- Bitcoin is likely to continue to trend downward in the coming weeks.

- The short-term holders’ average cost basis marked out a potential local top for Bitcoin.

As a seasoned researcher who has closely observed the crypto market for several years now, I find myself leaning towards the possibility of Bitcoin continuing its downward trend in the coming weeks. The short-term holders’ average cost basis seems to be a strong barrier that might prevent an immediate resumption of the uptrend after a price dip.

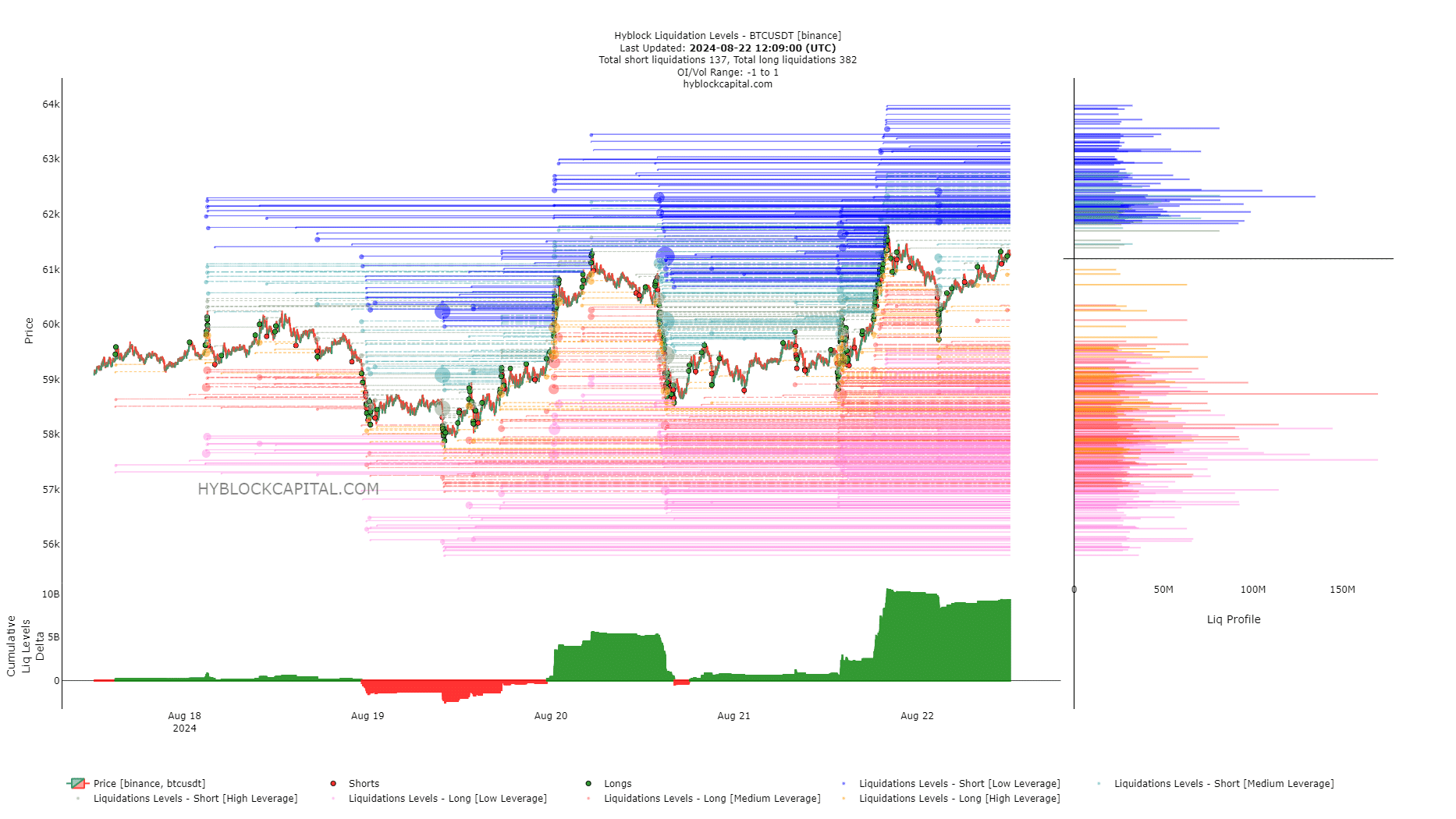

Over the last two days, there’s been increased price fluctuations with Bitcoin [BTC]. It peaked at approximately $61,800 on the 21st of August, only to drop down to around $59,700 a few hours later.

