- Over one million users bought BTC at $94K, making it a strong support for an upside move.

- But a sharp BTC pullback can’t be overruled, as key metrics flashed red flags.

As a seasoned researcher with years of experience in the cryptocurrency market, I have seen my fair share of bull runs and bear markets. The current state of Bitcoin at $98K ahead of key US inflation data is intriguing, to say the least.

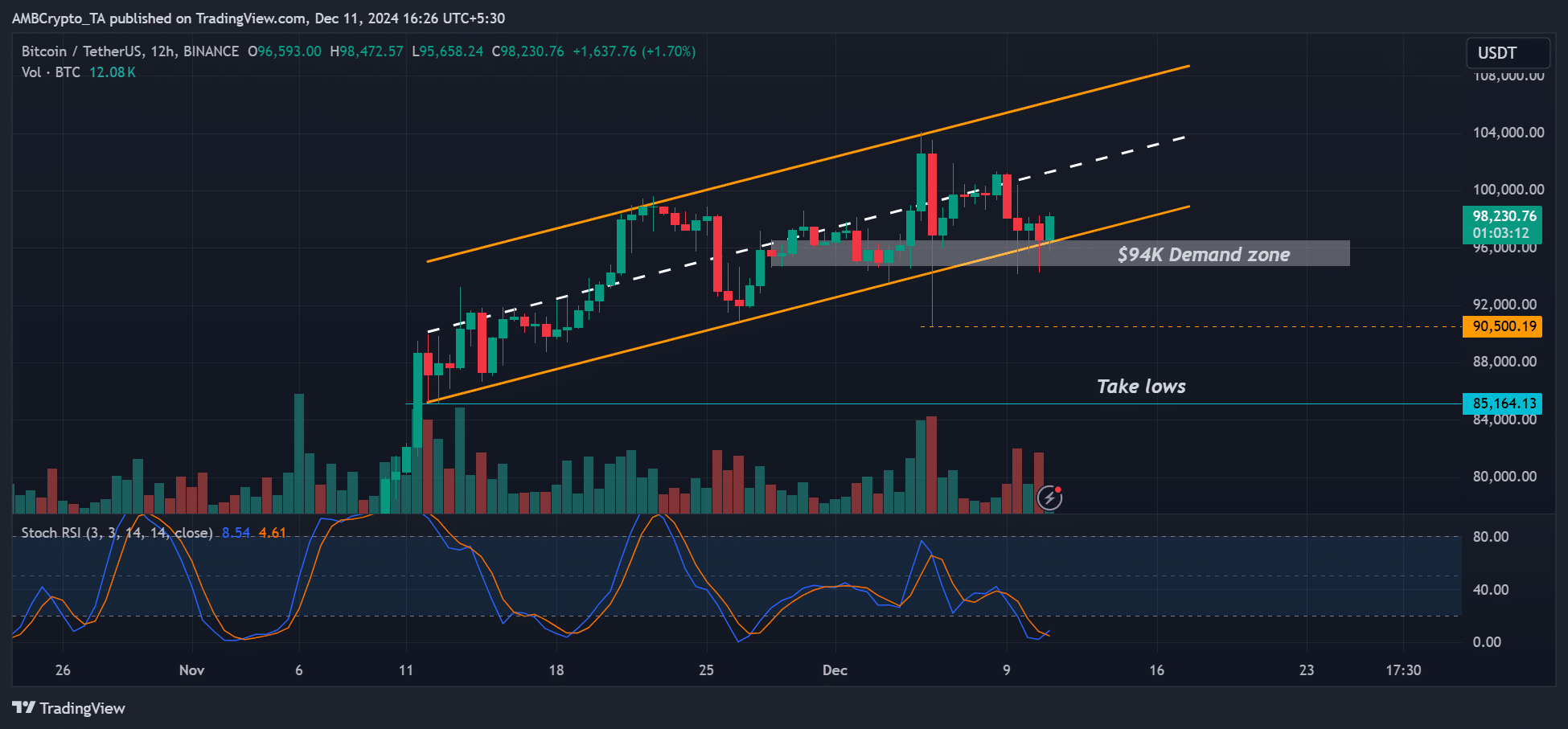

Regardless of the recent drops in value, Bitcoin [BTC] has established $94K as a crucial level of support. Its worth even climbed to $98K prior to the release of significant US inflation data (Consumer Price Index).

This week’s major economic indicators, including inflation and employment rates, could lead to significant fluctuations in prices because they will influence the Federal Reserve’s decision on interest rate reductions starting from December 18th. As of now, the market anticipates a quarter-point reduction in interest rates.

Another BTC crash?

It’s worth noting that Bitcoin has continued to maintain its short-term channel, with the level at $94K coinciding with the lower bounds of the current range. The question remains: will it stay within this channel or break out following the release of the CPI data?

