-

BTC has remained bullish despite recent fluctuations.

More long positions have been liquidated in the current trading session.

As a seasoned researcher with over a decade of experience in financial markets, I’ve seen my fair share of market volatility and liquidations, but the current trend in Bitcoin (BTC) is particularly intriguing. The first day of August has been a rollercoaster ride for BTC traders, with significant long liquidations dominating the scene.

At the start of this month, Bitcoin (BTC) experienced significant price swings, leading to a mix of responses among traders.

Even though it closed the last trading day with profits, it saw high volumes of selling due to its price fluctuations during the session.

Long liquidations dominate

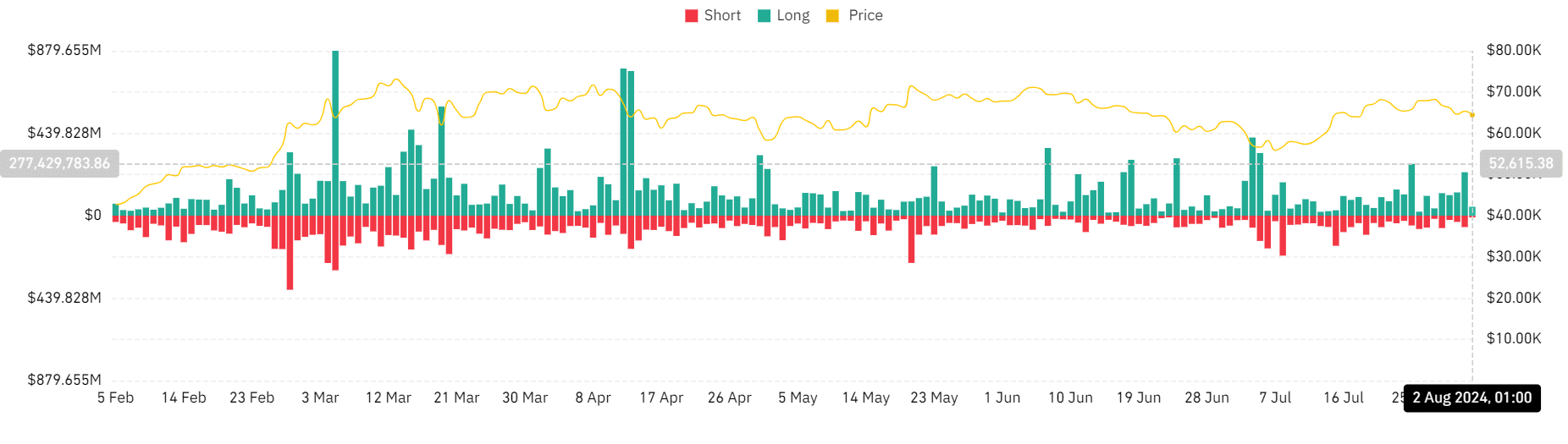

Examining the Bitcoin liquidations graph on Coinglass uncovered that the initial day of the month saw more than $280 million in liquidations.

Upon further examination of the data, it was found that a substantial portion of the total volume was due to long liquidations, amounting to approximately $231.6 million. On the other hand, short liquidations were relatively small in comparison, with a value of around $60.8 million.

It appears that the significant number of long liquidations seen on the 1st of August was not a one-off occurrence; instead, Bitcoin had been exhibiting a trend of frequent long liquidations in the days preceding this event.

It appears that this pattern indicates numerous traders had excessively high expectations regarding Bitcoin’s price fluctuations, causing an increased number of long positions. Consequently, when the market reversed, these positions were terminated or “liquidated.”

The frequent occurrence of extended sell-offs signaled a time of optimistic market conditions, which were unexpectedly disrupted, leading to significant financial consequences for investors with amplified long positions.

In my recent analysis as a researcher, I’ve noticed that the gap between extensive and minimal Bitcoin (BTC) liquidation volumes highlights the market turbulence this digital currency has experienced over the past few days.

