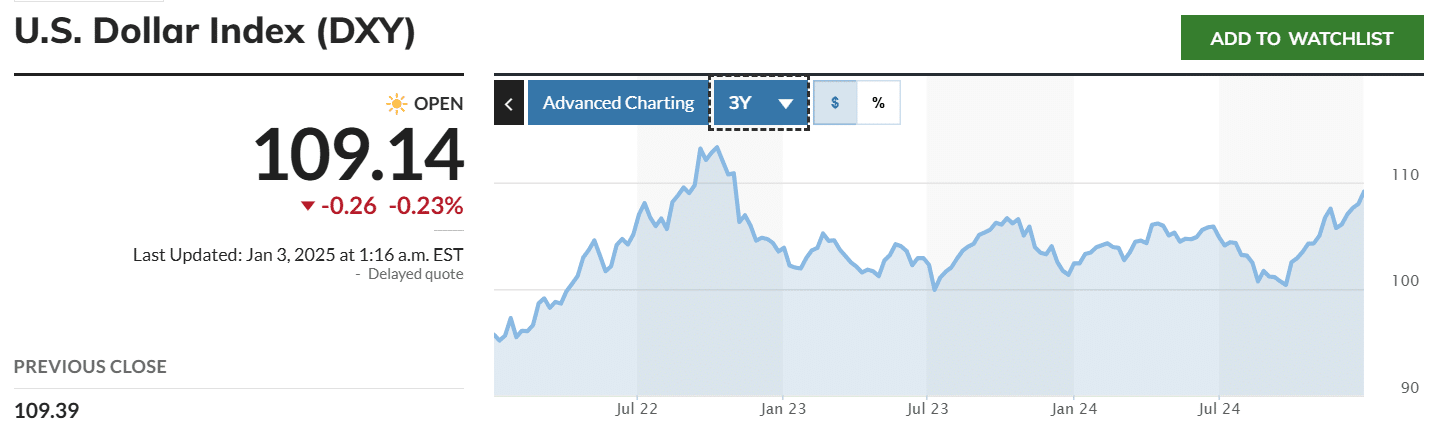

- U.S dollar index has surged to 109, marking its highest level since November 2022

- A strong dollar could weaken the demand for risk assets such as Bitcoin, which could limit the crypto’s uptrend

As an analyst with over a decade of experience in the financial markets, I have witnessed many bull and bear runs in various asset classes. The recent surge in the U.S dollar index to its highest level since November 2022 is a red flag for Bitcoin investors. A strong dollar often weakens demand for risk assets like Bitcoin, which could limit the crypto’s uptrend.

The DXY hitting 109 indicates that the U.S dollar has been gaining strength, and this inverse correlation with Bitcoin’s price could mean trouble for the king coin. The massive outflows from Bitcoin ETFs on the first day of trading in 2025 are also a worrying sign, as these outflows could fuel sell-side pressure and drive down BTC prices.

However, it is not all doom and gloom. The Fear and Greed Index, which measures market sentiment, suggests that traders are still bullish about Bitcoin’s price movement. If buy-side pressure can absorb the sold coins, it could lead to a recovery for BTC later this month, especially with Donald Trump’s inauguration as U.S President.

But let me remind you, in the crypto world, even a cat can predict price movements, so take all predictions with a grain of salt. And remember, the only constant is change! So keep your eyes on the charts and your fingers on the buy/sell buttons, because the market never sleeps!

In mid-December, Bitcoin (BTC) dipped below $100,000. Since then, it’s been having a tough time recovering its previous upward trend on the price charts. At this moment, BTC is being traded at approximately $96,789, representing a 1.5% increase in the last day. However, it’s still about 10% short of its all-time high (ATH).

Although Bitcoin might experience a rebound by the end of this month due to Donald Trump’s presidency, there are still two significant elements that may keep its value in check.

U.S dollar index soars to two-year highs

Recently, the U.S Dollar Index (DXY) has climbed to 109 – a peak not seen since November 2022. This increase suggests that the U.S dollar has been growing stronger compared to other major currencies in recent times.

When the DXY (Dollar Index) increases, it puts a cap on Bitcoin’s price growth because a strong dollar typically reduces the appeal of risky investments like cryptocurrencies. This is due to the inverse relationship between the DXY and Bitcoin’s price.

It’s clear that the decrease in demand for Bitcoin is already noticeable in the exchange-traded fund (ETF) market. On the opening day of trading in 2025, the BlackRock iShares Bitcoin Trust ETF experienced a historic high of $332 million in withdrawals. In addition, all 11 Bitcoin ETFs combined reported outflows totaling $242 million, according to SoSoValue.

If these outflows continue, they might ignite an increase in selling force. Consequently, this would likely initiate a decline in Bitcoin’s trend as depicted on the charts.

