- Bitcoin traders might not want to sell right now, as an uptrend seems imminent.

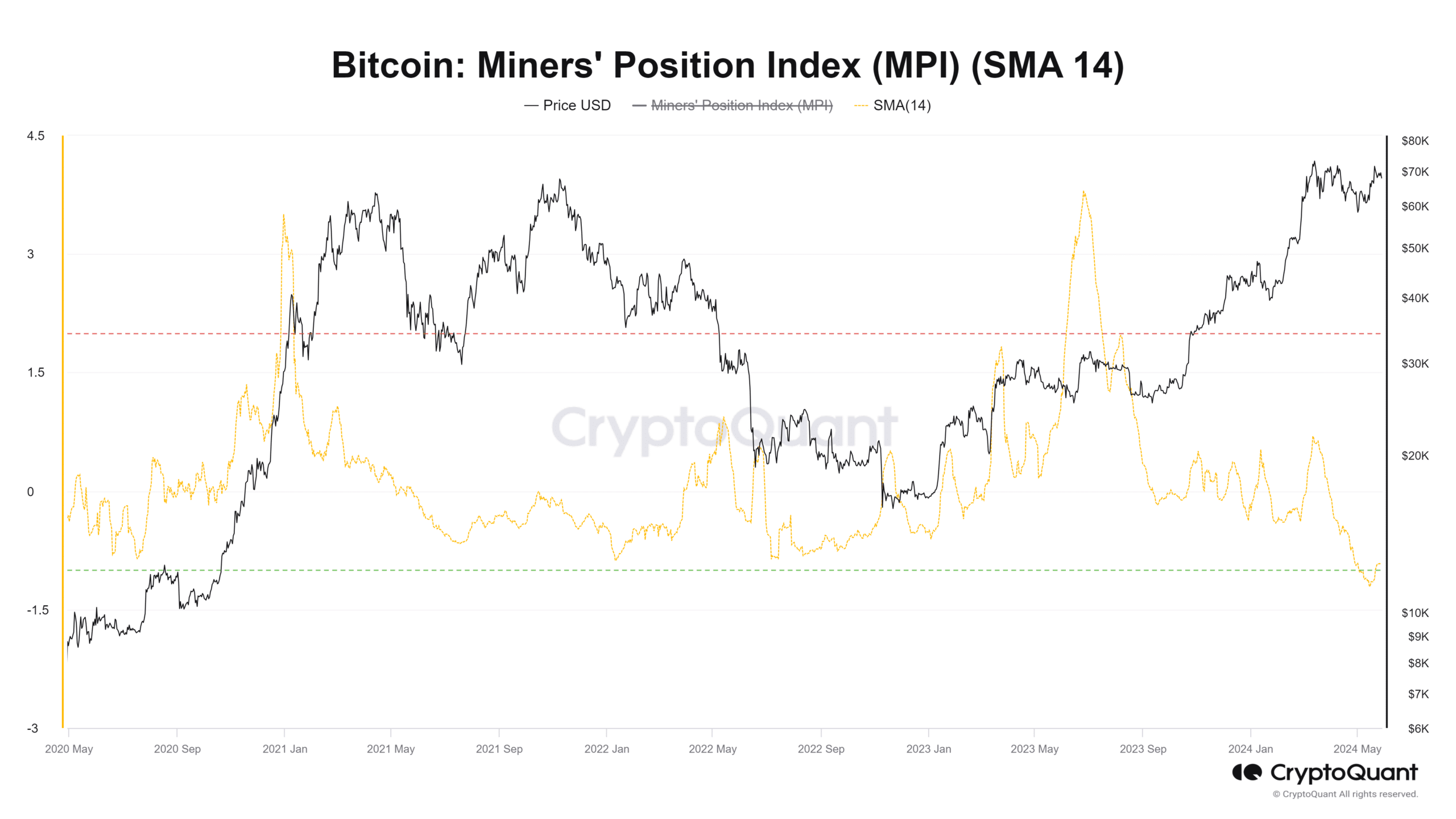

- Miners, generally considered market-savvy participants, were unwilling to sell their holdings.

As a long-term crypto investor with some experience in the market, I find the current Bitcoin situation quite intriguing. The recent range formation and rejection from the $70k resistance are not new developments, but the context is different this time around.

Last week, Bitcoin [BTC] broke through the resistance at $67,000 with a narrower price range in its wake.

The price ranged between $70,500 and $66,800, with May 27th marking the rejection of Bitcoin at the higher end of this short-term price range.

At the last occasion when Bitcoin approached the $70k mark, conditions were contrasting. The bulls now hold a stronger position to carry on the uptrend.

