-

One expert points to historical trends as a strong indicator of an impending BTC rally.

Several key metrics support the potential for Bitcoin to climb higher, backed by multiple confluences in the data.

As a seasoned analyst with over two decades of market analysis under my belt, I have witnessed countless market cycles and trends, from the dot-com bubble to the crypto revolution. The current state of Bitcoin (BTC) presents an intriguing case that seems to echo historical patterns, which in my experience, can often serve as reliable indicators for future price movements.

Over the past seven days, Bitcoin [BTC] experienced significant selling pressure which caused its value to decrease by approximately 1.67%. Nevertheless, the market seems to be bouncing back, as Bitcoin has managed to increase by around 1.30% in the most recent 24-hour period.

Experts predict that Bitcoin’s growth will persist, as past trends and various indicators point towards a possible surge beyond its latest 15.27% increase and potentially reach even greater heights within the upcoming weeks.

Historical data shows a 7% drop followed by a massive price surge

As per crypto expert Carl Runefelt’s latest post, Bitcoin now finds itself at a pivotal juncture reminiscent of October 2023.

He noted:

“Bitcoin dropped 7% at the beginning of October 2023, and now it’s dropped about the same!”

According to the graph he provided, if a similar historical trend occurs, Bitcoin could increase around 66.76%, possibly hitting $100,000. Nevertheless, it’s important to remember that in 2023, the rise before consolidation saw a gain of only 35.43%.

It’s unclear if Bitcoin will experience another significant price rise, as indicated by AMBCrypto’s analysis of different market indicators to predict future trends and actions among traders during the coming trading periods.

