-

BTC miners have shown resilience, intensifying the chances at an incoming supply shock.

However, the market bottom remained elusive, reducing the impact of their efforts.

As a seasoned analyst with over two decades of market experience under my belt, I find myself intrigued by the current state of Bitcoin (BTC). The resilience displayed by miners is indeed noteworthy, and their intensified efforts could potentially lead to an incoming supply shock. However, the elusive market bottom has been a recurring theme in this rollercoaster ride we call cryptocurrency, reducing the immediate impact of miner actions.

Over the weekend, Bitcoin (BTC) bulls demonstrated resilience, bouncing back from a drop to $52K. As volatility persists in highly leveraged trades, the support of major investors is growing more vital.

Among the significant investors, some are miners who often choose to either sell off or hold onto their assets during prolonged phases of pessimistic market conditions (bearish sentiment).

Consequently, it’s crucial for a supply shock to occur when certain essential factors line up. Once these conditions are satisfied, there might be a subsequent increase in price as the market’s supply dwindles.

BTC miners support the crunch, while whales retreat

From an economic standpoint, a significant crunch in BTC supply could be a crucial catalyst for a price correction. For a supply crunch to materialize, miners must transition past the distribution phase.

In short, miners offloading less BTC means the supply shock could become more pronounced.

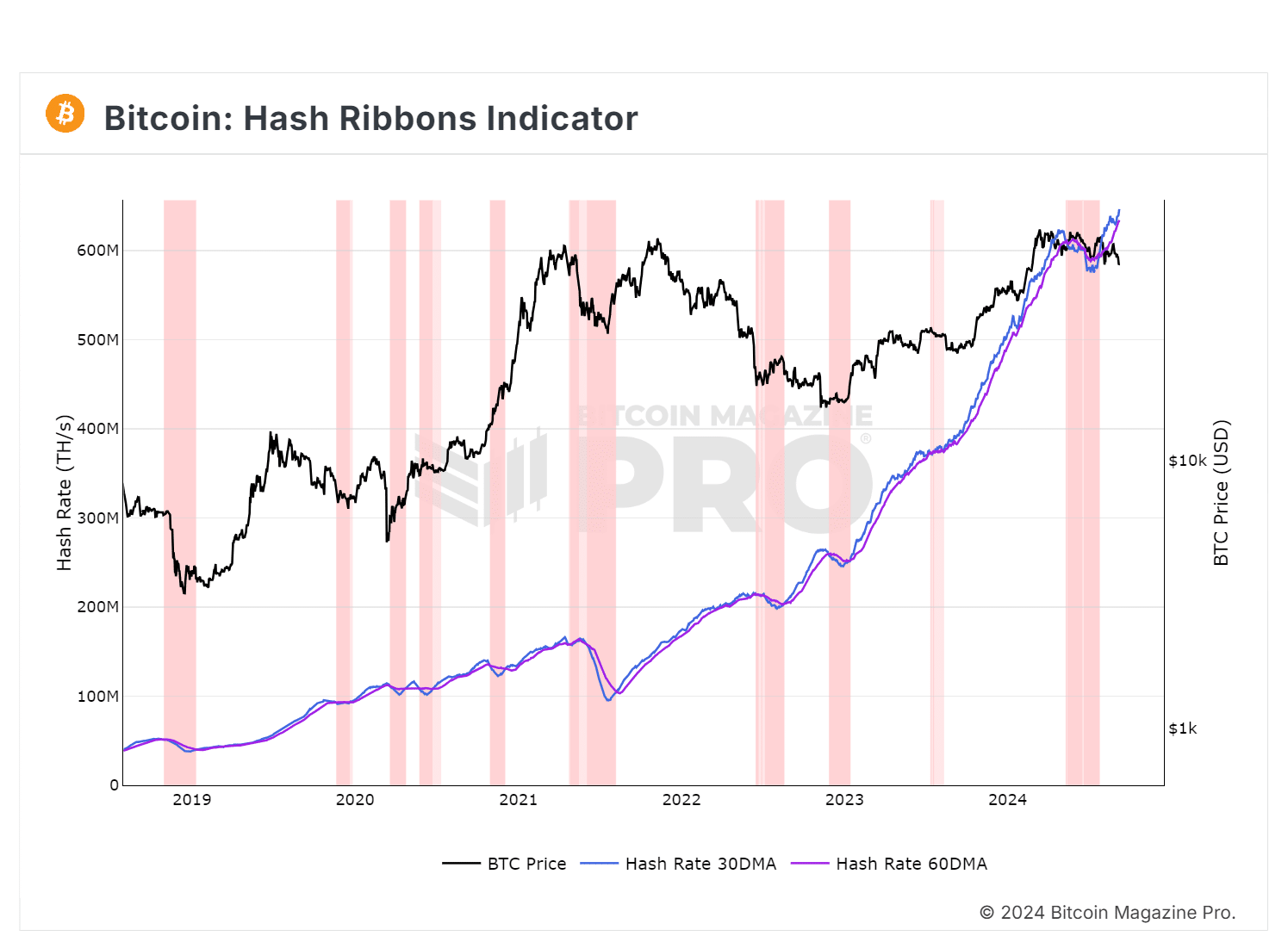

It’s worth noting that the graph shows the 30-day moving average has just crossed over the 60-day moving average, indicating a potential ‘hash ribbon’ buy signal.

Source : Bitcoin magazine Pro

This implies a possible upward trend, strengthening the notion that a price adjustment could be triggered by miners buying more.

Currently, I find myself delving into the world of Bitcoin, where the total circulating amount stands at roughly 19.7 million units. Interestingly, miners are in possession of about 1.8 million Bitcoins, which equates to approximately 9.1% of the entire supply.

