- Ah, the fickle nature of BTC, dipping by a modest 2.55% over the past day.

- But lo! A surge in institutional demand as the Coinbase Premium Index decides to flip to positive. How delightful! 🎉

In the past week, our dear Bitcoin [BTC] has been frolicking between the realms of $95k and $98k. As I pen these words, it finds itself at a rather precise $95,936. Alas, this marks a 2.55% decline on the daily charts, with a rather gloomy extension of 1.56% on the weekly charts. Oh, the drama!

As Bitcoin grapples with its uptrend, like a cat trying to catch its own tail, investors—particularly those illustrious institutions—have seized this moment to acquire BTC. A splendid opportunity, indeed!

In this context, the astute crypto analyst, Ali Martinez, has suggested a burgeoning institutional demand, citing the ever-reliable Coinbase Premium Index. How very insightful!

Bitcoin Institutional Demand Surges

With Bitcoin’s continued consolidation, institutional demand has surged like a wave crashing upon the shore. Over the past week, the Coinbase Premium Index has remained positively buoyant.

When this index is positive, it suggests that the buying pressure on Coinbase is stronger than that on Binance, implying that our dear U.S. investors are taking the lead in this grand market dance. 💃

Thus, institutions have taken advantage of this price stagnation, accumulating Bitcoin at lower rates. A clever strategy, wouldn’t you agree?

This rising buying pressure from institutions reflects a bullish sentiment, as they anticipate a rebound in prices. Optimism is in the air!

