- Despite recent bouts of decline, Bitcoin remains close to the $10,000-level

- Miners dumped their biggest batch of holdings in months as its price hit a major milestone

As a seasoned analyst with over two decades of experience in the financial markets, I have witnessed numerous bull and bear cycles, but none quite as intriguing as this one involving Bitcoin.

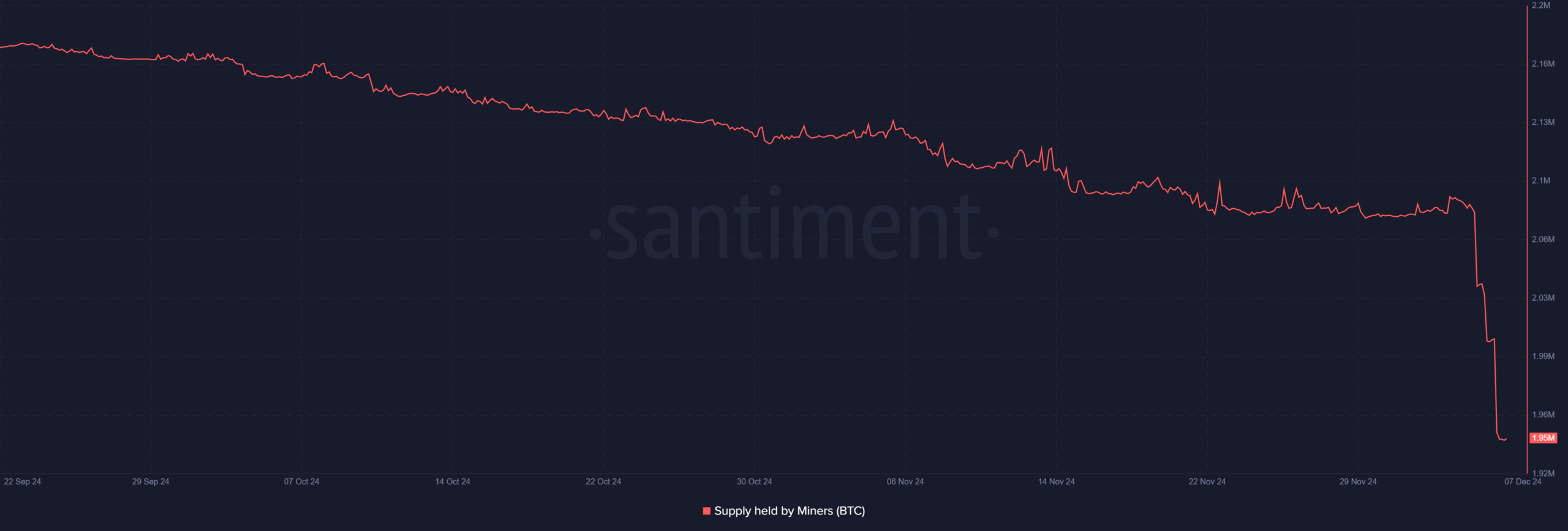

Over the past two days, Bitcoin miners have transferred a significant amount of 85,503 Bitcoins, which has led to a decrease in their stored Bitcoins to about 1.95 million – A level not seen for several months. Interestingly, this is the most substantial decline in miner holdings that we’ve witnessed so far in the year 2024.

As expected, this raises questions about its impact on Bitcoin’s price too.

Bitcoin miners’ selling and price trends

In terms of significance, the decrease in miner holdings observed recently is the largest since February; however, this decline hasn’t directly influenced Bitcoin’s price trend yet. By examining the miner supply on Santiment, we discovered that as of December 5th, it surpassed 2 million.

However, it had dropped to around 1.95 million, at the time of writing.

Historically, there’s usually a connection between major mineral sell-offs and market adjustments. However, in 2024, we’ve noticed a break from this pattern as miner activity and price movements seem to be going their separate ways. Interestingly, even with these sell-offs, large non-mining investors, often referred to as ‘whales’ and ‘sharks’, have persisted in buying, showcasing the intricate nature of market fluctuations.

