- Stablecoins are a vital component of crypto markets

- Trends in exchange reserves can give clues about market sentiment and wider price trends

As a seasoned crypto investor who has weathered the volatility of this space for years, I can confidently say that stablecoins are not just a buzzword but a cornerstone of the crypto markets. They provide much-needed stability in an otherwise tumultuous environment, facilitating transactions and easing complex activities.

Stablecoins are essential to facilitating a seamless crypto experience. It is a hedge against volatility since it is pegged to fiat and maintains its value. Stablecoins provide liquidity to the markets and eases complex activities such as lending, borrowing, and smart contract deployment in DeFi.

Additionally, an increase in the usage of stablecoins like Tether (USDT) and USD Coin (USDC) on the blockchain serves as a precursor to a rising market trend. This growing adoption and involvement indicates high demand, which is evident from the consistent creation of these stablecoins.

Confirmation of a bull run?

On CryptoQuant Insights, it was pointed out by analyst CrazzyyBlockk that Binance, the global crypto exchange with the highest trading volume, currently holds approximately $29 billion in reserves of two major stablecoins: Tether (USDT) and USD Coin (USDC). This underscores the increasing amount of these stable coins being held by the leading exchange.

It appears that the outlook is quite optimistic. Binance’s reserves facilitate smooth transactions between cryptocurrencies and traditional currencies, while its extensive liquidity instills trust in traders and investors, encouraging them to buy or sell substantial amounts of digital assets with confidence.

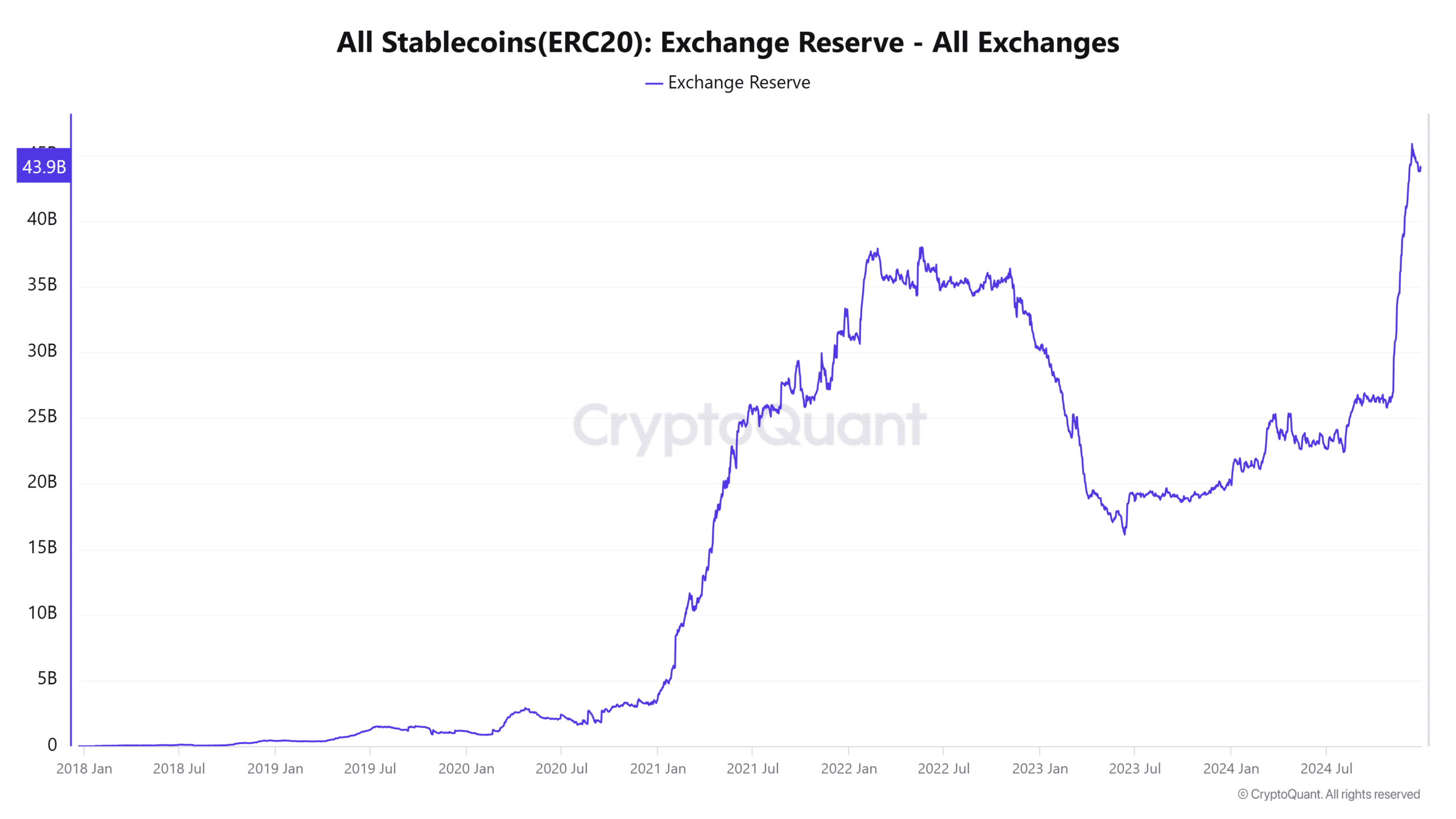

In addition to the increasing USDT reserves on Binance, it’s important to note that the total reserves of stablecoins across popular exchanges have also been rising. From October 24 to December 27, these reserves increased from $25.7 billion to $44.1 billion.

