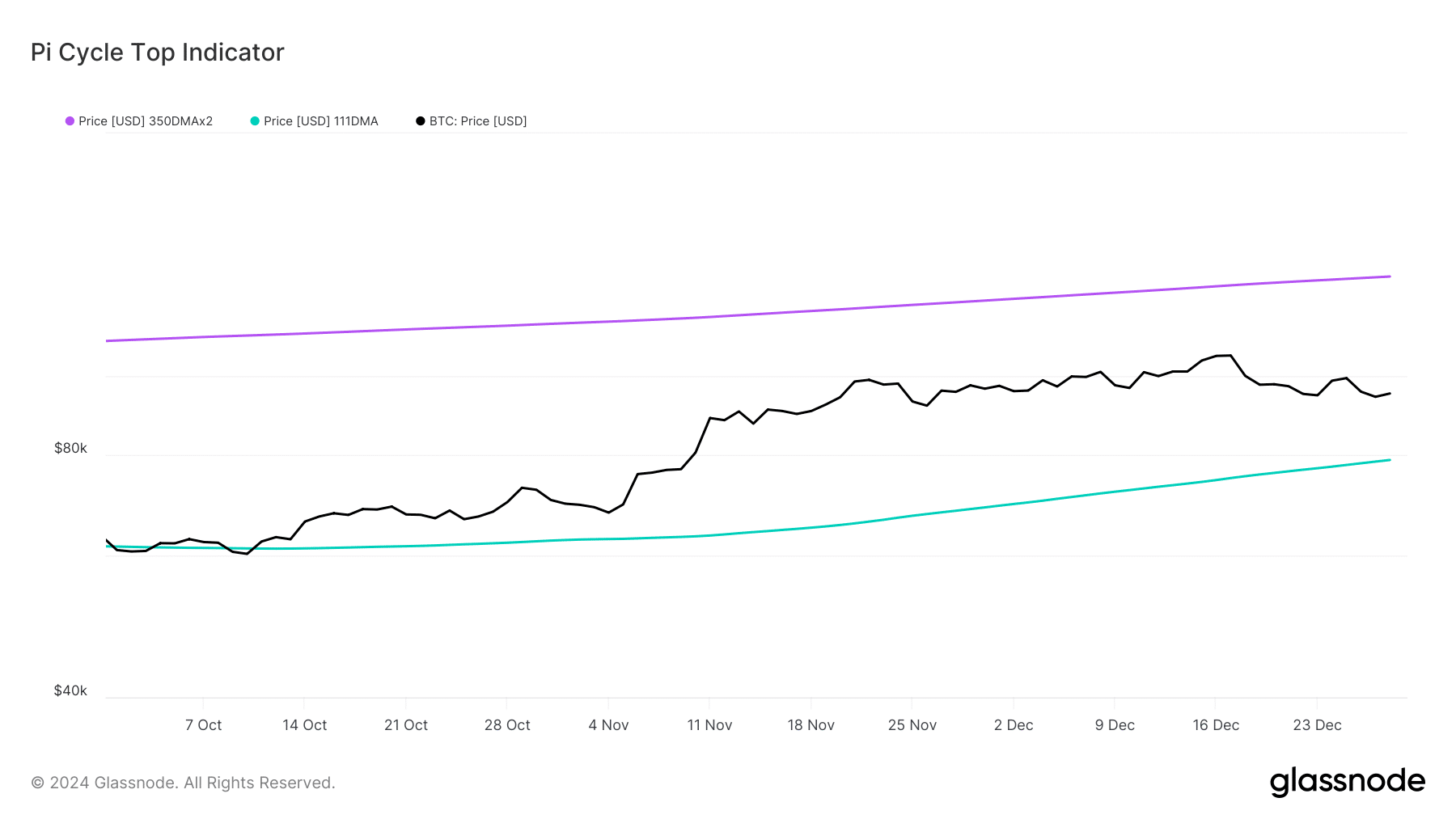

- The Pi Cycle Top indicator hinted at a possible market bottom near $78k.

- Selling pressure on BTC was rising, which could push its price further down.