What BTC Charts Suggest

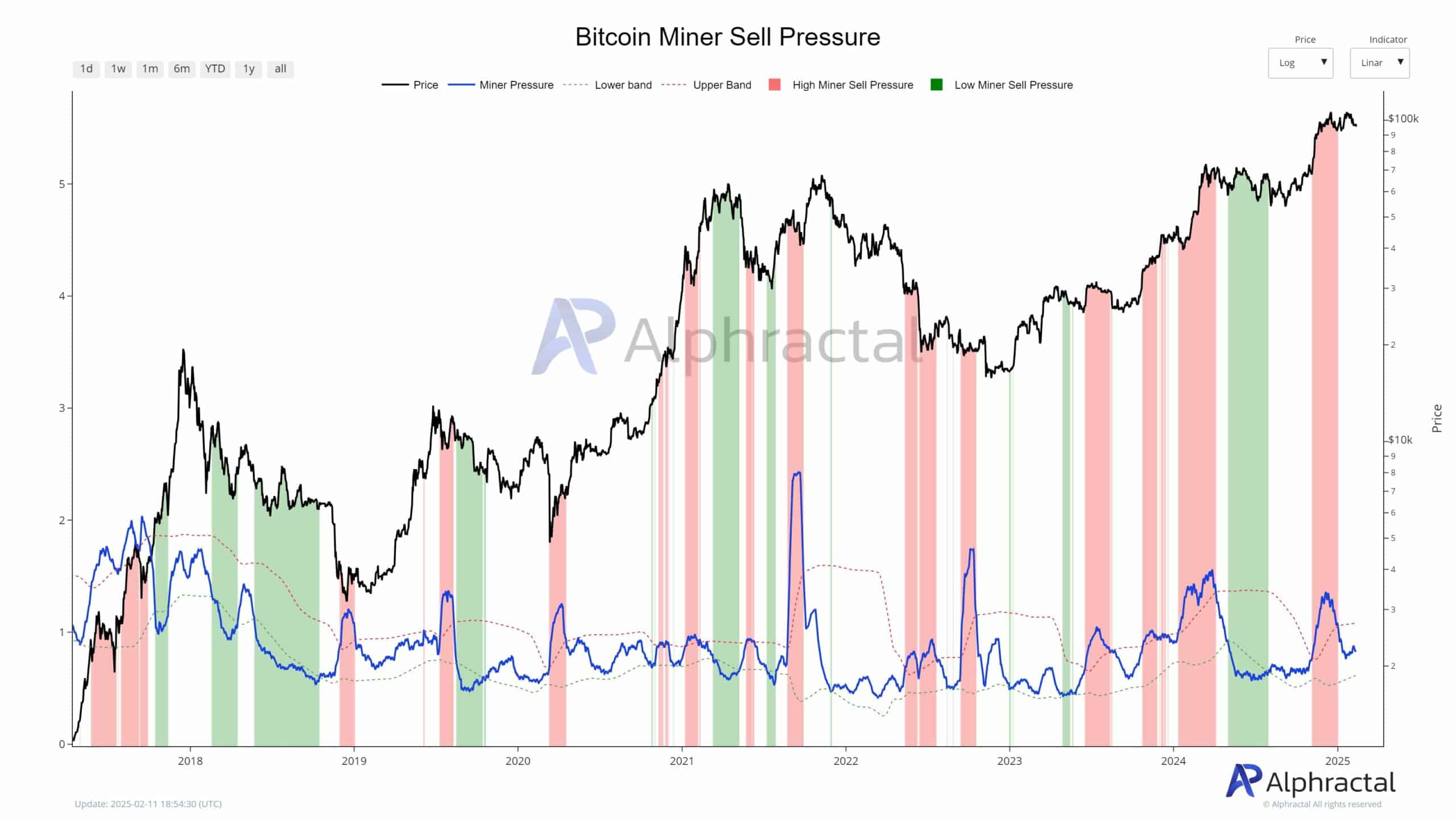

With institutional demand rising for BTC, we see a delightful bullishness among these entities. Notably, the selling pressure from miners is diminishing. According to Alphractal, miners’ selling pressure has dropped, leading to a reduction in BTC supply from these industrious miners.

After a period of high selling from miners, values are now below average, suggesting a pause in miner liquidations. How quaint!