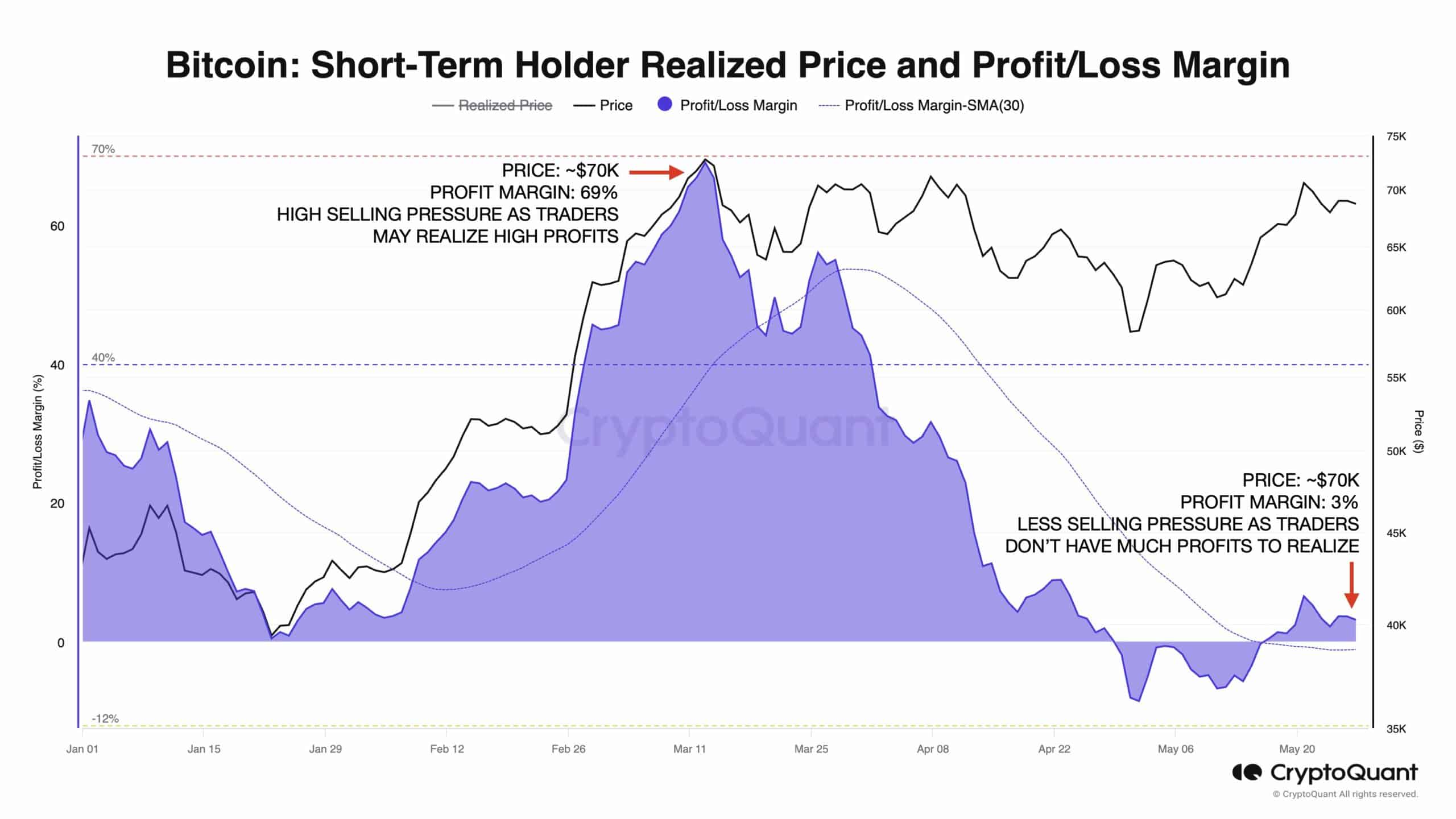

Selling pressure from profit-taking activity will be far less

According to Julio Moreno, crypto expert and research leader at CryptoQuant, the present market profits stand at a 3% level, while they peaked as high as 69% during the impressive price surge in mid-March.

As an analyst, I would interpret this as follows: Over the past ten weeks, the market has effectively absorbed the selling pressure instigated by profit-takers during the consolidation period.

The event may have eliminated substantial long and short positions in the futures market through heavy liquidation, leading to a more authentic and price-based upward trend.

The market is showing robust signs of growth, benefiting significantly from investors with long-term perspectives. Sellers have run out of steam, while buyers have taken advantage of this lull to regroup and prepare for another surge in prices.

Miner’s position shows a bullish sign too

The miner’s outflow ratio is the proportion of recent miner outflows compared to the average miner outflows over the past year.

A decrease in this measure is a positive indication, implying that miners are becoming less eager and less active in offloading their holdings.

In simpler terms, the 14-day moving average touched its lowest point in over four years. This signaled miner reluctance to sell, and a rising trend for this indicator might indicate an upcoming market peak for traders.

Read More

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Lisa Rinna’s RHOBH Return: What She Really Said About Coming Back

- Jelly Roll’s 120-Lb. Weight Loss Leads to Unexpected Body Changes

- OM PREDICTION. OM cryptocurrency

- 1923 Sets Up MASSIVE Yellowstone Crossover

- Despite Strong Criticism, Days Gone PS5 Is Climbing Up the PS Store Pre-Order Charts

- Moo Deng’s Adorable Encounter with White Lotus Stars Will Melt Your Heart!

- Netflix’s Dungeons & Dragons Series: A Journey into the Forgotten Realms!

- Leslie Bibb Reveals Shocking Truth About Sam Rockwell’s White Lotus Role!

2024-05-29 10:15