- Bitcoin has dropped below the $60,000 price range.

- More long positions have been liquidated in the last 48 hours.

As a crypto investor with some experience under my belt, I’ve seen my fair share of market volatility. And the recent downturn in Bitcoin’s [BTC] price has left me feeling uneasy, to say the least. With BTC’s price declining further and crossing critical thresholds, many holders like myself are facing liquidations on our long positions.

Due to the latest drop in Bitcoin’s [BTC] value, traders holding long positions find themselves at risk. As the price continues to slide and falls below important levels, numerous investors are selling off their Bitcoins.

Bitcoin sees over $100 million in liquidations

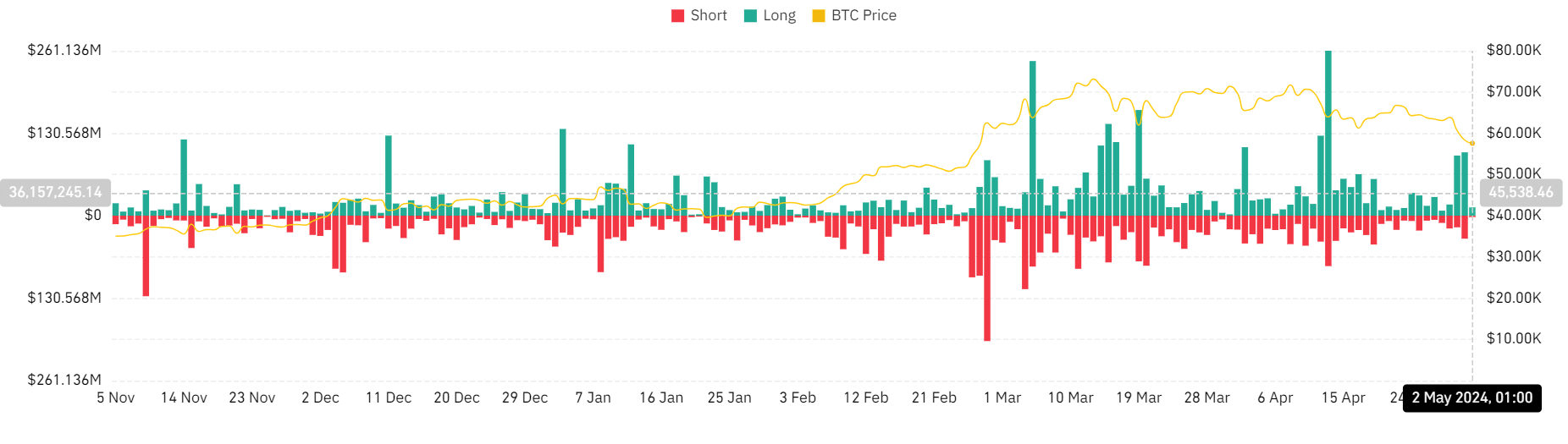

Based on information from Crypto Rank, the cryptocurrency market saw a substantial liquidation of approximately $464 million on May 1st. Among this amount, Bitcoin was responsible for around $136 million.

I recently came across an insightful analysis by AMBCrypto on the Bitcoin liquidation chart from Coinglass. According to their findings, long positions were significantly affected as around $100.3 million worth of these positions were liquidated on May 1st.

Conversely, short liquidations amounted to around $36.4 million.

As a researcher studying market trends on the 30th of April, I observed that long positions experienced significant unwinding, with around $95 million worth of these positions being closed out. In contrast, approximately $18.4 million was liquidated from short positions.

Based on the information from Crypto Rank, approximately 80% of all liquidations that occurred on May 1st were long liquidations.

At the point of composition, approximately $13 million worth of long positions had been cashed out, whereas short positions saw roughly $2 million in redemptions.