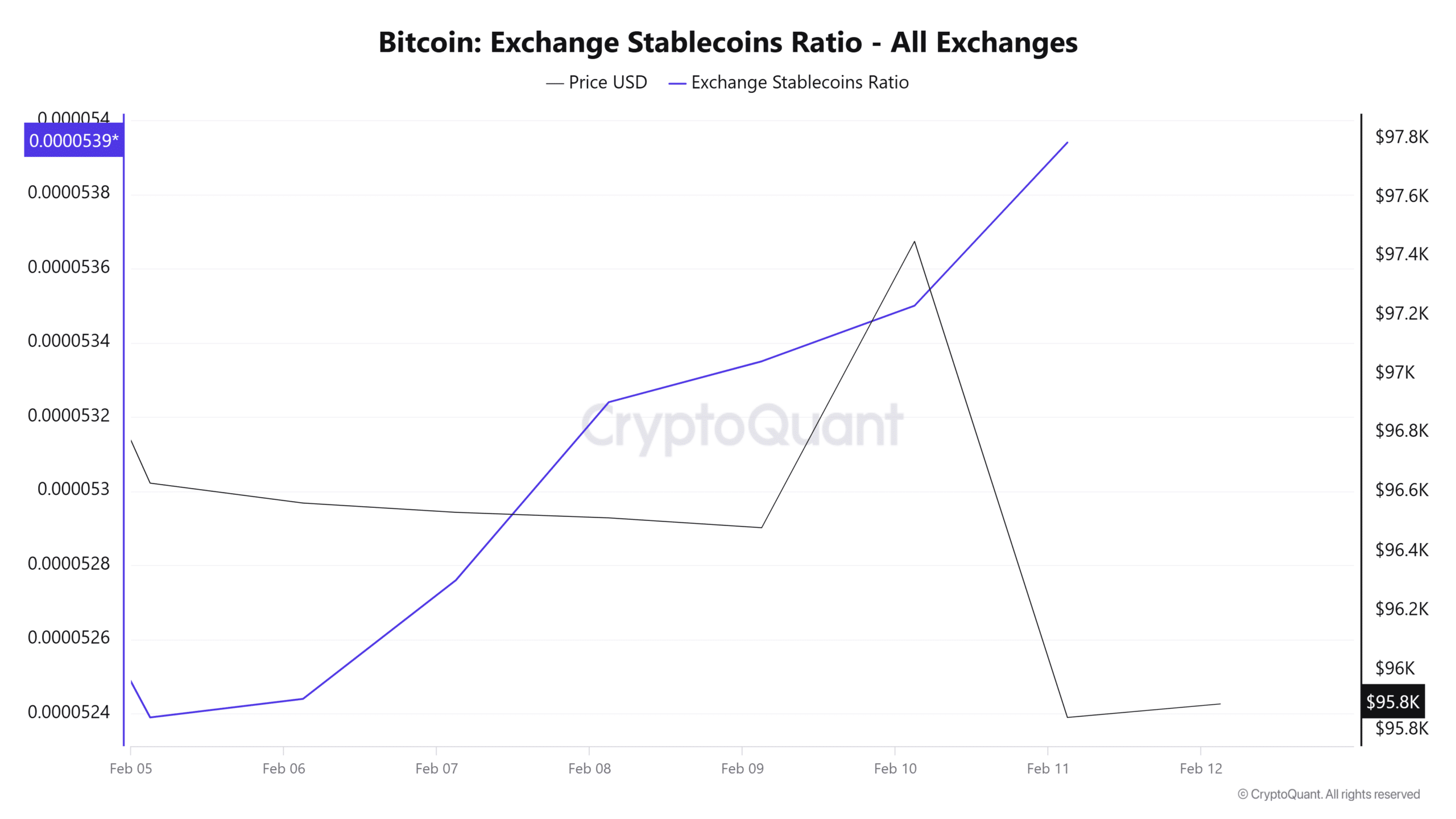

Moreover, Bitcoin’s exchange stablecoins ratio has surged over the past week. Institutions often utilize stablecoins like USDT or USDC to procure BTC, thus a rising stablecoin supply signals potential buying power in the market. A clever ruse!

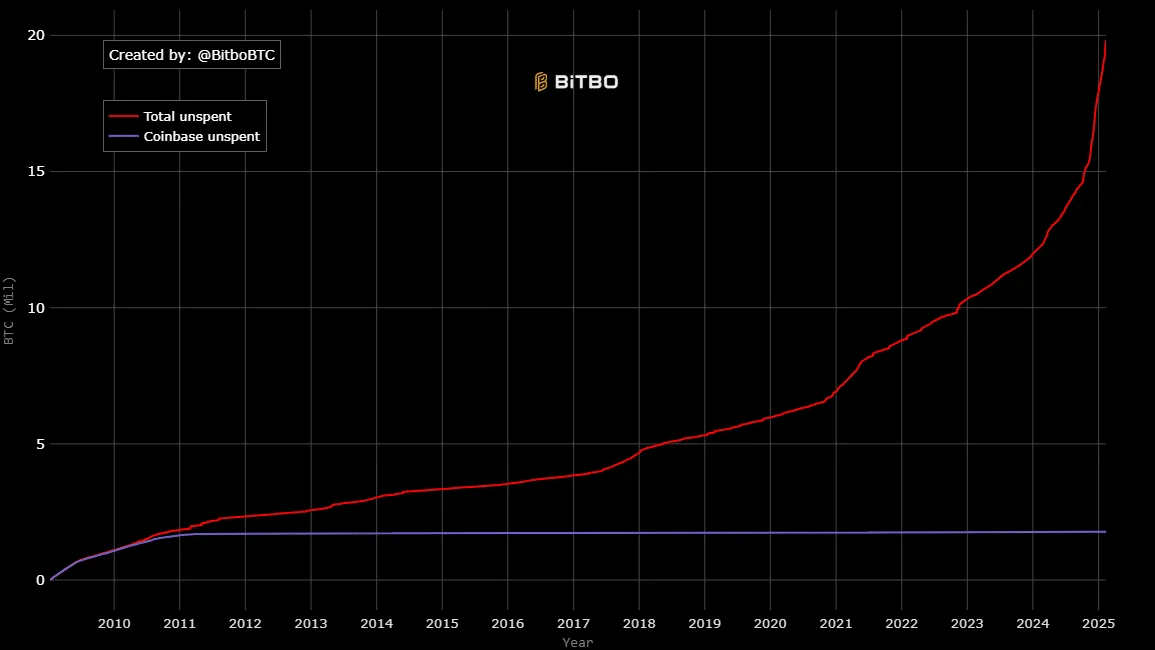

Equally, dormant coins, particularly total unspent ones, have experienced a steady rise, while Coinbase’s unspent coins have remained stagnant. This implies that our large and long-term holders are not parting with their BTC, either through Coinbase or other exchanges. How very loyal!

In conclusion, Bitcoin is experiencing high demand from institutions, evidenced by reduced selling pressure and increased buying activity. A veritable feast for the bullish sentiments!

With institutions buying without selling, it reflects a strong bullish sentiment as they turn to accumulate. The current market conditions position BTC for more gains on its price charts. If this trend holds, BTC could break out of $98,405 and make a valiant attempt at $100K. 🎯

However, with short-term holders still lurking in the market, a pullback could see the crypto retrace to $95,031. Oh, the suspense!

Read More

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- SOL PREDICTION. SOL cryptocurrency

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

2025-02-13 05:15