-

Market observers offer mixed signals on the Fed’s macro outlook impact on BTC and crypto.

BTC dropped to $67K after the Fed’s decision and threatened to post more losses.

As a researcher with a background in macroeconomics and experience in cryptocurrency markets, I believe that the Federal Reserve’s recent decision to maintain interest rates and the ambiguous economic outlook have introduced a significant macro risk for Bitcoin (BTC) in the third quarter of 2024.

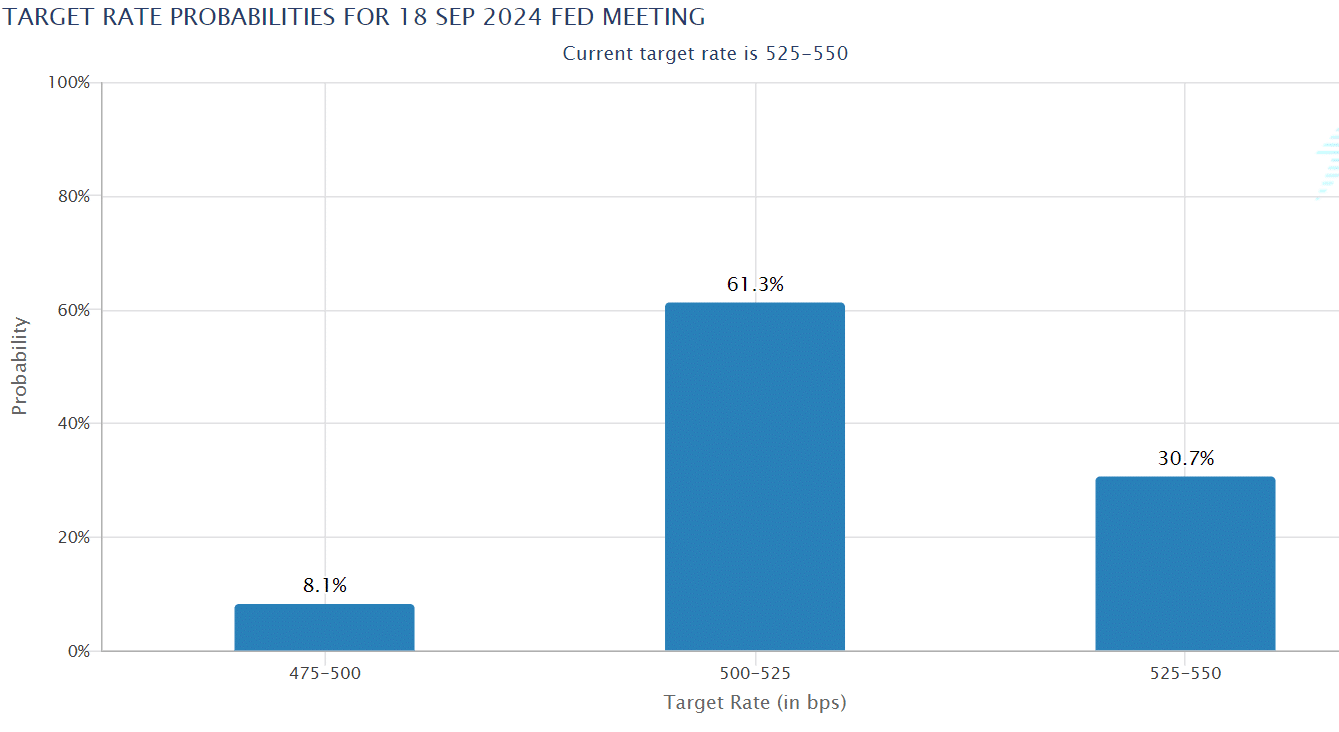

Bitcoin‘s price stayed below the $67,000 mark following the Federal Reserve’s decision to keep its benchmark interest rates unchanged at 5.25% to 5.5% for the seventh consecutive meeting.

The Fed’s economic outlook and future directives presented at the meeting have sparked varying perspectives among investors regarding the influence on cryptocurrencies such as Bitcoin.

According to JPMorgan’s analysis, the Fed’s future monetary policy direction is uncertain, as they now anticipate just one interest rate reduction by the end of 2024 instead of the previously predicted three cuts.

Is BTC facing macro risk in Q3?

The doubt deepened as Jerome Powell, the Fed chairman, expressed hesitance regarding the latest inflation figures. He voiced his uncertainty during his remarks.

“It is probably going to take longer to get the confidence that we need to loosen policy.’

From Quinn Thompson’s perspective, as founder and CIO of crypto hedge fund Lekker Capital, he considered the Federal Reserve’s perspective a potential threat to cryptocurrency assets. Anticipating a comparable liquidity squeeze similar to what Bitcoin experienced during the US tax season in April, Thompson warned.

As a researcher, I’m observing that the “liquidity air pocket” emerged towards the close of Q1, preceding the tax season. This phenomenon seems to persist until we witness another month or so of robust inflation data to strengthen the prevailing disinflationary trend.

Expanding on the potential risk for crypto assets, the hedge fund executive added,

In simpler terms, I believe the risk of a significant chain reaction in the crypto market is high, with most alternative coins potentially facing elimination. The market currently shows no signs of recovering from its downturn.

