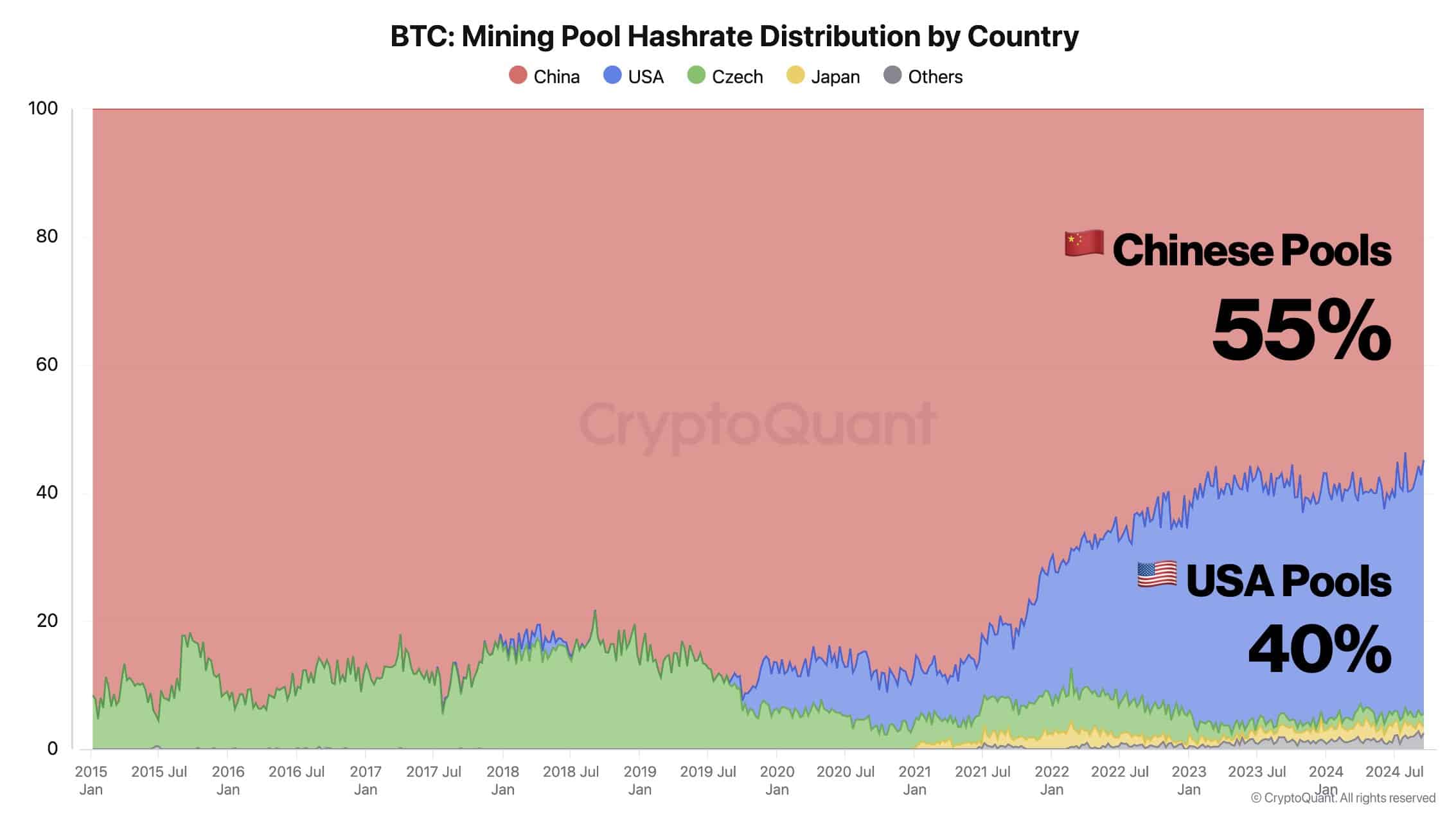

- Bitcoin mining has experienced a shift, with two countries now controlling 95% of the mining hash rate.

- This concentration of power could displease miners, prompting mass capitulation.

As a seasoned analyst with over two decades of experience in the tech and finance industries, I have witnessed countless shifts in power dynamics that have defined entire sectors. The recent concentration of Bitcoin mining hash rate in two countries is no exception, and it raises some intriguing questions about the future of this decentralized digital asset.

In recent developments, American mining pools have taken over a significant portion of the Bitcoin mining scene, accounting for approximately 40% of the total computational power, or hashrate. Conversely, Chinese mining pools continue to dominate, with about 55% of the hashrate under their control.

Initially thriving due to affordable computer hardware, Chinese cryptocurrency miners are now facing a decline in their advantage as the emphasis moves towards locations offering cheaper energy sources. This shift, instigated by China’s regulatory clampdown, is causing mining operations to consider re-locating to regions with more energy cost savings. We at AMBCrypto delve into the implications of this trend.

Hashrate distribution is too centralized

Earlier on, China dominated the mining sector, accounting for approximately 55% of the global Bitcoin hashrate. In other words, a large proportion of the Bitcoin mining capacity was located within China.