More Bitcoin hits exchanges

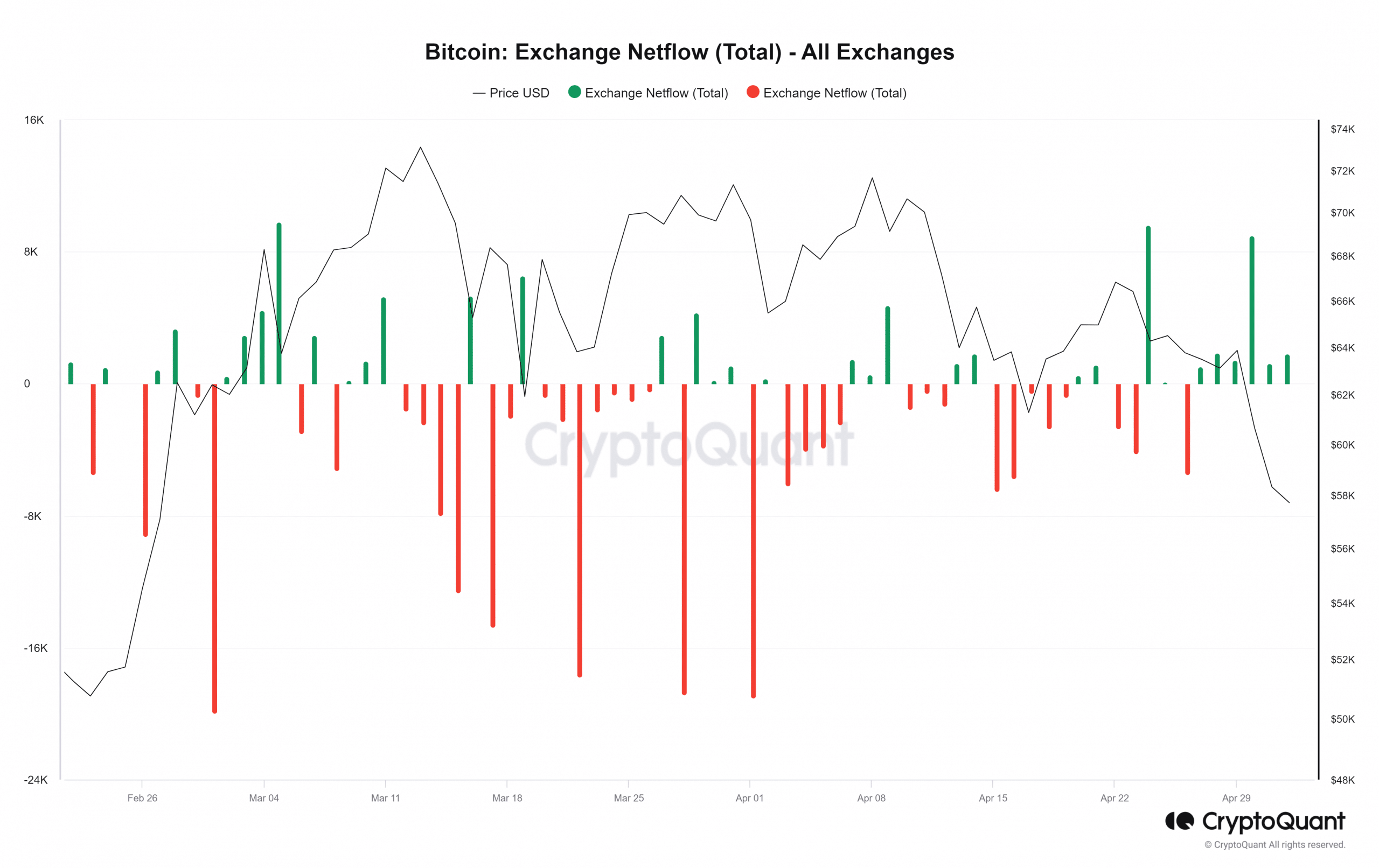

According to AMBCrypto’s analysis of Bitcoin exchange netflow, there was a significant surge in the quantity of cryptocurrency moving to exchanges around May 1st, which could be indicative of heightened selling pressure. The specific figure reported was 1200 assets.

