-

Metaplanet boosts BTC holdings amid price recovery, reinforcing its “Asia’s MicroStrategy” reputation.

Post-announcement surge lifts Metaplanet’s stock by 25.81%, marking a bold Bitcoin investment strategy.

As a seasoned researcher with extensive experience in tracking investment trends across various industries, I find Metaplanet’s recent move to boost its Bitcoin holdings particularly intriguing. Having closely followed the company’s actions for quite some time, I have come to appreciate Metaplanet’s reputation as “Asia’s MicroStrategy.”

Metaplanet, a well-known Japanese investment and consulting company that is publicly traded, has noticeably increased its ownership of Bitcoin (BTC).

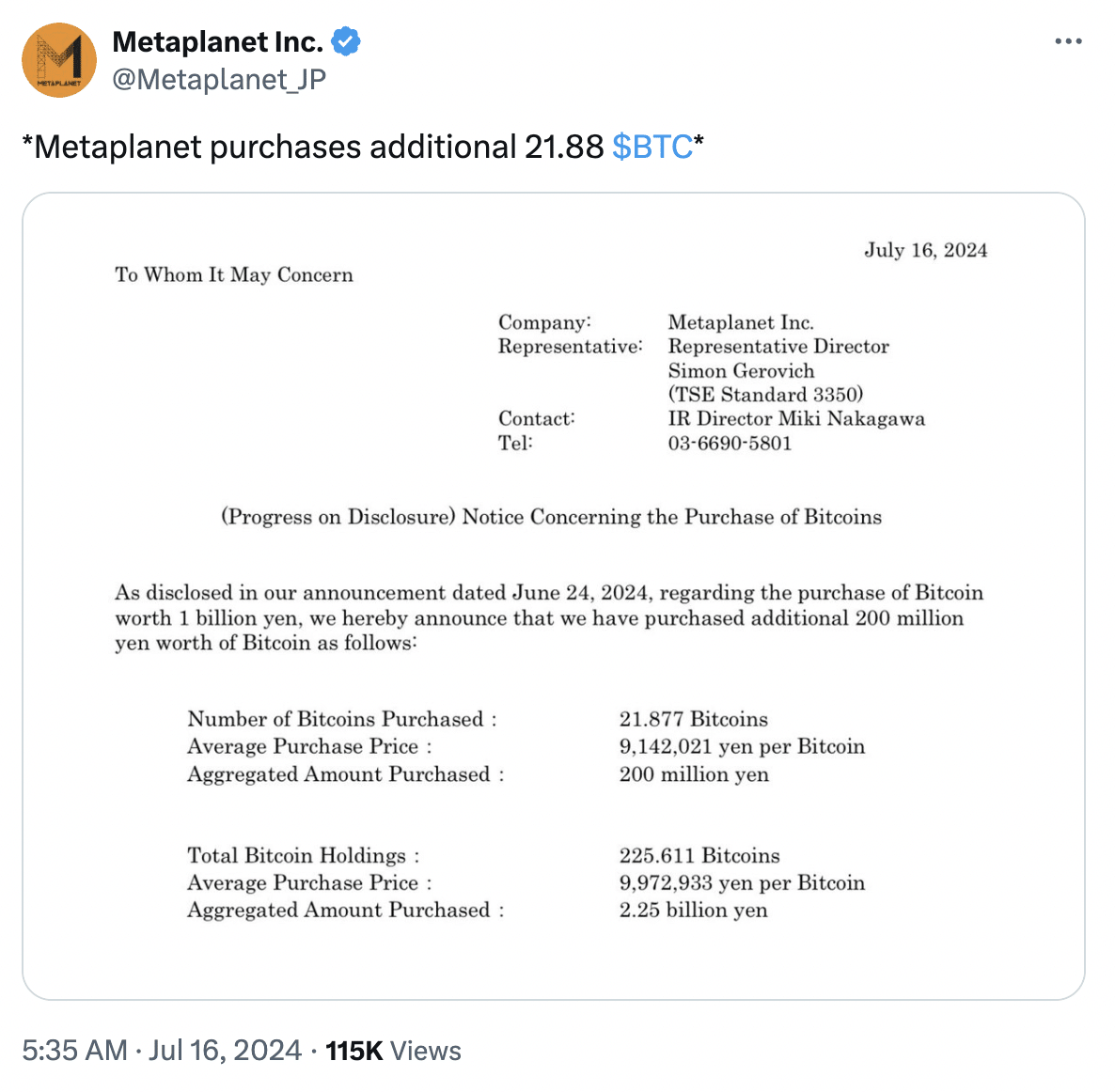

Metaplanet’s BTC holdings

As a crypto investor, I’ve recently observed that the company has purchased an extra 21.88 Bitcoins, which is equivalent to more than one million two hundred thousand dollars or around two hundred million Japanese yen based on current market rates.

