- Miners are facing one of the steepest declines in revenue in years.

- Reports suggested that the energy generated could be put to better use for more revenue.

As a seasoned analyst with years of experience navigating the volatile crypto markets, I find the potential for Bitcoin miners to tap into the AI sector intriguing and timely. Miners have been grappling with a steep revenue decline due to various factors, and this opportunity could serve as a much-needed lifeline for many struggling operations.

Over the last several months, Bitcoin miners have seen a substantial drop in their income, reaching profit levels not seen in years, which is quite low.

As a crypto investor, I’ve been keeping an eye on the fluctuations in the market, and it’s clear we’re facing some challenges. Yet, there seems to be a silver lining: Bitcoin miners might be able to mitigate these setbacks by embracing Artificial Intelligence (AI). This could potentially transform our mining operations for the better.

Bitcoin Miners could generate additional revenue, says VanEck report

Due to several reasons such as decreased Bitcoin values, more complex mining processes, and escalating operational expenses, Bitcoin miners are experiencing a drop in their earnings.

On the contrary, a fresh insight from VanEck proposes that miners might counterbalance their losses by partly shifting towards the Artificial Intelligence (AI) sector.

The report indicates that Bitcoin miners have access to the energy systems that are highly sought after by the AI and high-performance computing industries due to their urgent needs.

As a researcher, I find it compelling to propose that by strategically reallocating some of their resources towards bolstering these sectors, miners might be able to boost their annual earnings up to an estimated $13.9 billion by the year 2027.

According to the VanEck report, this transition could significantly impact mining companies, as numerous ones are grappling with unstable financial conditions. Often, these difficulties originate from excessive borrowing, excessive share issuance, high executive pay packages, or a mix of these issues.

Expanding into artificial intelligence (AI) might significantly enhance the profitability and longevity for mining operations.

