- Bitcoin’s ETF inflows and increased miner profitability suggest that BTC’s upward price momentum may continue.

- Active addresses and rising open interest volume signal strong market activity, despite mixed derivatives data.

As a seasoned researcher with years of experience in the dynamic world of cryptocurrencies, I find myself intrigued by the current momentum behind Bitcoin [BTC]. The correlation between increased ETF inflows and miner profitability is particularly fascinating, as it underscores the interplay between institutional interest and network activity.

Over the past few weeks, the value of Bitcoin (BTC) has been consistently rising, generating curiosity about the elements fueling this continuous growth.

Based on the analysis of an expert at CryptoQuant named Amr Taha, it appears that the flow of funds in Bitcoin Exchange-Traded Funds (ETFs) has a significant correlation with the ability of miners to sustain profits or losses, potentially shaping the fluctuations in Bitcoin’s price.

On the CryptoQuant QuickTake platform, an analysis was presented, offering insights into the interaction between these two indicators and their possible effects on the market.

Bitcoin ETFs, miners team up!

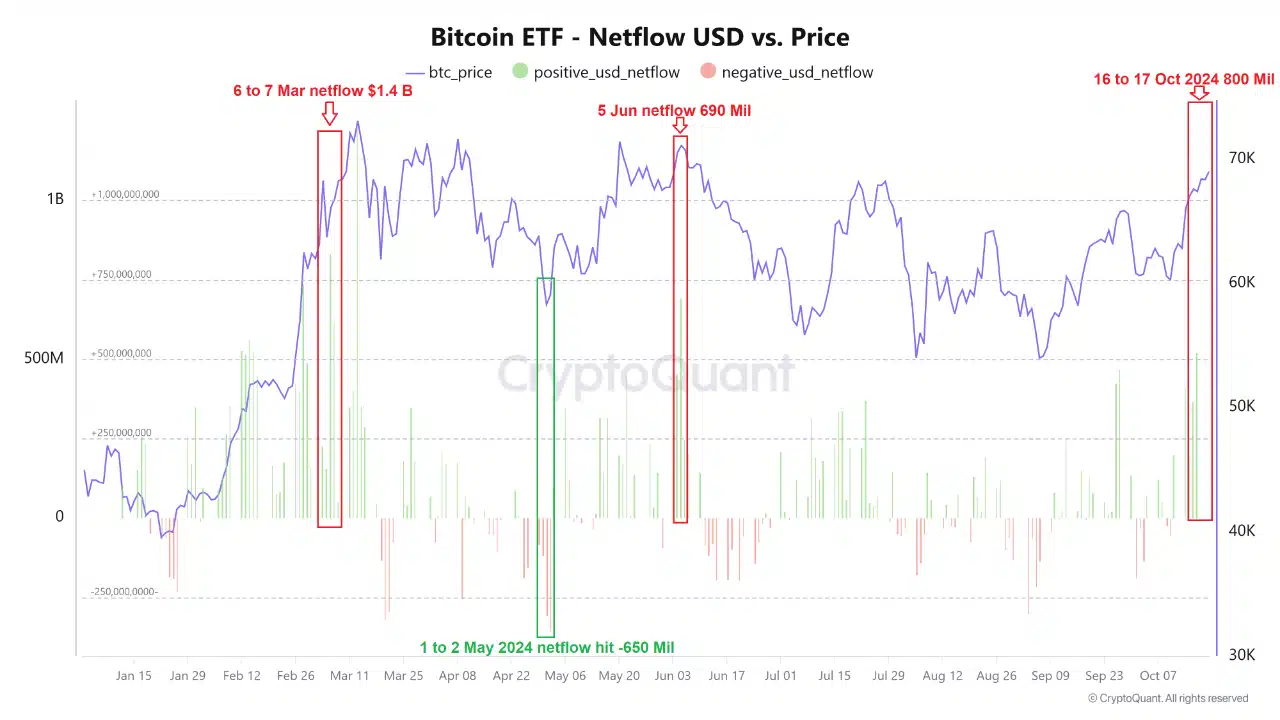

Taha’s research zeroes in on the overall movement of funds into Bitcoin Exchange-Traded Funds (ETFs). He points out that significant influxes of money, or positive net flows, typically happen close to market highs, whereas outflows of funds, or negative net flows, tend to be linked with market lows.

