-

BTC maintained the $67,000 price range despite declines.

The sentiment has also remained positive.

As a seasoned researcher with extensive experience in analyzing cryptocurrency markets, I have closely monitored Bitcoin’s [BTC] recent price movements and market sentiment shifts. Based on my observations and data from reliable sources, here is my perspective:

I’ve observed a decline in Bitcoin‘s [BTC] price within the past 24 hours. However, the broader uptrend remains strong despite this setback. This tenacity is reinforced by the crypto fear and greed index, which indicates a favorable outlook among investors at present.

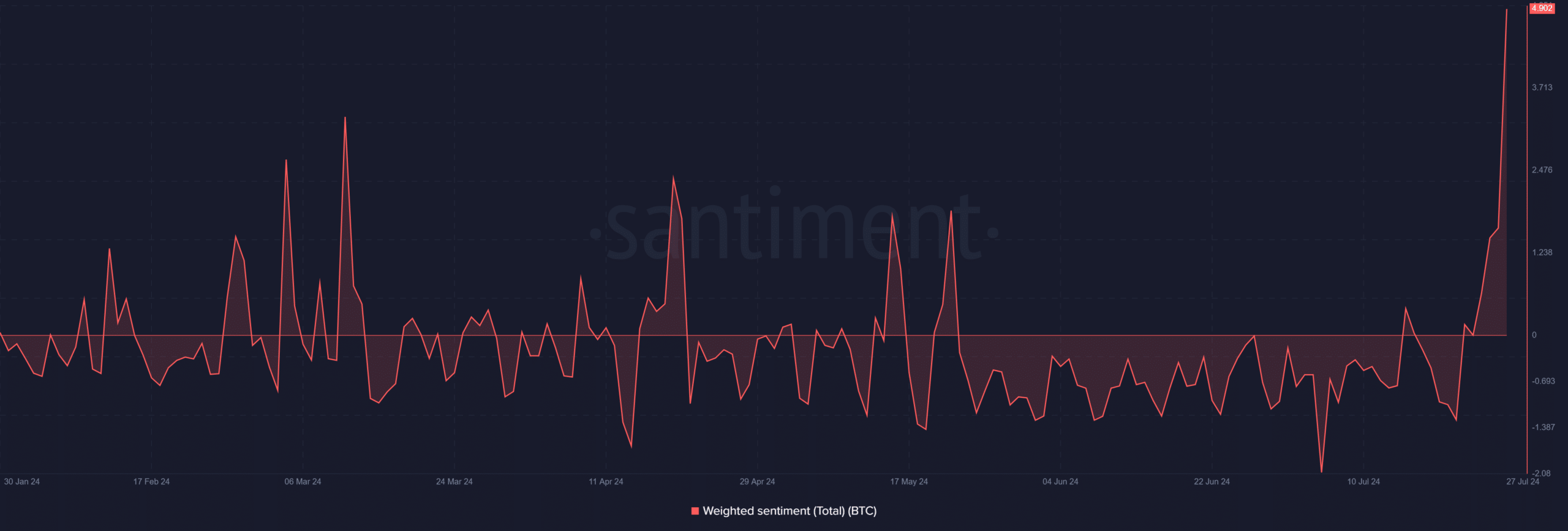

Bitcoin sees monthly high in weighted sentiment

Based on Santiment’s analysis of Bitcoin sentiment, there has been a notable rise in positive feelings towards Bitcoin recently, reaching levels not seen since several months ago, with a score above 4.9. This change comes after a prolonged period of mostly negative sentiments that began around May.

The data showed a short-lived increase in positivity around the 15th of July, which was then replaced by a resumption of negative readings.

Beginning around July 23rd, there was a gradual but steady increase in positive sentiment, which has led us to the current optimistic outlook.

Bitcoin’s weighted sentiment reached its peak since March 2023, reflecting a significant shift in investors’ outlook toward the cryptocurrency, suggesting a strong recovery in market sentiment towards Bitcoin.

The rise also reflects increased investor confidence and positive market expectations.

Bitcoin shows greedy sentiment

According to Coinglass, the Bitcoin Fear and Greed Index is approximately 71, signifying “confident optimism” amongst traders about Bitcoin’s price direction.

Despite a price drop in the past 48 hours, there remains unwavering faith in the cryptocurrency.

The index measuring the emotions and motivations behind Bitcoin investors’ actions indicates that a large number of them remain hopeful regarding Bitcoin’s capacity for rebounding and advancing further.

Additionally, investors are probably entering the market, betting on price increases. This positive attitude coincides with the surge in the heavy-weighted sentiment index, suggesting a predominantly optimistic market trend.

