- Bitcoin’s post-halving price struggles highlighted market volatility and challenges in surpassing $60,000.

- Mining profitability has dropped significantly, despite increased hashrate and equipment efficiency improvements.

As a seasoned crypto investor with a decade of experience navigating these digital waves, I find myself both intrigued and concerned by the current state of Bitcoin (BTC). The post-halving price struggles have been a rollercoaster ride, with the $60,000 mark proving to be an elusive summit.

It appeared that the predicted influence of Bitcoin’s [BTC] fourth halving, which some believed would push its price to record levels, was realized when Bitcoin exceeded $70,000 in March, reaching a new peak.

However, recent developments reveal a different story.

In my recent analysis, I’ve observed that Bitcoin (BTC) is finding it challenging to uphold its pace as per the latest CoinMarketCap update. Currently, BTC is being traded at approximately $58,629, representing a 2.41% decrease in its value over the past 24 hours.

Bitcoin miners struggle post-halving

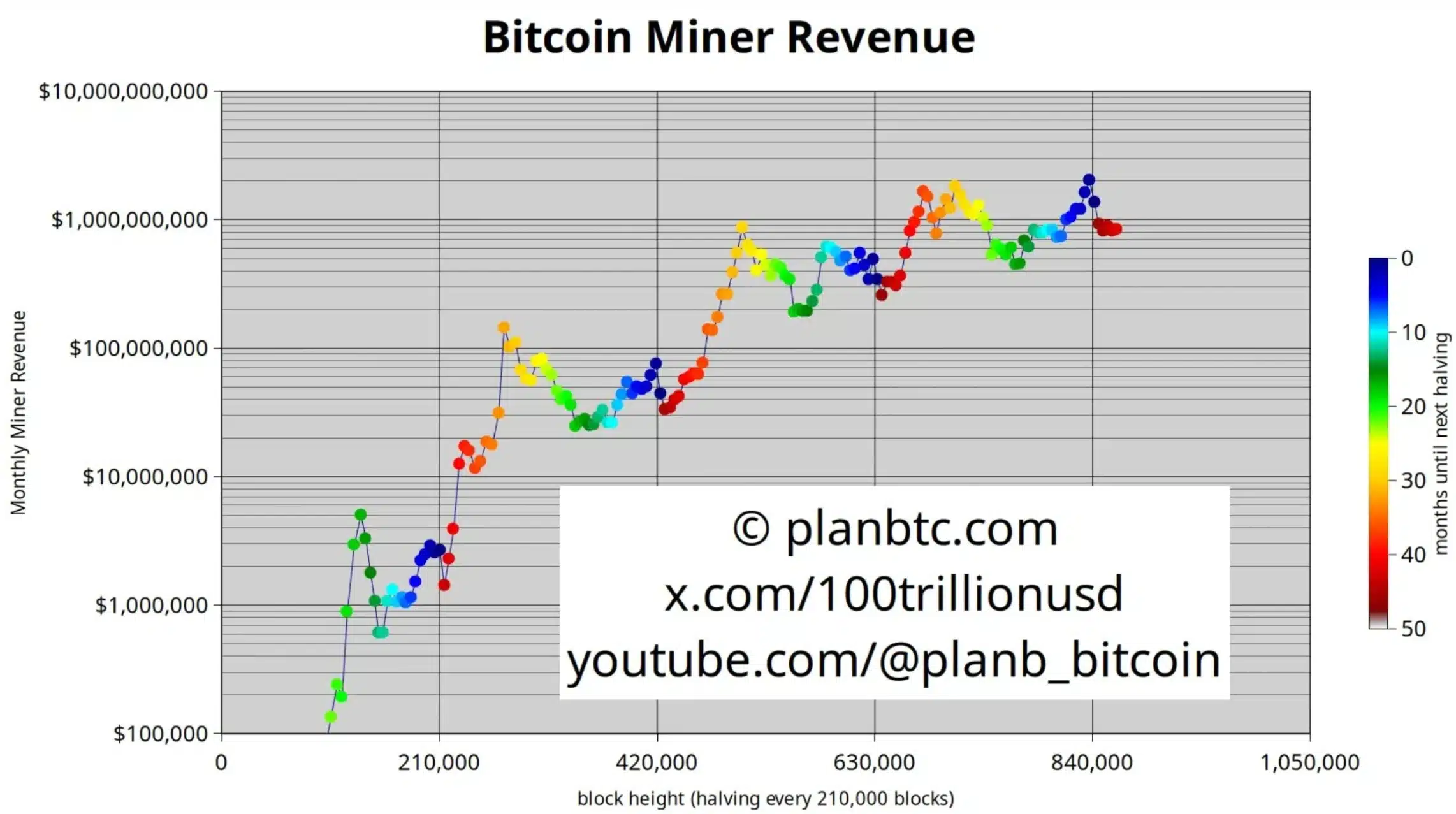

After the latest Bitcoin halving event, miners have faced several unique hurdles. Notably, PlanB, the inventor of the BTC Stock-to-Flow (S2F) model, shed light on these difficulties on platform X and emphasized their significance.

“Despite the mining community continuing to grapple with the repercussions of the halving, a doubling of the current Bitcoin price could potentially ignite another bullish market surge.

In addition to the existing difficulties, it’s worth noting that the profitability of cryptocurrency mining experienced a substantial decline in August, as pointed out by investment bank Jefferies in a recent CNBC report.

Based on Jefferies’ findings, the typical daily earnings per miner, calculated per exahash, dropped by approximately 11.8% compared to the last month.

This drop underscores the growing financial pressures faced by miners amidst fluctuating market conditions and rising operational costs.

Based on a study by AMBCrypto using data from IntoTheBlock, it appears that the compensation for Bitcoin miners has significantly dropped.

In the 2020 halving, miners were awarded 7,010 BTC, valued at approximately $75.99 million.

Consequently, during the ongoing 2024 halving event, the Bitcoin reward has dropped significantly to approximately 471.88 BTC, which translates to roughly $28.1 million.

This significant decrease clearly shows how financially challenging it is for miners, given the ongoing changes in market circumstances.

Hashrate sees a rise

However, BitcoinMiningStockGuy added,

“And Hashrate is still rising. Bullish.”

The increase in Bitcoin’s hashrate, as evidenced by AMBCrypto’s examination of IntoTheBlock data, provides additional support for this trend.

2020 saw the hashrate at approximately 140.93 million terahashes per second, but by 2024, this figure had significantly increased to around 695.84 million terahashes per second.

This substantial increase underscores the heightened rivalry and growing need for greater computational capabilities within the mining industry.

What’s the solution?

To improve their operational efficiency in light of decreased profits, North American public mining companies are making significant investments in updating their machinery and equipment.

Newer machines can now double their hashing power compared to older models, all while maintaining the same energy consumption levels.

In simple terms, according to Marathon CEO Fred Thiel, this update phase is significant because it aids in counterbalancing the worsening economic challenges faced within the mining industry.

“No need to add sites or power, just upgrade systems.”

However, not all miners are facing hardship equally.

To give an example, following its emergence from bankruptcy earlier in the year, Core Scientific has effectively transformed its vast resources into a platform for artificial intelligence and advanced computing (HPC), or high-performance computing.

Indeed, with the ongoing advancements in the industry, it’s essential to keep track of emerging strategies that could potentially address profitability challenges and establish fresh standards for success.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- SOL PREDICTION. SOL cryptocurrency

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2024-09-17 07:04