- Bitcoin’s price dropped by over 6% in the last seven days.

- A few metrics hinted at a market bottom, but indicators suggested otherwise.

As a researcher with experience in the crypto market, I’ve seen my fair share of price corrections and market volatility. Last week’s 6% drop in Bitcoin’s price was a setback for investors, but I couldn’t help but notice some positive signs that hinted at a potential trend reversal.

Last week brought about a significant price drop for Bitcoin [BTC], causing unease among investors. However, this downturn might be short-lived as indicators suggested a potential reversal of the trend. This theory gained traction as Bitcoin’s price movements started mirroring its 2017 price pattern.

Bitcoin’s historical trend

Last week, the cryptocurrency market saw investors failing to turn a profit as Bitcoin’s graph continued to display red figures. Based on CoinMarketCap data, Bitcoin experienced a decrease of over 6% within the past seven days, causing its value to drop below the $67k threshold yet again.

As a crypto investor, I’m observing that Bitcoin (BTC) is currently changing hands at around $66,896.42 in the market. Its total value is more than an impressive $1.32 trillion.

Recently, Milkybull, a well-known cryptocurrency analyst, brought attention to an intriguing observation in a tweet. According to this post, Bitcoin (BTC) seems to be mirroring the price trend it had back in 2017 before the start of its significant bull market.

As a crypto investor, I’ve noticed that the recent tweet suggests a potential market bottom for Bitcoin (BTC) is near based on its current price. If history repeats itself, following this market bottom, BTC could initiate a bull rally. Furthermore, an essential technical indicator has displayed a bullish divergence, as observed back in 2017.

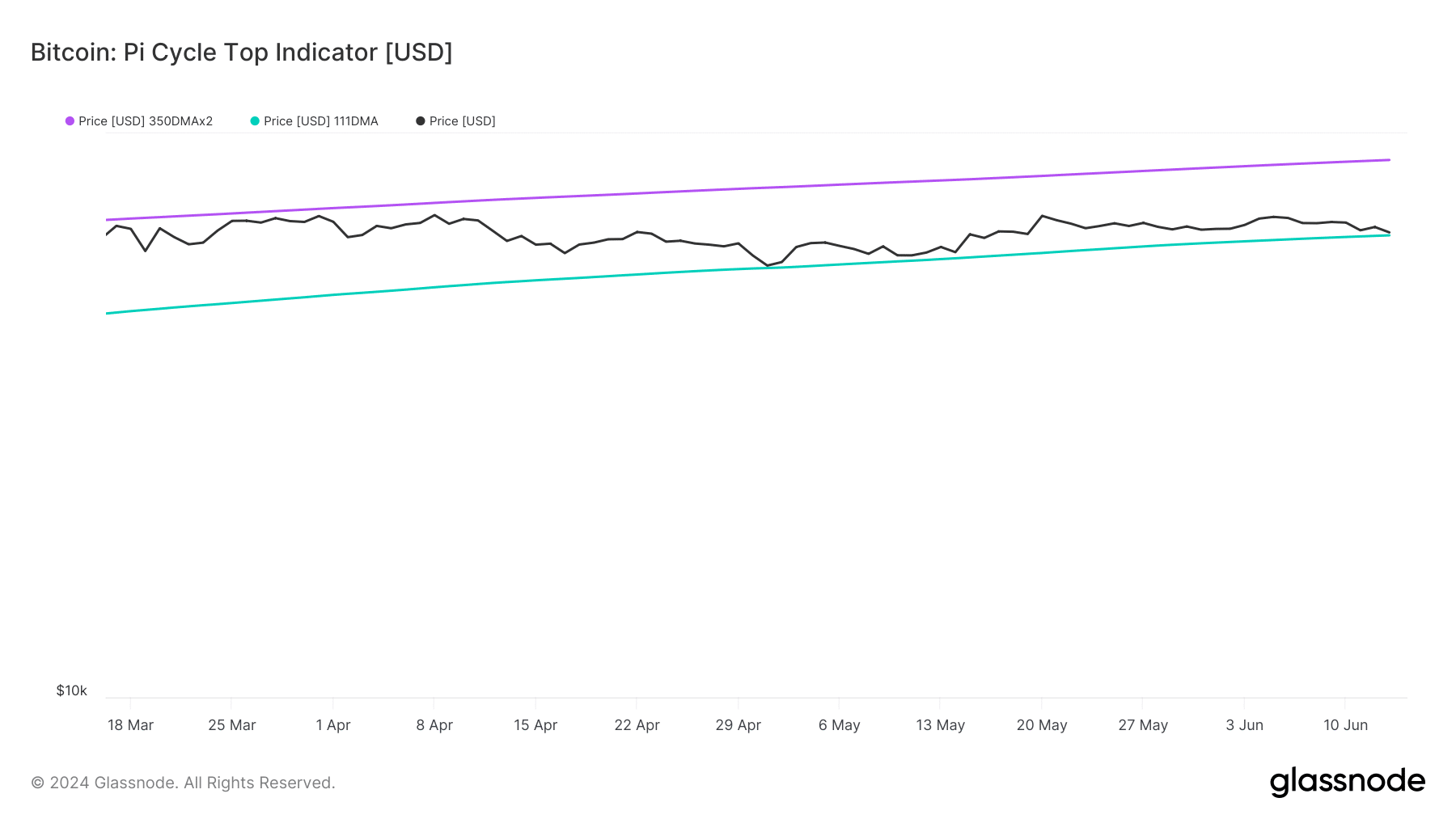

Additionally, AMBCrypto’s examination of Glassnode’s data uncovered a positive sign for potential price growth.