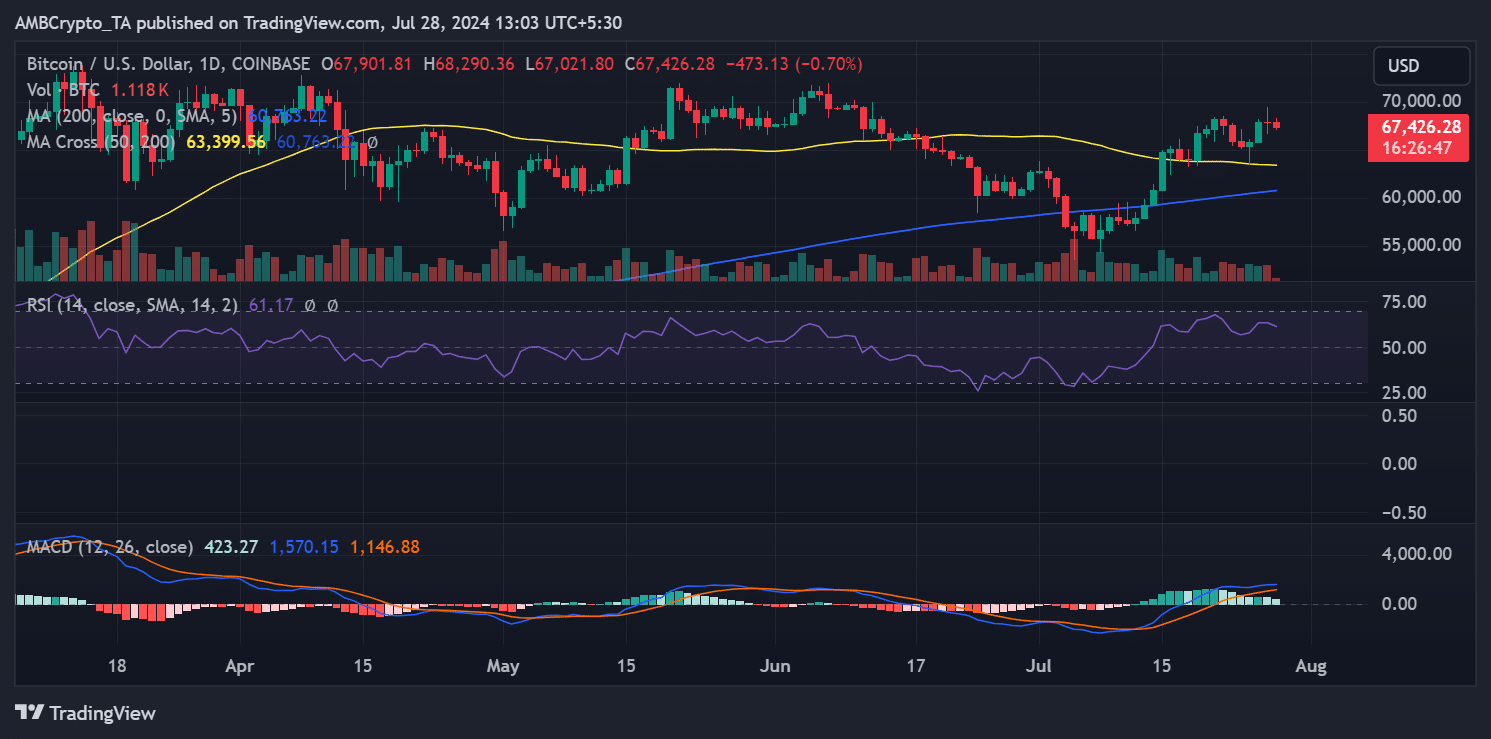

Bitcoin remains in a bull trend

The price of Bitcoin has seen a minor decline lately, yet it has remained contained between $67,000 and $67,000 on the charts.

The most recent data shows that BTC‘s price has persisted in dropping, albeit the decrease was minimal, hovering around 0.5% as of now, with the cryptocurrency being exchanged for approximately $67,425.

Although there have been some small dips, the overall trend remains positive based on its Relative Strength Index (RSI) of approximately 60, signifying robust bullish energy.

Read Bitcoin (BTC) Price Prediction 2024-25

Moreover, the price was hovering above its brief-term average represented by the yellow line, providing a cushion around the $63,000 price point.

The graph shows Bitcoin’s position above its moving average, strengthening the case for a persistent bull market. This level of market backing continues to hold significance.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- OM PREDICTION. OM cryptocurrency

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

- How to Get to Frostcrag Spire in Oblivion Remastered

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- Captain America: Brave New World’s Shocking Leader Design Change Explained!

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Fantastic Four: First Steps Cast’s Surprising Best Roles and Streaming Guides!

- Daredevil’s Wilson Bethel Wants to “Out-Crazy” Colin Farrell as Bullseye in Born Again

2024-07-29 06:05