The recent fluctuations in Bitcoin’s price might be due to the accumulation of liquidity reserves established around it during the last seven days.

In simpler terms, the total liquidity increase had been exceptionally large, suggesting a temporary drop in prices to expel overly optimistic buyers (bulls) in the near future.

To determine whether Bitcoin might continue its upward trajectory following a price drop, AMBCrypto examined additional data points and the behavior of large-scale investors (whales).

The short-term holder cost basis would be a strong barrier

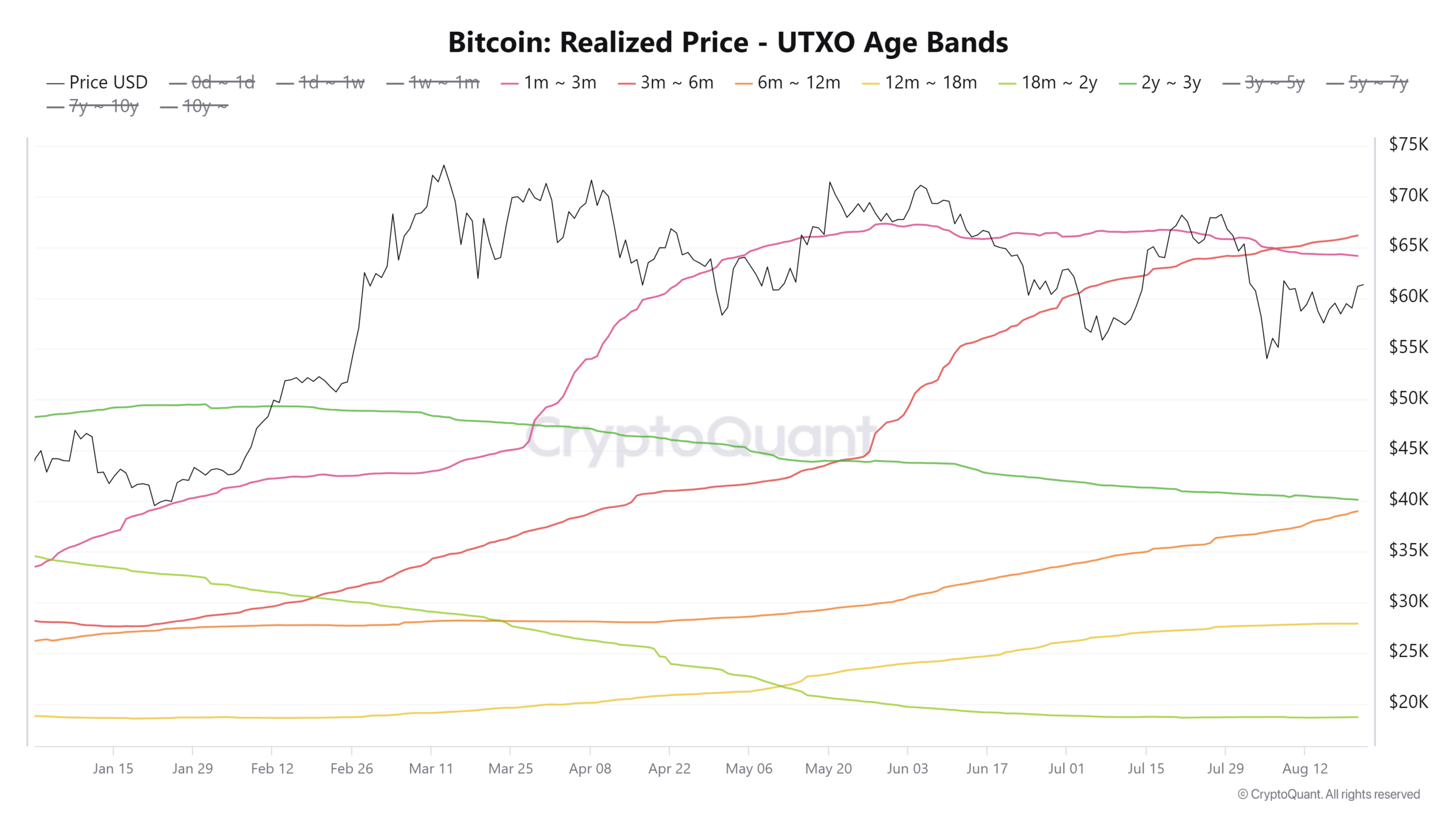

Analyst Burak Kesmeci from CryptoQuant pointed out that the prices at which short-term Bitcoin owners acquired their coins can help identify potential resistance levels. These short-term holders are individuals who have owned Bitcoin less than 155 days.

