- Some Bitcoin miners are considering strategic alternatives like asset sales post-halving

- Miners “extremely underpaid,” revenues now at lowest levels since late 2022

As a crypto investor with some experience in the market, I’m closely monitoring the developments in the Bitcoin mining industry following the recent halving event. The declining revenues and selling pressure from miners have raised concerns about miner capitulation, which could potentially impact the overall cryptocurrency ecosystem.

🔥 EUR/USD Rollercoaster Ahead After Trump Tariff Plans!

The euro faces intense pressure — shocking forecasts now revealed!

View Urgent ForecastLast month, the long-awaited Bitcoin (BTC) halving occurred. Although its effect on pricing hasn’t been felt yet, it has significantly influenced Bitcoin miners.

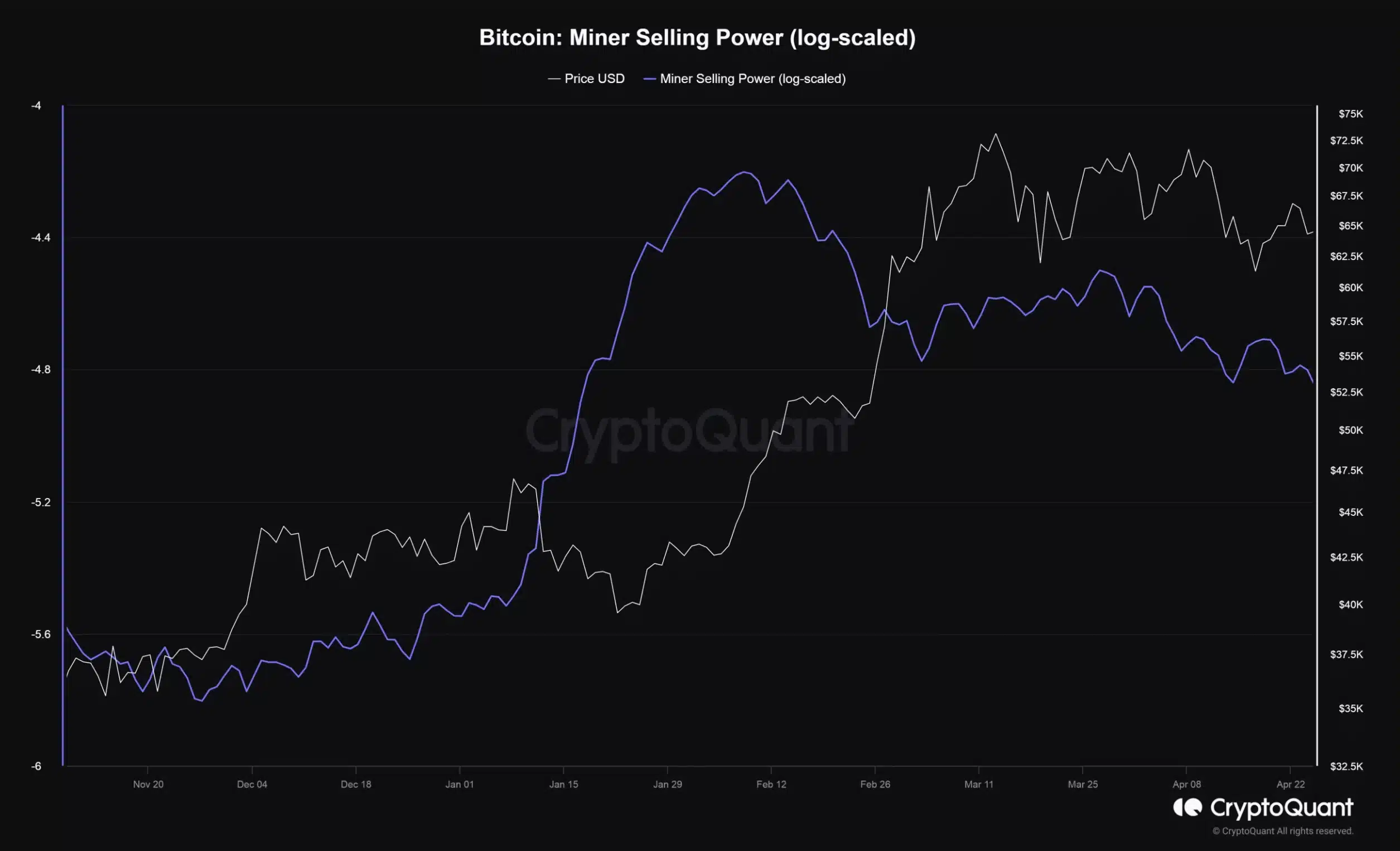

Based on my analysis of the data from CryptoQuant, I discovered that miner selling pressure has significantly decreased following the halving event.

Stronghold’s strategic decisions

As a researcher studying the cryptocurrency market, I’ve noticed the recent downturn in Bitcoin prices causing unease among miners, including major players like Stronghold Digital Mining. Today, Stronghold made headlines by releasing their financial and operational reports for Q1 of 2024.

It’s important to note that the rewards for mining are reduced following each halving event, which might have influenced Stronghold’s strategic planning.

As per a press release report released on 2 May,

The business is exploring various possibilities to boost shareholder worth. These options include, but aren’t limited to, selling the entire or a portion of the company, or engaging in another significant deal that would affect some or all of its assets.

The announcement has generated significant interest, particularly given the possible consequences for miners in the aftermath of the Bitcoin halving.

When numerous cryptocurrency miners decide to halt or decrease their mining operations, this is referred to as a miner capitulation. Factors such as extended slumps in cryptocurrency prices or surging operational costs may prompt this decision.

