-

BTC has declined by 10% over the past 30 days, yet it was in declining bullish consolidation.

An analyst eyed a new ATH, based on previous consolidation cycles.

As a seasoned crypto investor with a knack for deciphering market trends and a keen eye for spotting opportunities, I must admit that the recent 10% decline in BTC has left me feeling a tad uneasy, but not completely disheartened. Having weathered numerous market storms and cycles, I’ve learned to read between the lines and find hidden gems amidst the chaos.

Over the past few weeks, Bitcoin, the leading digital currency, has noticeably dropped. As of now, its value is being traded at approximately $57,736, representing a 9.58% decrease over the last seven days.

In August, the cryptocurrency market experienced significant price fluctuations. During this time, the value dipped to a temporary low of around $49,000 before gradually rebounding somewhat.

As a researcher, I observe that although BTC has experienced a dip recently, it currently stands 16.6% higher than its most recent local trough, indicating a consolidation within a declining yet optimistic trend. Simultaneously, it’s essential to note that the price is 59.94% above the yearly low of $38505 that was recorded earlier this year, demonstrating resilience and potential for further growth.

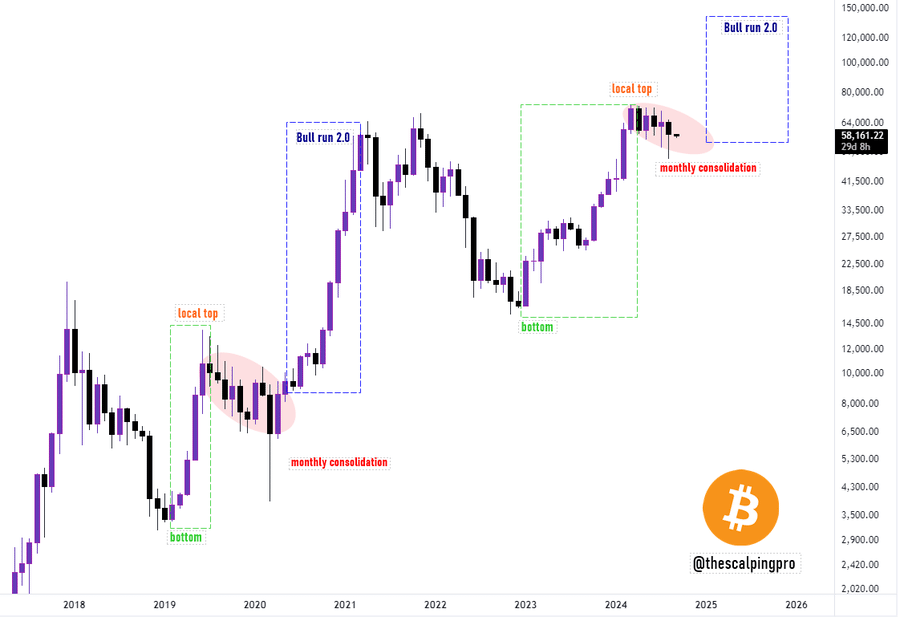

Based on current trends and market activity, many analysts are anticipating another significant bull market surge (bull run 2.0) that could reach new peak levels. As an example, well-known crypto analyst Mags is also forecasting a new record high due to the repetition of historical cycles.

Market sentiment

According to Mags’ examination, he referred back to the last two cycles that featured regular monthly consolidations, leading to yet another upward trend (bull market).

According to the cycle comparison, once Bitcoin (BTC) reaches its lowest point and then a short peak, a phase of stability usually occurs next. This stability phase is often followed by a robust upward trend, or a strong bull market.

He shared his analysis through X (formerly Twitter), noting that,

“It seems like Bitcoin is gearing up for another bull market, or phase 2.0. The recent pattern of monthly price movements resembles the earlier cycle that led to the record high price.”

This argument points to the previous bull run, which resulted from months of consolidation.

Significantly, consolidation is essential for maintaining market stability. During this time, the market has a chance to adapt to recent price fluctuations, thereby reducing excessive volatility.

As a crypto investor, I find that holding my investments for longer periods can help alleviate speculative pressures. Short-term traders often tend to liquidate their positions quickly, which can lead to increased volatility. By staying invested for the long haul, I can contribute to reducing this pressure and potentially enjoy more stable returns over time.

As more long-term traders join the market, there is a steady growth in their acquisition of assets. This gradual increase in ownership sparks higher demand, leading to a surge in purchasing activity.

What Bitcoin’s charts suggest

Given Mags’ conviction, it’s worth examining what other signals suggest about a potential upcoming bull run for Bitcoin (king coin). What are the current indications pointing towards?

