Overwatch 2 Season 17 Midseason Surge Brings Map Reworks, Hero Trial, and Massive Loot

The surge starts with major updates to New Junk City and Suravasa.

The surge starts with major updates to New Junk City and Suravasa.

Thanks, Ryokuta2089.

Here is an overview of the game, via SUCCESS Corporation:

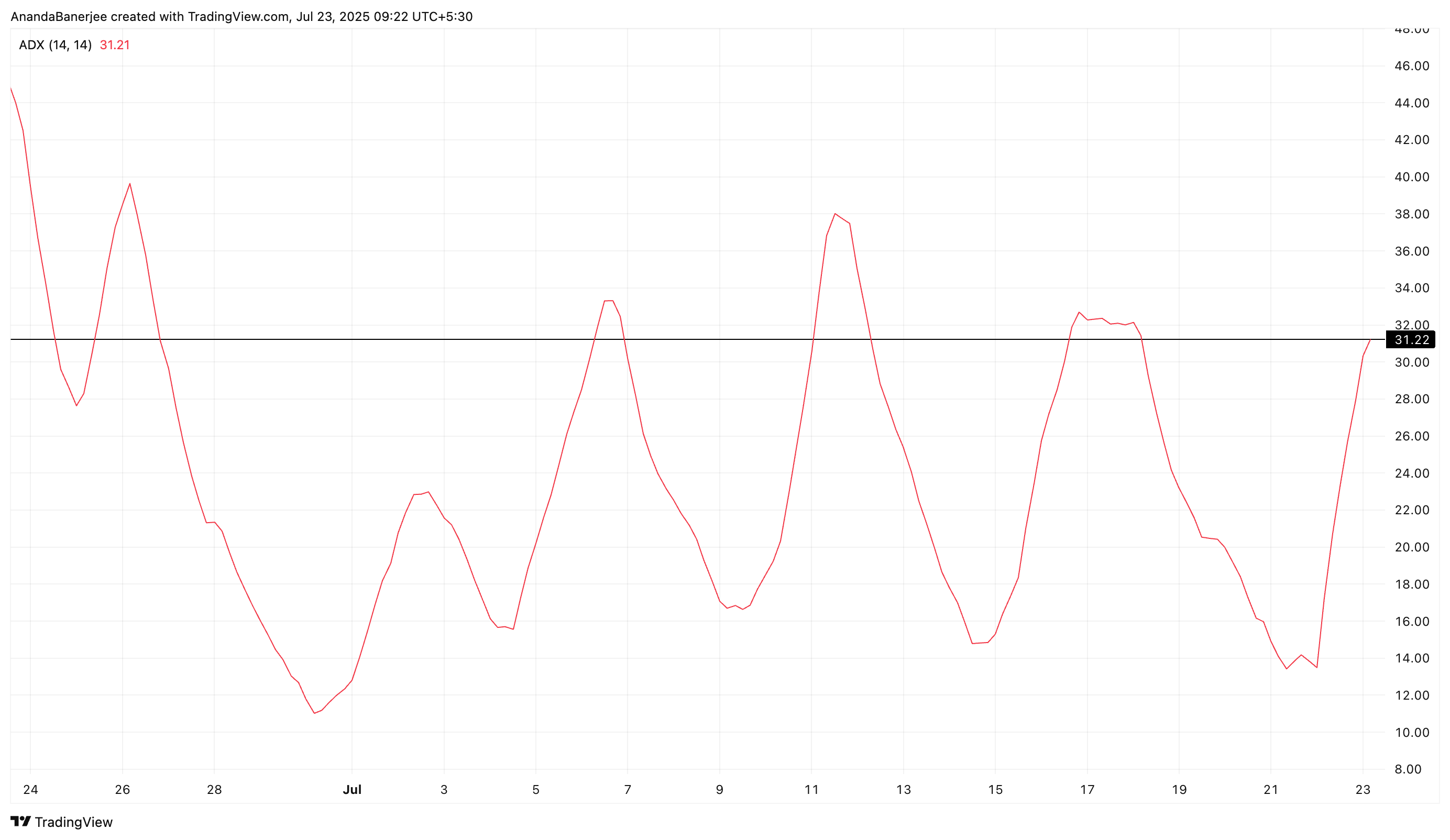

But hold your horses! Two hints on the lower timeframe suggest this might not just be a one-off leap; trend strength is back in the ring, and a second MOVING-AVERAGE trigger is lurking around the corner, like a cat eyeing a laser pointer. 👀

This all commenced after a superb breakout from a classic ascending triangle—think of it as the bullish version of a love triangle, but with profits. The move suggests a goal near $1,000, with the RSI still playing coy—remaining just shy of overbought, meaning there’s plenty of room for more dramatic performances. 🎭

The tentative release window for Doctor Strange 3 could be toward the end of 2027 or even 2028, according to reports from industry insider Daniel Richtman, who suggests that production might commence as early as 2026.

The Brave and the Bold release date estimate is late 2028 or 2029.

This new game is titled “Risk: G.I. Joe Special Missions,” a collaboration between Renegade Game Studios and Hasbro. It’s an innovative take on the classic strategic warfare game, with a twist from the G.I. Joe universe. The game accommodates 2 to 4 players, who can choose to align with either G.I. Joe or Cobra. Throughout the game, players work to accomplish missions and resolve plots in order to accumulate the highest number of objective points by the end. The game features five master scenarios that dynamically reveal various hotspots on the map, ensuring an exciting and unpredictable gameplay experience for both teams.

Netflix has confirmed that All of Us Are Dead Season 2 is now in production.