- Bitcoin was stable above $60K, but struggled to break the $70K resistance level.

- An analyst highlighted unrealized profits and whale activity as indicators of a potential buying opportunity.

As a seasoned researcher who has closely followed the cryptocurrency market for years, I find myself constantly intrigued by Bitcoin’s [BTC] ongoing journey. While it’s been holding above the $60K mark, its struggle to break through the $70K resistance is a familiar dance we’ve seen many times before.

As a researcher, I’m observing that Bitcoin (BTC) maintains its strength, consistently hovering above the $60,000 level. However, it hasn’t managed to push through the barrier at $70,000, which remains a formidable resistance so far.

As a crypto investor, I’ve seen the digital currency surge to an impressive $64,000, but it seems we’ve faced a small setback. Over the past day, there’s been a correction, with the price dipping to $62,340, marking a 1.8% decrease in value.

Regardless of its fluctuating cost, numerous experts maintain a positive outlook on Bitcoin’s present status, emphasizing possible purchase chances during this period of consolidation.

Bitcoin: Buying opportunity ahead?

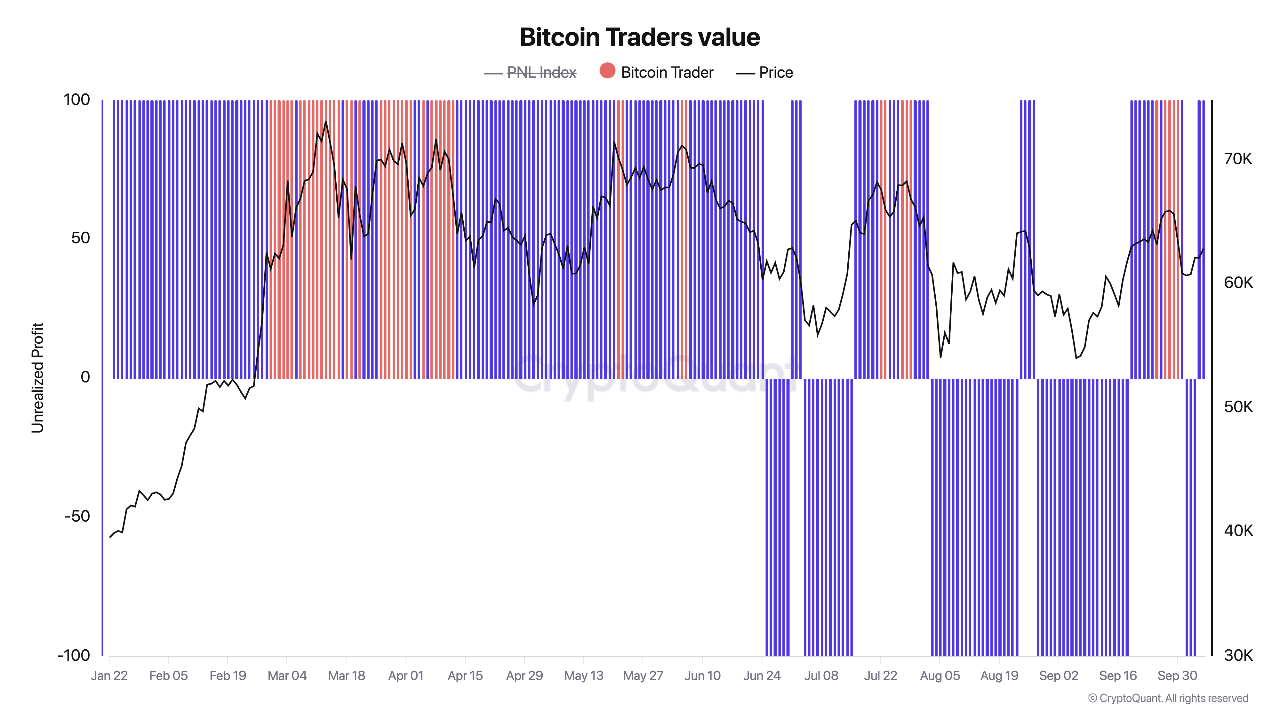

According to the analysis by CryptoQuant’s expert ‘Darkfost’, he sheds light on the present standing of Bitcoin in the market, focusing particularly on the Non-Realized Profit indicator.

In simpler terms, the expert pointed out that large amounts of profits not yet realized could indicate a possible surge in sell-offs. This is because traders might feel inclined to cash out their substantial earnings.

In other words, when traders find themselves in a situation where they haven’t realized any profits (yet), because they’re currently holding positions at prices lower than when they first entered the market, this could be a signal that the market might be reaching its lowest point. This situation could present an excellent chance for buying, as prices may start to rise again.