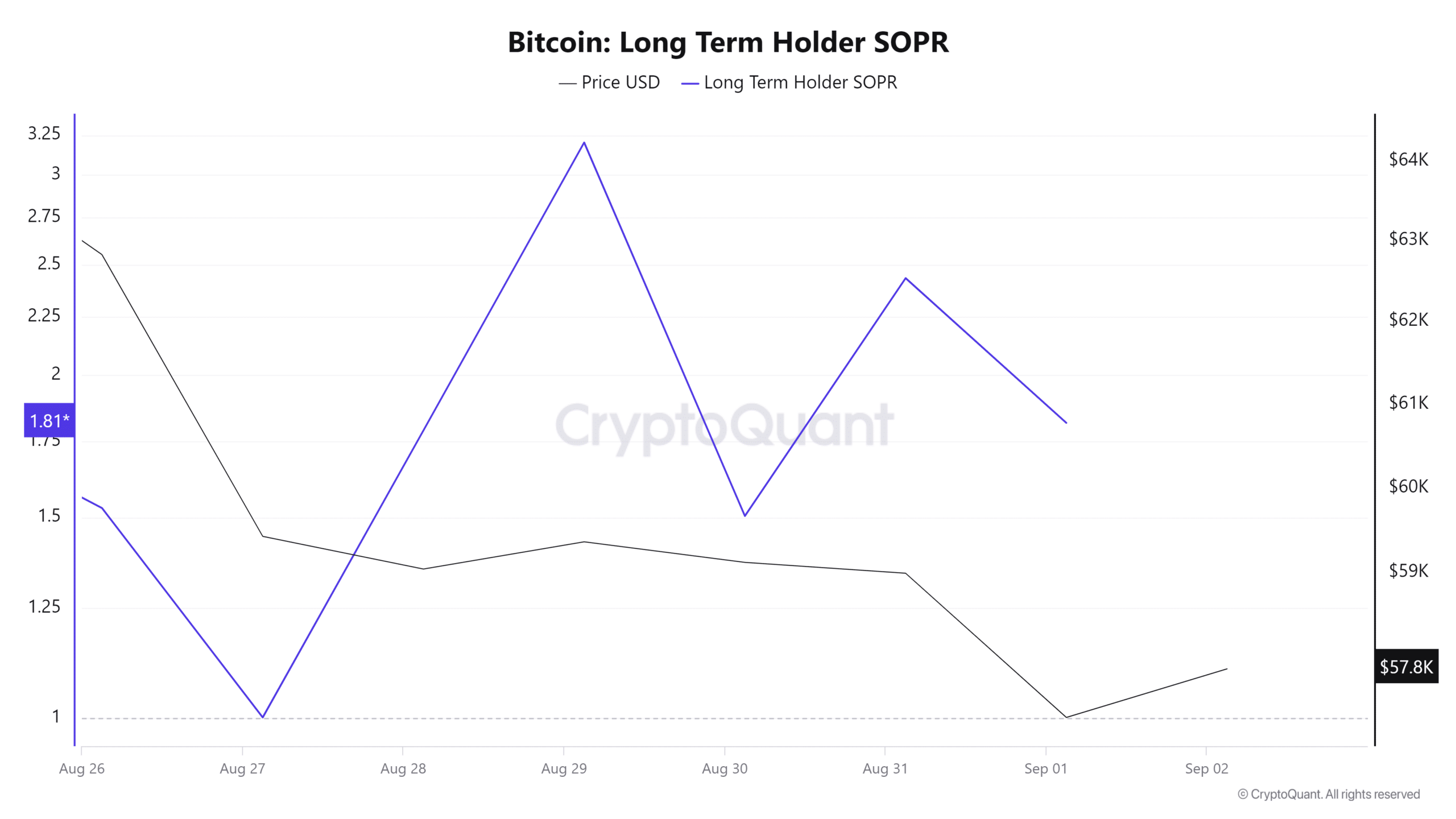

Initially, the Spent Output Profit Ratio (SOPR) of Bitcoin’s long-term holders has hovered near 1 for the last week. When the long-term holder SOPR stays close to 1, it typically indicates that cryptocurrency is being sold at its original purchase price.

In this situation, we see market consolidation as those who have held onto their investments for a longer period are neither making a profit nor suffering losses. This circumstance encourages these long-term holders to keep their positions, hoping for opportunities to sell at a profit down the line.