Understanding the cause

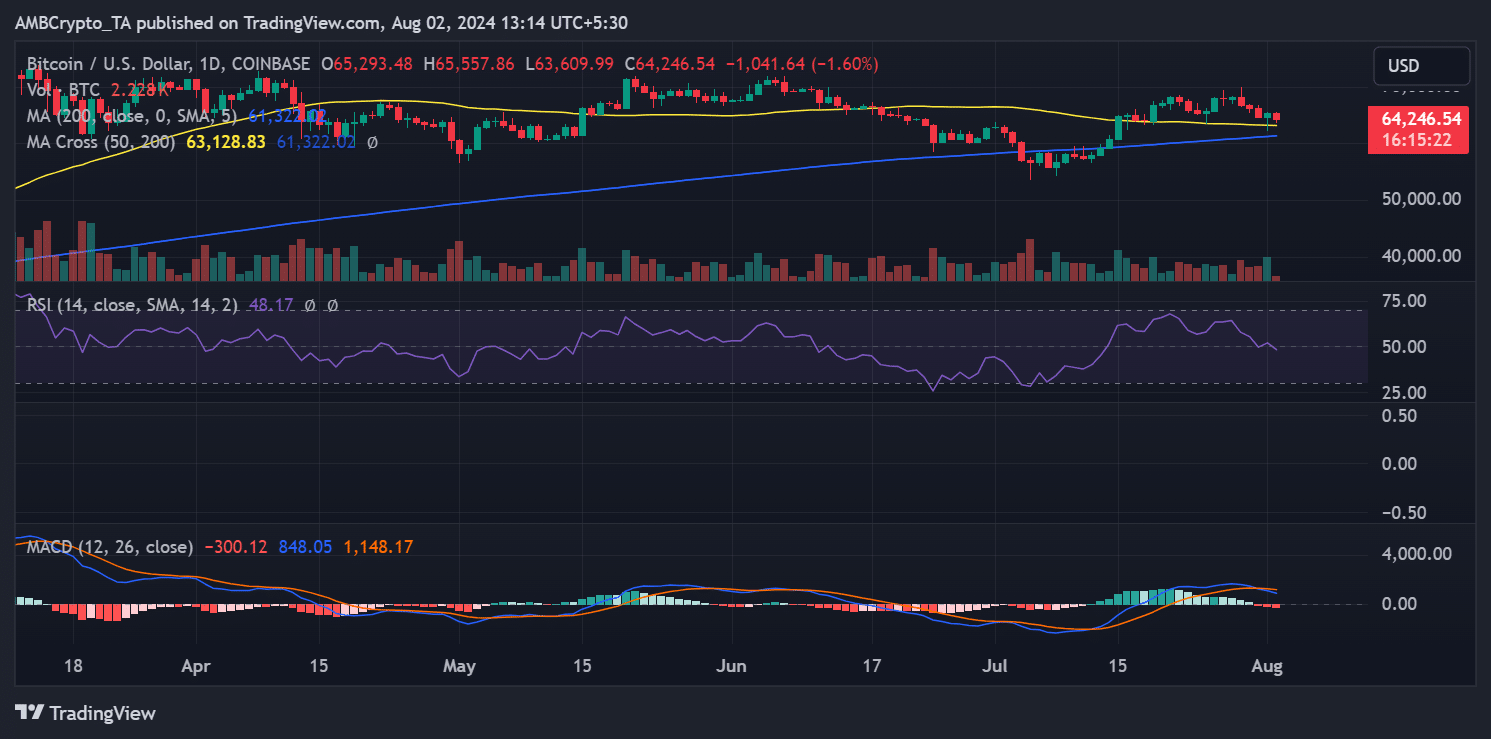

According to AMBCrypto’s examination using a daily chart, Bitcoin concluded its prior trading period with a rise of more than 1%.

As a researcher examining market trends, I noticed that intraday liquidations tended to have a more substantial impact on our returns, even though we experienced gains throughout the day. This was primarily due to the high volatility within the trading sessions, rather than the prices at the end of each session.

Based on AMBCrypto’s examination, the value of Bitcoin initially traded at about $64,600, but later fell to roughly $62,212. This significant decrease in price led to the large amount of long positions being liquidated.

By the end of the day, Bitcoin had recovered and traded at about $65,288.

Currently, Bitcoin has dropped by more than 1% and is being exchanged for approximately $64,254. Should this downward trend persist, it’s possible we might see another day characterized by high liquidation activity.

Bitcoin sees high-volume activity

In simpler terms, the pattern of Bitcoin’s trading activity, as shown by Santiment, suggests a substantial amount of transactions. The peak trading volume from the last session was approximately $41 billion.

As of this writing, the volume was already over $38 billion.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Regardless of the present market situation that appears to be advantageous for sellers, there’s a possibility that buyers might take over if they manage to assert their influence.

Shifting gears might reverse the current sell-off, possibly leading to fewer extended sales and promoting more stable price fluctuations instead.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Elden Ring Nightreign Recluse guide and abilities explained

2024-08-02 15:04