- Bitcoin miners exiting the cycle may signal a market bottom, paving the way for fresh interest

- And yet, specific conditions must align for a confirmed bull rally

As a seasoned analyst with years of observing and interpreting market trends, I find myself intrigued by the recent developments in Bitcoin’s price dynamics. The mass exit of miners from the cycle might indeed signal a potential market bottom, but it’s important to remember that markets don’t always follow textbook patterns.

For a week, Bitcoin [BTC] experienced a bearish drop, dipping below the $61,000 mark from its prior resistance at $65,000. Yet, as we speak, there appears to be growing optimism in the market, with the cryptocurrency hovering around $62,000.

During the second week of the fourth quarter, there may be a period of adjustment in prices, with many investors choosing to sell off their profits and depart the market. This group includes miners who have been gradually selling their Bitcoin holdings as the price approaches $62,000.

Yet, if the bottom resources are not entirely depleted, it could prove challenging for bulls to sustain a steady rise.

Miners’ exit may hint at a market bottom

On a day-to-day graph, Bitcoin’s weekly fluctuations mimicked its behavior from mid-August, where a refusal at approximately $65,000 paused a possible bull market surge.

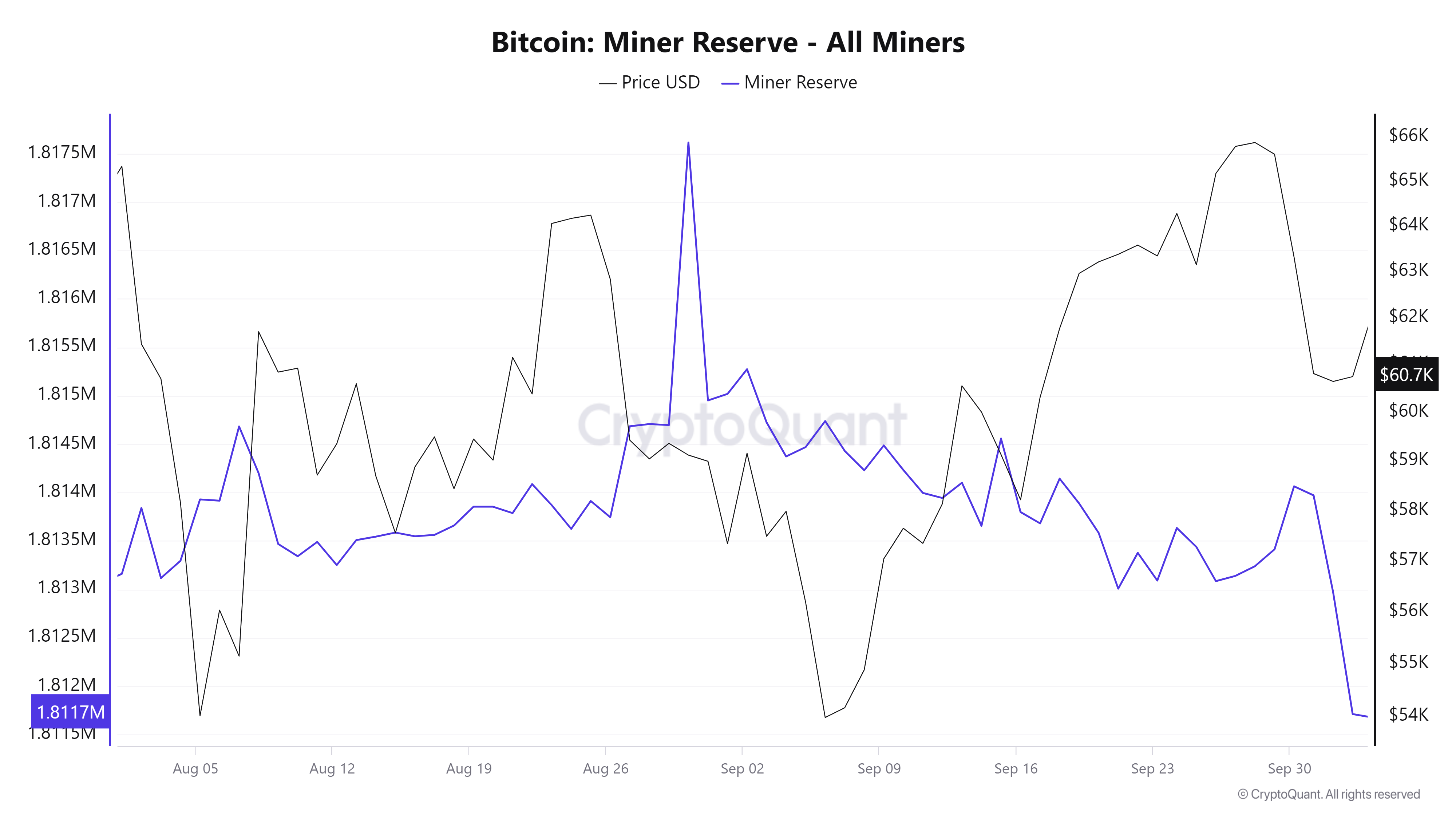