As I delved deeper into the Bitcoin transaction data, I uncovered a noteworthy influx of approximately 32,300 coins flowing into exchanges. This discovery indicated a persistent pattern of higher volumes of Bitcoin being transferred to these platforms.

BTC in free fall

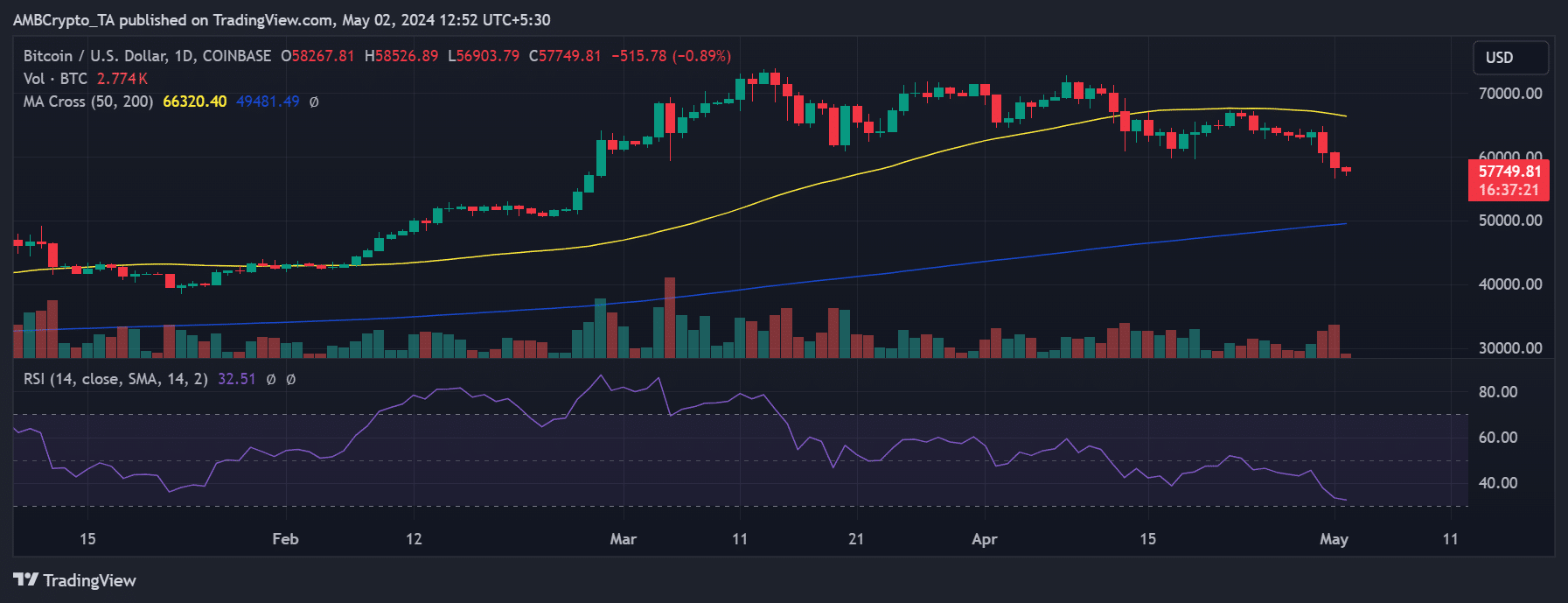

An examination of Bitcoin’s daily chart by AMBCrypto showed a persistent downward trend in its price over the last three days. Specifically, on May 1st, Bitcoin suffered a setback of approximately 3.89%, causing its value to slide down to around $58,260.

This marked the first time it fell below the $60,000 price range since its March surge.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Currently, Bitcoin is priced around $57,740 during my writing, representing a minimal decrease of nearly 1%. This extended period of price decrease has intensified the bearish sentiment, as suggested by its Relative Strength Index (RSI).

The decreasing prices are leading to a surge in trading activity and the selling off of long-held positions.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

2024-05-03 03:03