Bitcoin miner sees revenue decline

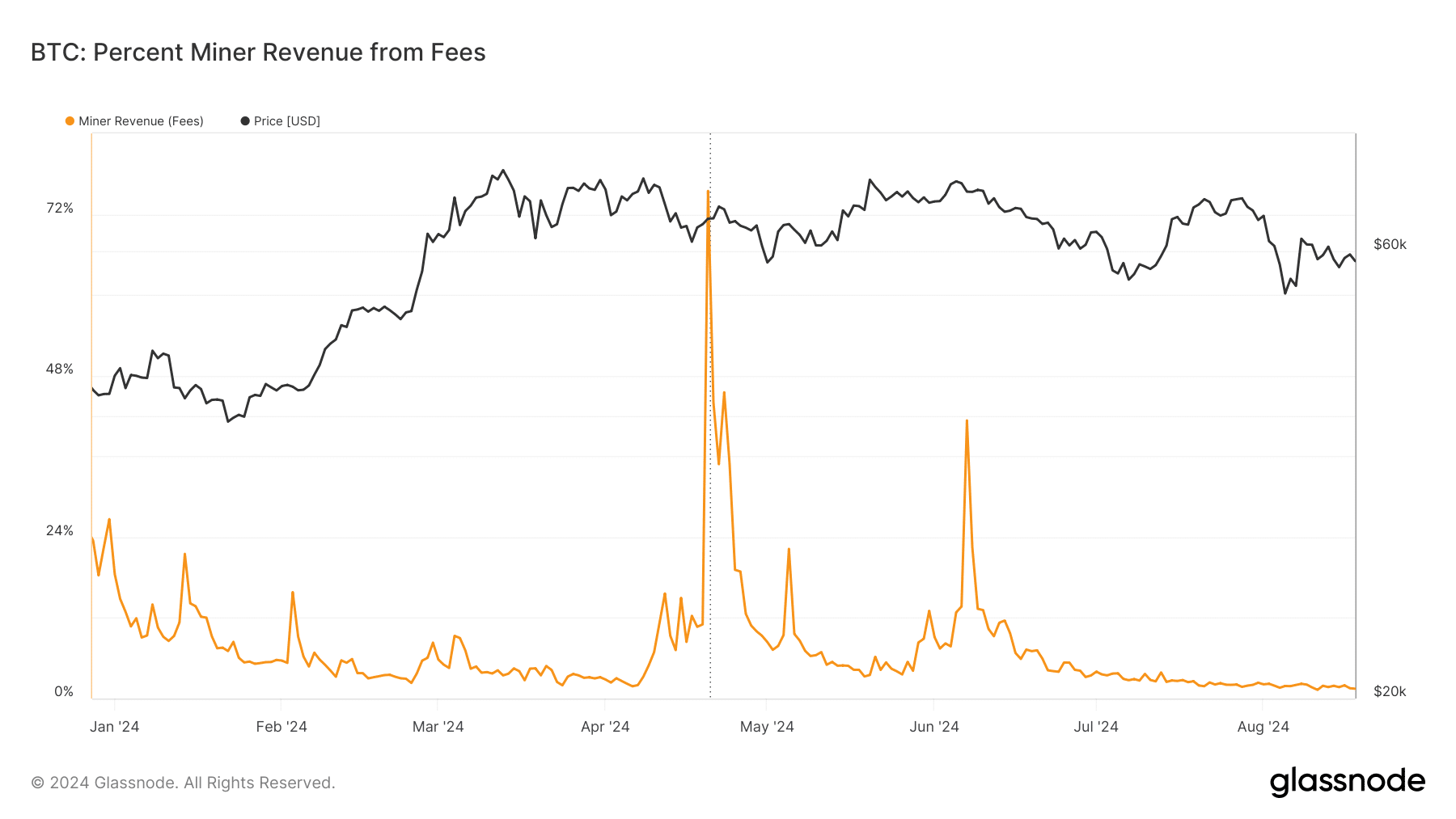

2024 saw Bitcoin mining revenue exhibit considerable volatility, marked by substantial surges in the last weeks of April and early May, as well as in June. (Glassnode’s latest analysis)

Between late April and early May 2024, miner income increased more than 70% and then experienced a considerable jump again in June 2024, peaking around 40%.

Following these high points, the graph indicates a significant drop in mineral revenue, down to approximately zero percent.

This sharp decline underscores a critical challenge for Bitcoin miners: their heavy reliance on block rewards for the majority of their income.

Since the portion of income coming from transaction fees is usually quite small, often less than 10%, miners primarily rely on block rewards to keep their mining activities running smoothly.

Using block rewards as the primary source of income could potentially carry a substantial long-term risk, as these rewards are programmed to be cut roughly in half about once every four years within Bitcoin’s monetary policy framework.

Bitcoin price struggles below $60,000

Currently, a single Bitcoin (BTC) is being traded around $58,600, showing a minor rise of almost 1% compared to earlier values. It’s worth noting that historically, the value of Bitcoin has shown a significant link with the earnings made by Bitcoin miners.

At the moment, Bitcoin is finding it tough to surpass the psychological threshold of $60,000, a level it’s been struggling to exceed over the past few weeks.

Read Bitcoin (BTC) Price Prediction 2024-25

The ongoing difficulty in surpassing this key level is compounded by bearish market sentiment.

A look at Bitcoin’s Relative Strength Index (RSI) shows that it falls below the neutral threshold, suggesting the market continues to exhibit a downtrend or bearish condition.

Read More

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- The Weeknd Shocks Fans with Unforgettable Grammy Stage Comeback!

- Taylor Swift Denies Involvement as Legal Battle Explodes Between Blake Lively and Justin Baldoni

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Lilo & Stitch & Mission: Impossible 8 Set to Break Major Box Office Record

- Disney Cuts Rachel Zegler’s Screentime Amid Snow White Backlash: What’s Going On?

- We Ranked All of Gilmore Girls Couples: From Worst to Best

2024-08-20 08:08