During that period, the miners ended their cycle following five straight days of price decrease, resulting in a reduction in their holdings from 1,817,000 units to 1,814,000 units.

Source : CryptoQuant

A similar trend was seen recently too. Over the past week, as Bitcoin retraced from $65k to $60k, miner reserves noted a significant decline, dropping from 1.814M to 1.811M at press time.

Generally speaking, when less experienced or smaller investors exit the market, it usually results in a more steady market environment. This is because larger, more skilled investors have the opportunity to buy assets at lower costs due to reduced competition.

If the current trend persists, miners making their costs back might indicate a possible lowest point for the market. With weaker investors exiting to cash in on their gains, this situation could offer strong potential for new buyers to make strategic purchases during a price drop.

But to initiate a bullish trend, it’s essential that the price level of around $61k strengthens as a support. Miner sell-offs could serve as confirmation for this support, but there are other factors that need to fall into place as well.

LTHs have confidence in Bitcoin bulls

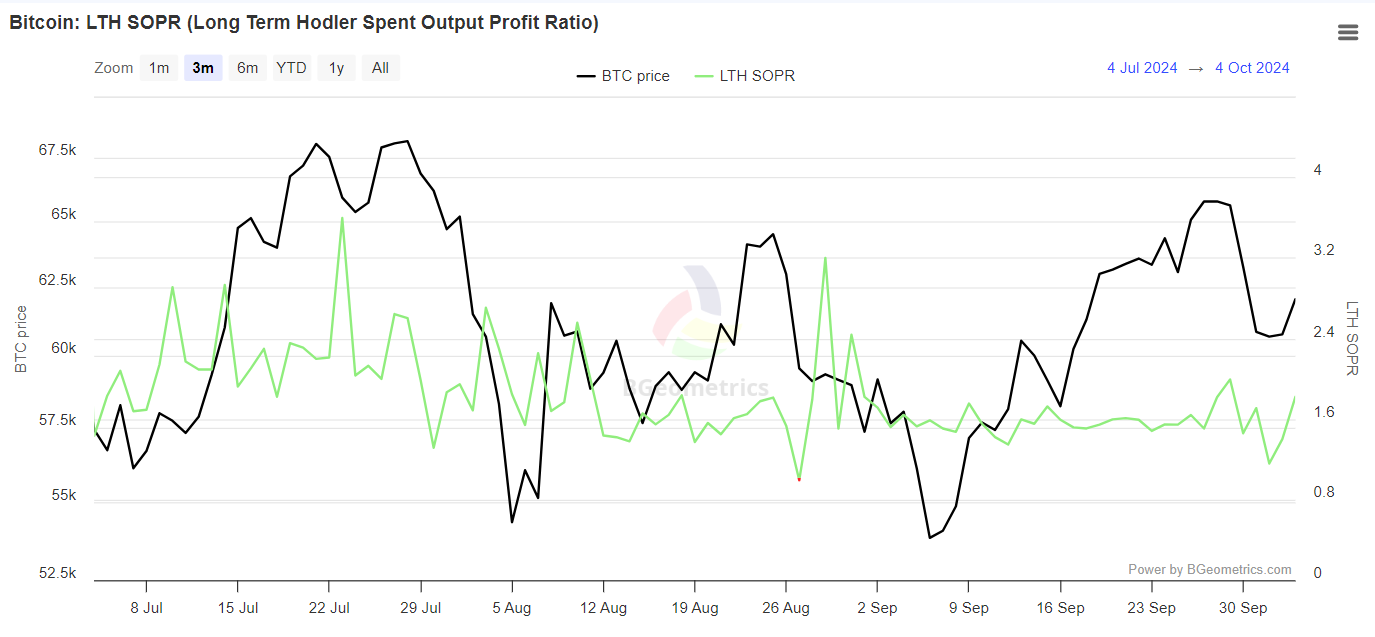

Instead of miners choosing to sell at a loss due to the fear of market decline, it seems that investors who have held Bitcoin for over 155 days are opting to sell at a profit.

