- Bitcoin’s mining difficulty has reached an all-time high due to a surge in the network.

- BTC has remained above the $67,000 price range.

As a seasoned crypto investor who’s weathered multiple bull and bear markets, I can confidently say that the recent surge in Bitcoin’s mining difficulty and hashrate is a testament to its robustness and global appeal. The network’s growing security, despite presenting challenges for miners, underscores the resilience of this decentralized financial system.

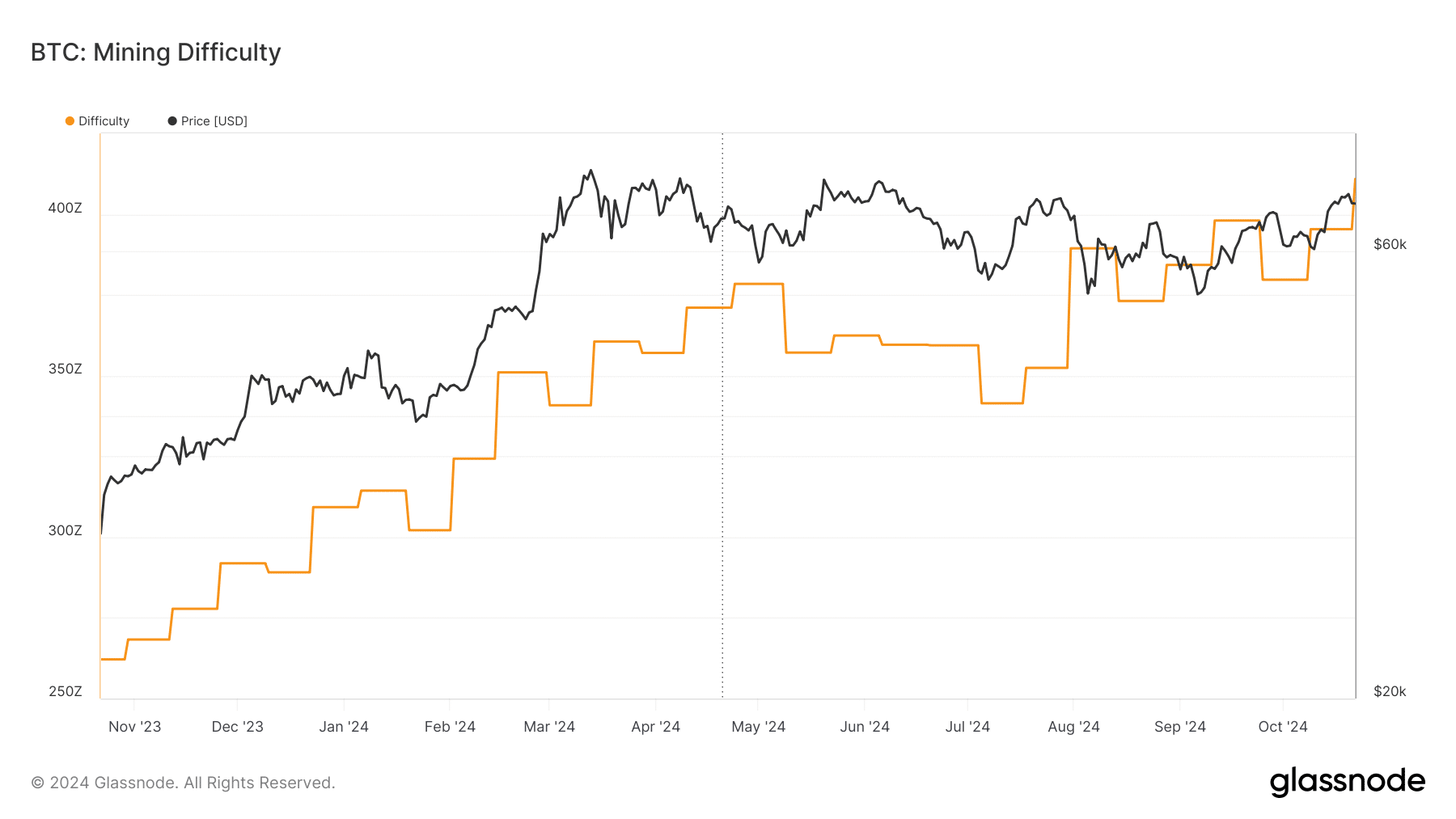

The challenge of mining Bitcoin (BTC) has hit an all-time peak due to a significant rise in the network’s computational power, or hashrate. This escalation stems from the upward trend in Bitcoin’s price, which motivates miners to enlarge their operations to reap the maximum benefits from potential returns.

Increased mining difficulty signals stronger network security, yet it also poses difficulties for miners due to escalating expenses they must contend with.