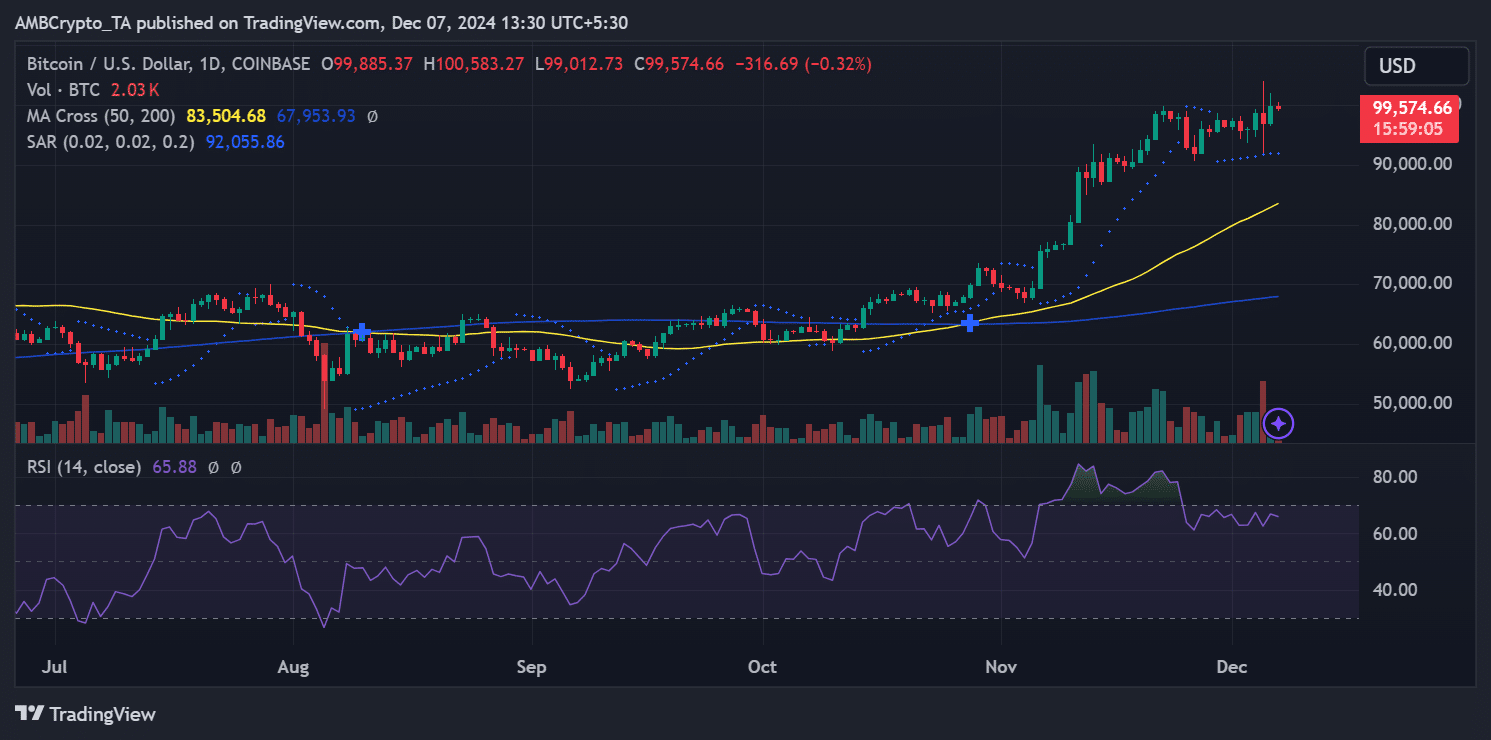

As an analyst, I’m observing Bitcoin’s behavior at the moment. It appears to be holding steady around the psychologically significant level of $100,000, suggesting consolidation. The Relative Strength Index (RSI) is currently reading 65.88, indicating that while the asset continues to show bullish signs, it hasn’t yet entered overbought territory.

The technical indicators, namely Parabolic SAR and moving averages, indicated a positive outlook, as the price consistently hovered above its 50-day and 200-day moving averages. Specifically, at the time, it was trading around $83,504 and $67,953 respectively for these two moving averages. This suggests a bullish trend in the market.