Traders exit exchanges, increasing demand for Bitcoin

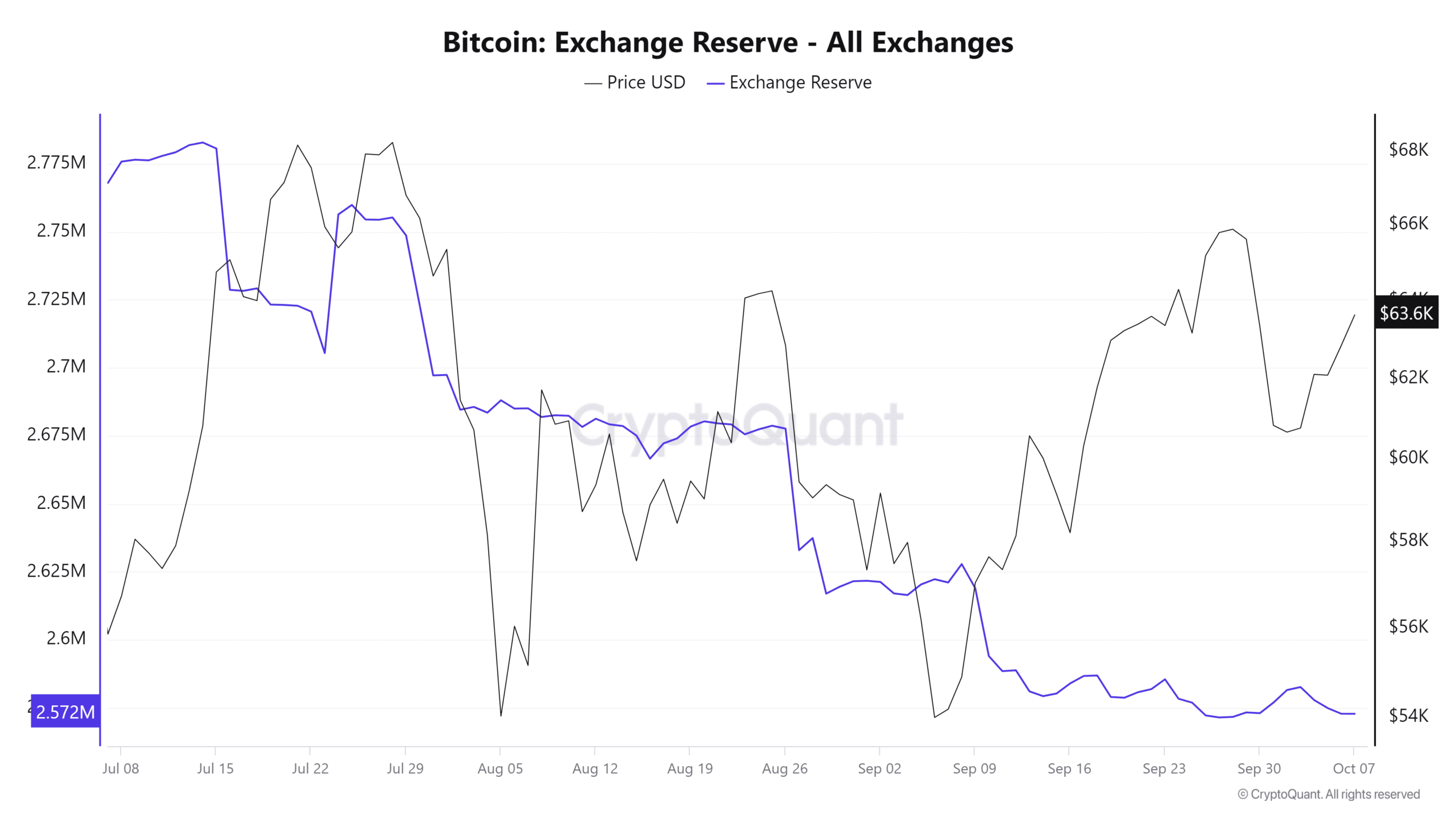

Currently, the sum of Bitcoin (BTC) circulating on various cryptocurrency exchanges, according to the Exchange Reserve, has shown a consistent decrease since October 3rd.

At present, approximately 2.57 million Bitcoins are kept on exchanges, a decrease from 2.58 million. This reduction suggests that traders are progressively choosing to hold their Bitcoin outside of exchanges, which could be an indication of growing faith in the asset. Concurrently, this trend is fueling a surge in demand for BTC.

The decrease in CryptoQuant’s Exchange Stablecoin Ratio for BTC implies that there’s increased demand for buying Bitcoin with stablecoins, which can drive up its price. At the moment, the ratio stands at 0.00009506 and is showing a downward trend.

If these indicators keep pointing downwards, it’s probable that Bitcoin will persist in its rise, given that the overall market feeling is leaning more towards the optimistic “bulls.

Apart from these robust bullish signs, AMBCrypto has also found other measures that seem to support this same outcome.

Short traders face losses as BTC rises

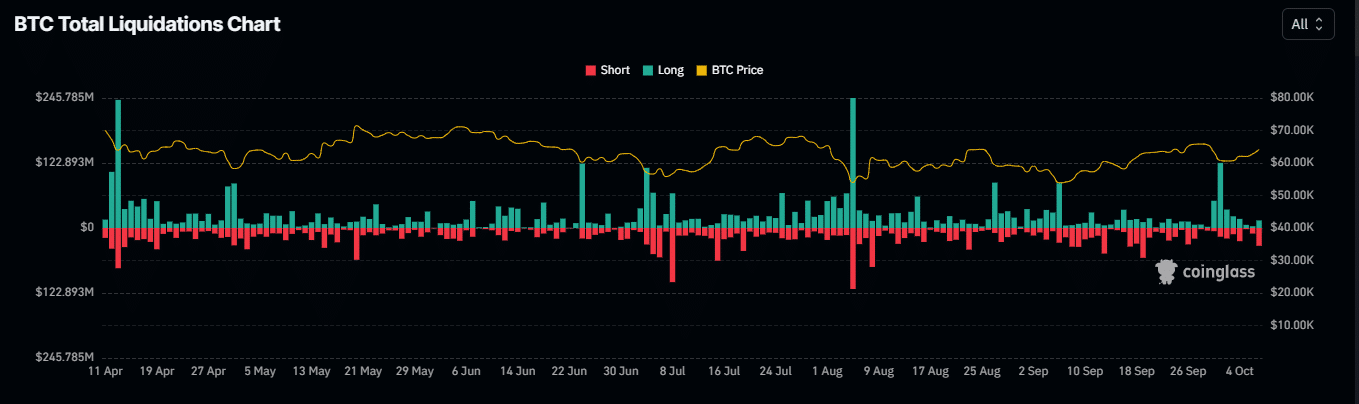

Over the last day, many short traders found themselves forced to sell off their Bitcoin holdings because the market’s upward trend contradicted their pessimistic forecasts.

As a researcher examining data from Coinglass, I’ve uncovered an intriguing finding: Around $41.80 million worth of short positions on Bitcoin were liquidated, signaling a robust move towards a bullish trend in the market.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Moreover, Open Interest, an important measure reflecting trading activity, shows a rising trend as it climbed by 3.66%, taking the total to a staggering $34.08 billion.

Should this trend carry on, it’s reasonable to expect Bitcoin’s upward trajectory will likely remain, supporting the optimistic outlook among investors.

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

2024-10-08 09:12