Rising hashrate signals Bitcoin mining difficulty

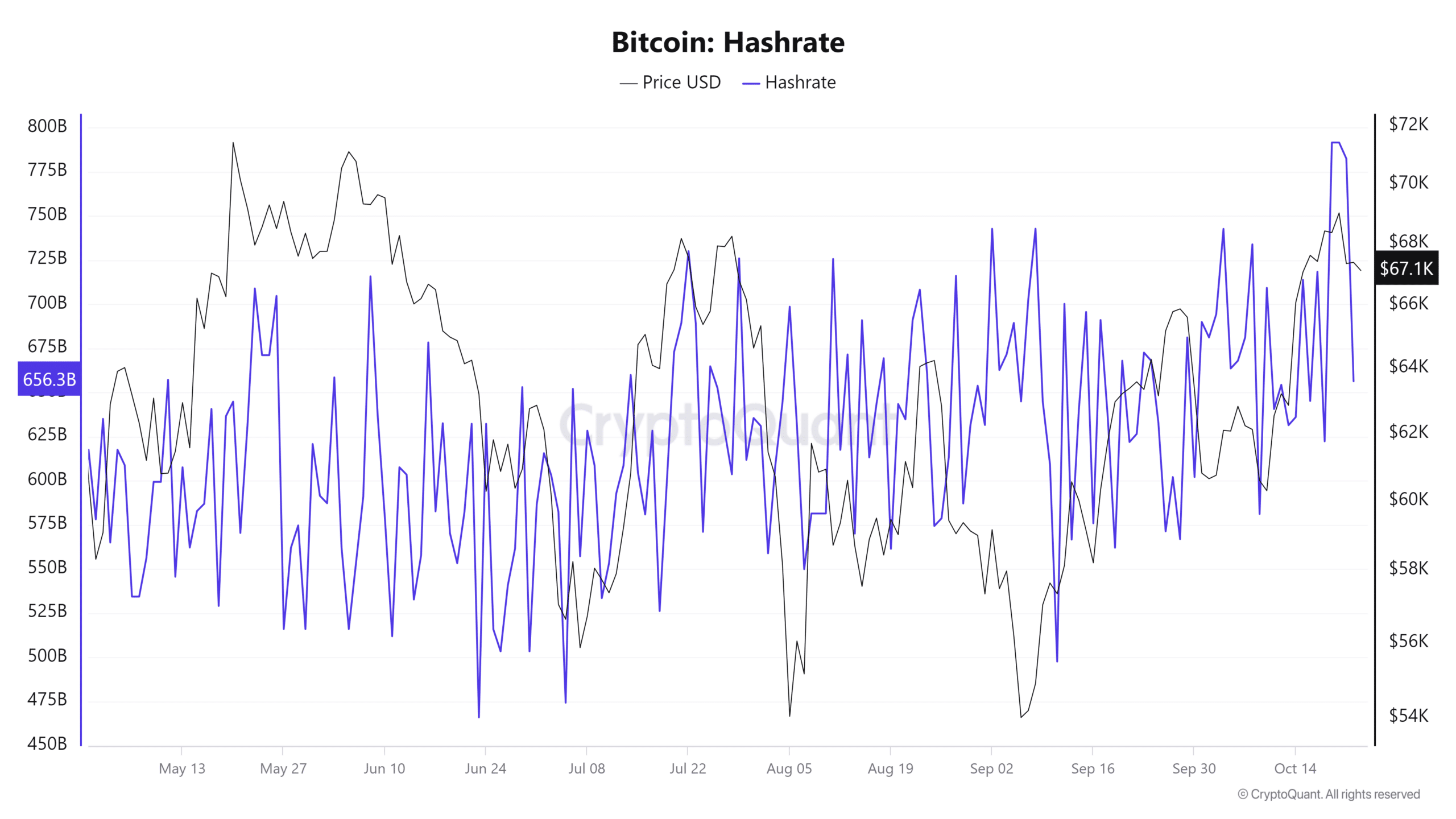

2024 saw a continuous rise in the hashrate of Bitcoin. By mid-October, it had soared to an all-time high of 656.3 billion, which suggests that there’s been a significant increase in mining efforts on the network.

A higher hashrate means more miners are joining the Bitcoin network, competing for blocks.

Miners are driven by the continuous increase in Bitcoin’s value, which has led them to boost their processing capabilities significantly.

As Bitcoin trades approximately at $67,193, there’s a stronger motivation to validate new transactions within the blockchain. Interestingly, this surge in trading activity has automatically triggered an increase in the mining network’s complexity, making it more challenging for miners to solve the mathematical puzzles and add new blocks.

Bitcoin mining difficulty reaches new heights

Due to an increase in computational power, or hashrate, within the Bitcoin network, the difficulty of mining has reached an all-time high. Every fortnight, the network self-adjusts this difficulty level to maintain a consistent rate of block production, aiming for roughly 10 minutes between each new block.

With an influx of miners into the network, the level of competition rises significantly, leading to higher mining difficulty and increased expenses related to the mining process.

For miners, an increase in complexity implies they require greater computational resources and higher energy expenditures to sustain their profits. Although Bitcoin’s escalating value offers possible returns, it simultaneously boosts the expense of ensuring these gains, putting pressure on the profitability of numerous miners.