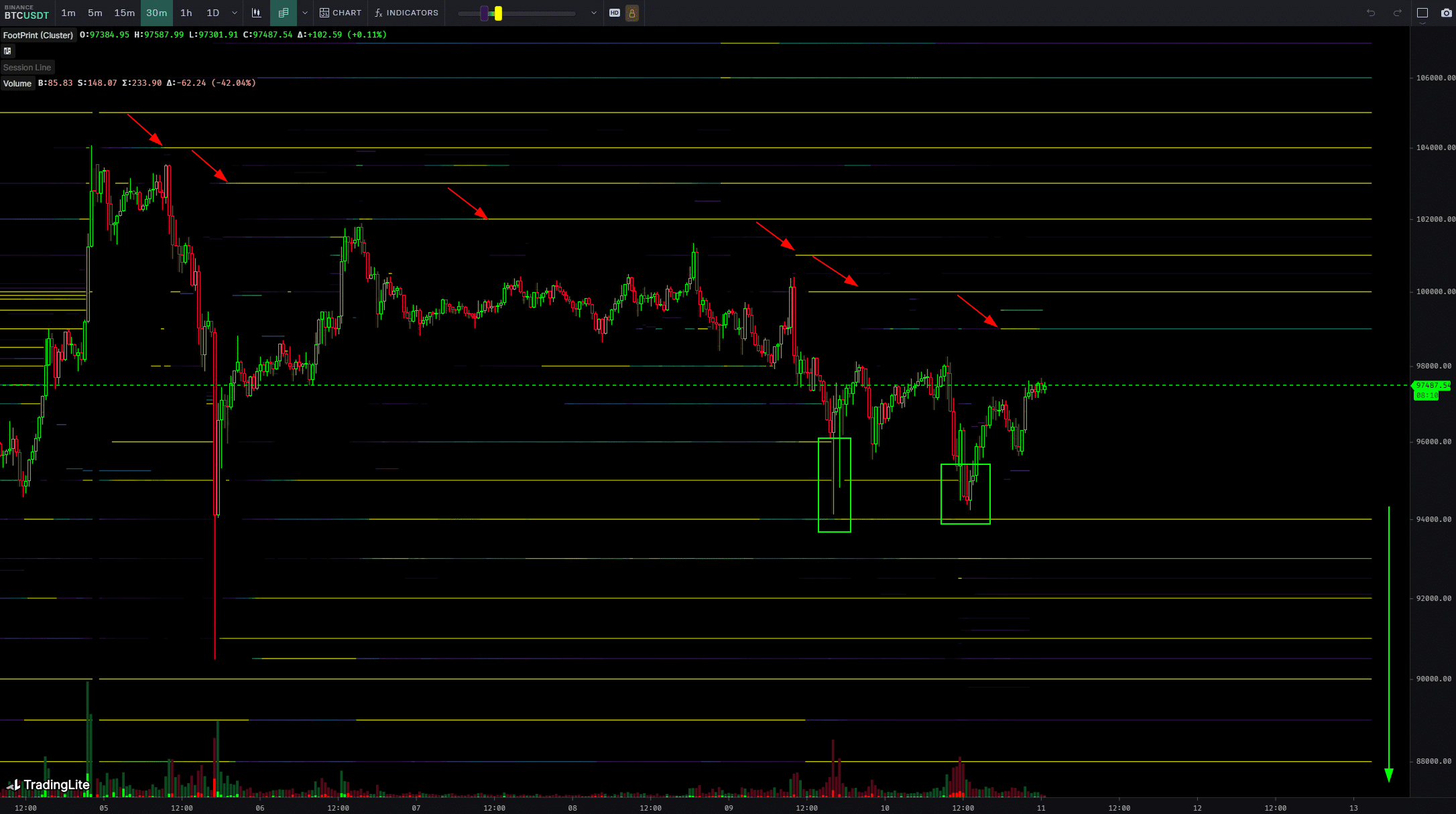

As a crypto investor, I’ve noticed from the insights shared by BTC trader Skew that there was robust demand between the price ranges of $90K and $95K. This indicates to me that Bitcoin might have found a stable footing at these levels, with $97K potentially serving as an equilibrium point. In simpler terms, it appears that Bitcoin has been finding its balance around these prices, and $97K could be the sweet spot for now.

It seems that the market has reached a balance at this point, with continued accumulation of buy orders around the price range of $95,000 to $90,000. Furthermore, there’s been some passive buying activity observed within this price bracket.

According to blockchain analysis company, IntoTheBlock, there are robust buying interests apparent at prices surpassing $90K. They mentioned this observation due to the notable demand in the market.

In the crucial price range of $94,800 to $97,700, approximately 1.3 million Bitcoin addresses have amassed their holdings. This area could serve as a strong foundation for possible future price support.

In other words, the $94,000 level served as an important barrier or resting point, potentially leading to a future increase towards the $105,000 goal.