Darkfost noted that the present low Non-Realized Profit area for Bitcoin suggests numerous traders currently hold positions without much or any profit, hinting at the possibility of a potential market bottom emerging.

The analyst noted,

At the moment, we’re spending a lot of time in a situation that might be considered unfavorable, but it could actually present hidden chances or possibilities.

Moreover, it was emphasized by Darkfost that the current market has seen an exceptionally high amount of unrealized profits, a phenomenon not typically observed in prior market cycles. This indicates that the current cycle may present distinct risks and possibilities for investors, unlike any they’ve encountered before.

Backing up the data

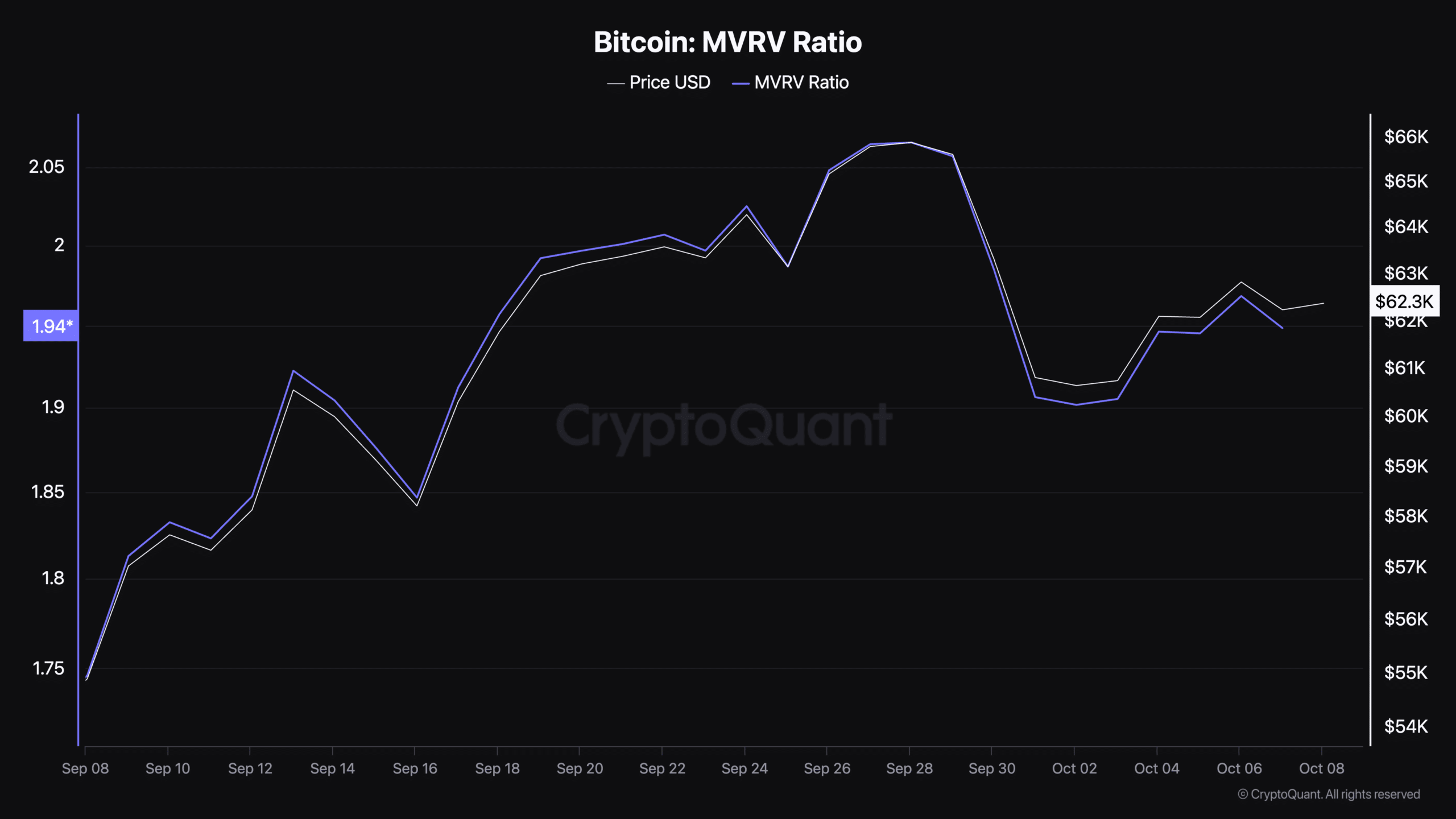

It might be beneficial to examine additional factors that could influence Bitcoin’s position in the market, like the Market Value to Realized Value (MVRV) ratio.

