-

Hayes put a buy call for BTC in anticipation of US dollar liquidity as Japanese banking crisis worsens.

However, another analyst suggests that BTC headwinds will only end if the miner crisis ends.

As a seasoned crypto investor with a keen eye on market trends and geopolitical events, I’m excited about the potential impact of Japan’s banking crisis on Bitcoin (BTC) and the broader crypto market. Arthur Hayes, the founder of BitMEX, has put a buy call for BTC in anticipation of US dollar liquidity injection due to the worsening Japanese banking crisis.

The financial crisis in Japan’s banking sector is said to be teetering on the edge of a major explosion, potentially leading to an influx of American dollars and stimulating both Bitcoin (BTC) and the broader cryptocurrency market.

In his latest blog entry published on the 20th of June, BitMEX founder Arthur Hayes considered the Japanese banking crisis as a significant factor that could shape the crypto sector.

‘This is just another pillar of the crypto bull market.’

Based on information from Hayes, the fifth largest Japanese bank, Norinchukin, has announced its intention to dispose of approximately $63 billion worth of its US and European bonds due to current financial pressures.

The founder of BitMEX indicated that the United States might have no choice but to step in and address the crisis, potentially leading to a covert infusion of liquidity into the dollar market.

How will Bitcoin benefit?

Per Hayes, the Norinchukin’s US Treasury (UST) sell-off could tip other mega banks to follow suit.

As a crypto investor, I’m concerned about the recent decision by Nochu (Norinchukin), one of Japan’s megabanks, to sell off its UST (Uniswap Token) holdings. Given that other Japanese megabanks are expected to follow suit, this could translate into a significant market impact. Specifically, approximately $450 billion worth of UST tokens may flood the market rather abruptly. This potential influx could influence the price and liquidity dynamics of UST, making it essential for investors to closely monitor these developments.

According to Hayes, the US could prevent the described situation due to the significant increase in yields that would result, leading to substantial expenses for the federal government.

The US could persuade the Bank of Japan (BoJ) to employ a repurchase facility program to purchase U.S. Treasury securities, thereby taking up excess supply. In exchange, the BoJ would receive newly printed American dollars from the US, leading to an increase in the availability of U.S. dollars in the financial markets.

As a researcher studying the behavior of cryptocurrencies in financial markets, I’ve come across an interesting observation. In Q4 2023, there was a notable situation that reminded me of a previous experience. The market responded dramatically to this event, with all risk assets – including crypto – experiencing significant gains. This surge came on the heels of the US banking crisis in March 2023. Once the bailout announcement was made, Bitcoin’s price surged by approximately 200%.

For the founder of BitMEX, the US election in November served as another potential catalyst, possibly leading the US government to take action in resolving the Japanese banking crisis.

During an election year, it’s unfavorable for the Democratic party in power to experience a significant increase in U.S. Treasury yields since these developments can impact matters of great financial concern to the average voter.

Due to the Japanese crisis, the United States was expected to provide the next round of monetary stimulus. This situation benefited cryptocurrency investors, as Hayes urged them to seize the opportunity and purchase during market dips.

BTC dilemma

As an analyst, I would rephrase that sentence as follows: Although the macro buying signal for Bitcoin emerged due to Japan’s economic issues, the ongoing Bitcoin miner crisis had not yet been resolved to fully validate this buy call.

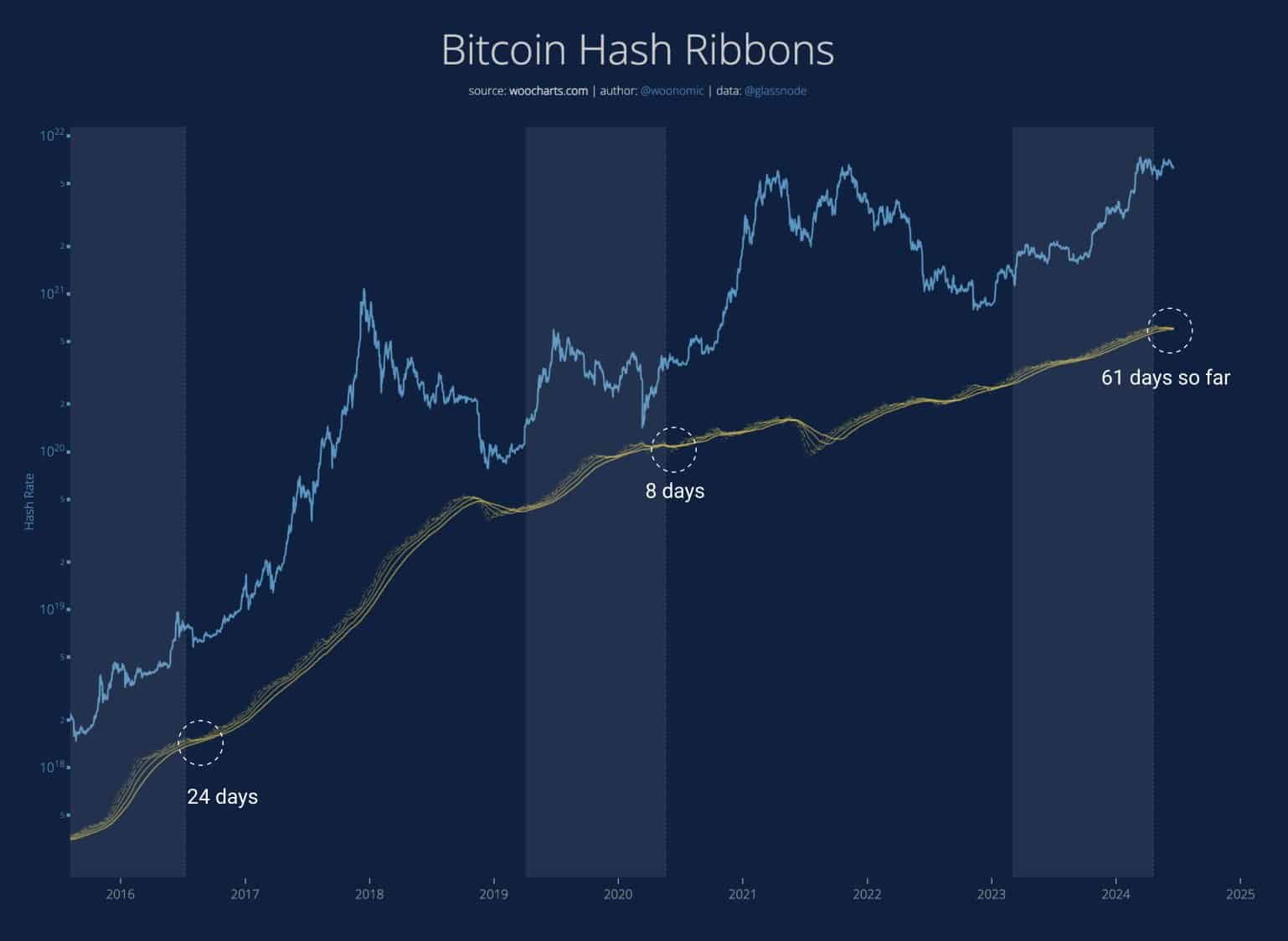

Based on the insights of Willy Woo, a well-known Bitcoin analyst, the miner predicament for Bitcoin appears to be prolonging, yet Bitcoin is predicted to thrive in the long run.

‘When does #Bitcoin recover? It’s when weak miners die and hash rate recovers.’

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-06-21 14:15