-

BTC saw positive moves from some of its key indicators

Crypto’s price dropped slightly after rising to over $58,000 on the charts

As a seasoned analyst with years of market observation under my belt, I’ve seen enough price movements and sentiment swings to fill several cryptocurrency chronicles. The recent developments in Bitcoin (BTC) have caught my attention, particularly its social volume and taker buy/sell ratio indicators.

In my recent investment journey, I noticed some encouraging signs in Bitcoin (BTC). Specifically, its social volume and taker buy/sell ratio showed some promising trends during the latest trading session.

Indeed, the data indicates that both the social media activity and buy-to-sell ratio of Bitcoin experienced significant increases. Previously, such spikes in these indicators have occasionally hinted at Bitcoin potentially nearing a temporary peak.

Bitcoin’s social commentary spikes

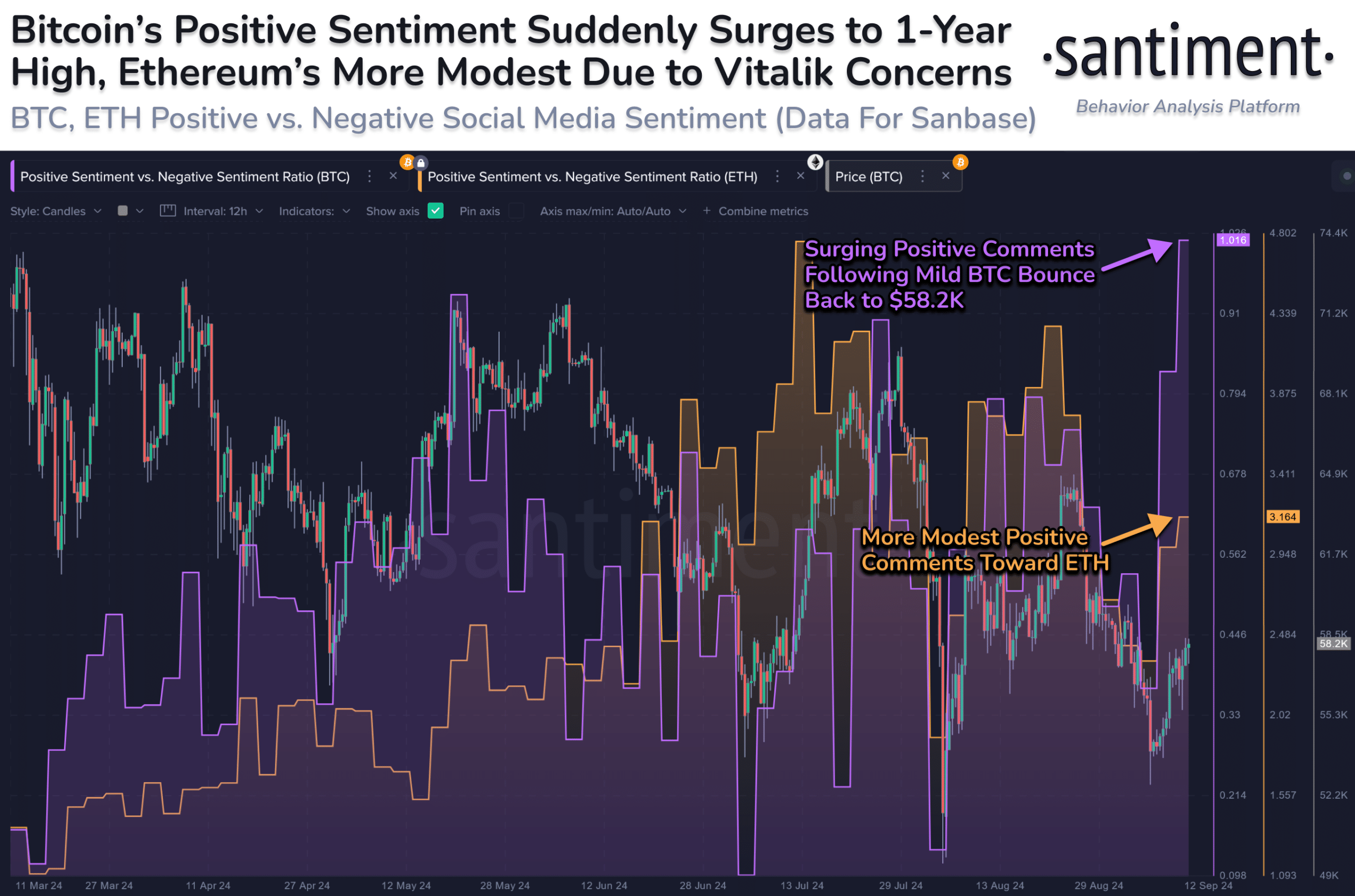

Based on Santiment’s analysis, there was a substantial rise in discussions about Bitcoin during the recent trading period. Both favorable and unfavorable opinions rose, yet the positive sentiments experienced a more marked increase. This surge in conversations represents the highest spike in commentary this year, suggesting increased interest and optimism towards Bitcoin.

As a researcher delving into historical Bitcoin market trends, I’ve noticed an intriguing pattern: surges in overall social sentiment, especially optimism, tend to precede the formation of local price peaks for Bitcoin. Past occurrences seem to validate this pattern as well.

On May 19th and 20th, an increase in social discussion about Bitcoin corresponded with its price surging by more than 7% to reach approximately $71,400. In the same way, from June 29th to 30th, Bitcoin’s price responded to a surge in social opinion, rising to over $62,000.

Based on past patterns, this surge in optimistic feelings might signal that Bitcoin is nearing a new local peak.

