-

Bitcoin miners are embracing AI as alternative revenues amidst a decline in mining income.

Possible miner capitulations flash a BTC buy signal as spikes in Hash Ribbons persist.

As a seasoned crypto investor with a keen interest in the Bitcoin mining industry, I’ve witnessed firsthand the challenges miners face following the halving event. The significant reduction in revenue streams has forced many miners to explore alternative avenues for growth, and AI computing seems to be an attractive option.

An increasing number of Bitcoin [BTC] mining companies, including Core Scientific, are expanding their businesses by investing heavily in artificial intelligence (AI) technologies. This move aims to enhance their income sources following the halving event in April.

The Bitcoin halving in April led to a decrease in miner rewards from 6.25 Bitcoins to 3.125 Bitcoins per block, resulting in miners experiencing a significant 50% reduction in income.

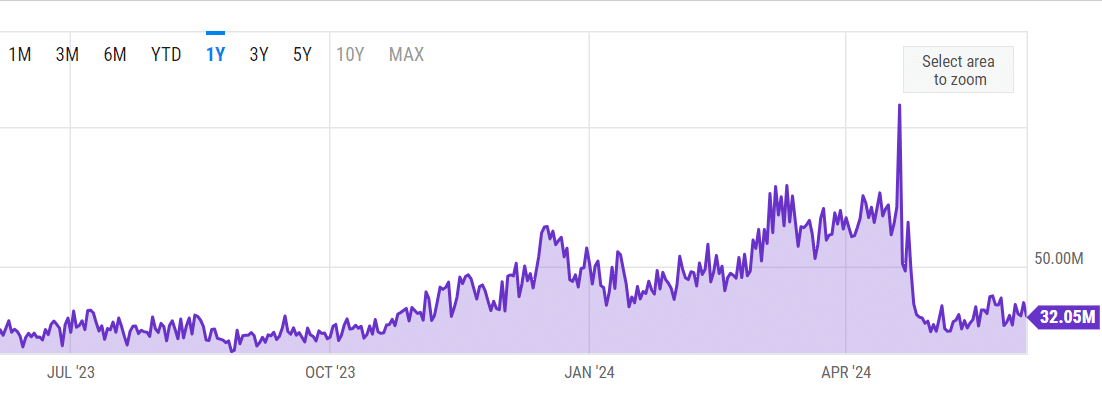

On the 5th of June, Bitcoin mining earnings amounted to approximately $30.05 million on a daily basis, as reported by YCharts. This figure represented a substantial decrease of around 70% in comparison to the peak revenue of $107 million recorded on April’s halving day that year.

AI to solve Bitcoin miners’ revenue problems?

Based on a recent article in CNBC, there’s been a change in mining priorities as AI computing is now drawing more interest due to lucrative returns and growing demand, fueled by the achievement of models like ChatGPT from OpenAI.

As a crypto investor, I’d rephrase that to: In the latest reports, Bit Digital generates about a quarter (25%) of its earnings from artificial intelligence (AI), while Hut 8 and Hive contribute around 6% and 4%, respectively, to their revenues through AI technology.

According to Core Scientific CEO Adam Sullivan, the shift to AI will help create,

‘Diversified business model and more predictable cash flows.’

The AI diversification could be a welcome relief given the reported miner capitulations.

Are some Bitcoin miners exiting?

Around the middle of May, a report by AMBCrypto indicated that Bitcoin’s hashrate experienced a substantial decline. This drop coincided with potential miner withdrawals in response to heightened Bitcoin Hash Ribbon levels.

Hash Ribbons monitor the moving averages of the Bitcoin mining hashrate, indicating highs represent decreased mining activity or departure of less profitable miners.

As a crypto investor, I’ve been closely monitoring the Hash Ribbons signal, which has remained consistent. Recently, this trend has caught the attention of crypto hedge fund Capriole Investments, who described the latest price movement as an enticing Bitcoin buying opportunity.

“Hash Ribbons has made its return. Known as a reliable long-term indicator for Bitcoin purchases, the Miner Capitulation signaled by Hash Ribbons began two weeks ago and could be an attractive opportunity for investors.”

