- Everybody’s buying Bitcoin again like it’s the last roll of toilet paper during a pandemic, but the whales? The big guys? They’re acting like they lost their wallets at the beach.

- RSI’s at “your mother-in-law’s opinion” levels: completely over the top, while MACD’s momentum looks about as lively as my enthusiasm for yoga. BTC needs to clear $105K or, you know, we all get to panic. Again. 😊

So here we go again. The Bitcoin [BTC] hype machine is revving back up, with aggressive buyers stampeding as if Satoshi Nakamoto’s coming back to hand out free snacks.

The Taker Buy/Sell Ratio just hit 1.02. Wait, does that mean something? Sure! Apparently, that’s some magical number last seen before big BTC breakouts—so all the “conviction” in the world is suddenly back in style. (I guess we’re ignoring all the times magical numbers meant nothing, but, whatever.)

On-chain data is now telling us that large wallets are stocking up, getting ready for what everyone hopes is the big, world-changing, yacht-buying pump… assuming the universe cooperates. 🤞

So with sentiment “heating up” (whatever that means—maybe everyone’s yelling on Twitter again?), is this all about to blast off or are we in for yet another Jerry Seinfeld rerun of dashed hopes?

A Surge in Market Confidence? Or Just Premature Excitement?

CryptoQuant says the Taker Buy/Sell Ratio, which totally isn’t a made-up indicator, just smashed through 1.00 to 1.02. Historically, this happens right before coin flips disguised as “breakouts.”

Déjà vu: This was the vibe when Bitcoin was clawing from $15K to $20K in late 2022 and then doing the “October rally” last year. Now, with BTC parked just under all-time highs, buyers seem more confident than a guy who thinks cargo shorts are coming back in style. Only problem: every time we get this cocky, half the market suddenly falls down the stairs.

Mega Holders Take a Nap

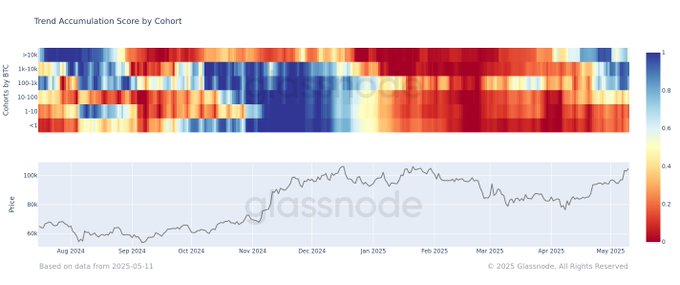

Zoom in a little and, wouldn’t you know it, things aren’t so simple. Glassnode’s data says the mega-whales (10,000+ BTC) have stopped buying. Maybe they’re on vacation? Maybe they ran out of wallets? Maybe they’re just bored?

Middle-class whales (1,000–10,000 BTC) are still stacking like they’re at an all-you-can-eat buffet, though. And the not-quite-poor, institutional wallets? Still hustling. Retail? They’ve apparently switched to selling sock puppets on Etsy.

Basically, the rally’s now being driven by mid-tier whales, while the mega-whales are somewhere between “Let’s see what happens” and “Wake me up when it’s over.”

Bitcoin: Tired, Hungover, or Just Messing With Us?

The RSI is at 70.68, which in crypto land is the equivalent of your uncle at the barbecue saying “You gotta sell right now!” It’s supposedly a warning for a local top or corrections, but hey, maybe this time is different? (Haha, no.)

MACD is technically bullish, but slowing down—like when you promise yourself you’ll run a marathon, then remember Netflix exists.

Prices are stuck, enthusiasm is high, whales are divided, and the memes are outstanding. If Bitcoin doesn’t break above $105K soon, expect a “healthy correction” (translation: more collective angst, more think pieces, and a few thousand crypto bros blaming the Fed) before anybody gets a real moon mission.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Despite Bitcoin’s $64K surprise, some major concerns persist

2025-05-14 12:33