- Bitcoin may reach the $60,500 level if its daily candle closes above the $58,500 level.

- Veteran trader Peter Brandt suggests a buy signal in Bitcoin for the short term.

As a seasoned crypto investor with several years of experience under my belt, I’m closely monitoring the current market volatility and keeping an eye on key developments that could impact Bitcoin’s price. Two such developments that have caught my attention are Michael Saylor’s bullish stance and Peter Brandt’s buy signal.

The cryptocurrency market has seen significant fluctuations over the past few days, with consistent price changes.

In the face of current difficulties, Michael Saylor, MicroStrategy’s founder and chair, along with experienced trader Peter Brandt, have adopted optimistic views towards Bitcoin [BTC].

Michael Saylor and Peter Brandt post on X

On 7th July, 2024, Michael Saylor made a post on X stating that

“Bitcoin is engineered to keep winning.”

The chairman of MicroStrategy emphasizes that Bitcoin’s inherent design ensures its value and significance will increase, regardless of market fluctuations.

He posted a tweet accompanied by a graphic illustration, which highlighted Bitcoin’s progression throughout the year in contrast to other investment options such as Gold and Silver.

Independent trader Peter Brandt, known for his expertise, shared his analysis on platform X regarding Bitcoin (BTC). He identified a bullish pattern, referring to it as the “Foot Shot” formation. This discovery signifies a buying opportunity in the near term for potential investors.

Two tweets from prominent figures in the industry drew significant interest from investors and market participants during this volatile period, potentially shaping the sentiments of the optimistic crowd.

Bitcoin technical analysis and key levels

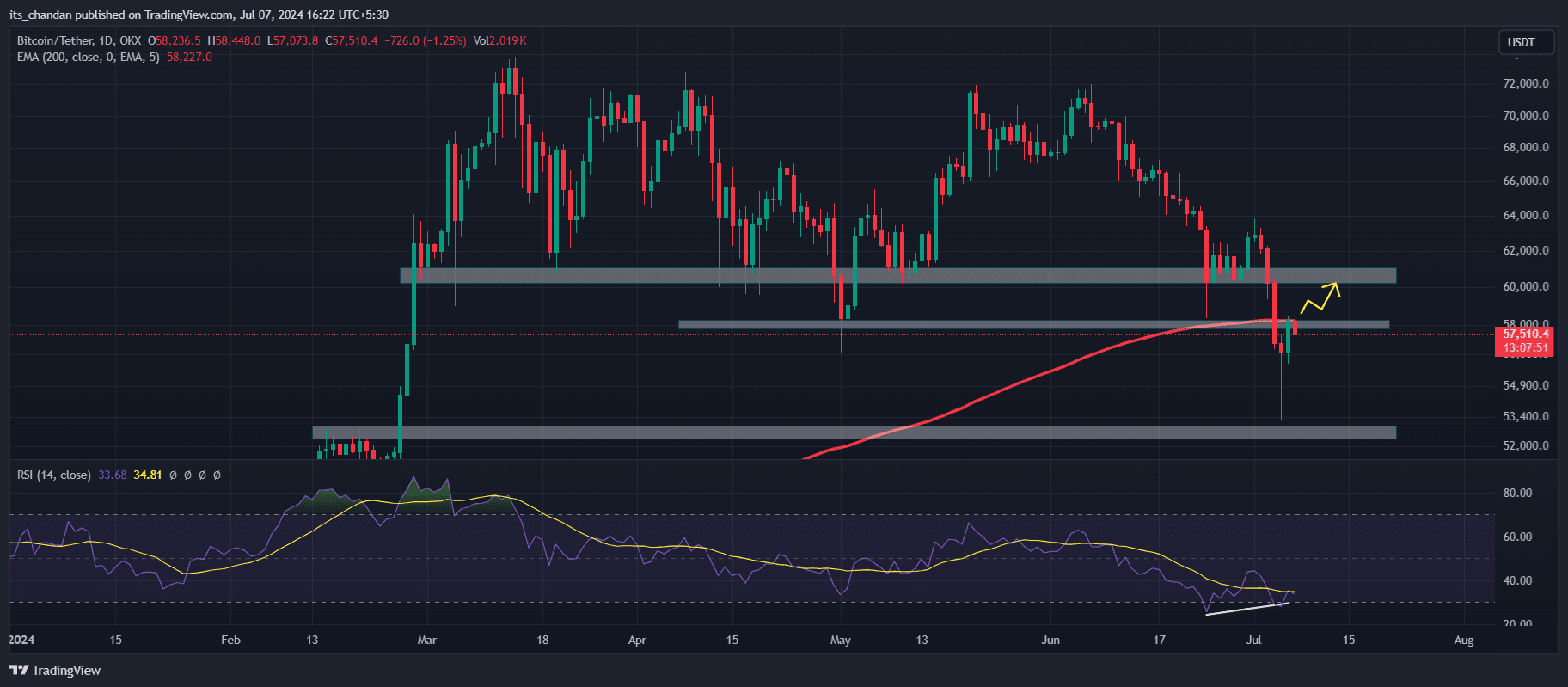

Based on technical analysis, Bitcoin’s current trend appears bearish as it encounters resistance around $58,000 from the 200 Exponential Moving Average (EMA).