In simpler terms, the MVRV ratio measures how much more or less the current worth of Bitcoin is compared to the cost at which all its coins were previously sold.

If the given ratio is large, it may signal overpricing and possible market adjustments or corrections. On the other hand, a smaller ratio could hint at underpricing, signaling potential buying chances.

Currently, the Market Value Realized to Value (MVRV) ratio for Bitcoin has risen from 1.74 at the start of this month to 1.94 now. This suggests that the market is moving towards a more even state, yet there’s still potential for further increase.

An increasing MVRM ratio implies that Bitcoin’s worth is appreciating more than its previous value trends, potentially indicating a favorable outlook within the cryptocurrency market.

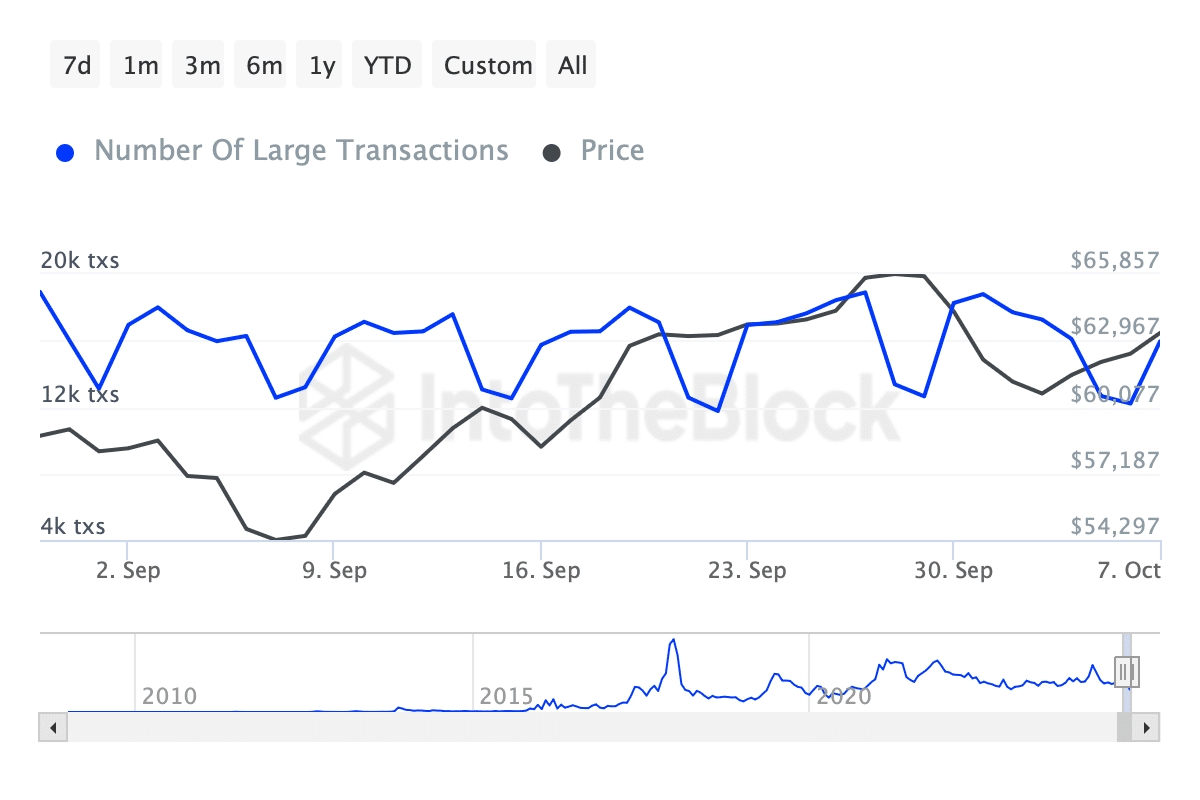

Keeping an eye on both price fluctuations and profit-related indicators gives us useful information, but it’s also important to observe the behavior of large Bitcoin holders, known as “whales,” as their actions can significantly impact the market.

According to data from IntoTheBlock, there has been a substantial increase in large transactions (over $100,000) recently.

The quantity of these substantial transactions has risen significantly, going from less than 13,000 to over 15,000. This suggests a rising curiosity among institutional investors and wealthy individuals.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

A rise in whale Bitcoin transactions often implies that major investors are amassing Bitcoin, a move that might bolster its price and underscore their faith in Bitcoin’s potential for continued growth.

Whale activities in the market are frequently associated with major shifts, since their transactions have a substantial impact on the balance between supply and demand.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-10-09 04:08