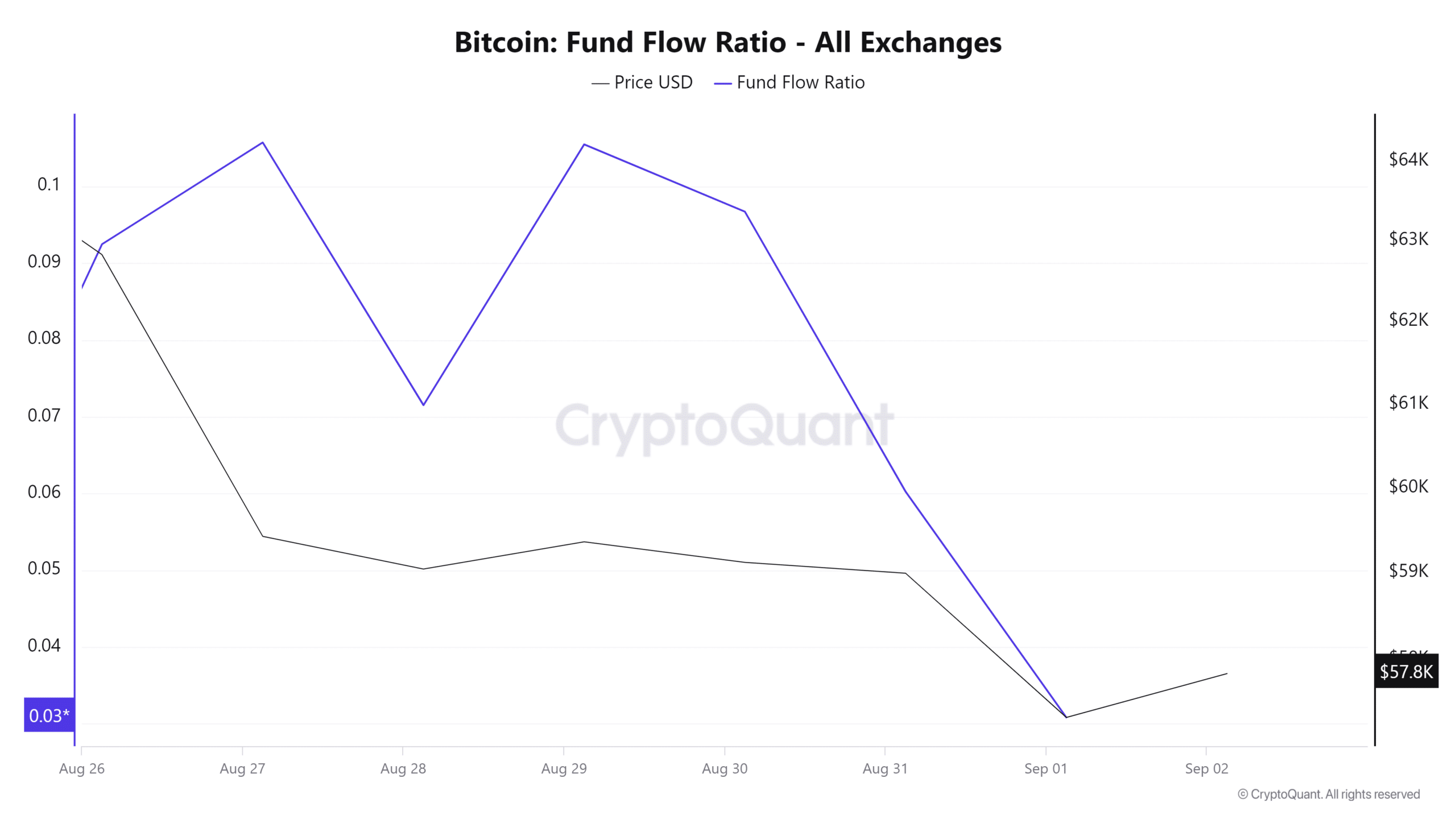

Over the last week, I’ve noticed that the withdrawal-to-deposit ratio for Bitcoin on exchanges has been consistently greater than one. In simpler terms, this suggests that more BTC is being taken out of these platforms compared to what’s being put in, indicating a potential trend of selling or transferring BTC to personal wallets.

This is a bullish signal, indicating investors are moving their crypto off exchanges for long-term holding, thus reducing supply available for immediate sell.

Such moves reduce selling pressure and increase demand, which in turn helps in trend reversal.