Bitcoin sees hike in taker buy/sell ratio

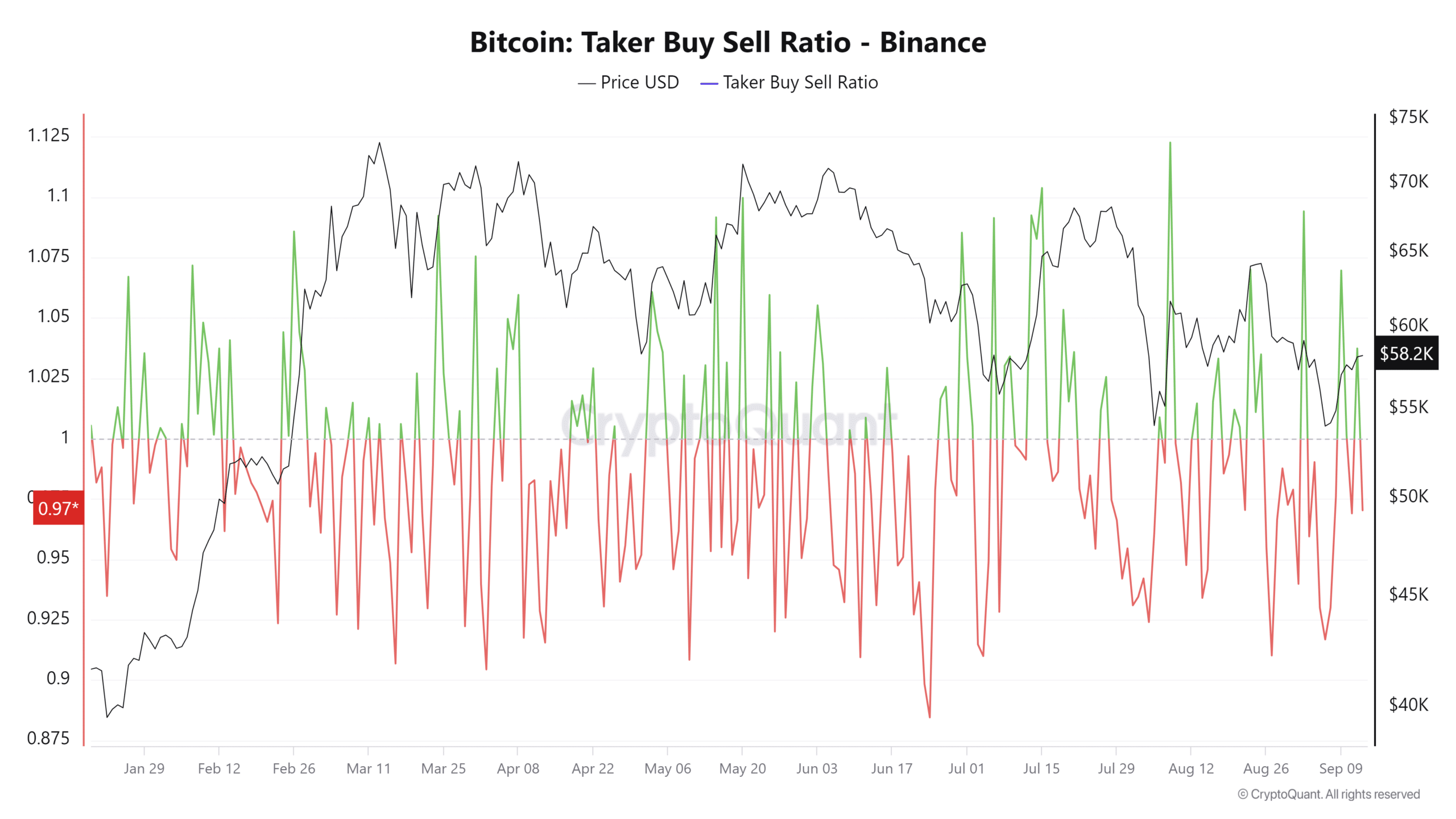

Moreover, as we delve deeper into the recent trading activity, it’s worth noting that the taker buy/sell ratio experienced a substantial increase during the last trading session. Analyzing data from CryptoQuant and AMBCrypto’s evaluation, this ratio on Binance surged beyond 2%. Generally, when this ratio exceeds 1%, it suggests a strong bullish trend, indicating that traders are actively buying more than selling, thus demonstrating high levels of optimism.

Historically, increases in this ratio have often been preceded by an increase in Bitcoin (BTC) prices. The most recent notable increase happened on August 8, causing BTC’s price to jump up to approximately $61,697 from around $54,000 earlier. This surge in buying activity resulted in substantial price growth as shown on the charts.

The recent surge in buying and selling activity (taker buy/sell ratio) has occurred concurrently with a minor price increase. Specifically, Bitcoin climbed from around $57,000 to approximately $58,000. If past trends are any guide, this data might suggest potential further increases in the immediate future.

What this means for BTC

The blend of rising public opinions and the number of buyers exceeding sellers suggests a surge in positivity, potentially indicating more growth could follow.

It’s important to note that when significant increases in metrics such as the buyer/seller ratio and public commentary take place, they often ignite FOMO (Fear of Missing Out) within traders. This emotional response usually leads to increased buying actions, as traders hurry to join the market, aiming to profit from potential future price increases.

– Read Bitcoin (BTC) Price Prediction 2024-25

However, as the market rises, FOMO is gradually replaced by FUD (Fear, Uncertainty, and Doubt). Traders may start to question whether the rally can be sustained, leading to a shift in sentiment and potential profit-taking.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-09-13 19:03