Network metrics – Hashrate, difficulty, and revenue

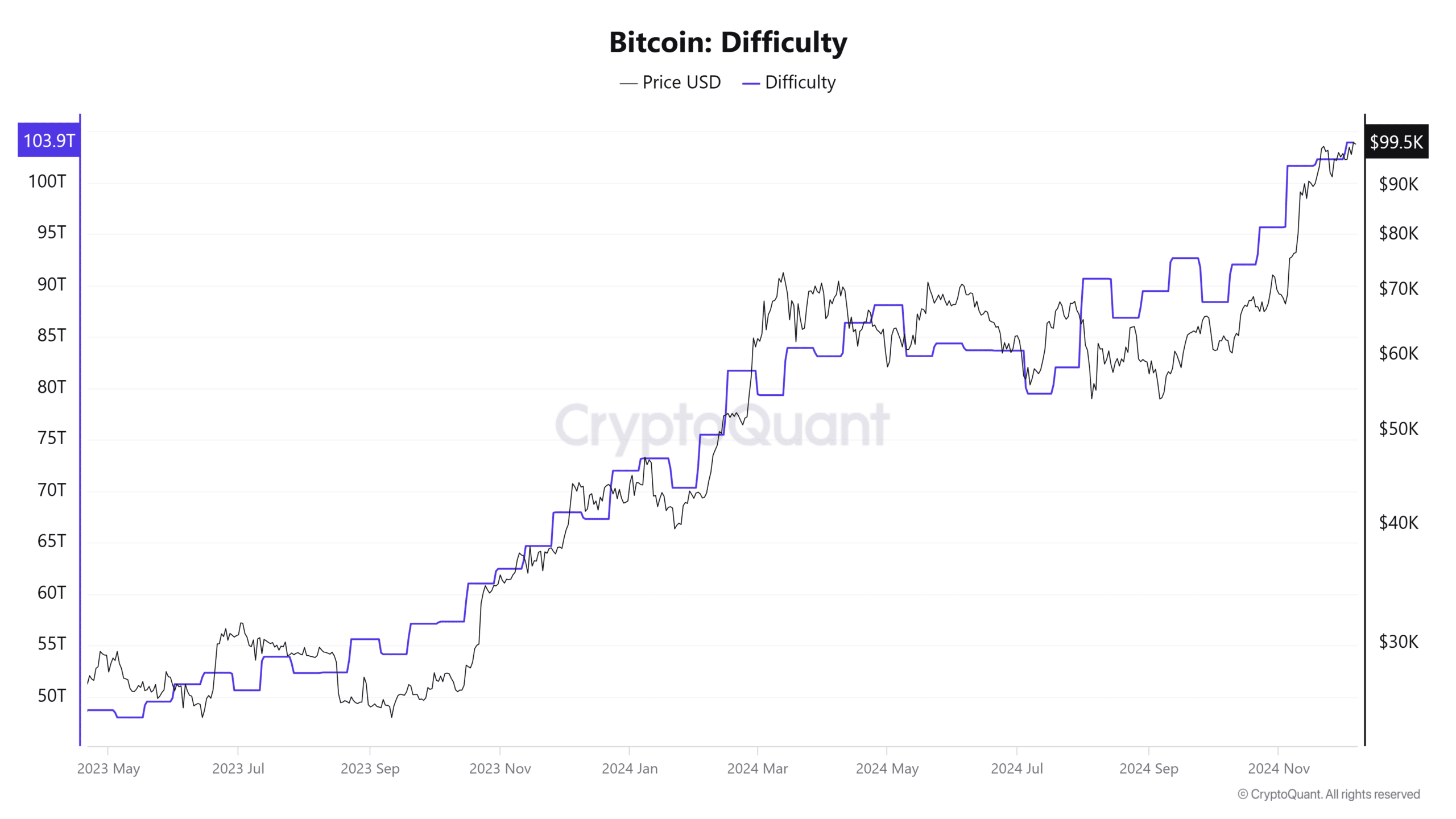

An analysis of Bitcoin’s hashrate revealed that it hit an all-time high of over 900 EH/s. The sustained hike indicated strong competition among miners.

As a researcher, I’ve noticed that even with a challenging network difficulty of 103.9T, there’s been an unrelenting surge in mining activities. Despite the observed decrease in miner balances, it seems miners remain active and resilient in their operations.