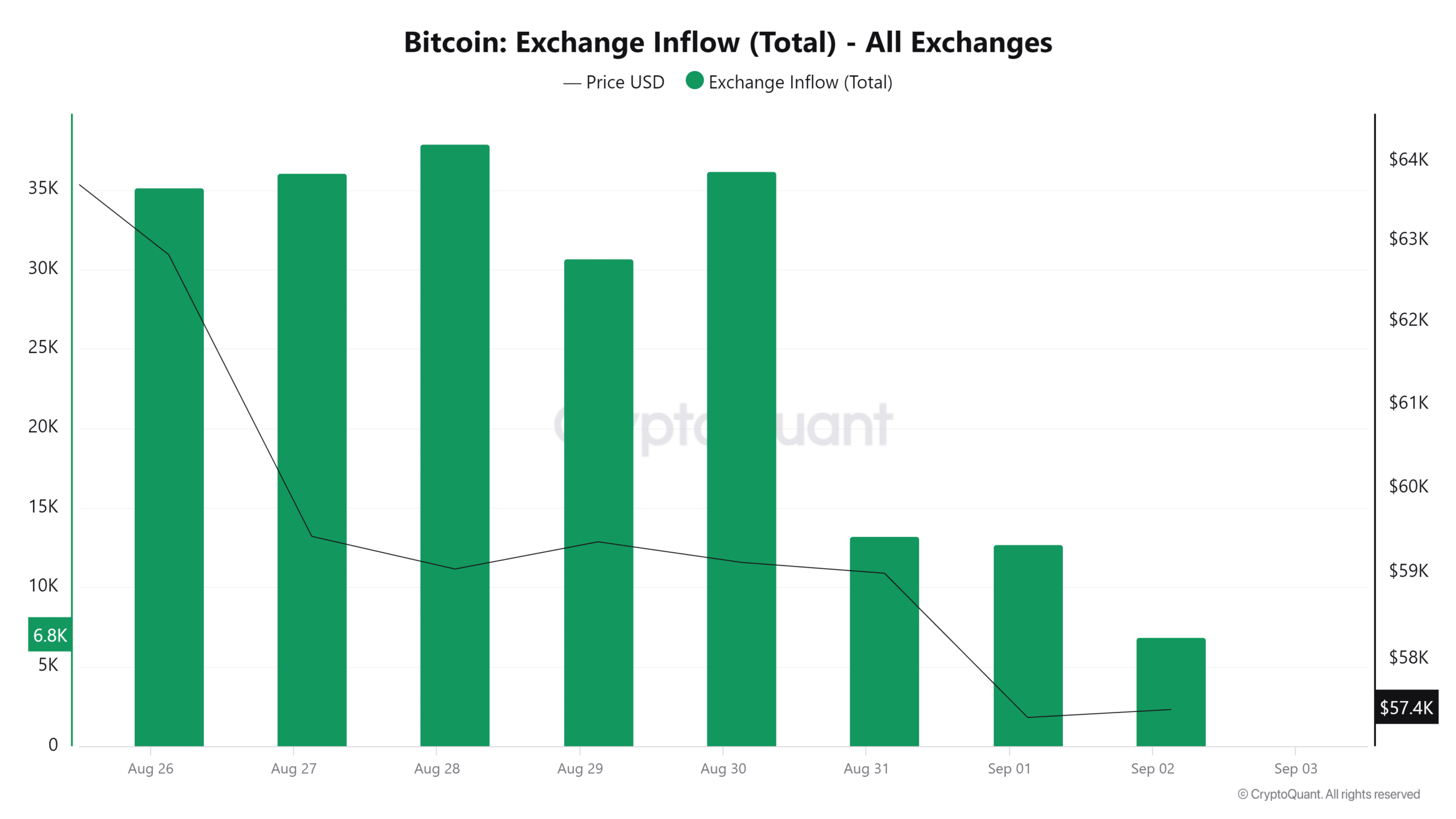

In summary, there’s been a decrease in Bitcoin inflows to exchanges over the past three days, with the weekly peak at 37,899.7 dropping down to 6,869. This reduction suggests that investors are holding onto their Bitcoins, possibly due to expectations of rising prices ahead.

The current mood in the market lessens the amount of selling, making it a positive or ‘bullish’ sign because there are fewer cryptocurrencies easily accessible for trading.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Despite a 30-day drop in Bitcoin’s price, it’s experiencing a bearish trend with a bullish consolidation. The uncertainty in the market is leading investors to hold onto their coins, which in turn, decreases the available supply.

Building up this pattern results in a decrease of supply and a surge in interest, giving advantage back to the bulls over the market. Consequently, Bitcoin could surpass the barrier at $61,159, possibly aiming for $70,000.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- SOL PREDICTION. SOL cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- PGA Tour 2K25 – Everything You Need to Know

- MrBeast Slams Kotaku for Misquote, No Apology in Sight!

2024-09-03 05:12