Investing money into Bitcoin ETFs could potentially push prices up (upward pressure), while withdrawing money might cause prices to drop (downward pressure).

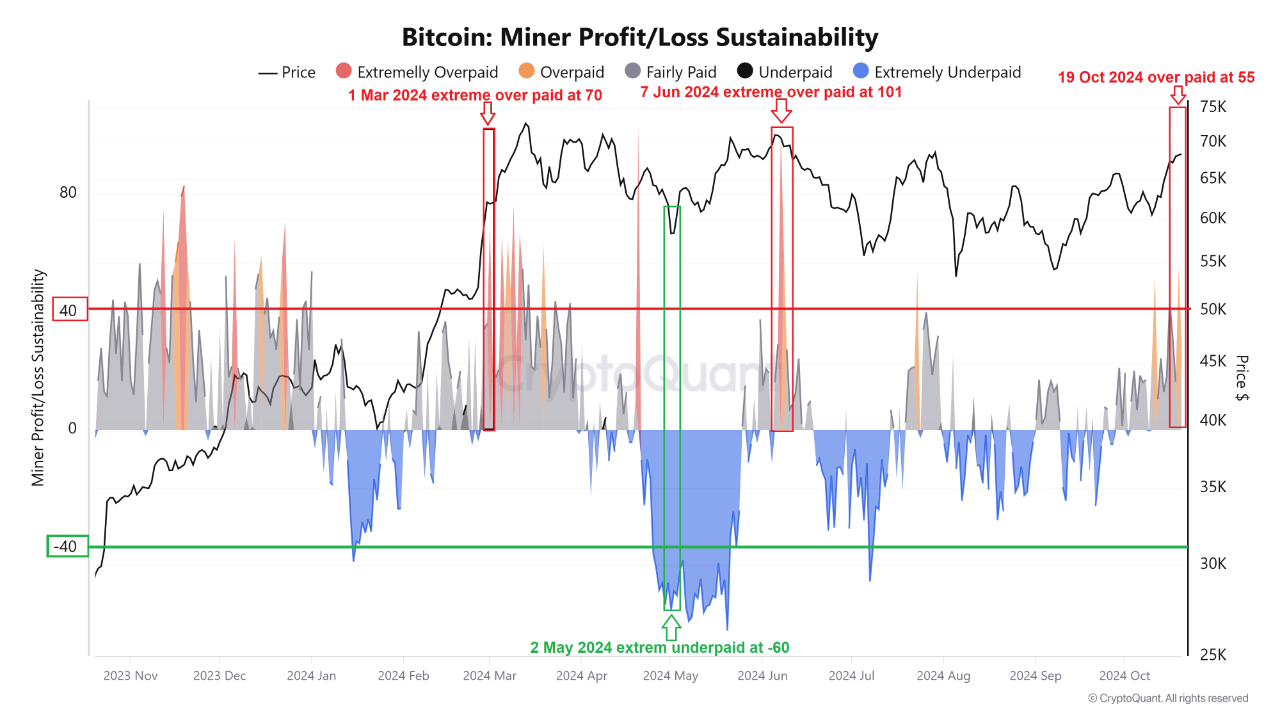

Furthermore, the Miner Profit/Loss Stability graph serves as a tool for monitoring if Bitcoin miners are running at a profit by comparing the current Bitcoin market prices with their operational expenses.

The diagram distinguishes between regions where miners are earning substantial profits, which we call “high-profit” areas, and locations where miners are experiencing losses, referred to as “loss-making” zones.

Taha’s research provides valuable perspectives on the relationship between Bitcoin mining profits and market prices. When Bitcoin values increase, such as in March, June, and October of 2024, miners typically experience higher profitability due to this correlation.

Throughout these stretches, my findings show that mining activities yielded substantial earnings, and the sustainability of miners surpassed the 40% threshold.

On the other hand, if investors withdraw their capital from Bitcoin ETFs, it could lead to increased selling pressure, causing miner revenue to drop and potentially placing them in a situation where they’re no longer making a profit or are even losing money.