Examining the UTXO age brackets, he noted that the group holding Bitcoin for 1 to 3 months on average purchased it at approximately $64,000. Likewise, those who have held Bitcoin for 3 to 6 months typically bought it around $66,000.

With market prices beneath this zone, most of these holders were likely at a loss.

Consequently, if the price reaches this level, it’s probable that those who are currently underwater (owing more than their current investment is worth) will sell their holdings close to breakeven. This mass exit could potentially increase the selling force in the market.

In simpler terms, the pattern of Bitcoin’s price fluctuations over the past few months suggests that if it reaches around $66k, it might be a wise moment to cash out.

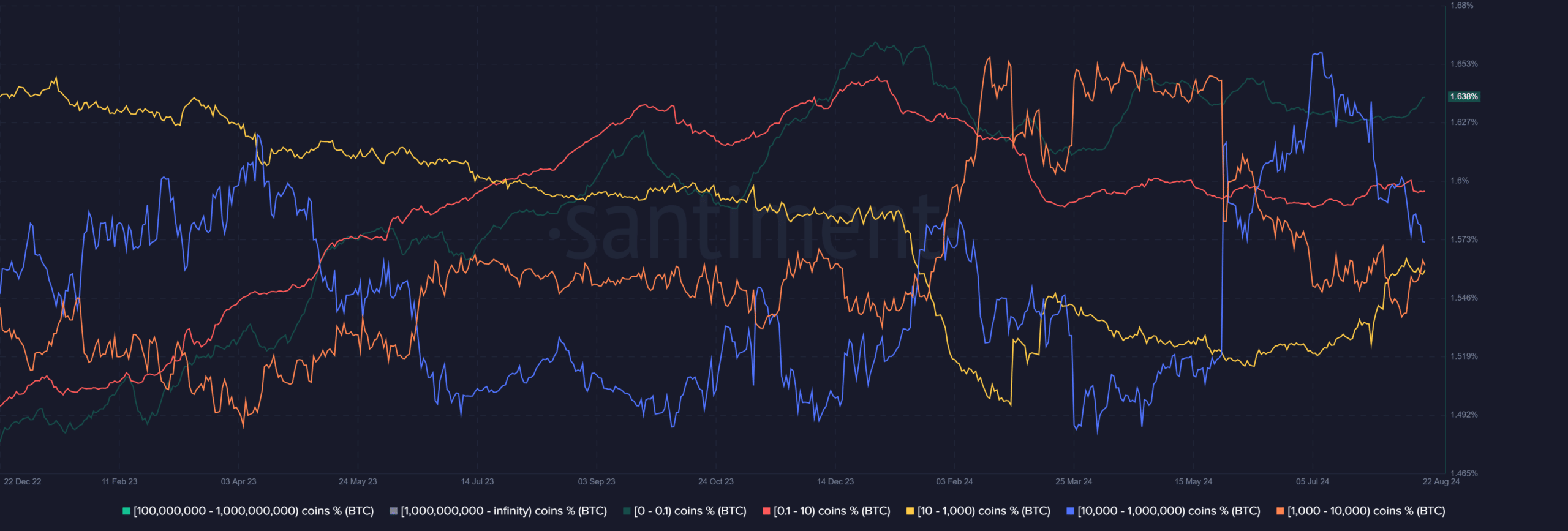

Assessing whale accumulation/distribution trends

From early December 2023 through late January 2024, there was a prolonged buildup in wallets containing between 10,000 and 1 Million Bitcoins. This phase coincided with a 16% increase in the value of Bitcoin, which is often referred to as the leading cryptocurrency.

By March, Bitcoin had surged an additional 70%. However, this growth occurred in tandem with significant Bitcoin “whales” (those holding over 10,000 coins) offloading their holdings and cashing out during the surge.

Over the last six weeks, these groups of whales experienced a dispersal stage, despite the fact that the performance of Bitcoin prices wasn’t particularly bullish.

The implication was an expectation of a price dip and continued downtrend.

