- Jack Mallers asserted Bitcoin is the ultimate hedge against economic uncertainty.

- Despite volatility, significant investor interest in Bitcoin persisted.

As a researcher with a background in economics and finance, I have closely observed the recent surge of interest in Bitcoin from institutional investors and Wall Street. Jack Mallers, CEO of Strike, has been vocal about his belief that Bitcoin is the ultimate hedge against economic uncertainty and currency debasement. Despite its volatility, the significant buying activity among certain investors suggests continued confidence in its long-term potential.

Since the approval of the Bitcoin [BTC] spot Exchange-Traded Fund (ETF), the foremost cryptocurrency has continued to garner significant attention.

With an increasing number of institutional investors joining the cryptocurrency market, there’s growing curiosity as to what’s fueling Wall Street’s newfound optimism towards crypto.

Jack Mallers’s insight on the current macroeconomy

During his discussion with Anthony Pompliano, Jack Mallers, the CEO of Strike, hinted at a possible reason for the recent surge in cryptocurrency popularity: the underlying issues in our current geopolitical landscape.

He continued by expressing two potential possibilities. The first was letting the banking system collapse. The second, which Mallers favored, was devaluing the currency.

“I think Bitcoin is the best thing you can own.”

In this context, Maller sees Bitcoin as a protective measure against the potential devaluation of currencies and broader economic instability.

Additionally, during interviews, Mallers explained that there are reasons causing investors to shift their funds away from the US dollar and towards investments such as stocks, real estate, Bitcoin, and gold. This includes holdings in the stock market, real estate markets, cryptocurrencies like Bitcoin, and precious metals like gold.

In simpler terms, if you believe the most effective representation of the devaluation of fiat currency is what you’re describing, then consider expressing it using the context of Bitcoin. Bitcoin stands in stark contrast to fiat money; it operates independently of central banks and governments, its monetary policy is predetermined, its supply is limited, and it embodies all the qualities that fiat currency lacks. Therefore, if your concern is fiat devaluation, then using Bitcoin as an analogy may best convey your message.

Diverging opinions on Bitcoin

Despite Bitcoin’s price fluctuations, there is ongoing debate among people about whether to purchase or dispose of Bitcoin.

In a recent X (previously Twitter) update from well-known crypto analyst Ali Martinez, he noted that particular investors have displayed noticeable purchasing behavior over the past few days.

As an analyst, I can express this by saying: I observed a persistent belief in Bitcoin’s long-term worth and a buoyant outlook on its future price based on the available data.

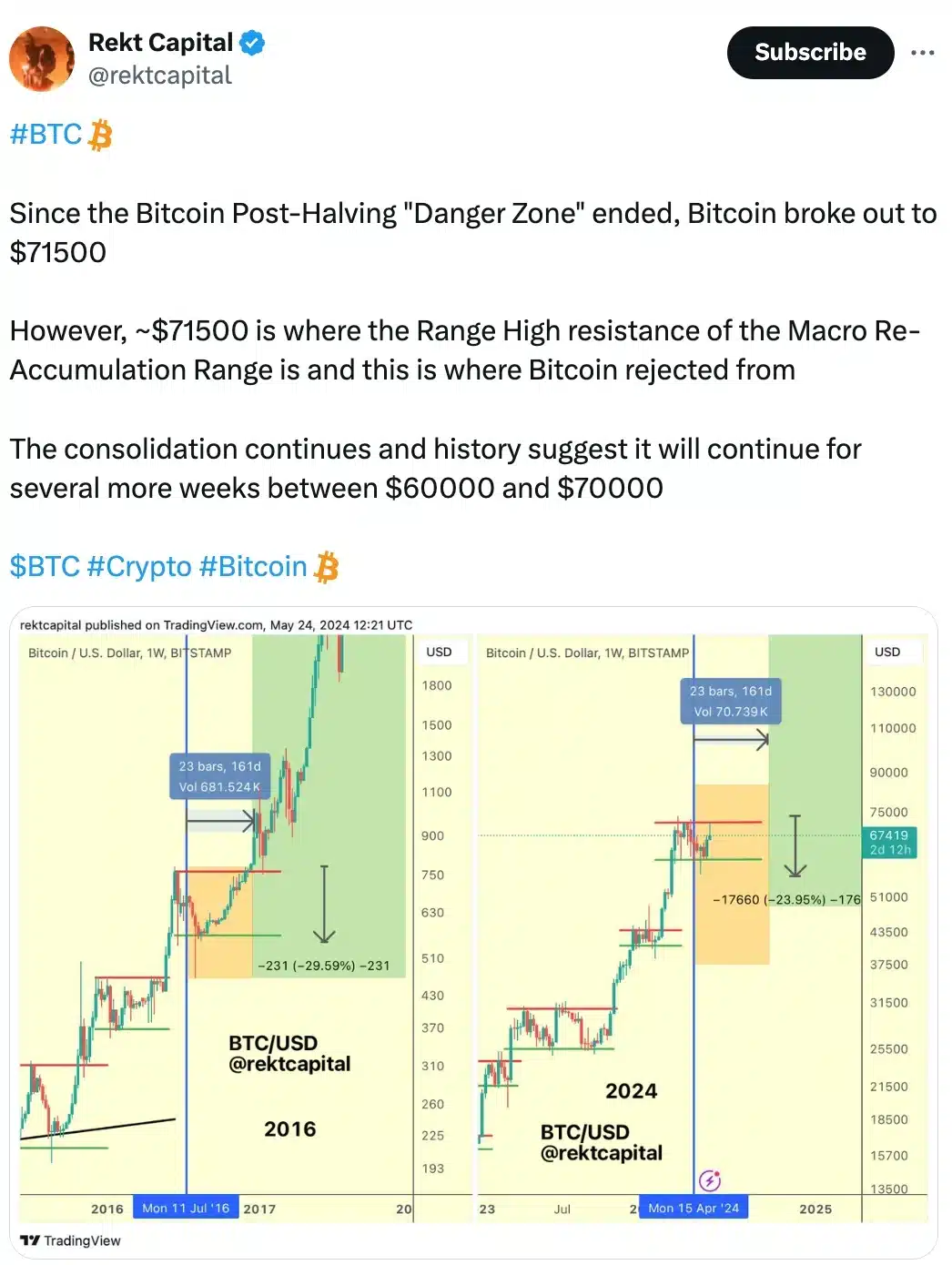

Contrary to some optimistic outlooks, Rekt Capital, a pseudonymous trader, cautions that Bitcoin could see a possible drop of around 13% despite the danger zone appearing to have passed.

Bitcoin vs. shitcoins

As a dedicated crypto investor, I firmly believe in Bitcoin’s superiority amidst the market turbulence and uncertainties. I strongly advocate for a maximalist approach, emphasizing Bitcoin’s inherent value as the ultimate form of digital currency.

As a researcher studying the Ethereum [ETH] blockchain, I closely examine its adherence to foundational monetary principles. I believe that some of its decisions may be influenced by the founder or driven by external pressures leading to protocol modifications.

He said,

As a crypto investor, I’ve noticed that there’s something troubling about how Ethereum is frequently associated with Bitcoin, despite being founded with distinct goals. While Ethereum was intended to surpass Bitcoin, it seems to ride on Bitcoin’s coattails and often gets conflated with Bitcoin’s narrative. This can make it difficult for the unique value proposition of Ethereum to shine through.

He ended the conversation giving his opinion on meme coins –

“I mean to be honest like I don’t really give a s**t about s**tcoins to be totally candid.”

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-05-26 10:15