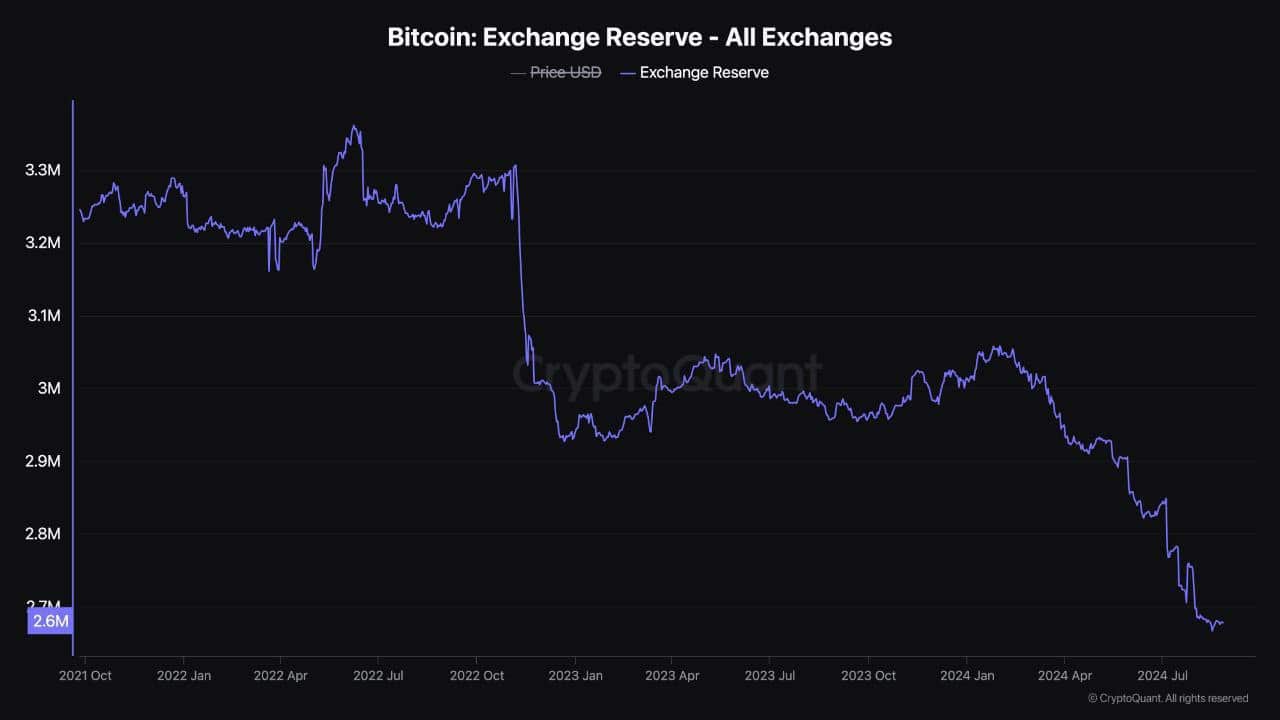

- Significant amount of Bitcoin had moved out of exchanges.

- Bitcoin showed strength as the market anticipated a bullish end to the year.

As a seasoned analyst with over a decade of experience in the ever-evolving world of cryptocurrencies, I can confidently say that Bitcoin’s recent behavior is reminiscent of a well-trained acrobat preparing for a grand finale. The movement of BTC off exchanges and into cold wallets is akin to an artist stowing away their most precious paintbrush, ready to unveil a masterpiece.

Bitcoin (BTC) demonstrates strength, hinting at a possibly optimistic last quarter of 2021 for the cryptocurrency market.

At the moment of reporting, Bitcoin was being bought and sold for approximately $64,000. This comes after it reached $66,000 three days prior. The slight decrease in value hints at a temporary adjustment, however, data from blockchain indicates that Bitcoin is being transferred from online exchanges to offline wallets.

Investors appear to be stockpiling Bitcoin, suggesting they expect a price surge, which could reflect growing faith in the cryptocurrency’s long-term value consistency.

Bitcoin flips bull support band on the weekly

The departure of Bitcoin from exchanges reinforces a positive perspective, as Bitcoin is currently being traded above its bull market support level.

Bitcoin has been hovering near a crucial point, yet it managed to end the week above its price range for the second week in a row.

If Bitcoin continues to gain speed, it might outpace its current support range, leading to a significant increase that could possibly surpass its all-time high records.

As a researcher studying cryptocurrency trends, I’ve noticed an interesting pattern historically – strong fourth quarters for Bitcoin often follow a bullish September. Remarkably, in the year 2024, we’re seeing Bitcoin already up by more than 8% in September, suggesting a potentially positive outlook for the rest of the year.