In simple terms, an instance of this situation unfolded in May 2024. The price of Bitcoin plummeted significantly, causing the miner compensation rate to drop to a staggering -60, suggesting that miners were severely undercompensated for their work.

It’s important to mention that Bitcoin ETFs have seen a surge in positive trends recently, as per data from Sosovalue, these ETFs have recorded consistent inflows exceeding $200 million over the past week.

For seven days straight, we saw an influx of funds, indicating growing interest in Bitcoin-centric financial services. This trend might lead to additional price rises.

Additionally, CryptoQuant’s data reveals that the rate at which miners are depositing Bitcoin has grown, reaching a high of 11,810 BTC on October 14th and another substantial deposit of 9,302 BTC on October 21st.

As a researcher, I’ve observed an interesting relationship: Inflows into Exchange-Traded Funds (ETFs) seem to be closely tied with Bitcoin’s current price surge. This correlation implies that not only is institutional interest playing a significant role, but also the mining activity itself could be fueling Bitcoin’s momentum in today’s market.

Active Address growth and market data

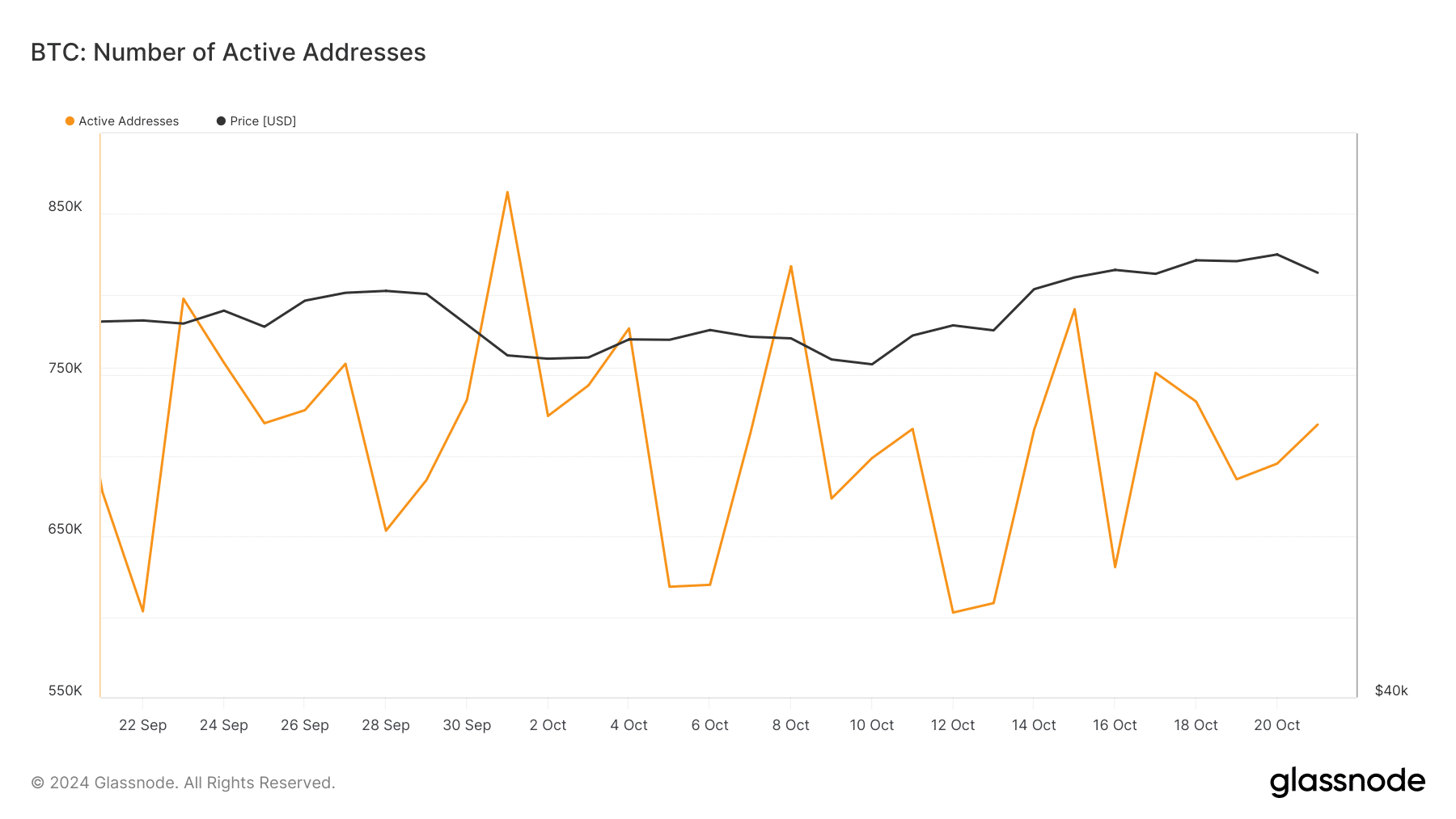