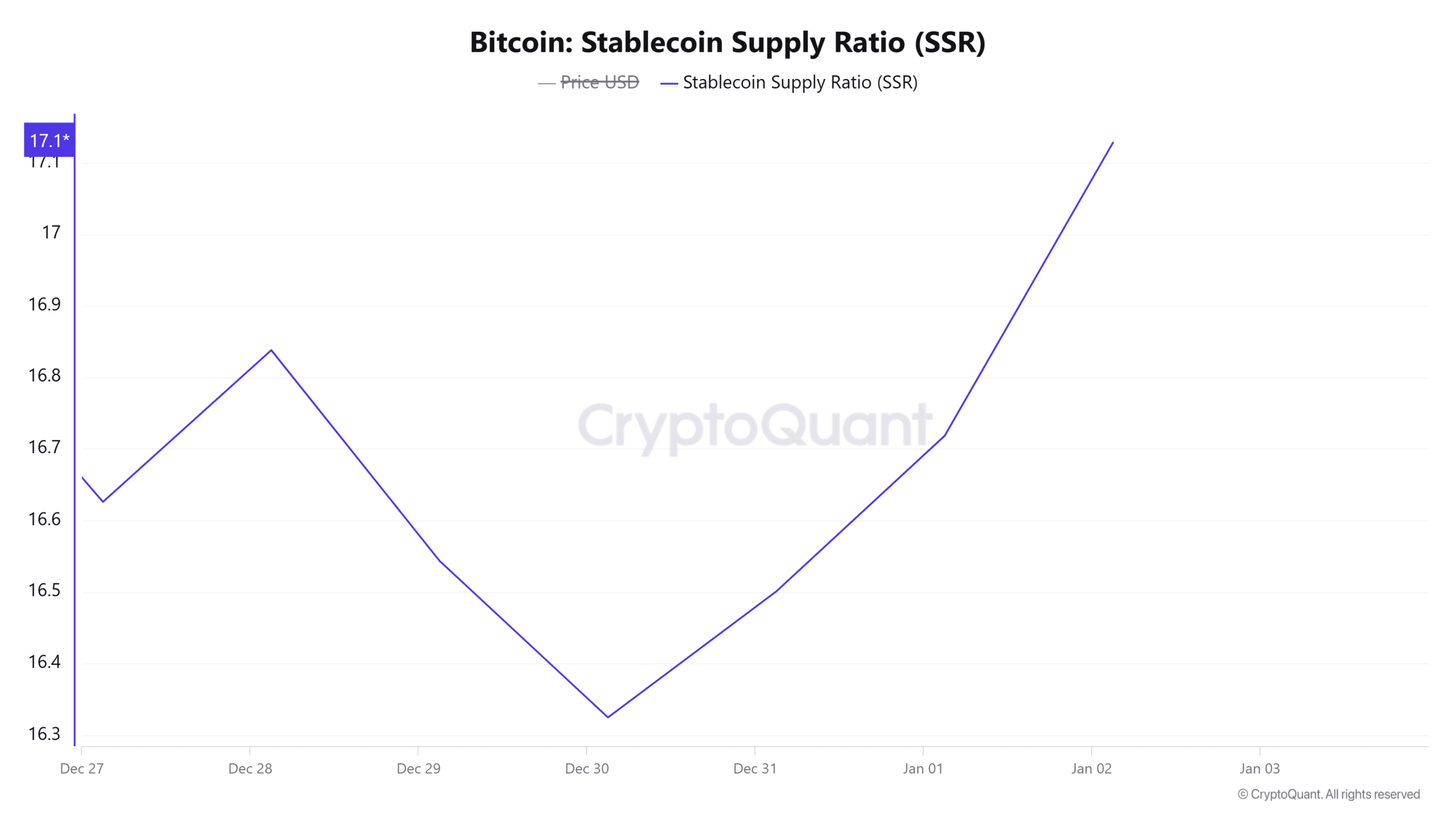

Rising stablecoin supply ratio

It appears that the decrease in demand is noticeable not just among professional investors, but also in the individual market as well. For example, according to CryptoQuant, the Bitcoin Stablecoin Supply Ratio (SSR) reached a seven-day high at 17.

A larger supply-to-market-cap ratio for Bitcoin indicates a greater abundance of Bitcoin compared to stablecoins, which suggests less demand and consequently lower buying pressure. This potentially weakens the price due to decreased upward pressure.

Bitcoin’s fear and greed index is still bullish

Despite indications that the market’s demand might decrease and purchasing enthusiasm wane, it appears that traders remain optimistic according to the Fear and Greed Index, a tool designed to gauge market sentiment.

At the moment of publication, this index stood at 74, implying that the majority of traders are hopeful about Bitcoin’s price trend. Given that the index has risen from 65 earlier in the week, this might indicate positive prospects for Bitcoin as more traders potentially decide to invest.

If there isn’t sufficient demand (buy-side pressure) to purchase the sold coins, this might restrict the potential increase in charted prices.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- SOL PREDICTION. SOL cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- PGA Tour 2K25 – Everything You Need to Know

- MrBeast Slams Kotaku for Misquote, No Apology in Sight!

2025-01-03 23:03