Based on predictions made by AMBCrypto earlier, we could witness a rise to unprecedented heights in November.

The show’s results support a positive perspective, indicating that Bitcoin may continue to climb in the upcoming weeks.

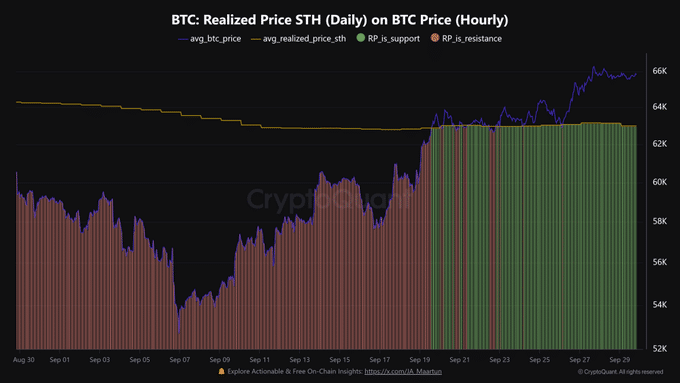

Short-term holders back in profit

The latest fluctuations in Bitcoin’s value have returned temporary investors to a profitable position. These investors, having transacted with Bitcoin within the last six months (155 days), are now experiencing profits since the price has surpassed $63K.

This price point is expected to act as a support level, potentially pushing BTC higher.

For short-term investors, the return to profitability supports the general movement of Bitcoin being withdrawn from exchanges, adding strength to the optimistic perspective about its future price increase.

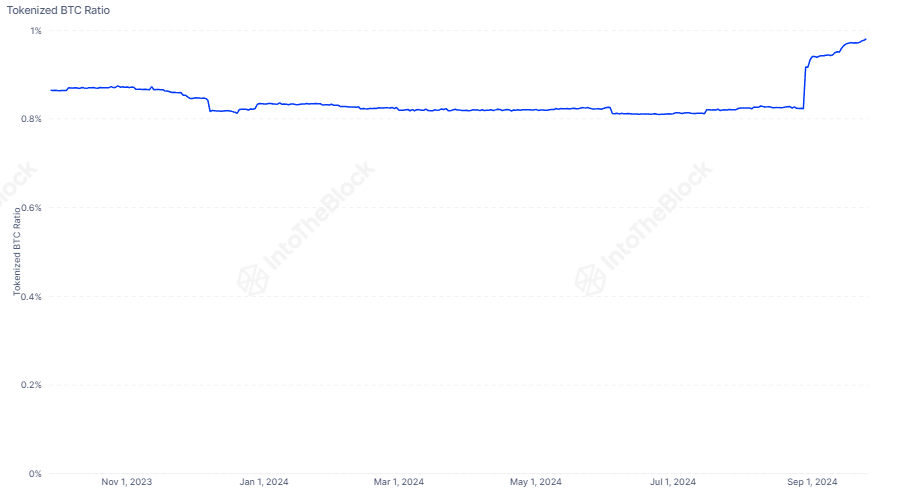

Bitcoin locked in DeFi

Another factor supporting Bitcoin’s bullish momentum is the growing demand for BTC in decentralized finance (DeFi). Currently, 1% of Bitcoin’s total supply is locked in DeFi protocols.

The rise in this trend can be attributed to the growing need for returns tied to Bitcoin and the recent introduction of Coinbase’s Bitcoin equivalent token called cbBTC.

With an increasing amount of Bitcoin being used within Decentralized Finance (DeFi), the availability of Bitcoin in traditional trading markets decreases due to locking. This reduction in supply might lead to a rise in Bitcoin’s value as demand remains high.

With less Bitcoin being available on trading platforms and a rising trend in using it for Decentralized Finance (DeFi), we might witness substantial price hikes for Bitcoin in the upcoming months.

These advancements strengthen our optimistic perspective, making us even more certain as we approach the last part of the year.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

As a researcher observing the crypto market, I’m noticing an intriguing trend with Bitcoin – its robustness, escalating hoarding by investors, and heightened interest from decentralized finance (DeFi) platforms all point towards a potentially optimistic future price trajectory for this digital currency.

Should Bitcoin continue on this trajectory, it might reach unprecedented peaks prior to New Year. Many investors are keeping a keen eye on it, anticipating that its value could escalate further as we move into a traditionally robust financial quarter.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Solo Leveling Arise Tawata Kanae Guide

2024-10-01 07:04