In addition to examining ETF and mining statistics, data from Glassnode shows an increase in Bitcoin’s on-chain activity over the past few days.

The number of active Bitcoin addresses grew significantly from approximately 630,000 on October 16th to more than 719,000 by October 22nd.

An increase in active Bitcoin addresses suggests more user interaction and transactional actions within the network, which could boost the cryptocurrency’s positive trend.

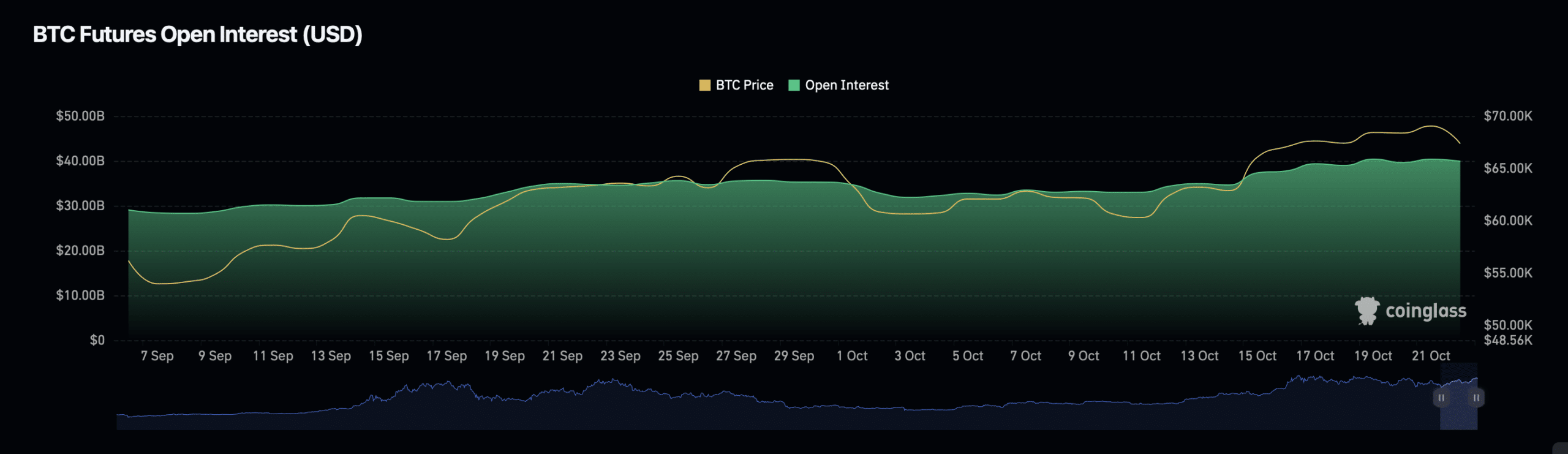

In contrast, data from Coinglass highlighted some mixed signals in Bitcoin’s derivatives market.

Bitcoin’s Open Interest, which measures the total value of outstanding derivative contracts, has decreased by 3.17% to a press time valuation of $39.36 billion.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

However, Bitcoin’s Open Interest volume has surged by 55.69%, reaching $68.28 billion.

An increase in Open Interest indicates that although the total number of open positions might be decreasing, the size of these positions may be growing larger. This could mean that there’s a potential accumulation of market activity as traders are positioning themselves for notable price fluctuations.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-10-23 05:44