-

Miners have added 153,000 BTCs to their OTC reserve in the last three months.

BTC’s price trend has remained slightly bearish.

As a seasoned analyst with a wealth of experience in tracking the cryptocurrency market, I can confidently say that the recent surge in Bitcoin miner OTC reserves is a cause for concern. Historically, such spikes have not boded well for Bitcoin’s price trend, and this time seems to be no exception.

A recent examination shows that the Bitcoin miner’s Over-The-Counter (OTC) stockpile has reached a multi-year peak.

Over the years, increases in this specific indicator haven’t usually led to positive developments in Bitcoin’s value, and it seems that this pattern persists, as Bitcoin has encountered considerable difficulties in the last few weeks.

Bitcoin miner OTC spikes

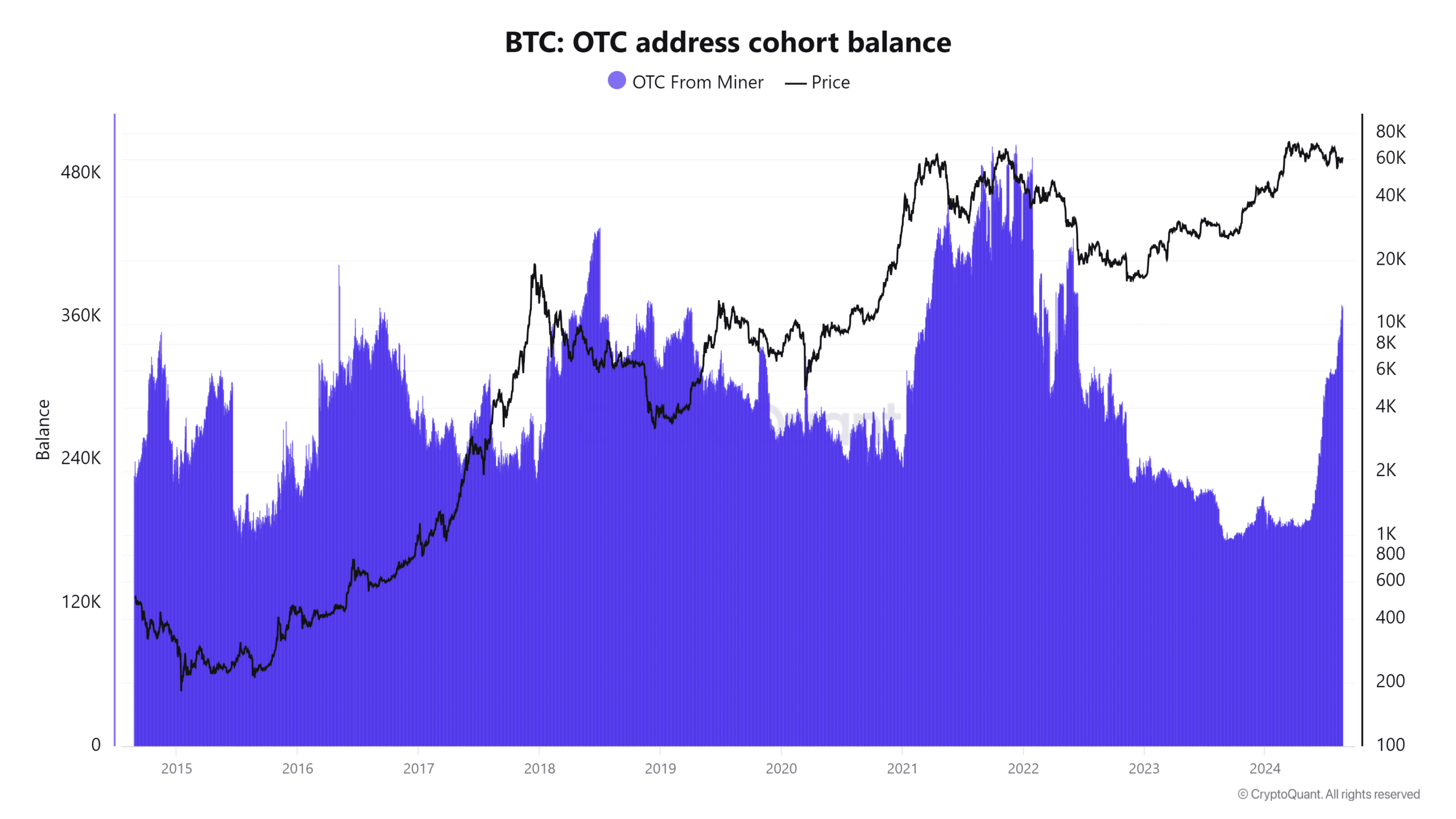

Recent data from CryptoQuant reveals that the Bitcoin Miner OTC reserve has surged to its highest level since 2022.

The data showed that over the past three months, the reserve has increased by more than 70%. It climbed from 215,000 BTC in June to 368,000 BTC in August, which was a significant rise of 153,000 BTC.

Miners often resort to over-the-counter deals to prevent significant trades from causing unfavorable price fluctuations in the market.

On the other hand, a study of past events suggests that despite employing this strategy, Bitcoin’s price has often been affected by significant expansions in Over-the-Counter (OTC) reserves.

How price has responded

Back in May 2018, when the Bitcoin Miner OTC desk holdings exceeded 400,000 Bitcoins, the value of a Bitcoin was approximately $8,475. However, by December 2018, the price had plummeted by 63%, dropping to $3,183.

In November 2021, a situation akin to what we’re seeing now took place with Bitcoin. The price of Bitcoin was around $64,000, and the total holdings of miners at OTC desks peaked at nearly half a million Bitcoins, which was a record high.

In approximately two months from now, around January 2022, the value of Bitcoin dropped by a substantial 45% and settled at $35,058. The past demonstrates that large fluctuations in Over-the-Counter (OTC) balances can exert a considerable influence on Bitcoin’s market price.

An escalation in Over-The-Counter (OTC) reserves might indicate that miners are preparing to sell, thereby adding to the difficulties in preserving market price equilibrium.

Unfavorable market, leading to sell-offs

The fluctuating prices in the Bitcoin market right now have significantly boosted the accumulation of miners’ Over-The-Counter reserves, which had already been rising.

Furthermore, following the latest halving event that reduced miner rewards, some miners have been forced to liquidate part of their Bitcoin holdings in order to capitalize on their earnings.

Compounding this issue is the recent increase in mining difficulty.

As the increased complexity is weighed against the lower transaction costs, it’s apparent that Bitcoin mining is yielding fewer profits. Consequently, miners are forced to sell off a larger portion of their holdings.

At present, Bitcoin’s value stands around $61,000, marking a rise of more than 1%. If this positive trend continues…

If so, the profitability of Bitcoin Mining could find a balance, making it more advantageous for miners during these difficult times.

Keeping a steady increase in prices can potentially balance out the current challenges brought by rising mining complexities and decreased transaction fees.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-08-23 20:08