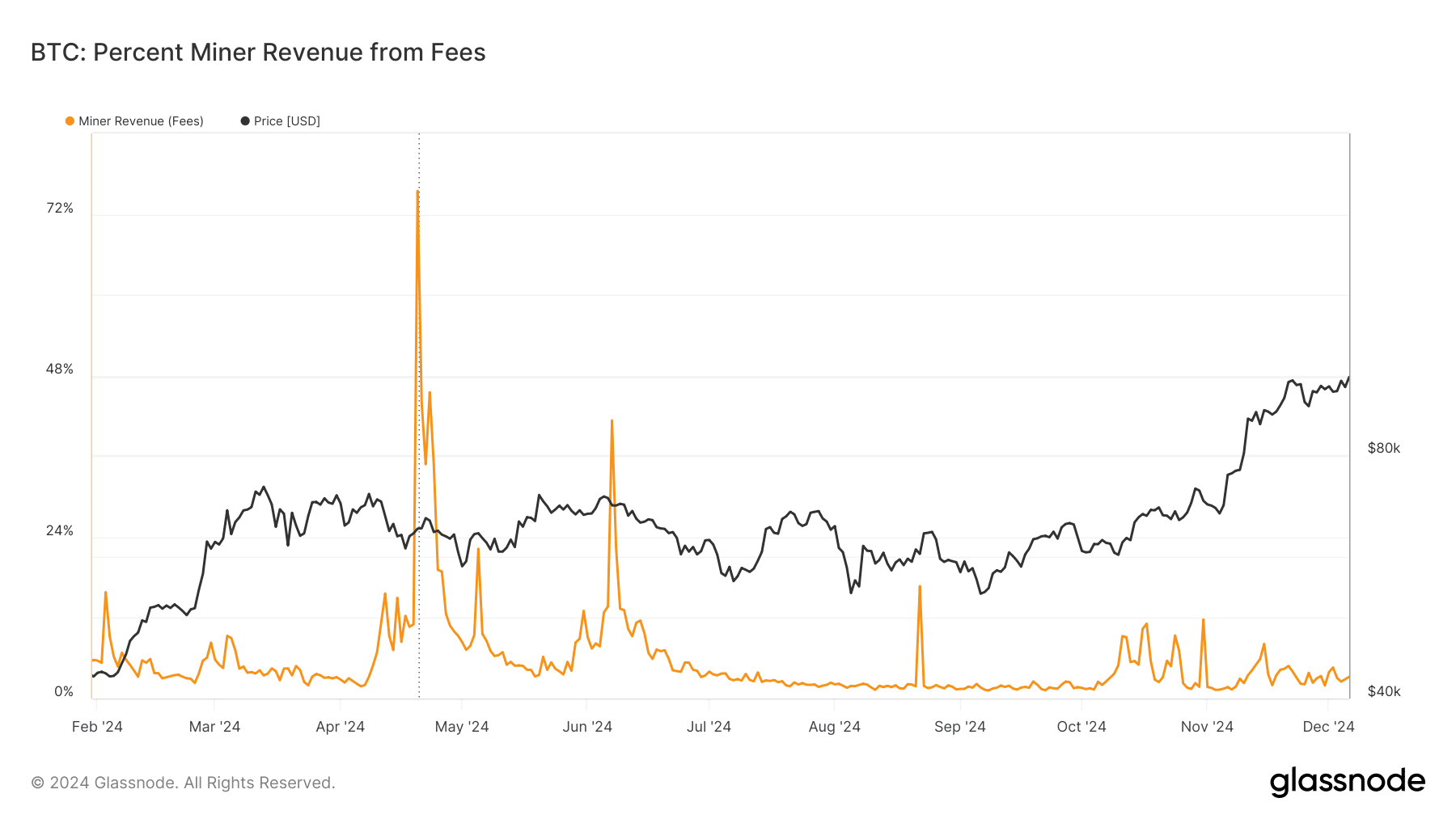

Additionally, it’s worth noting that the income miners receive from transaction fees is relatively low, accounting for approximately 10% of their overall earnings.

2024 has seen higher levels compared to what we’re currently experiencing now, highlighting the crucial role of block rewards for miners. (This sentence maintains the original meaning while making it easier to read and understand.)

Implications for Bitcoin’s price

The divergence between miner activity and price trends underscored Bitcoin’s market maturity. Despite major sell-offs, Bitcoin’s price has remained resilient, consolidating near its all-time high as buyers stepped in to absorb the selling pressure. However, sustained selling from miners could lead to heightened volatility, especially if compounded by macroeconomic or liquidity concerns.

The fact that Bitcoin’s value hovers around $100,000 despite heavy miner selling indicates a rise in the impact of non-mining investors and a wider spread use of this digital asset.

Read Bitcoin (BTC) Price Prediction 2024-25

In my research, I’m keeping a keen eye on Bitcoin’s performance as miners readjust their holdings. Market observers and I are eagerly waiting to see if Bitcoin can surpass its psychological resistance and maintain its upward trend. The forthcoming weeks will be pivotal in deciding whether the recent miner selling is indicative of a potential turning point or merely a temporary market correction.

Read More

2024-12-07 21:11