Based on the Pi Cycle Top indicator of Bitcoin (BTC), the cryptocurrency’s price seemed to have reached its lowest point in the market. If there is a change in trend, Bitcoin could potentially reach a new height of around $89,000.

Is BTC preparing for a rally?

To determine if there were signs of an impending price rise for Bitcoin (BTC), AMBCrypto examined the data provided by CryptoQuant. The level of Bitcoin held in exchanges was decreasing, which indicated a reduction in the amount of Bitcoin available for trading and thus less pressure from sellers.

In simpler terms, the long-term investors’ trading activity in the Binary CDD was less than usual over the past week, implying they are holding onto their coins with intent. The other indicators, however, displayed a bearish trend.

As a crypto investor, I’ve noticed that the moving average of BTC‘s sell-to-buy ratio (sometimes called the all-signals moving average or aSORP) has been indicating an increase in the number of investors selling at a profit. This trend could potentially exacerbate the existing downturn in Bitcoin’s price action.

As a crypto investor, I’ve noticed that the Bitcoin Fear and Greed Index stood at 63% during the latest market assessment. This figure signifies a “greed” phase in the market. Historically, when this index reaches such levels, it suggests that the probability of a price drop is significantly increased.

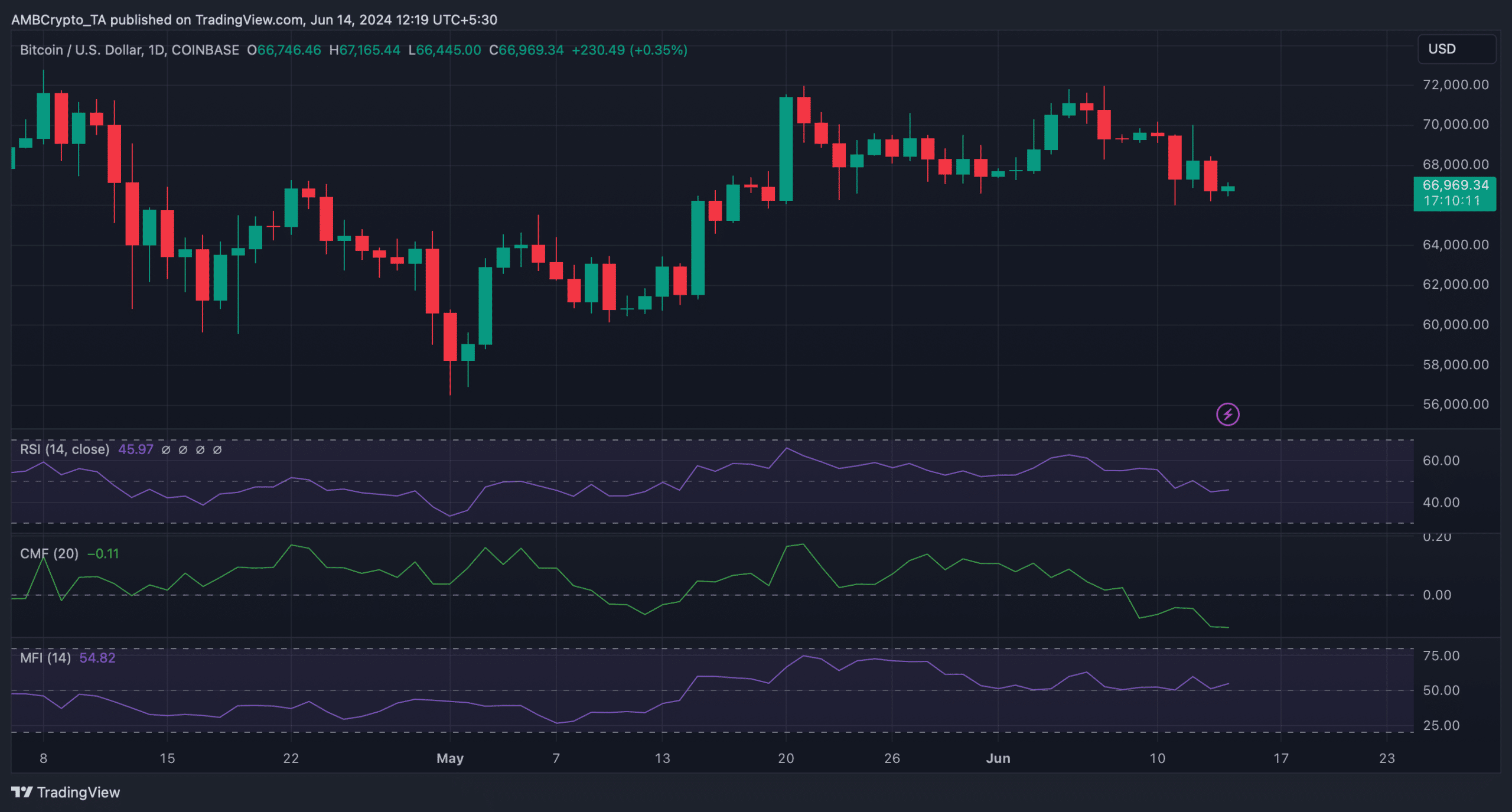

Some market signs were quite pessimistic as indicated by a significant decrease in the Chaikin Money Flow (CMF).

Read Bitcoin’s [BTC] Price Prediction 2024-2025

The RSI, or Relative Strength Index, was sitting below the neutral level; this implies that a potential drop in price may still ensue.

Despite this, the Money Flow Index (MFI) reinforced the bullish sentiment by climbing upward from its neutral position.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-06-15 01:11