As a seasoned crypto investor with over five years of experience navigating the rollercoaster ride that is the cryptocurrency market, I can’t help but feel a sense of deja vu looking at the current state of Bitcoin (BTC). Having weathered multiple market cycles and crashes, I have learned to be cautious when it comes to making investment decisions based on short-term trends.

In the past few weeks, BTC has been struggling to make significant gains, with a recent analysis suggesting that the coin might drop to $85k in the near future. This is concerning as Bitcoin’s price volatility has dropped, and the Short-Term Holder Realized Price metric is indicating potential obstacles for the king coin going forward.

I remember when I first invested in BTC at around $700 back in 2016, I had no idea how volatile this market could be. But as the price surged to an all-time high of nearly $20,000 by the end of that year, I was hooked. Since then, I’ve learned to ride the waves and not get too attached to any one price point.

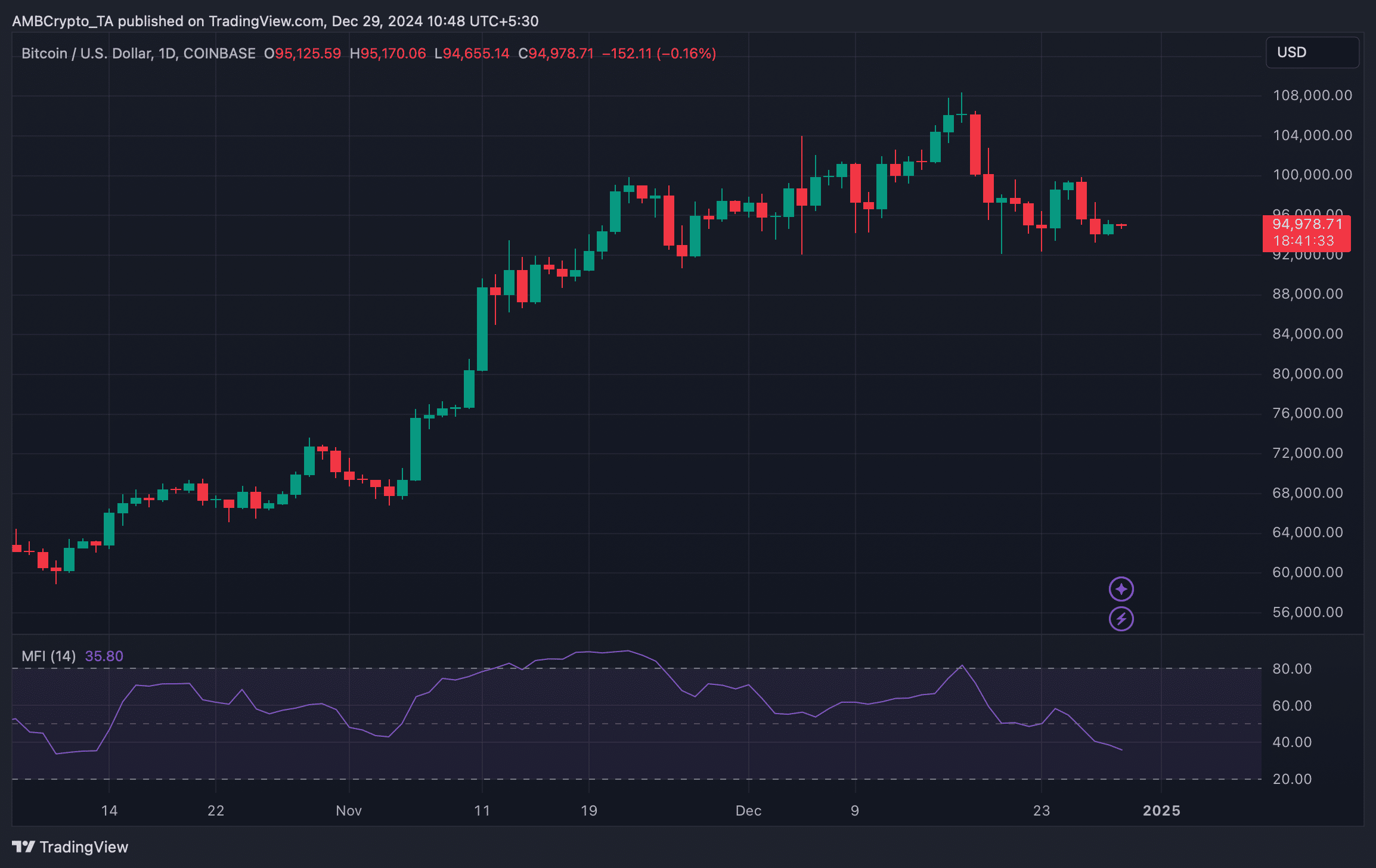

However, the recent rise in selling pressure on BTC is a cause for concern. The influx of 20k BTC into spot exchange reserves suggests that investors are cashing out, which typically has a negative impact on prices. Additionally, the red taker buy/sell ratio and downtick in the Money Flow Index (MFI) further support the notion that selling pressure is rising.

If this trend continues, it’s possible that Bitcoin might drop to the $85k range again in the near-term. But as I learned from my past experiences, crypto market trends can change quickly and unexpectedly. So while it’s important to stay informed and make smart investment decisions based on data, it’s equally important not to panic and hold on tight during turbulent times.

On a lighter note, I always tell myself that if Bitcoin ever drops back down to $85k again, at least I’ll be able to afford a really nice coffee!

Over the past several weeks, Bitcoin [BTC] has struggled to make noteworthy progress, with its value remaining relatively stagnant instead of surging forward.

It’s indicated by recent assessments that there could be further deterioration, since the possibility exists for the price of the coin to potentially plummet back down to around $85,000 in the short term.

Bitcoin is in trouble!

Bitcoin’s price has been somewhat consolidating in the past few days.

Over the last day, the price of King Coin experienced a slight increase of 0.5%, causing it to be traded at approximately $94,937.45. Its market cap now exceeds $1.88 trillion.

As the volatility of Bitcoin’s price decreased, Alphracatal – a widely-used data analysis tool – shared a tweet pointing out a potential hurdle that Bitcoin might encounter in the future.