Chinese miners benefited from their dominant position, earning more staking rewards, which resulted in a higher concentration of Bitcoin within China.

Source : CryptoQuant

Currently, the United States is gaining ground and now controls about 40% of the Bitcoin mining operation. The attention is starting to shift towards American Bitcoin mining firms, especially those that primarily serve large institutional investors, as they are seeing significant advantages.

The shift of Bitcoin miners from China to the United States is frequently prompted by a decrease in return on investment, rendering mining operations less financially viable in China.

On the other hand, this large-scale migration could pose a problem for U.S. miners since intensified competition could erode their profits. Keeping a close eye on each miner is essential, as when operational expenses exceed profitability, they may decide to abandon their operations.

Fear is clearly visible

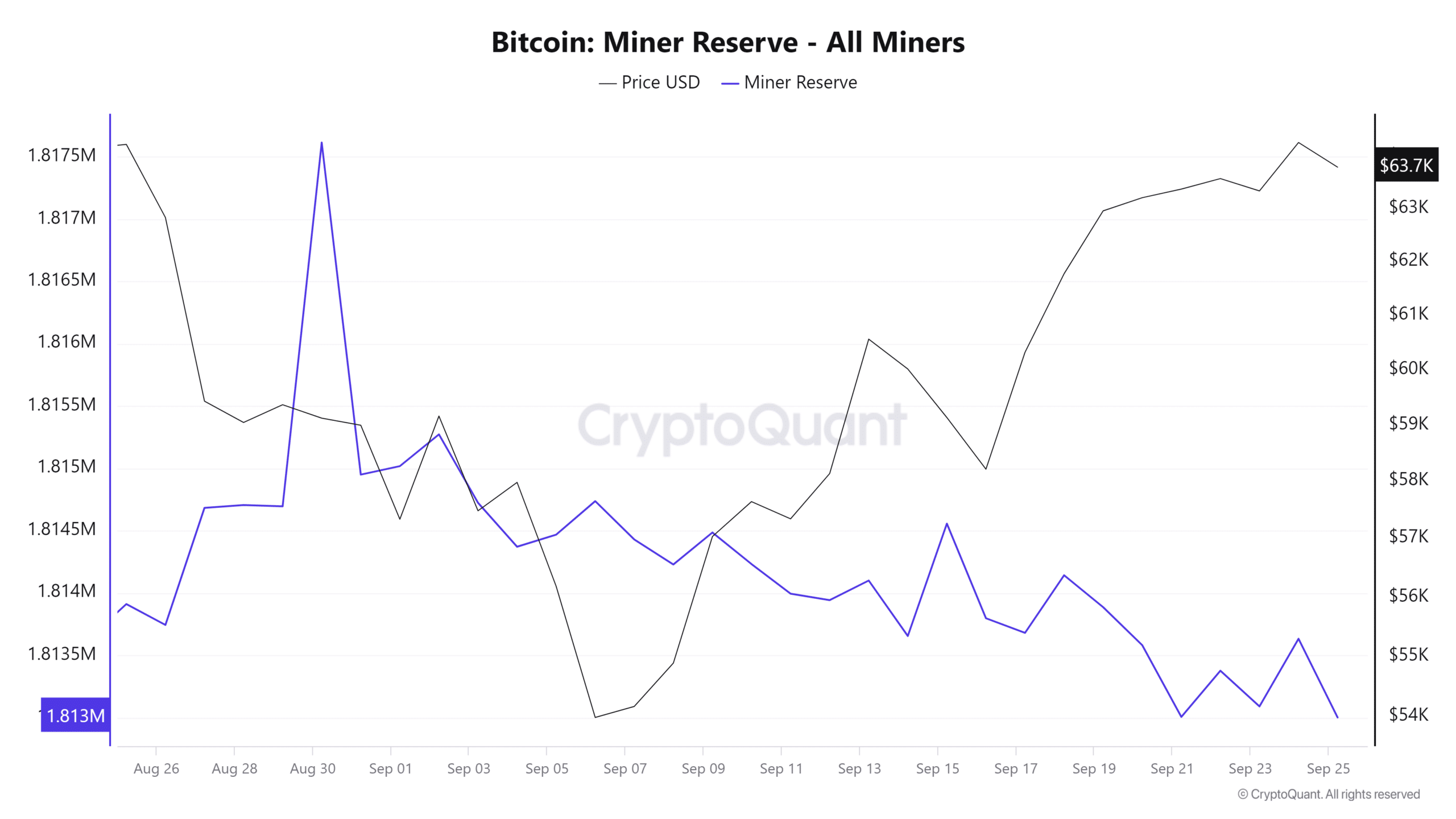

With the recent price spike, it’s probable that Bitcoin miners have made significant profits. This is suggested by the fact that miner reserves have reached record lows, indicating they may have taken advantage of BTC being stabilized above $63K and peaking near $64K.

Source : CryptoQuant

As a crypto investor, I’ve found myself constantly on the lookout for profitable opportunities amidst the rising Bitcoin mining difficulties that hit record highs each month. These moments of gain are increasingly precious and must be seized when they present themselves.