Stronghold’s potential for growth

Highlighting Stronghold’s solid market footing and promising opportunities for expansion and variation, Greg Beard, Stronghold’s Chairman and CEO, remarked.

Based on our analysis, there appears to be a discrepancy between Stronghold’s market value and the valuations of its publicly traded Bitcoin mining peers, merchant power companies, and data center and power generation assets.

In the first quarter of 2024, the company experienced a substantial gain in revenue, representing a 27% rise from the previous quarter and a remarkable 59% leap compared to the same period the previous year. The total revenue reached an impressive $27.5 million.

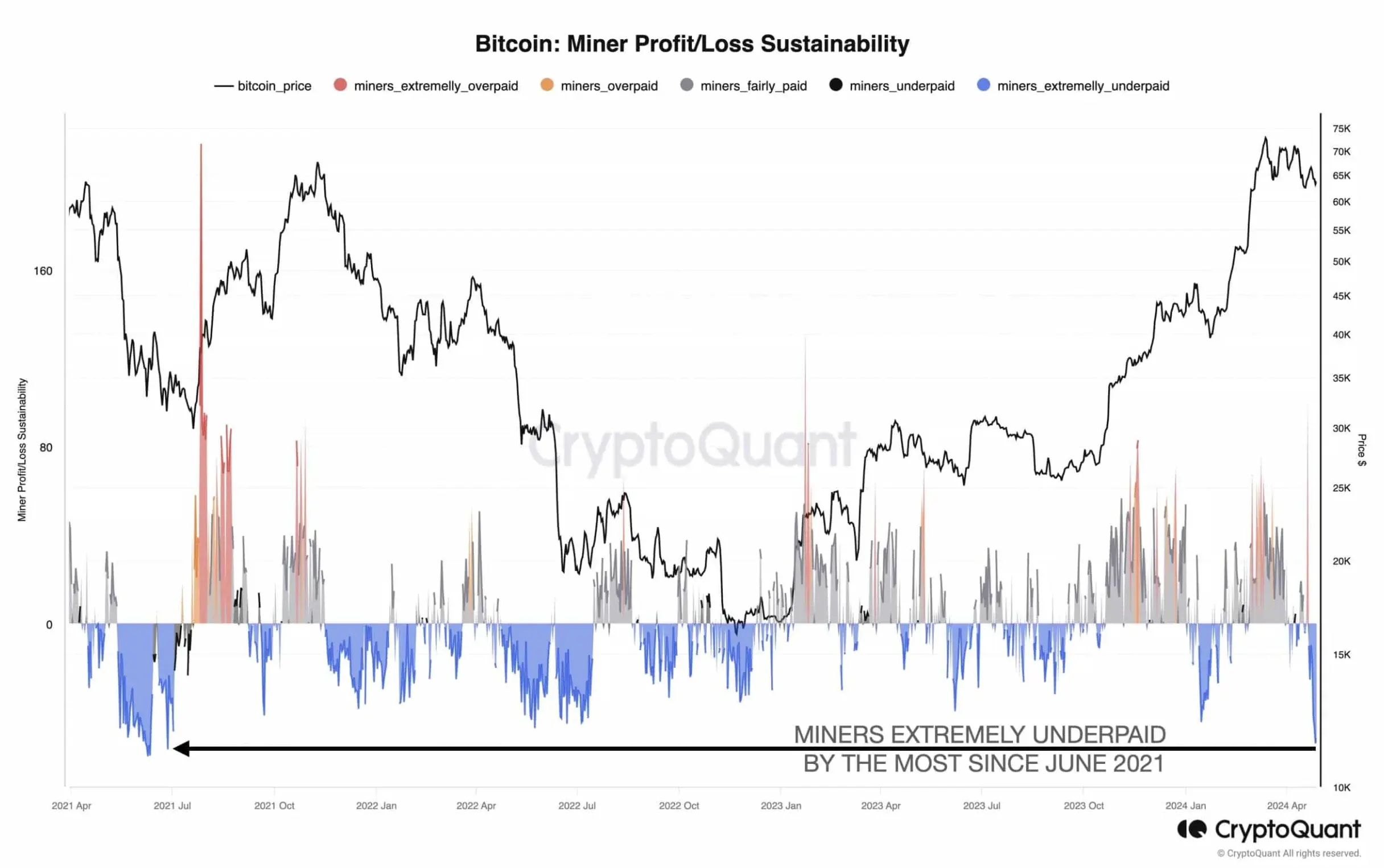

As a curious crypto investor, I’ve been pondering over some intriguing insights from Julio Moreno, the insightful Head of Research at CryptoQuant, an esteemed on-chain analytics firm. By examining historical trends, Julio has shed light on some compelling comparisons that could provide valuable context for current market conditions.

Bitcoin miners are currently earning very little, with daily revenues at their lowest point since November 2022. The profitability of mining operations has become a real struggle for many, reaching its lowest mark since June 2021.

As a crypto investor, I’ve observed that the reward I’m receiving for adding new blocks to the blockchain has been less than what it should be, considering the current mining difficulty. Moreover, my daily revenue from mining has been disappointing lately, as depicted in the charts.

As a researcher studying the impact of Bitcoin’s halving events on mining operations, I found that each halving event reduces miner rewards by half. Consequently, miners must double their investment to maintain their previous profit levels and break even. This poses significant challenges for smaller miners who may struggle to afford the increased costs, potentially leading to some exiting the market.

Way forward

A significant issue arises: What adjustments will miners make to their strategies and bitcoin mining operations to continue providing support, given the reduction in rewards?

Despite current challenges, the Bitcoin halving could result in miners enhancing their efficiency and robustness. With significant players such as Stronghold contemplating new strategies, there’s great anticipation regarding how the mining sector will adapt to these changing circumstances.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

2024-05-03 15:04