- Marathon Digital’s MARA surged 17.98% on Monday after its listing on the S&P SmallCap 600 index

- Company set to release its quarterly earnings report on 9 May

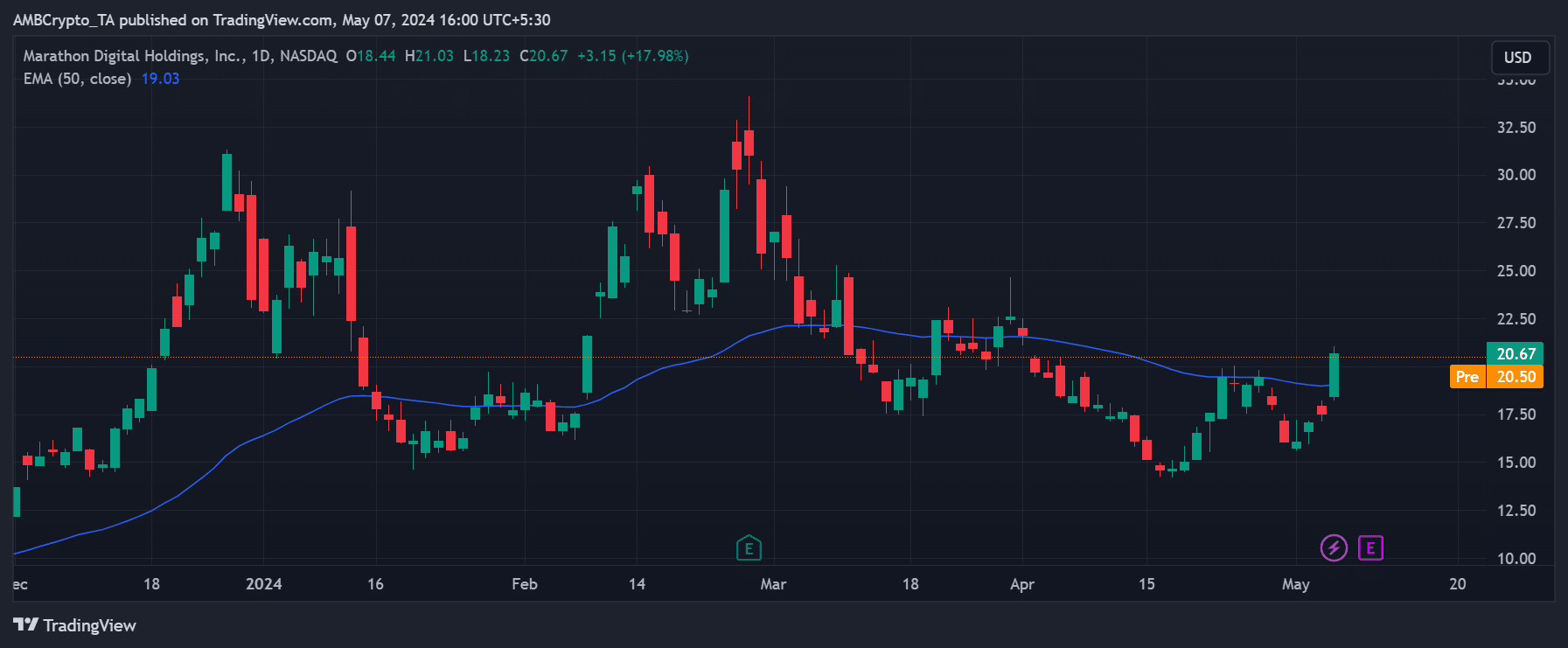

As a researcher with experience in the cryptocurrency and stock markets, I find Marathon Digital’s (MARA) recent surge intriguing. The Bitcoin miner experienced a significant 17.98% increase in shares on Monday following its inclusion in the S&P SmallCap 600 index last Friday. This development was priced in on Monday, resulting in a substantial jump.

As a crypto investor, I’m excited to share that Marathon Digital, the largest Bitcoin miner by market cap, experienced a significant surge during Monday’s trading session. Specifically, MARA shares jumped by an impressive 17.98%. This upward trend marks an extended recovery for MARA, drawing it nearer to the $20 mark and effectively reversing more than 90% of its losses in April.

Bitcoin miner joins S&P 600

Following its addition to the S&P 600 index last Friday, Marathon Digital experienced a significant one-day surge in its stock price. The S&P 600 is a market cap-weighted index that represents the smallest publicly traded U.S companies.

As a researcher, I’ve uncovered an intriguing occurrence in the financial markets. Last Friday, following the market close, there was a significant development that didn’t reflect in stock prices until Monday. This jump in prices can be attributed to this previously unpriced event. The S&P 600, or SmallCap 600 index, is home to companies with a market capitalization ranging from $1 billion to $6.7 billion. To become a part of this index, firms must not only meet the size requirement but also report positive earnings for the last four consecutive quarters.

Following the rally on Monday, Mara’s market capitalization stood at $5.64 billion. Upcoming in the calendar is their Q1 earnings report, set for May 9th. Their position on the index hinges upon their future reported earnings during this quarter.

Although MARA experienced a rise in May following a downturn on Mondays, its year-to-date (YTD) decline amounted to 9.86% at the time of reporting. Interestingly, many other mining stocks, such as Riot Platforms and Hut 8, have suffered double-digit percentage losses YTD.

Instead of just earning rewards through mining, which were reduced by half post-halving, Bitcoin miners now heavily depend on transaction fees as another significant source of income.

As a researcher studying the cryptocurrency market, I can share that an intriguing development unfolds with Marathon Digital Holdings (MARA) joining the S&P 600 index. This event signifies another significant milestone for Bitcoin-associated publicly traded companies. For me, this means increased exposure and potential to draw in more investors towards Marathon Digital. The mining ecosystem is poised to benefit from this boost in interest.

Despite BTC finishing the trading day in the negative on Monday when Marathon Digital rallied, it remains to be seen how Bitcoin will respond to Marathon’s quarterly earnings report due out on May 9th.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- SOL PREDICTION. SOL cryptocurrency

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- SUI’s price hits new ATH to flip LINK, TON, XLM, and SHIB – What next?

- Sacha Baron Cohen and Isla Fisher’s Love Story: From Engagement to Divorce

- Michelle Trachtenberg’s Mysterious Death: The Unanswered Questions

- PGA Tour 2K25 – Everything You Need to Know

2024-05-07 23:03