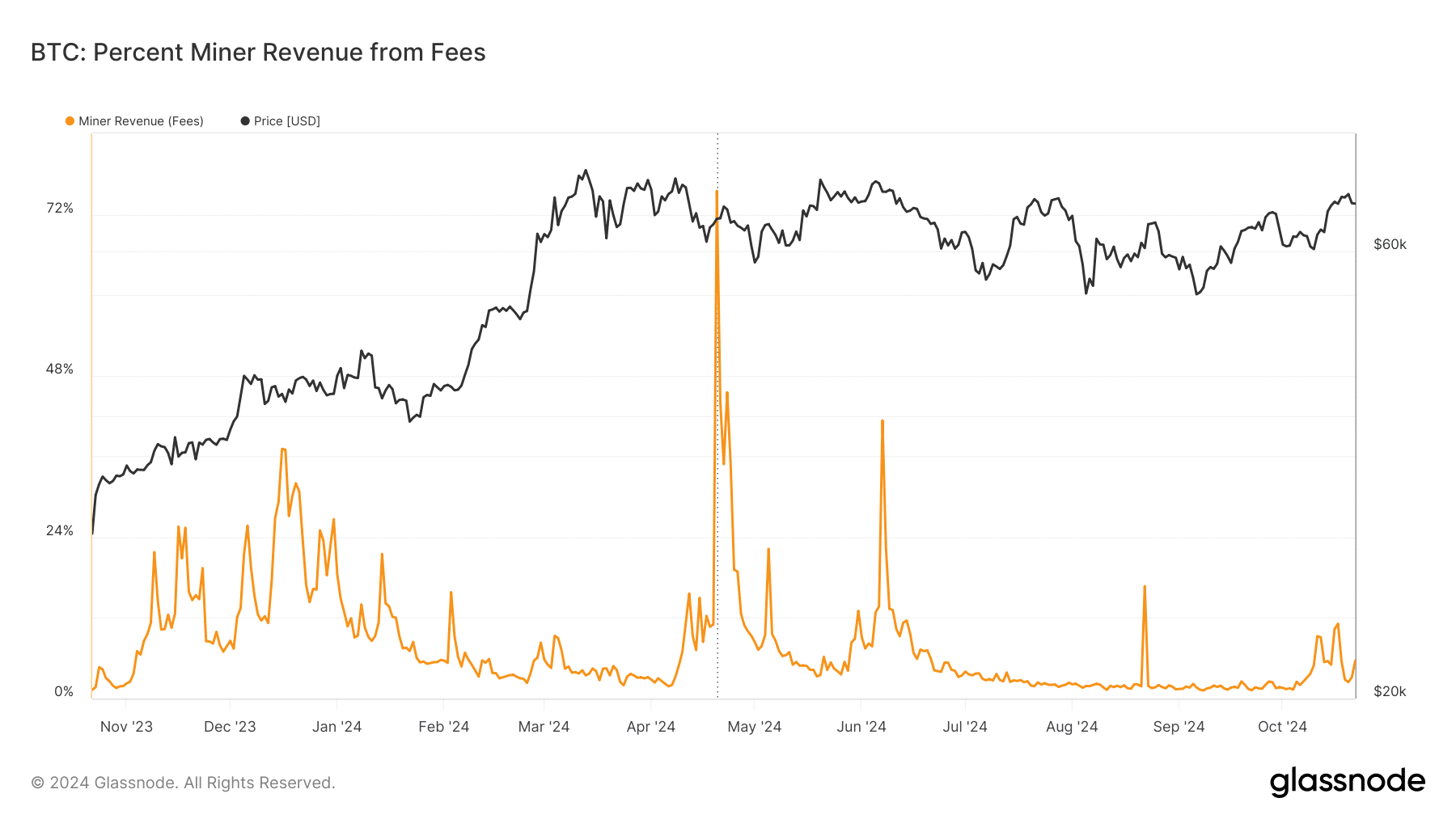

Miner fees see slight uptick, while Bitcoin price holds steady

Concurrently with the growth in the complexity of Bitcoin mining operations and the number of miners (hashrate), transaction fees have exhibited a mild upward trend. These fees tend to go up whenever there’s an uptick in network usage, as miners often give preference to transactions that promise greater returns.

Although miner fees have spiked during network congestion in 2024, block rewards continue to account for the bulk of miners’ income.

Although these changes within the network, Bitcoin’s value has generally held steady. At present, it is being traded for approximately $67,193, representing a decrease of 0.28%.

Read Bitcoin (BTC) Price Prediction 2024-25

The Average True Range (ATR) indicator points to potential volatility in the short term, suggesting that BTC’s price could see fluctuations as the mining ecosystem adjusts to the increased difficulty and network activity.

Keeping an eye on how miner profitability, transaction fees, and the price of Bitcoin interact with each other becomes increasingly important as the mining difficulty and hashrate increase.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-10-23 23:03