This 200 EMA may create a hurdle for BTC until it gives a candle closing above the $58,500 level.

As a crypto investor, I’ve noticed that despite the price facing significant resistance, the Relative Strength Index (RSI) has entered an oversold territory. Surprisingly, this situation is accompanied by a bullish divergence, indicating a possible reversal and a potential sign of recovery in the near future.

If Bitcoin (BTC) manages to end its daily trading with a closure above the $58,000 mark, there’s a strong likelihood that its price will ascend to around $60,500.

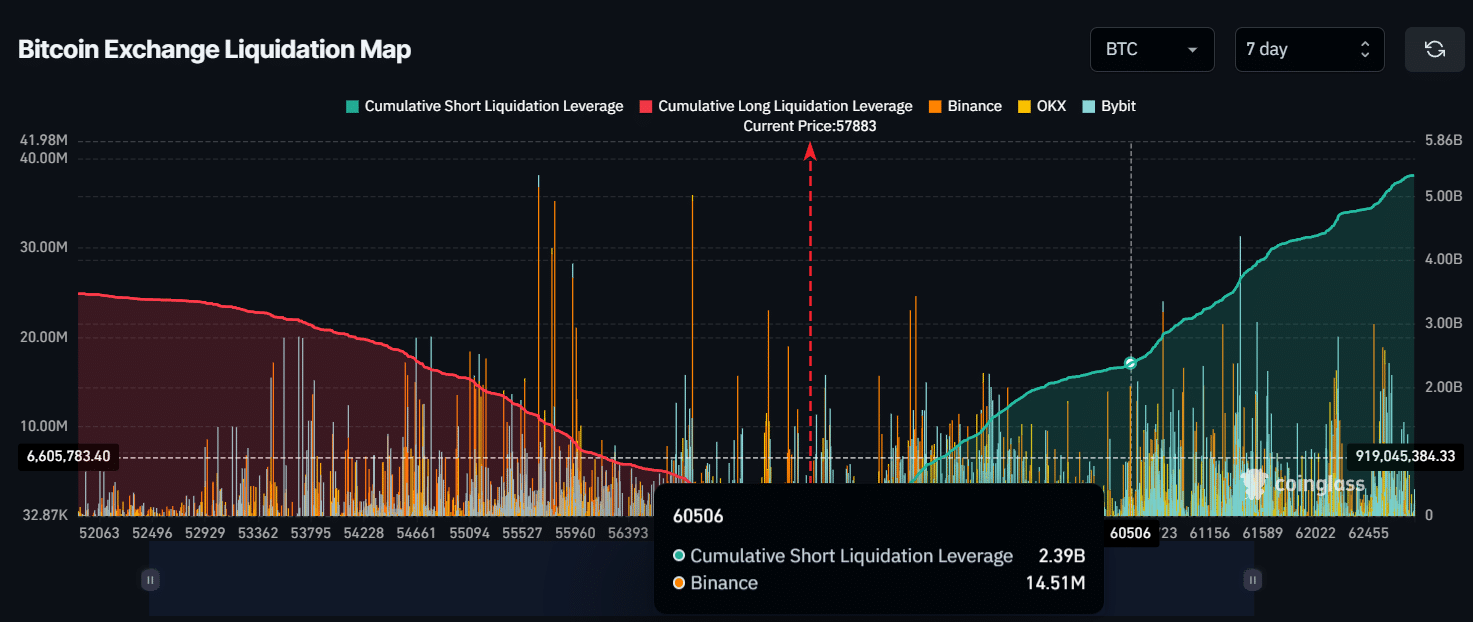

Based on data from cryptocurrency analysis firm CoinGlass, approximately $2.4 billion worth of bitcoin short positions would be liquidated if the price of BTC reached $60,500.

As I delve into the latest market statistics, I notice an intriguing development: The open interest for Bitcoin has experienced a noteworthy increase of approximately 1.4% within the past twenty-four hours, according to CoinGlass data. This uptick in open interest is an indicative sign of heightened investor and trader engagement with Bitcoin.

BTC price-performance analysis

At present, Bitcoin’s price hovers around $57,800 mark, with a 2% price increase observed over the past day.

Read Bitcoin’s [BTC] Price Prediction 2024-25

In contrast, there was a notable 37% decrease in trading activity during the previous 24-hour span, implying reduced involvement from investors and traders.

As a crypto investor, I’ve observed that Bitcoin (BTC) experienced a 6% decrease in value over the last week. However, the downturn became more significant when we look at the past 30 days. During this period, BTC dropped dramatically from $71,300 to $57,800, representing a loss of approximately 20%.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2024-07-07 20:07