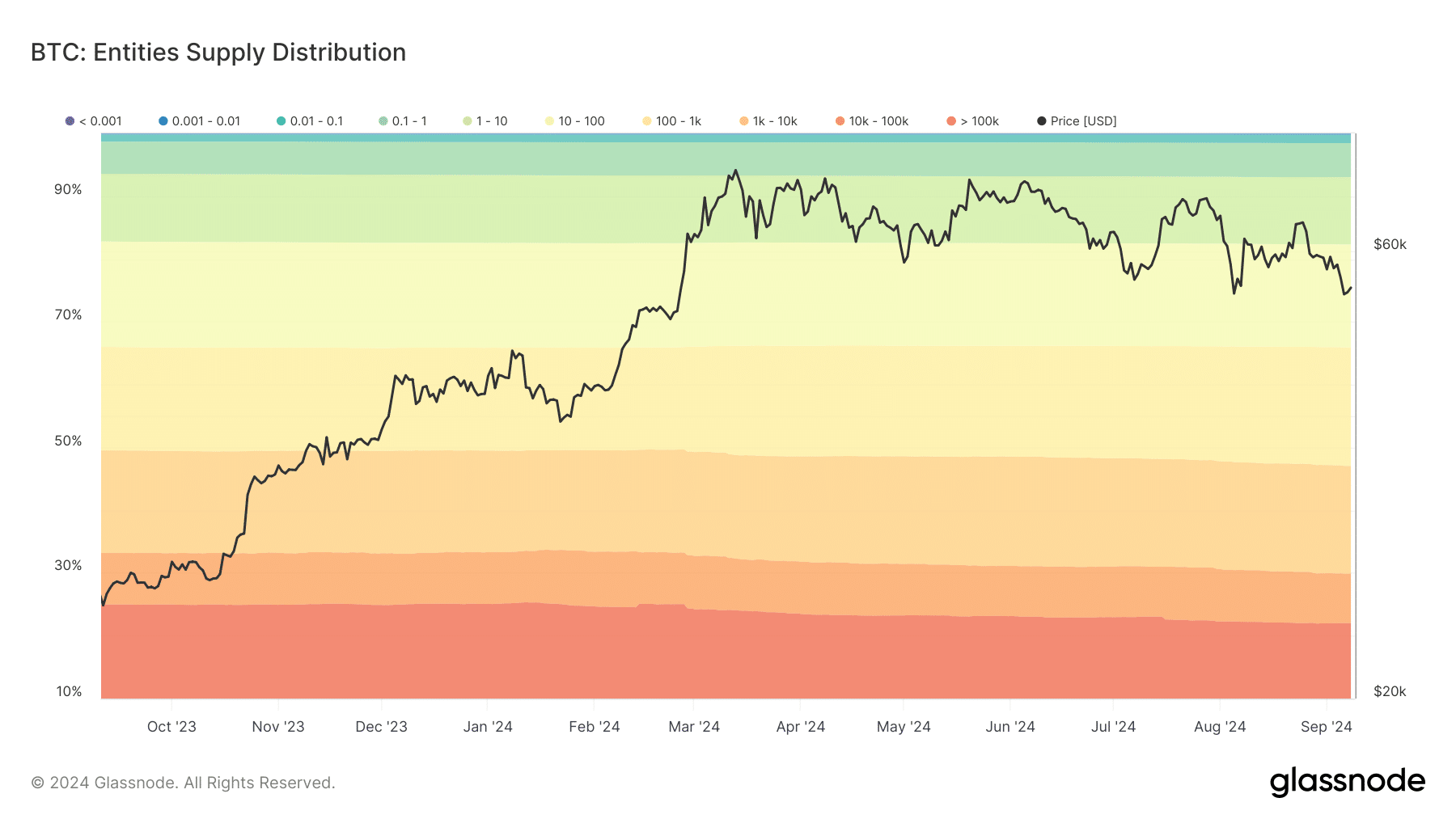

Currently, the percentage of Bitcoin owned by large wallet holders (often referred to as “whales”) has dropped from approximately 24%, a figure seen when Bitcoin reached its peak of around $73,000, down to 21.9% at the present moment.

Source : Glassnode

As reported by AMBCrypto, this drop suggests a decrease in the number of significant Bitcoin holders.

Even though mineral reserves continue to be robust, the regular deposit releases by whales have reduced the probability of a sudden supply shortage. However, should demand significantly surpass the selling pressure, there could still be a reversal in this trend.

If Bitcoin supporters keep its value above the $51,000 resistance point, a significant turnaround could occur as more buyers jump in.

Maintaining this strong purchasing activity might lead to a persistent shortage in supply, resulting in what’s known as a “supply disruption.” The crucial factor is whether demand keeps exceeding the current supply levels.

The MVRV chart tells you..