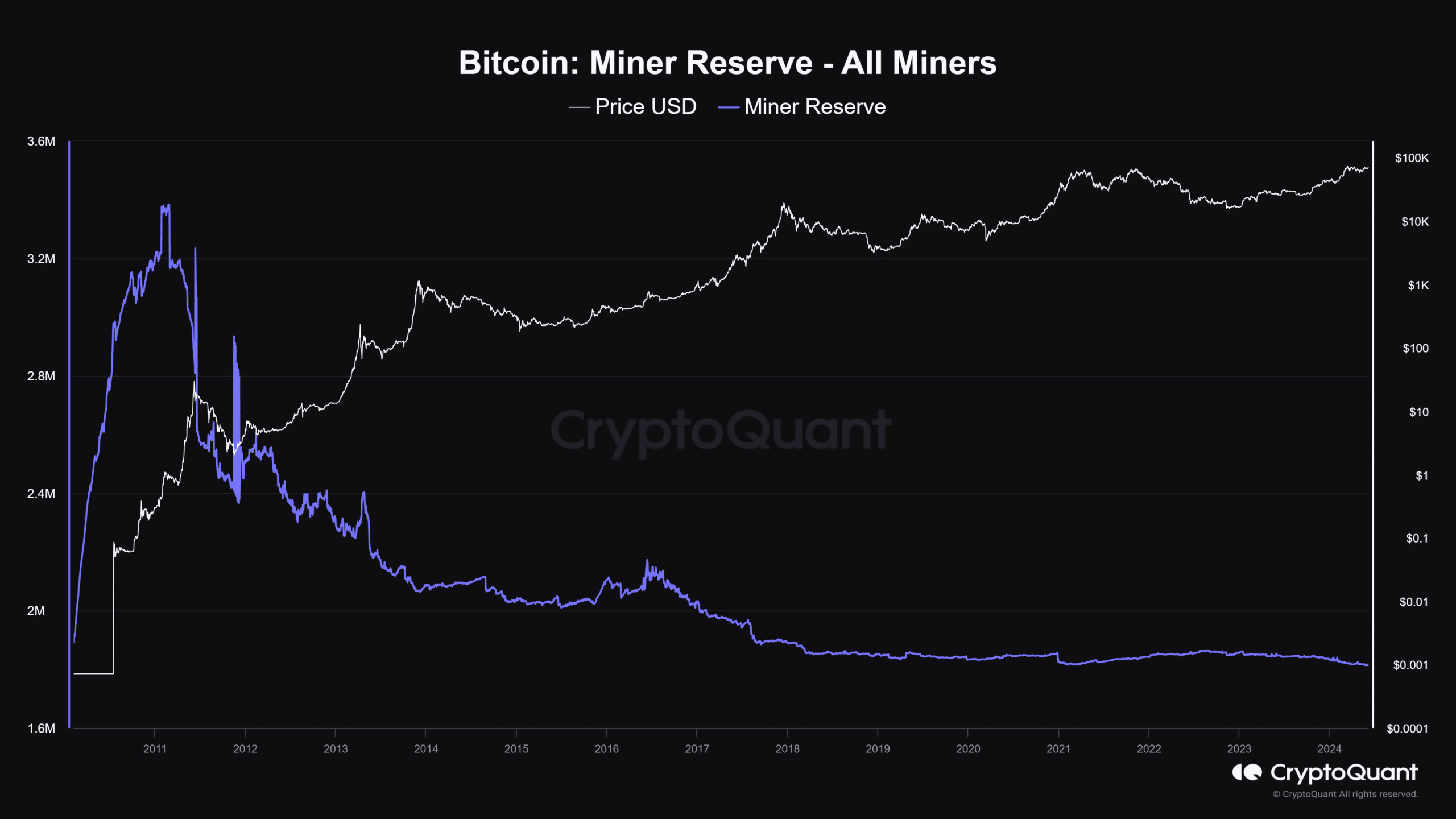

As a bitcoin market analyst, I’ve observed an intriguing development: the Bitcoin miner reserve reached its lowest point this year, with approximately 1.8 million BTC in reserves. This level hasn’t been seen since over a decade ago. Miners might be selling their Bitcoins through off-exchange markets, also known as OTC markets, indicating potential mass disposal of their holdings.

Could it be that the Hash Ribbons’ ‘buy signal’ was further validated by Willy Woo’s observation that institutions have shifted their strategies and started buying? Should amateurs follow the lead of these professionals or hold off until a clear price range breakout occurs before making a move?

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-06-06 10:15