The price jump of Bitcoin to approximately $65,000 coincides with a significant 4.5% rise, coming after several weeks of downward trend.

As I analyze the Bitcoin market at this moment, the daily chart indicates a bullish trend with a 1.94% price rise over the last 24 hours.

Metaplanet takes cues from MicroStrategy

It’s intriguing how Metaplanet has earned the nickname “Asia’s MicroStrategy” given its propensity to mimic MicroStrategy’s investment approaches.

Metaplanet is following a strategy akin to MicroStrategy’s by funding its Bitcoin acquisitions via bond offerings. This move underscores the increasing acceptance of Bitcoin among institutions.

On July 16th, Metaplanet increased its Bitcoin reserves to more than 225 coins, which corresponds to approximately $14.55 million according to present-day valuations.

As a crypto investor, I’ve noticed an exciting development with Metaplanet. They recently disclosed plans to increase their Bitcoin holdings, leading to a significant boost in the company’s share price. In just a short time, the stock price jumped by an impressive 25.81% and reached a new high of 117 JPY.

The remarkable increase in investor confidence, as evidenced by this surge, stems from their faith in the company’s forward-thinking approach to Bitcoin. This belief has significantly propelled the firm’s stock price, resulting in a breathtaking 631% rise since the new year commenced.

What’s more to it?

The most recent figures show that Metaplanet’s market value amounts to approximately 17.5 billion Japanese yen, while the value of their Bitcoin holdings is around 2.25 billion Japanese yen according to their latest financial report.

With Bitcoin’s share in Metaplanet’s overall assets persistently increasing, there’s growing debate among analysts that it may soon exceed the 100% mark. This strong commitment to cryptocurrency underlines Metaplanet’s daring approach to integrating it deeply into their investment portfolio.

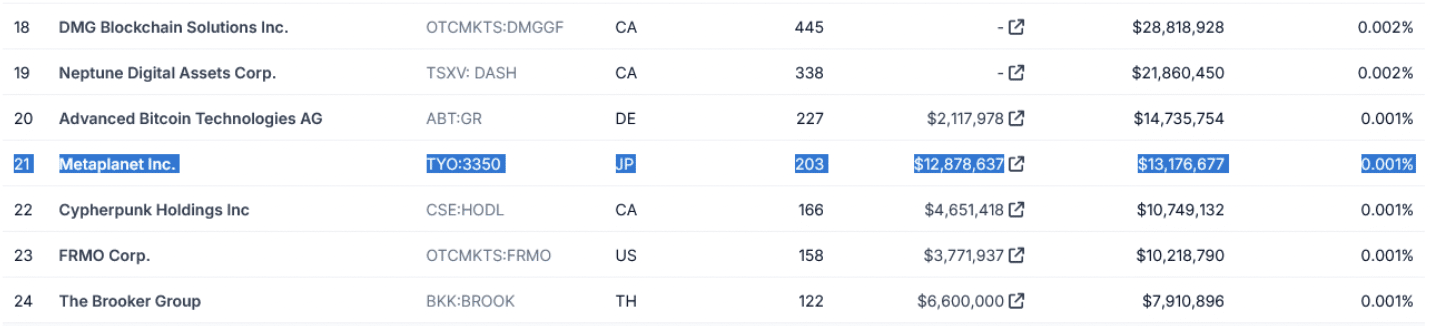

The data from CoinGecko added credence to the fact that Metaplanet is the 21st largest corporation globally in terms of Bitcoin holdings.

Metaplanet takes a forward-thinking approach by taking steps to protect against Japan’s growing debt problem and the weakening Japanese yen through hedging.

The Japanese yen has dropped by approximately 54% in value against the U.S. dollar since the beginning of 2021. In contrast, Bitcoin has shown remarkable strength, increasing by more than 145% when measured against the yen over the past year.

To put it simply, Metaplanet’s approach is in line with the increasing practice among institutions to incorporate Bitcoin into their portfolios as a means of risk management and investment diversification alongside conventional assets.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Elden Ring Nightreign Recluse guide and abilities explained

2024-07-17 07:04