Additionally, the surge of miners within the U.S. has stirred worries, since heightened competition could potentially propel difficulty levels to unprecedented highs. Consequently, this situation might lead to a decrease in rewards earned.

As a result, if miners give up (capitulate), it might pose a substantial risk for Bitcoin to surpass the resistance level of $68K.

Conversely, this situation could underscore the superiority of large mining companies, granting them a distinct edge since smaller miners depart, potentially leading to increased concentration within the network.

Bitcoin mining houses might take charge

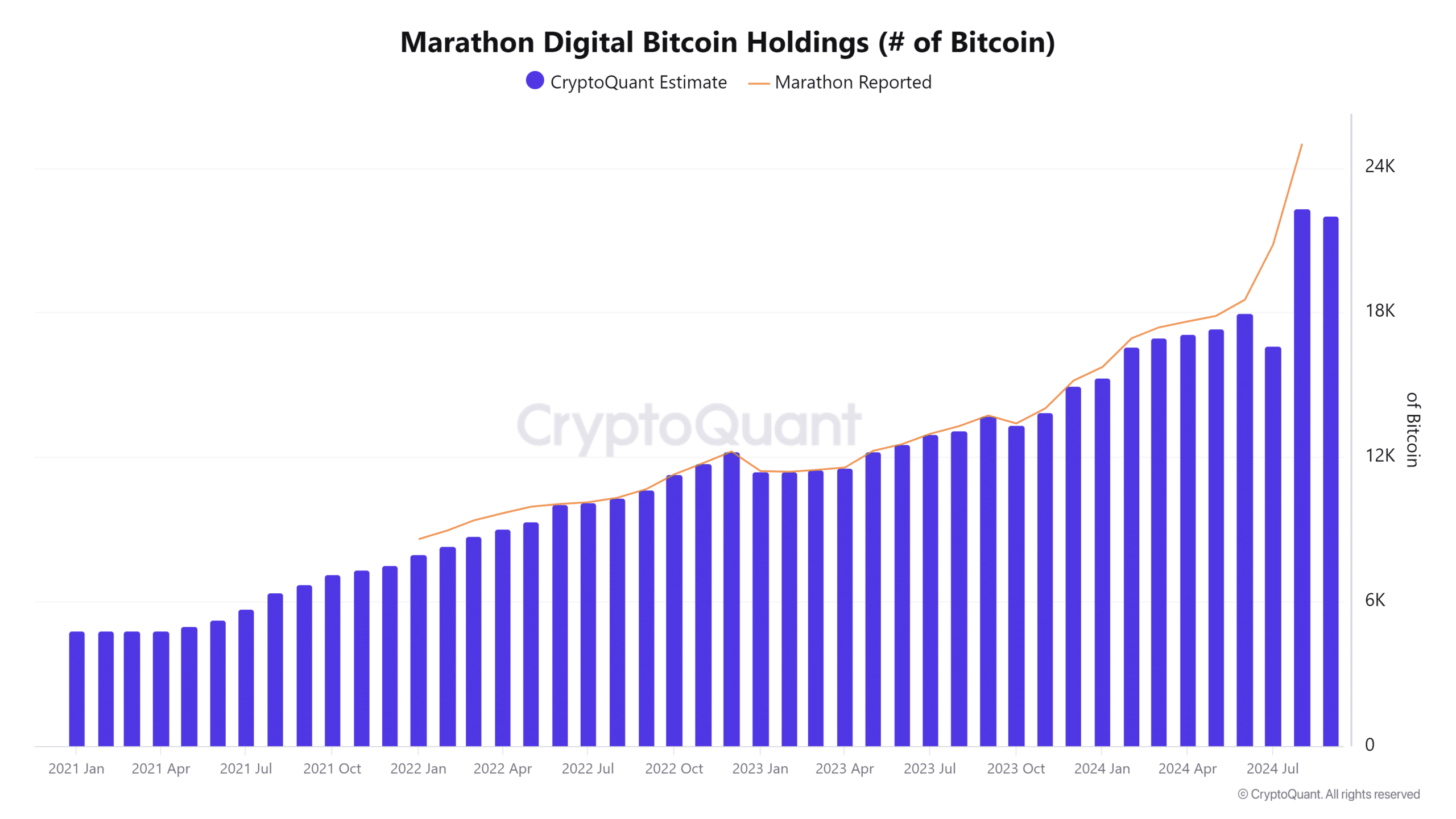

Bitcoin mining operations with significant assets might choose to utilize their resources effectively, aiming to assume leadership roles as more miners leave due to the escalating mining difficulty.

For example, The biggest Bitcoin mining corporation in America has smartly accumulated assets, reaching approximately $22,022.4, with potential reported values being even greater.

Source : CryptoQuant

Read Bitcoin’s [BTC] Price Prediction 2024-25

Moreover, having a significant amount of holdings might give them an edge during miner sell-offs (or miner capitulation), allowing them to withstand the pressure on Bitcoin when it reaches its market peak.

Yet, a greater concentration of Bitcoin mining might pose issues for the Bitcoin mining sector, hindering Bitcoin’s ability to surpass the significant $64K barrier.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-09-25 17:12