- Bitcoin miners face a dilemma as they incurred their lowest mining rewards in the month of August, squeezing their profits.

- However, a strategic approach could help them navigate these challenges.

As a seasoned analyst with over two decades of experience in the cryptocurrency market, I’ve seen the ebb and flow of digital assets like Bitcoin more times than I can count. The current situation facing miners is indeed challenging, but it’s not the first time we’ve encountered such turbulence.

In simple terms, during the closing days of August, Bitcoin’s price saw significant ups and downs, moving between approximately $64,000 and $57,000. Currently, its value stands at $58,385.

Bitcoin’s price is attempting to break through the $64K threshold, but this surge comes at a time when Bitcoin miners are experiencing their lowest earnings for the year. This represents the poorest performance in over 11 months.

As a result, AMBCrypto examined if the significant decrease in Bitcoin rewards could prompt miners to withdraw from the market instead.

August brings Bitcoin miners’ lowest revenue

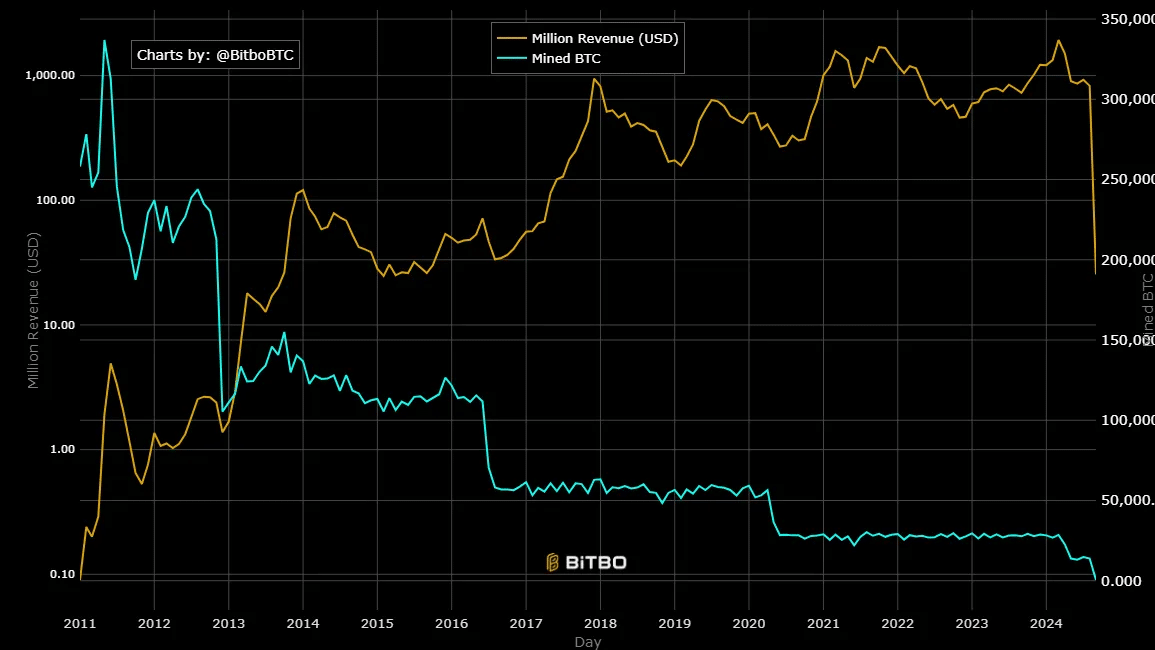

In August, Bitcoin miners experienced a dip in earnings, marking their lowest revenue-producing month since September 2023, due to a substantial decrease in the number of coins they mined.

Furthermore, because Bitcoin mining is expensive to run, if the earnings do not offset these costs, miners could be forced to give up or scale back their operations.

Based on AMBCrypto’s examination of the provided chart, it appears that miner income dropped to approximately $820 million in August. This decrease represents more than 10% compared to the revenue of $927 million recorded in July.

Source : BitBo

Notably, the August figure signifies a 57% drop compared to the record-high $1.93 billion in March, the month when Bitcoin hit an all-time high (ATH) of around $73,000.