Read Bitcoin’s [BTC] Price Prediction 2024-25

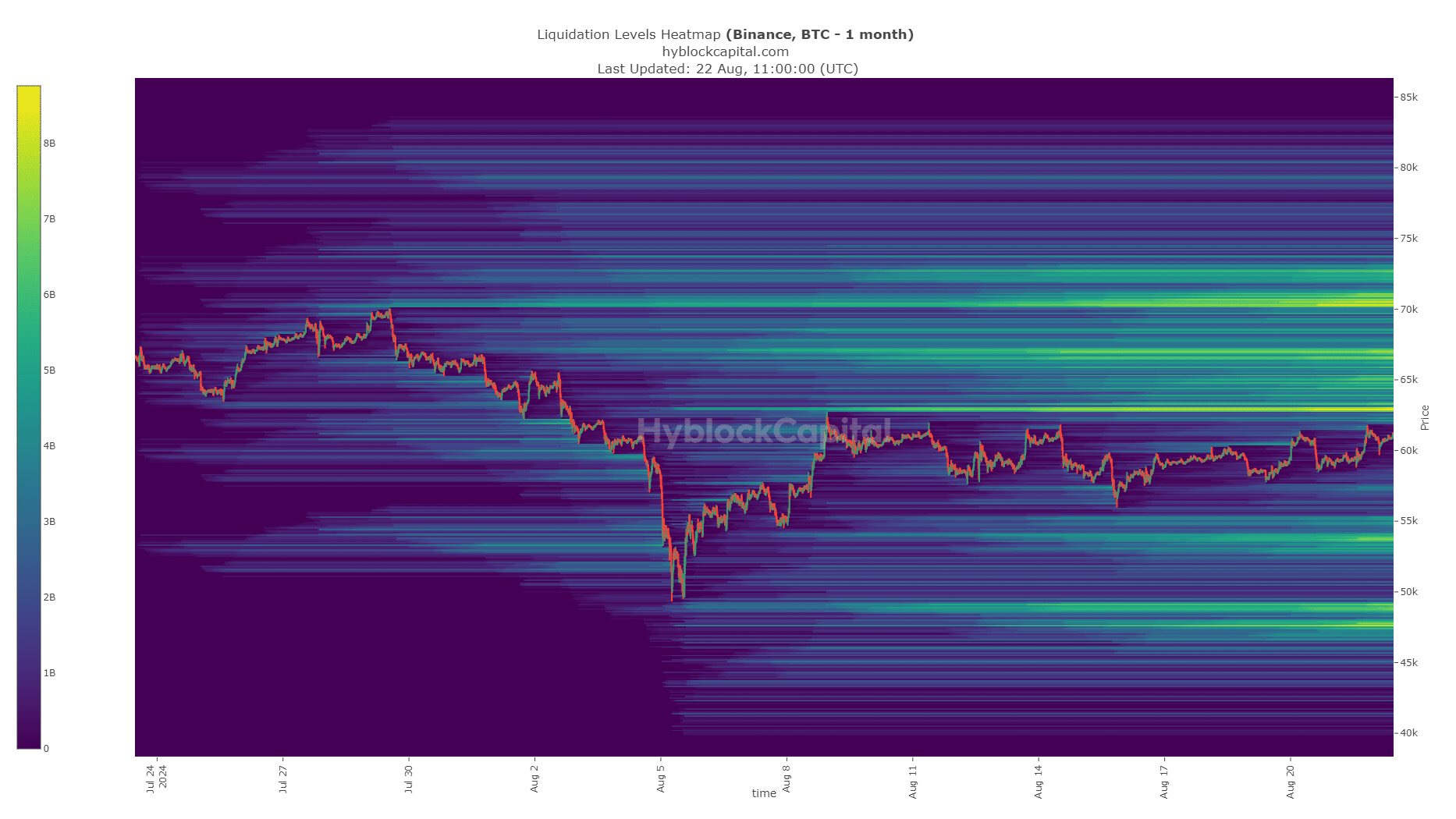

As a cryptocurrency investor, I found that the one-month liquidation heatmap offered a clearer view of potential price ranges ahead. It seems quite probable that the substantial pockets of liquidity at approximately $63k, $67k, and $70k will pull prices towards them in the upcoming weeks.

Yet, the liquidity built up to the south at $54k and $49k were also significant magnetic zones. As things stand, the price action and whale accumulation trends do not favor a breakout past $66k.

Read More

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-08-23 04:40