-

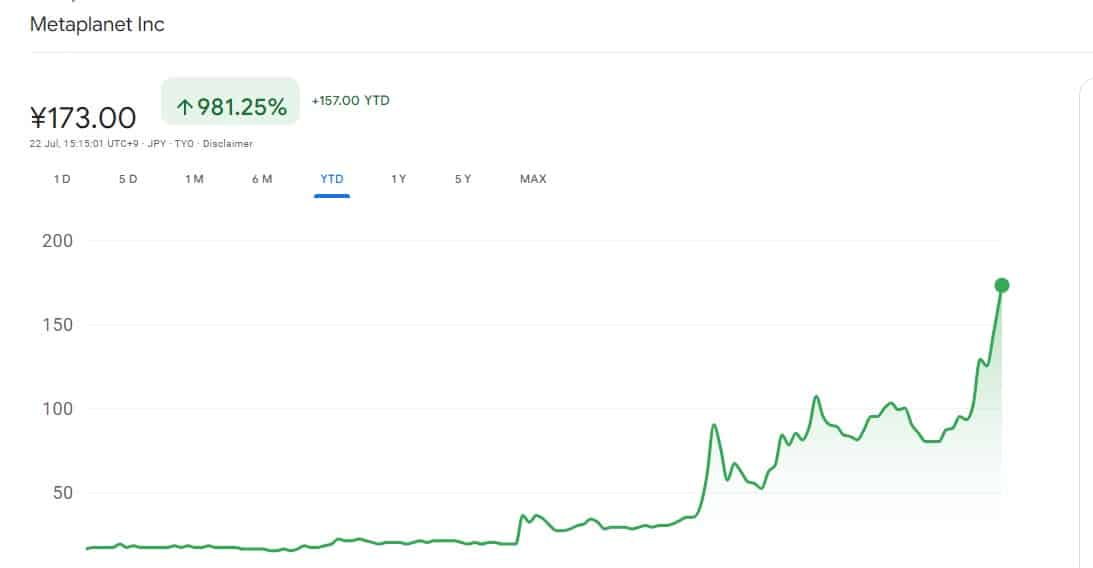

Metaplanet soared over 900% YTD as its BTC strategy paid off.

Metaplanet has been accumulating BTC over the last two months, totaling to 225.611 BTC

As a seasoned researcher with extensive experience in the financial industry, I have closely followed Metaplanet’s strategic moves in the Bitcoin market over the past few months. And I must admit, their bold decision to accumulate large amounts of BTC has paid off handsomely.

During the course of the year, numerous leading corporations have been utilizing Bitcoin (BTC) as a means to enhance their stocks. Metaplanet, a pioneering Japanese business, has played a pivotal role in fueling institutional investment in Bitcoin.

Metaplanet’s strategy pays off

For the past two months, Metaplanet has actively acquired Bitcoins, expanding its cryptocurrency reserves. On May 28, 2024, the corporation disclosed the acquisition of Bitcoins valued at approximately $1.6 million.

As a researcher, I’ve discovered that in the earlier part of the month, Metaplanet acquired 19.87 Bitcoins valued at approximately $1.7 million. Later in June, they made another purchase consisting of 23.25 Bitcoins, equating to around $1.59 million. The combined value of these two transactions reached a substantial total of $141.07 million.

So far in July, the company has acquired an additional 21.877 Bitcoins, adding to its existing stash, bringing the current Bitcoin holdings to a total of 245.611 BTC. This equates to a value of approximately $14.8 million at present market rates.

Metaplanet’s strategic BTC accumulation over the past months has seen its stock rise exponentially.

Metaplanet’s significant purchases have proven beneficial, now ranking as the 20th largest corporate Bitcoin holder based on CoinGecko’s latest report.

Over the last 24 hours, Metaplanet’s shares have experienced a significant increase of 19.31%, while the ownership of Bitcoin (BTC) has progressively grown, resulting in its value soaring exponentially.

Based on Google Finance’s data, their shares have experienced a significant increase of 51.75% in just the previous five days, and a remarkable jump of approximately 82% within the past month. This recent growth has propelled the year-to-date percentage to exceed 900%.

The rising value of their Bitcoin holdings indicates that their decision to adopt it as a primary reserve asset has been highly profitable.

Bitcoin as an alternative in Japan?

Among the developed and G-7 economies, Japan’s has endured greater hardships than any other.

To mitigate risks arising from a sluggish economy, Metaplanet has devised strategies.

As an analyst, I would express it this way: My current analysis reveals that Japan’s national debt stands at a substantial 261% of its Gross Domestic Product (GDP). This significant debt load has been putting pressure on the Japanese Yen. At present, one US dollar is equivalent to approximately 156.70 Japanese Yen in the foreign exchange market.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Metaplanet decided to add Bitcoin to its corporate assets in their treasury, as a means of countering the substantial depreciation of the Yen over the past year.

Metaplanet intends to capitalize on Bitcoin’s anticipated continued expansion beyond $100k by 2024, in order to enhance its own stock value.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

2024-07-22 17:12