This showed a big drop in mining revenue despite Bitcoin’s high price earlier in the year – But why? AMBCrypto investigated.

After the Bitcoin halving in April, which cut down the block rewards to 3.125 Bitcoins per block, the mining difficulty experienced a significant surge.

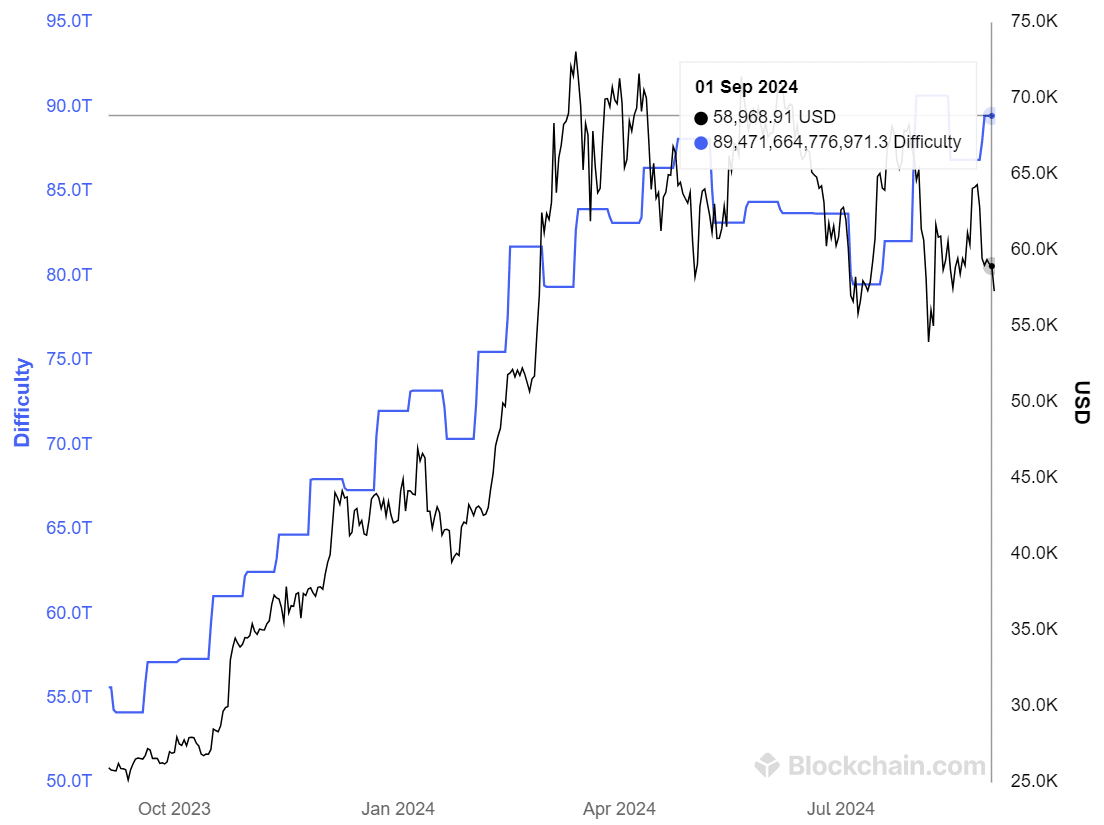

Source : Blockchain.com

Consequently, the mining difficulty reached a record peak of 89.47 trillion in August, marking a 3% increase over its previous level of 86.87 trillion in July.

As an increasing number of Bitcoin miners join the network, validating transactions becomes increasingly challenging, leading to a decrease in the amount of coins mined and ultimately reducing the earnings from mining.

To put it simply, the increasing mining complexity, largely due to the Bitcoin halving, has noticeably reduced miners’ profits. As a result, some Bitcoin miners might be considering withdrawing from the industry.

