So, public bitcoin miners decided to play a game of “let’s sell 40% of our mined BTC” in March. Because, you know, who needs financial stability when you can have a dramatic exit? 🎭

Mining Firms Go Liquidation Crazy to Keep the Lights On! 💡

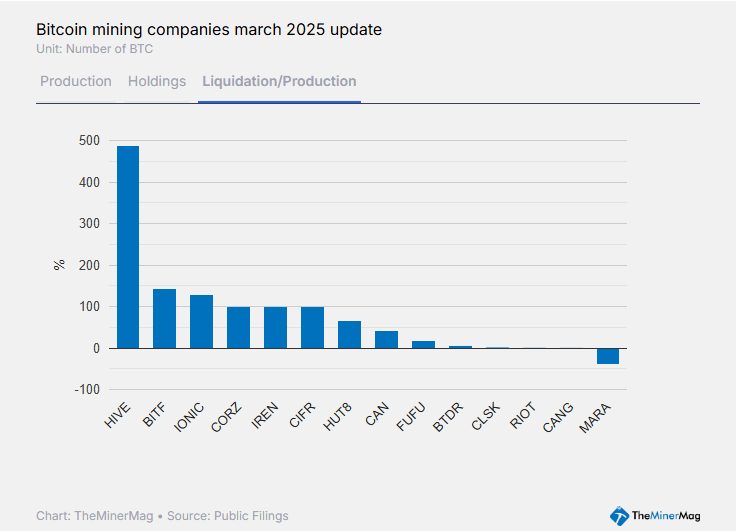

In a shocking twist, public bitcoin mining companies have resumed their heavy selling spree in March, offloading over 40% of their monthly BTC output. This is the highest liquidation rate since October 2024. Talk about a plot twist! 📉

According to theminermag.com, this shift comes after a few months of hoarding, reflecting the growing financial strain. Apparently, low hash prices and global trade tensions are not the best friends of miners. Who knew? 🤷♀️

Remember the post-election rally in late 2024? Miners were all like, “Let’s hold onto our BTC!” But now, with the market down about 20% and block fees plummeting to a staggering 1.1%, it seems they’ve decided to cash out. Because liquidity is the new black! 💁♂️

Not to be outdone, miners like Cleanspark are now selling bits of their monthly production to cover operational costs. Meanwhile, HIVE, Bitfarms, and Ionic Digital are reportedly selling more than 100% of their March production. Are they drawing from reserves or just really good at borrowing? You decide! 🤔

And while all this chaos unfolds, capital-intensive moves like ASIC upgrades and data center expansions are still happening. Because why not bet on long-term growth while juggling short-term pressures? 🎪

Some firms have stopped monthly disclosures, but the data available shows a clear trend: miners are tightening their belts and using every available BTC to stay in the game. It’s like a reality show, but with more spreadsheets! 📊

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2025-04-16 23:30