The most recent sharp increase in momentum, reminiscent of the one we saw between December 2020 and January 2021, is taking place currently. This growth phase persisted until early 2022, marking the previous bull market. Today, we’re witnessing a situation similar to that, as an influx of stable coins into reserves is often viewed as ‘dry powder’, a term used for resources saved up to fuel future price increases.

Total market cap projections for 2025

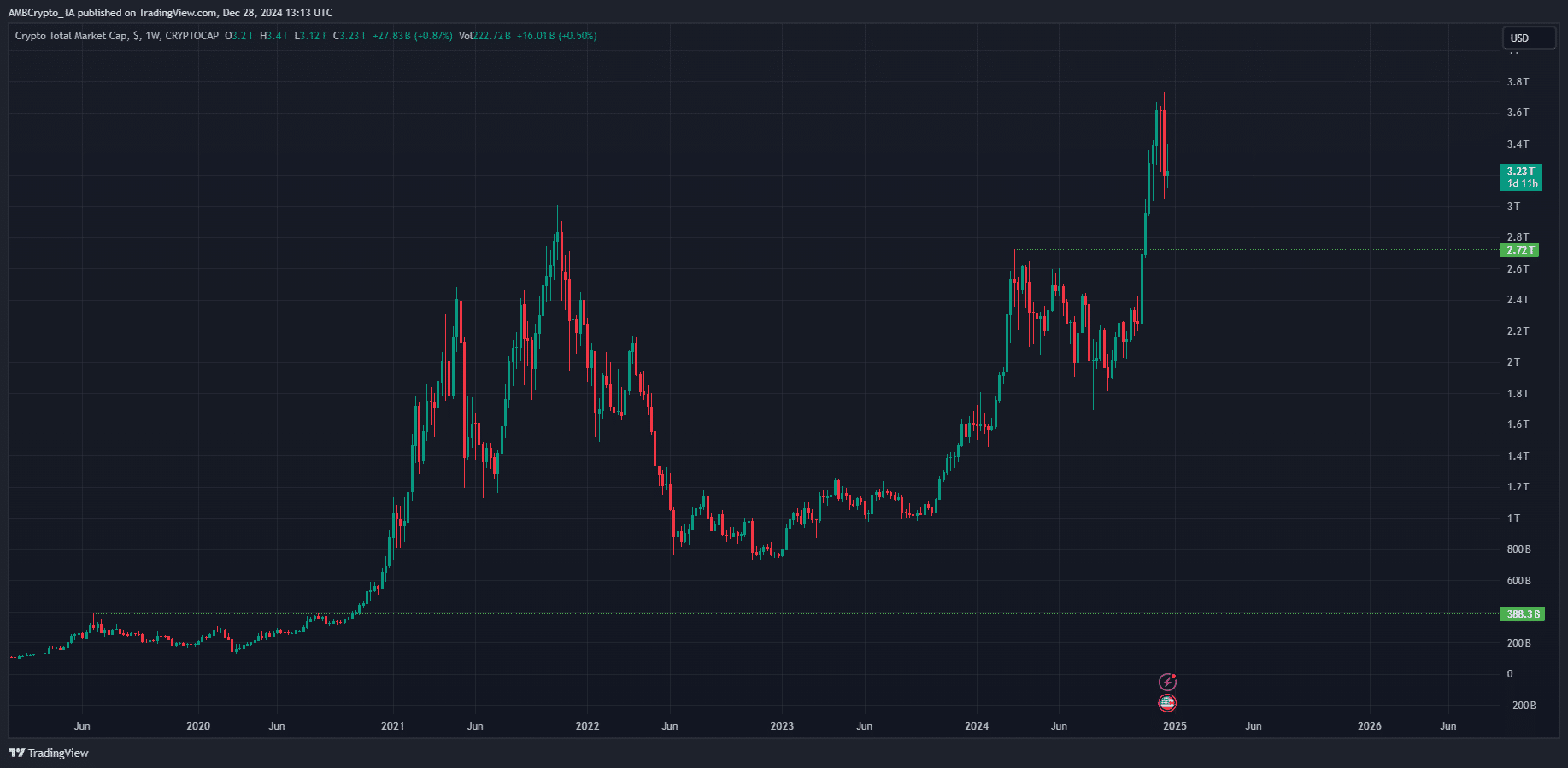

By early November 2020, the combined value of all cryptocurrencies exceeded its previous peak at approximately $388 billion. In the subsequent year, this figure skyrocketed by an impressive 685%, reaching a record high of around $3.01 trillion. Jumping forward to 2024, a fresh all-time high was set.

Should another 500% to 600% increase occur, the overall crypto market capitalization could soar to between $16.8 trillion and $19.5 trillion. Given Bitcoin‘s approximate 50% share of the market, this would place its own market cap at around $8 trillion.

Is your portfolio green? Check the Bitcoin Profit Calculator

The predicted price for Bitcoin is $400,000. Whether this high target is achieved or not, the overall conclusion remains unchanged.

Currently, there’s an ongoing surge in prices, similar to a bull charging forward. Meanwhile, the market is engaging in a game of anticipation, setting fresh price milestones for investors to target.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2024-12-28 18:15