Miners strategic positioning counters short-term volatility

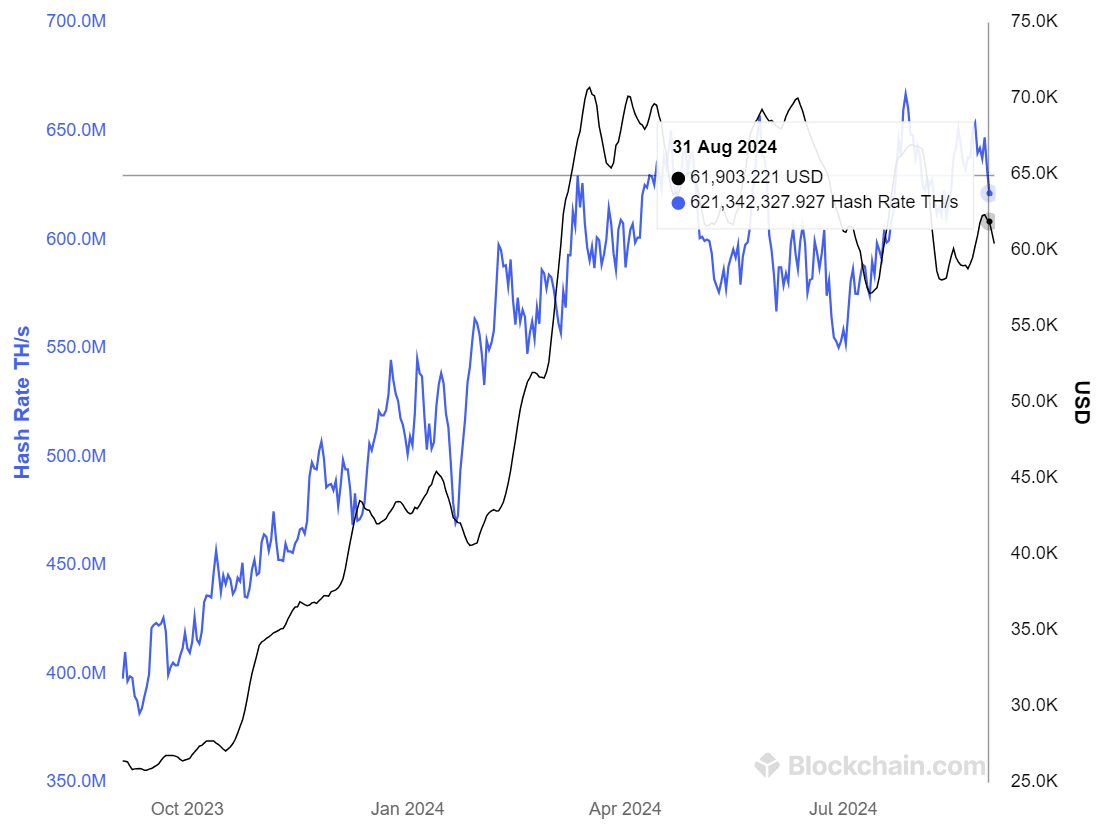

In layman’s terms, the hash rate represents the collective computing power that’s being employed for mining and verifying transactions across the Bitcoin network.

If this figure drops significantly, it can be an indicator that miners are leaving the network.

Source : Blockchain.com

The graph demonstrates an intriguing pattern: every time Bitcoin (BTC) approached a significant resistance point, the mining activity (hash rate) noticeably increased as well.

Based on AMBCrypto’s report, it appears that miners showed increased interest or enthusiasm towards possible price fluctuations.

Over the past week, there’s been a significant decrease in the hash rate. It started at 667 million and dropped to 620 million, which represents a fall of approximately 7%.

As a crypto investor, I’ve noticed a shift in mining activities that seems to be influenced by the evolving conditions within the market. It could very well be because of the reduced rewards, which might have prompted miners to adjust their strategies accordingly.