The LTH SOPR recently made a higher high. Historically, such movements have driven positions into FOMO and fueled expectations for future gains in the next cycle.

Source : BGeometrics

As a crypto investor, I find myself in a position where a temporary price drop appears imminent, given that long-term holders (LTHs) may choose not to panic sell. This potential correction could pave the way for the current resistance level at $61k to be transformed into support. Once this occurs, bullish investors will then aim to breach the next resistance at $64k.

From my perspective as an analyst, the dip of Bitcoin from $65,000 down to $60,000 played a crucial role in thinning out the hands of less resilient investors, thus setting the stage for $61,000 to become the new support level.

As someone who has been investing for over a decade, I can confidently say that market declines often serve as a crucial filtering process for investors. During such times, those with less commitment or weaker conviction in their investments tend to sell off, leaving room for more dedicated and resilient investors to accumulate positions. This experience has taught me the importance of staying patient and focused during turbulent market conditions, as it presents opportunities to build a stronger investment portfolio over the long term.

As an analyst, delving deeper into the data, I aimed to discern whether the latest surge was a genuine market rally or merely a consequence of a short squeeze.

BTC longs are regaining control

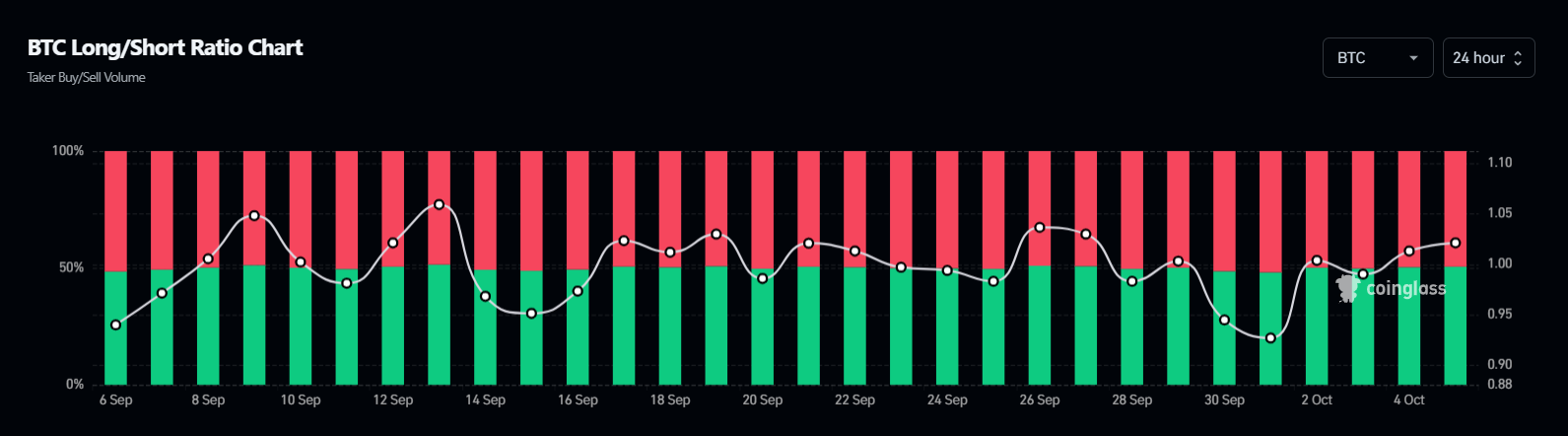

For the last four days, long investments have taken control in the derivative market, making it challenging for those who were betting on a decrease (short sellers) in Bitcoin’s price to do so effectively.

Source : Coinglass

This development suggests buyers are gaining strength, which in turn forces sellers (shorts) to close their positions, resulting in extensive liquidations.

Consequently, it doesn’t completely exclude the possibility of a short-squeeze situation, yet it might provide an opportunity for a bullish turnaround, sparking enthusiasm among investors.

Read Bitcoin’s [BTC] Price Prediction 2024-25

In summary, with $61,000 serving as a solid foundation and a fresh wave of optimism among long-term investors, it seems the bullish sentiment will maintain $62,000 as the immediate target. This could potentially trigger a surge aiming for $64,000.

However, for this to materialize, closely monitoring short sellers is essential.

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

2024-10-05 18:16