Thompson expressed doubt on Bitcoin’s potential for growth during the summer, as it had not managed to surpass its previous record-high despite attempts to do so.

As an analyst, I acknowledge the ambiguity in the Federal Reserve’s latest statement regarding interest rates. However, similar to crypto trading firm QCP Capital, my outlook remains optimistic for the remainder of 2024. In their recent Telegram update, they explicitly stated their bullish stance.

For the rest of this year, we hold a optimistic view based on the expected approval of an Ethereum Exchange-Traded Fund (ETF) Structural Form and possible interest rate reductions in September and at the end of the year.

At the moment of publication, the probability of a September rate reduction was 60% higher than that of maintaining existing rates.

As a crypto investor, I’ve been following the insights of macro analyst TedTalksMacro closely. Recently, he expressed his optimistic perspective on the market and considered the May US Consumer Price Index (CPI) print to be “disinflationary,” which could have short-term positive implications for cryptocurrencies.

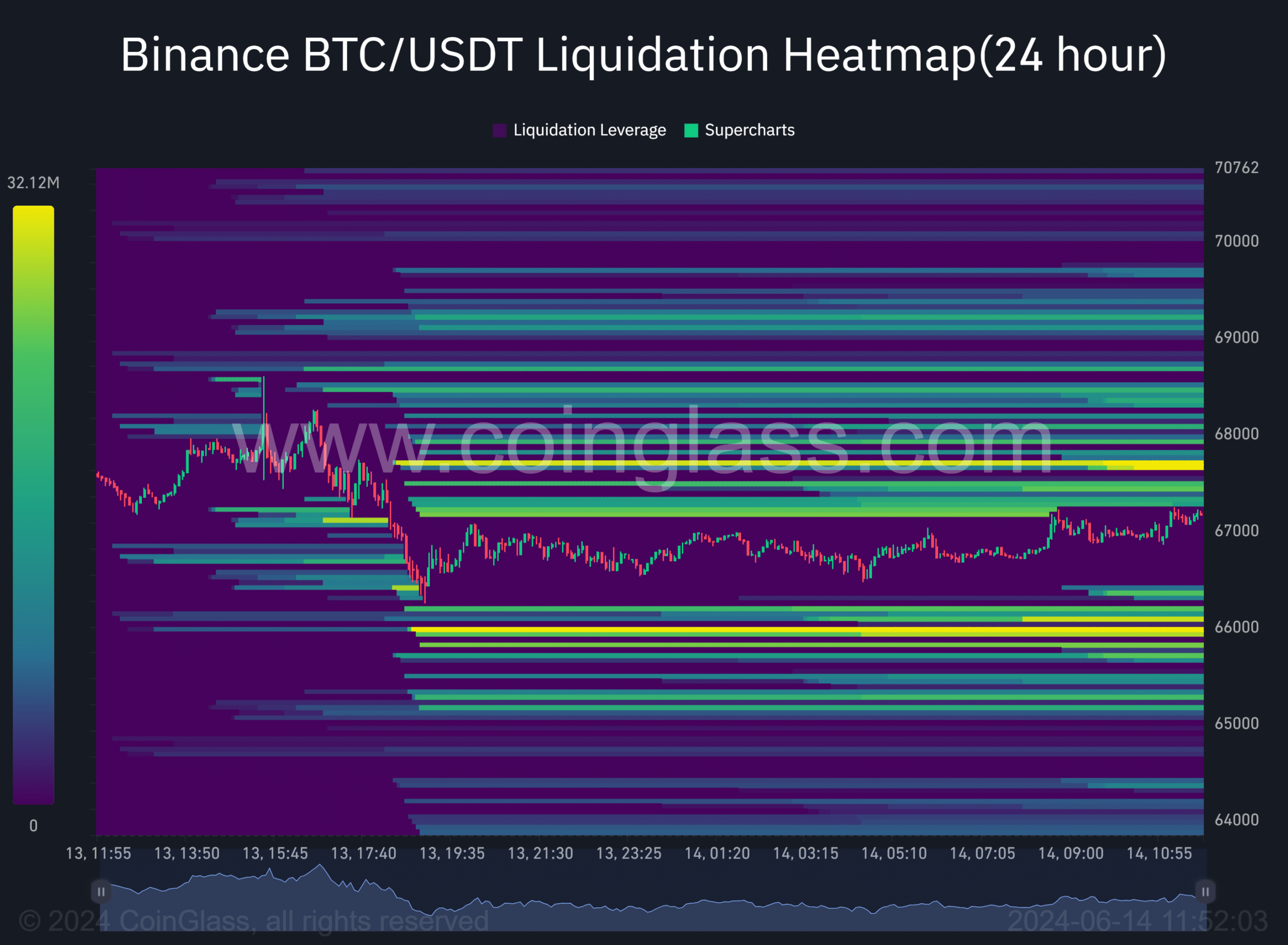

As I analyzed the daily liquidation charts, I noticed significant groups of liquidations clustered around the prices of $66K and $68K (indicated in orange), according to the data available up to the press time.

Normally, price movements tend to hit pockets of high liquidity, implying that a return to the $66K and $68K mark could be likely in the near future.

Read More

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- Grammys Pay Emotional Tribute to Liam Payne in First Honorary Performance

- Has Unforgotten Season 6 Lost Sight of What Fans Loved Most?

2024-06-14 15:19