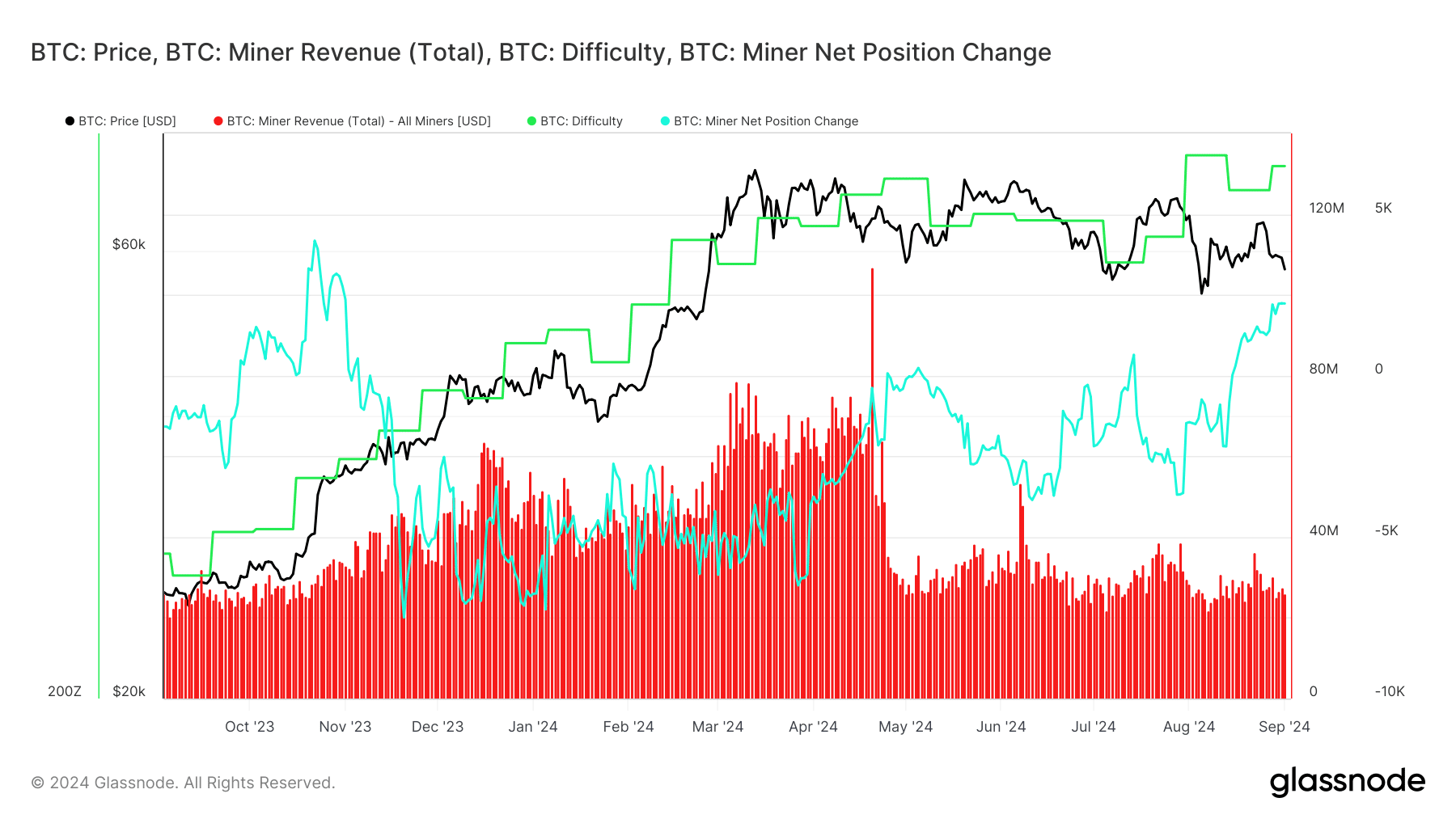

Contrarily, the shift towards a positive net position for Bitcoin miners occurred from mid-August onwards, even though they experienced a reduction in their rewards.

Source : Glassnode

This suggests that despite a decrease in mineral rewards, miners are now hoarding more Bitcoin instead of offloading it.

Moreover, AMBCrypto points out that miners could potentially be taking a strategic approach by amassing Bitcoin when the prices are comparatively lower.

Read Bitcoin’s [BTC] Price prediction 2024-25

As a crypto investor, even amidst tightened profit margins, I remain optimistic about Bitcoin’s future returns, as evidenced by the overall positive shift in sentiment.

In the future, such high confidence might result in an escalation of mining complexity, which could in turn lower miner rewards drastically.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Solo Leveling Arise Tawata Kanae Guide

2024-09-03 07:04