The tweet employed the Short-Term Holder Realized Price statistic based on Bitcoin (BTC), which signifies the average cost at which Bitcoin was purchased by brief-term investors, usually identified as those who move their coins within approximately 155 days.

The tweet mentioned,

If the price drops at the 85,000 level, it might lead to catastrophic consequences and initiate a downward trend in the market. Consequently, the bulls will exert maximum effort to prevent any significant decline between 85,000 and 86,000.

Will BTC drop to $85k again?

According to the Pi Cycle Top indicator, Bitcoin may have reached a potential market minimum around $78,000. Consequently, it’s important to consider the possibility that Bitcoin could potentially drop to $85,000 as well.

Apart from this, selling pressure on the king coin was also rising.

Previously reported by AMBCrypto, Bitcoin’s reserve holdings on spot exchanges have seen a consistent decrease for about a month due to investors withdrawing their assets. However, there has been a notable surge in the last few days, with approximately 20,000 BTC being deposited back into these exchanges.

An increase in the metric indicates that investors are offloading their assets, typically leading to a drop in prices. The derivatives market also displayed some troubling signs.

Based on my observations as a seasoned cryptocurrency investor, I have learned to pay close attention to the taker buy/sell ratio provided by platforms like CryptoQuant. In this case, when I saw that Bitcoin’s taker buy/sell ratio had turned red recently, it was a clear signal for me that selling sentiment is dominating the futures market right now. This kind of information helps me make informed decisions in my investments, as it allows me to gauge the overall mood and direction of the market.

As a crypto investor, I noticed that the downward trend in the market was supported by the Money Flow Index (MFI), which showed a decrease, indicating that more investors were offloading their assets.

If the demand for purchasing Bitcoin weakens persistently, it could potentially dip back down towards the $85k price point in the short term.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Has Unforgotten Season 6 Lost Sight of What Fans Loved Most?

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- SUI’s price hits new ATH to flip LINK, TON, XLM, and SHIB – What next?

- The Battle Royale That Started It All Has Never Been More Profitable

- Michael Saylor’s Bitcoin Wisdom: A Tale of Uncertainty and Potential 🤷♂️📉🚀

- Buckle Up! Metaplanet’s Bitcoin Adventure Hits New Heights 🎢💰

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- McDonald’s Japan Confirms Hatsune Miku Collab for “Miku Day”

2024-12-29 12:08