Consequently, this suggests that falling below $94,000 might leave more than a million wallets with negative equity. If these holders aren’t “diamond hands” (a term for those who hold onto their cryptocurrency despite market fluctuations), they may choose to sell in panic, potentially pushing Bitcoin’s price even lower.

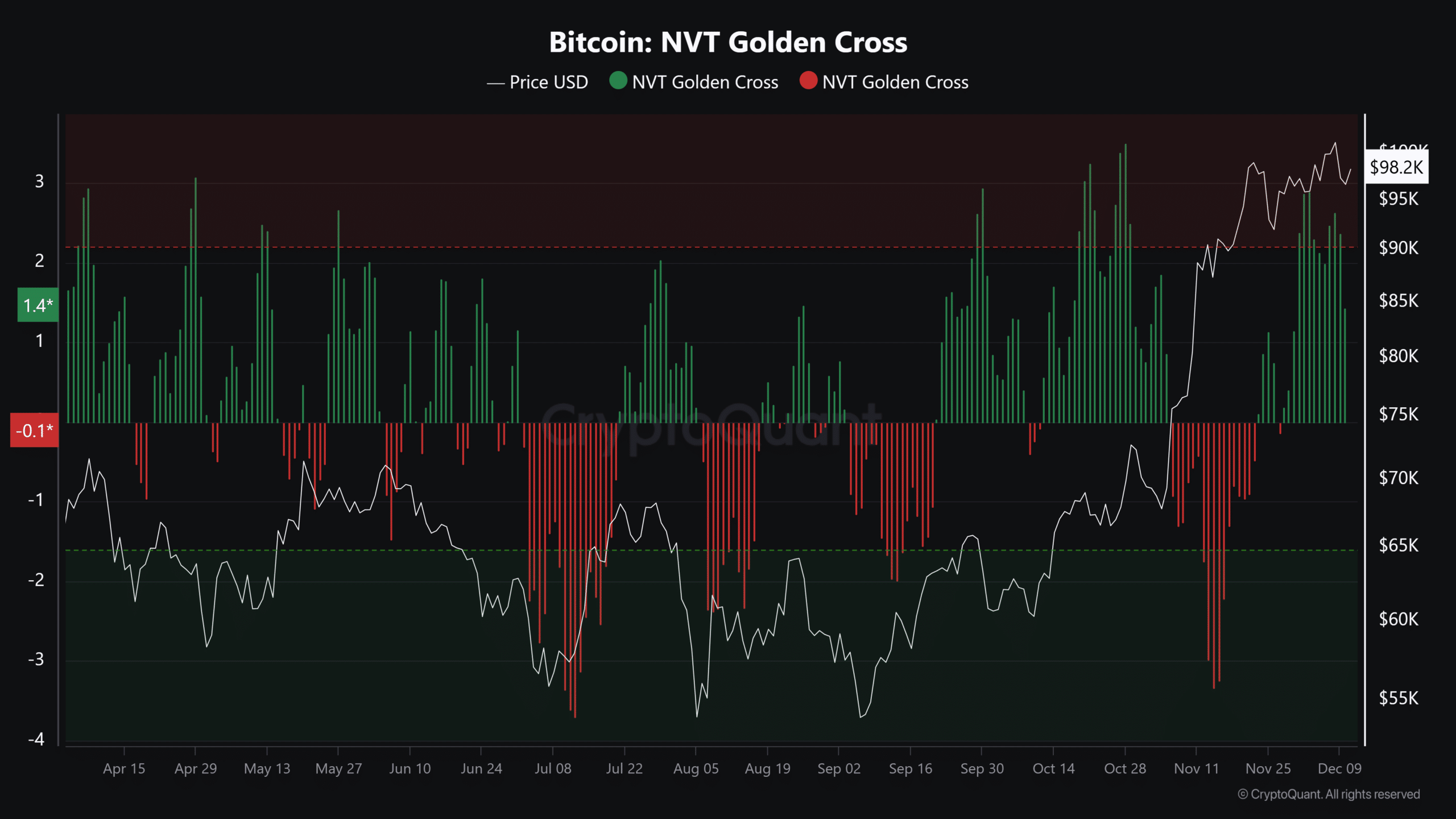

The sticky NVT Golden Cross metric supported this potential bearish scenario.

In simple terms, the marker we’ve been using signaled the high points and low points of the local Bitcoin market. Back in late November, it indicated an approaching peak for Bitcoin (signified by green bars). Even after this week’s market turbulence, it has continued to signal that the local top remains intact.

According to the NVT Golden Cross, it seems that although Bitcoin has experienced some recent setbacks, it may still not have fully recovered, at least for now.

Read Bitcoin [BTC] Price Prediction 2024-2025

Additionally, the Multi-VDG Ratio Value (MVRV) is currently trending towards overbought territories, suggesting a potential correction may occur. However, this doesn’t necessarily mean that Bitcoin won’t reach $100K or more, but it does indicate that a sudden drop in value shouldn’t be discounted.

Read More

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-12-11 23:03