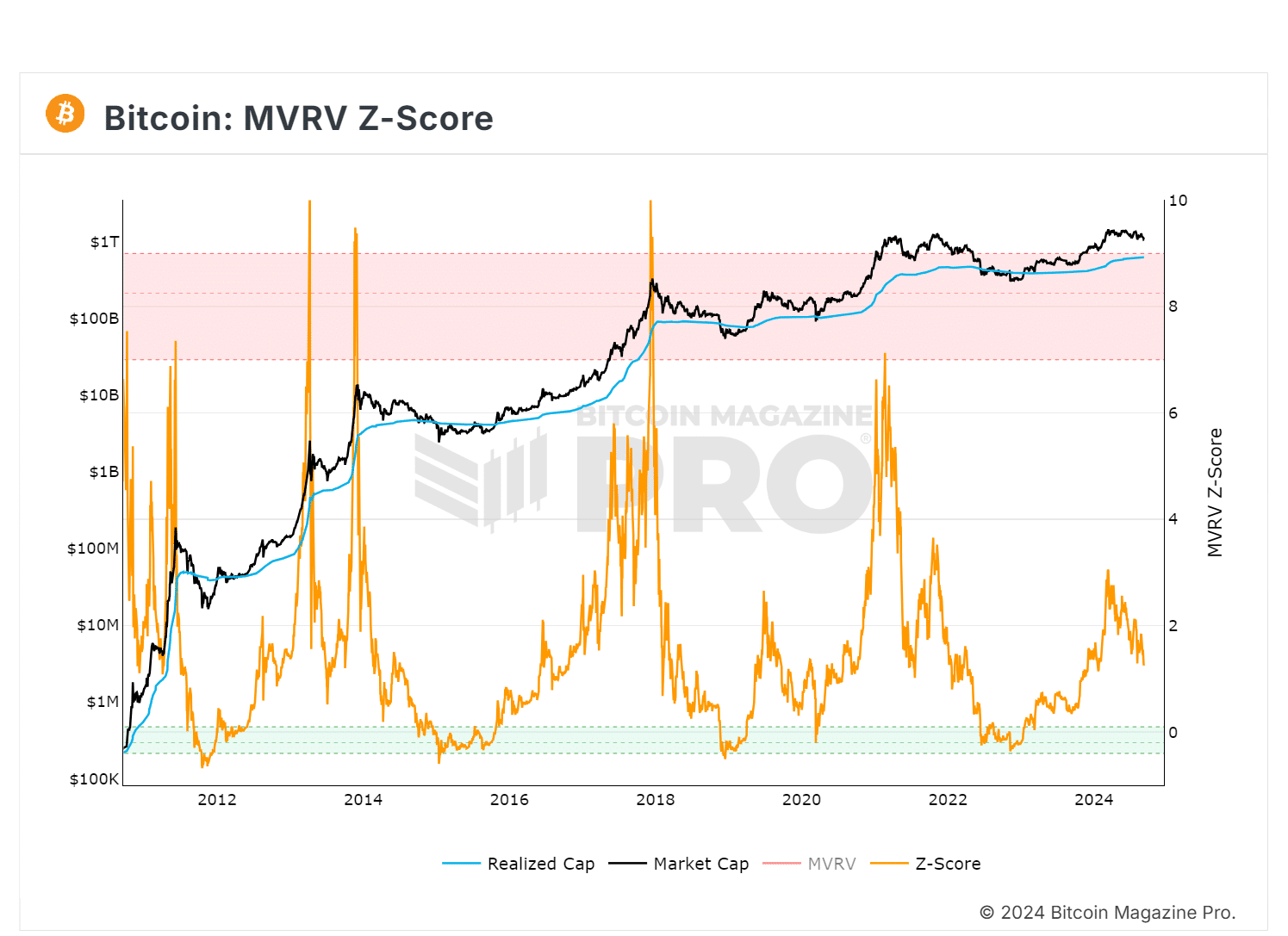

Historically, the MVRM Z-score has proven useful in pinpointing instances where the market value significantly exceeds the actual realized value, suggesting unusual market movement.

Source : Bitcoin Magazine Pro

As a crypto investor, I’ve found that when the Z-Score (represented by the orange line) dips into the pink box, it usually marks the pinnacle of the market cycle. This tool has shown an impressive ability in the past to predict market highs within approximately two weeks.

From my perspective as a researcher, when the Z-Score falls within the green zone, it suggests that Bitcoin might be underpriced. Historically, investing in Bitcoin during such phases has yielded significantly higher returns.

Consequently, a skilled trader keeps watch for the market’s lowest point to pinpoint the best moment for capitalizing on “buying the downturn”.

Read Bitcoin’s [BTC] Price Prediction 2024-25

This phenomenon can be seen as the bullish trend that usually emerges after the market has hit its lowest point.

In simpler terms, it’s rare for demand to outstrip supply, unless we reach a critical point or ‘bottom’. Essentially, what AMBCrypto suggests is that a turnaround or reverse in trend seems improbable without strong signs of support. Without convincing evidence of sustained holding, the chances of a recovery decrease.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-09-09 18:16